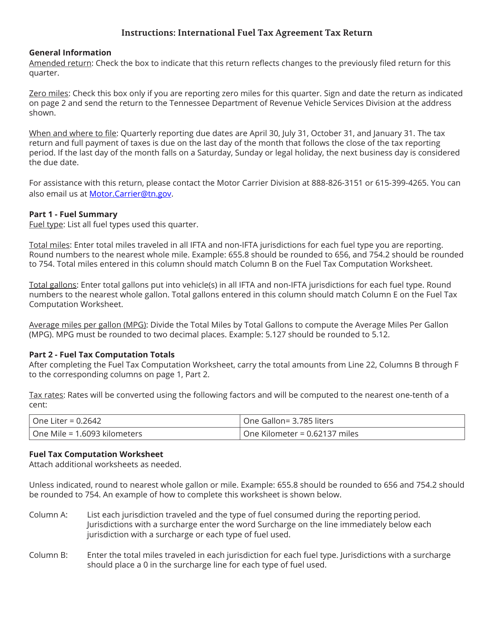

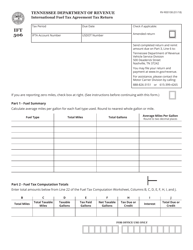

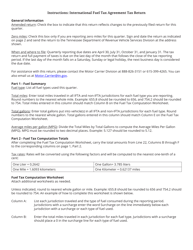

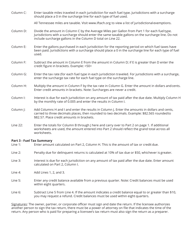

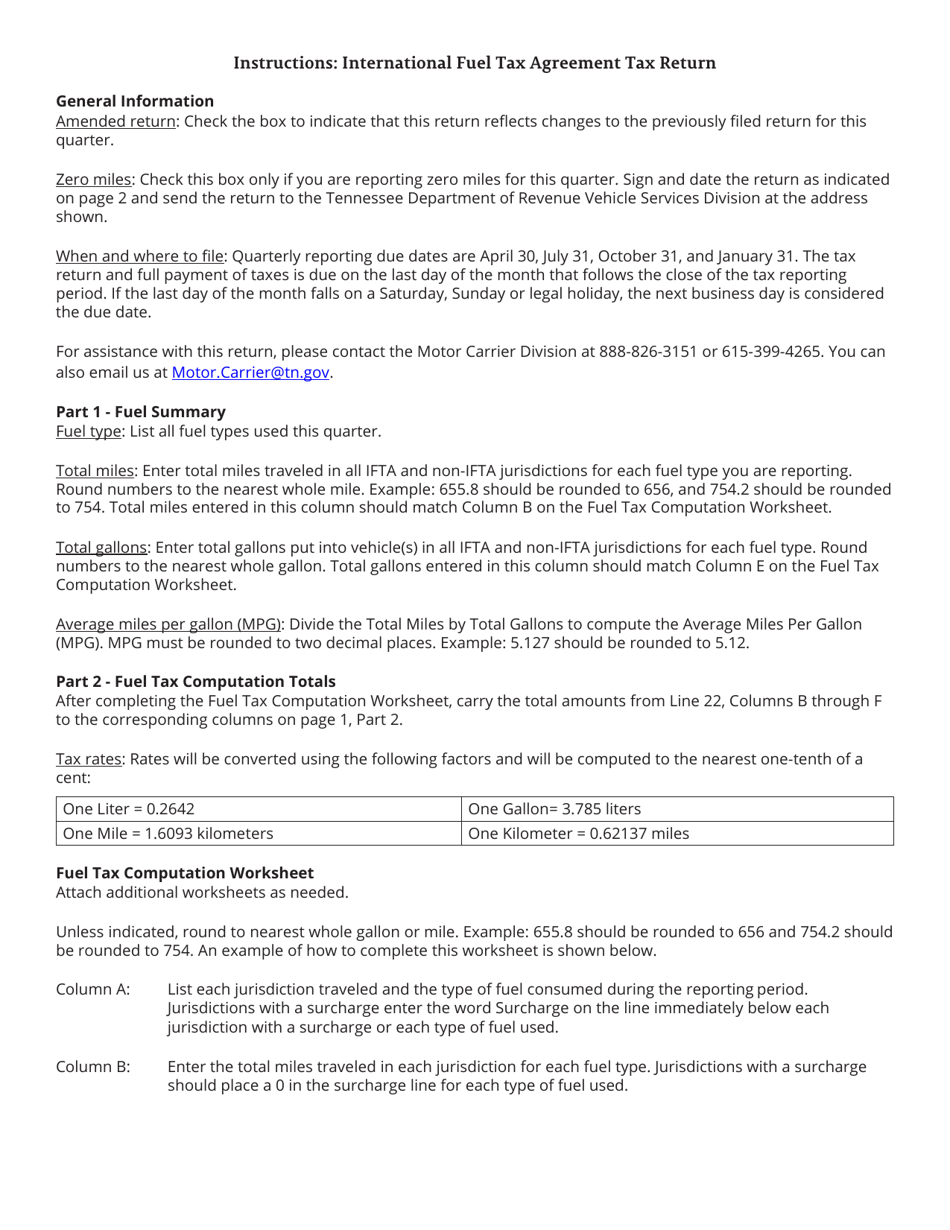

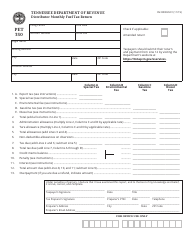

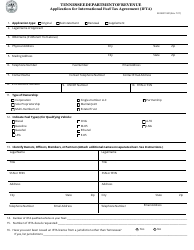

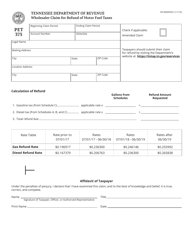

Instructions for Form IFT506, RV-R00108 International Fuel Tax Agreement Tax Return - Tennessee

This document contains official instructions for Form IFT506 , and Form RV-R00108 . Both forms are released and collected by the Tennessee Department of Revenue. An up-to-date fillable Form IFT506 (RV-R00108) is available for download through this link.

FAQ

Q: What is Form IFT506?

A: Form IFT506 is the International Fuel Tax Agreement (IFTA) Tax Return form for Tennessee.

Q: Who needs to file Form IFT506?

A: Motor carriers who operate qualified motor vehicles in Tennessee and other IFTA member jurisdictions need to file Form IFT506.

Q: What is the purpose of Form IFT506?

A: The purpose of Form IFT506 is to report and calculate the taxes owed for the operation of qualified motor vehicles in Tennessee and other IFTA member jurisdictions.

Q: When is Form IFT506 due?

A: Form IFT506 is due by the last day of the month following the end of the quarter for which the tax is due.

Q: Are there any penalties for not filing Form IFT506 or filing it late?

A: Yes, failure to file Form IFT506 or filing it late may result in penalties and interest being assessed on the unpaid tax.

Q: What other documentation do I need to include with Form IFT506?

A: You need to include copies of your fuel receipts and mileage records for each qualified motor vehicle.

Q: What is a qualified motor vehicle?

A: A qualified motor vehicle is a motor vehicle used, designed, or maintained for the transportation of persons or property and that meets certain criteria specified by the IFTA.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Tennessee Department of Revenue.