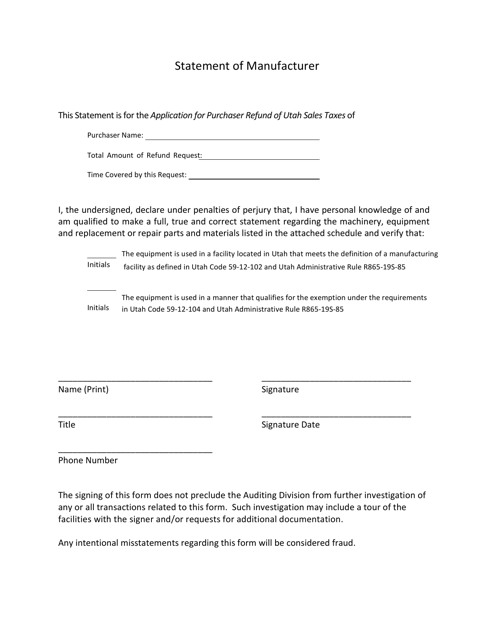

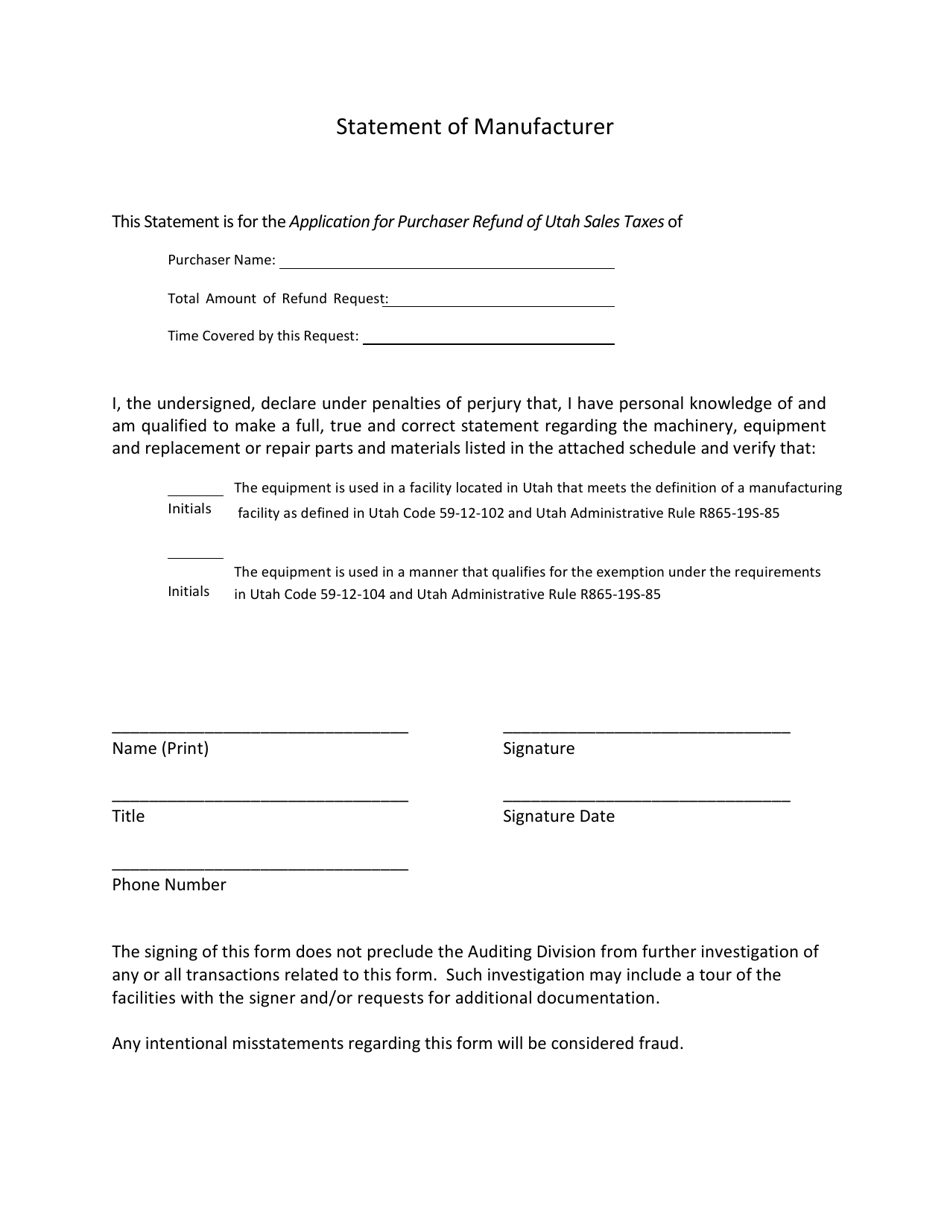

Statement of Manufacturer for Refund Transactions on or After January 1, 2019 - Utah

Statement of Manufacturer for Refund Transactions on or After January 1, 2019 is a legal document that was released by the Utah State Tax Commission - a government authority operating within Utah.

FAQ

Q: What is the Statement of Manufacturer for Refund Transactions?

A: The Statement of Manufacturer for Refund Transactions is a document related to refunds.

Q: When does the Statement of Manufacturer for Refund Transactions apply?

A: The Statement of Manufacturer for Refund Transactions applies to transactions that occur on or after January 1, 2019 in Utah.

Q: Why is the Statement of Manufacturer for Refund Transactions important?

A: The Statement of Manufacturer for Refund Transactions is important because it outlines the terms and conditions for refund transactions.

Q: Who is responsible for providing the Statement of Manufacturer for Refund Transactions?

A: The manufacturer is responsible for providing the Statement of Manufacturer for Refund Transactions.

Q: What information does the Statement of Manufacturer for Refund Transactions contain?

A: The Statement of Manufacturer for Refund Transactions contains information about the manufacturer, the product, and the terms and conditions for refunds.

Form Details:

- The latest edition currently provided by the Utah State Tax Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.