This version of the form is not currently in use and is provided for reference only. Download this version of

Form DRS MS344

for the current year.

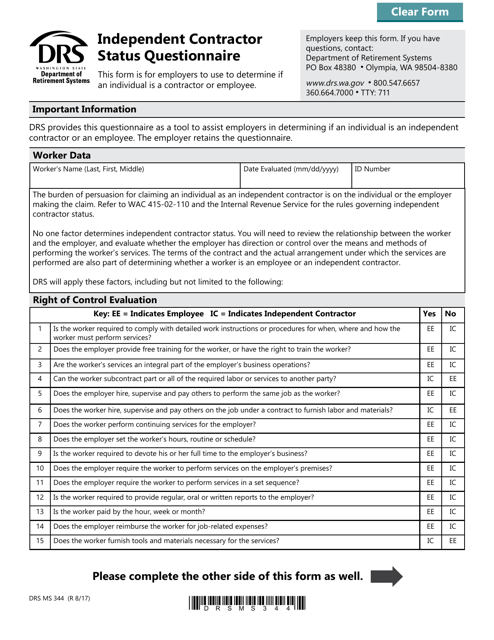

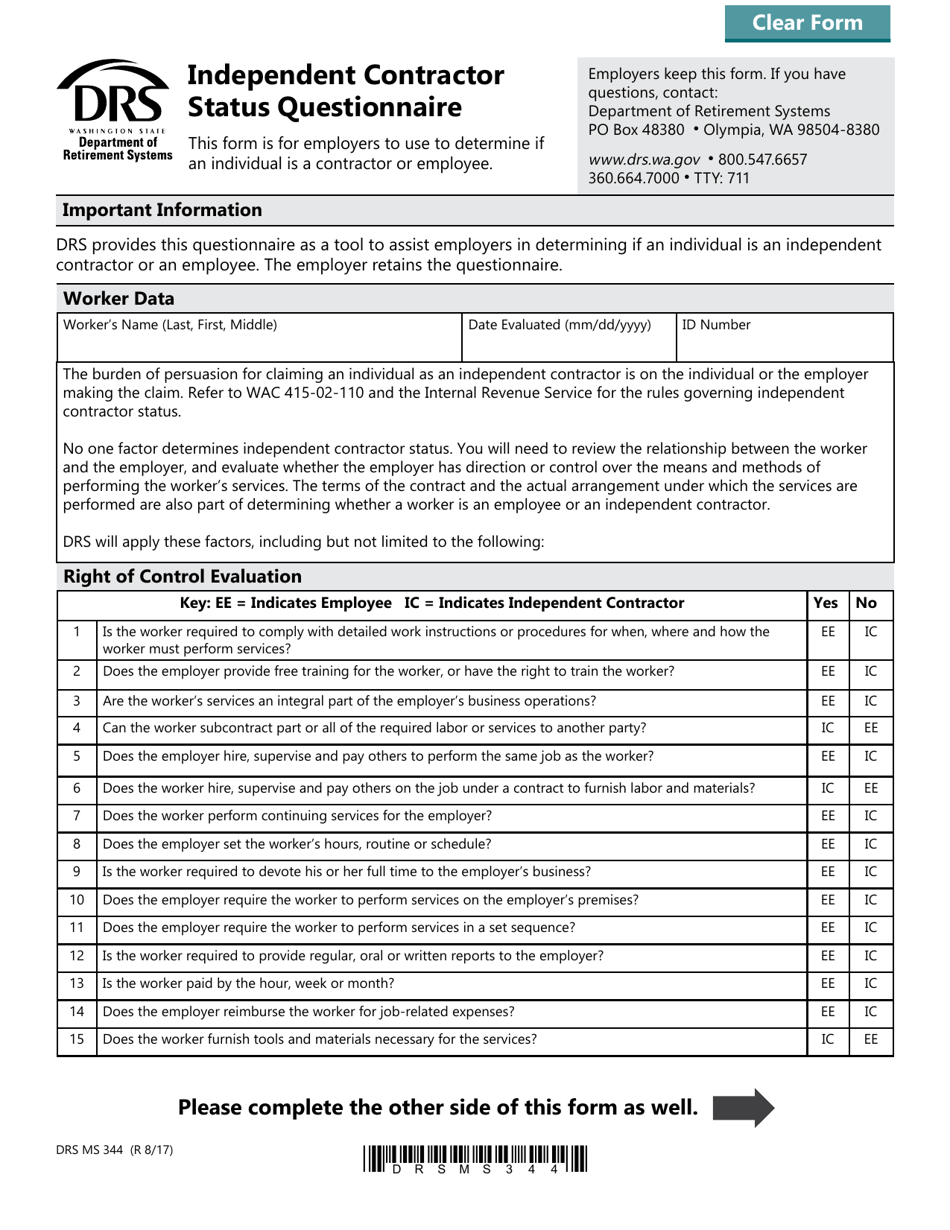

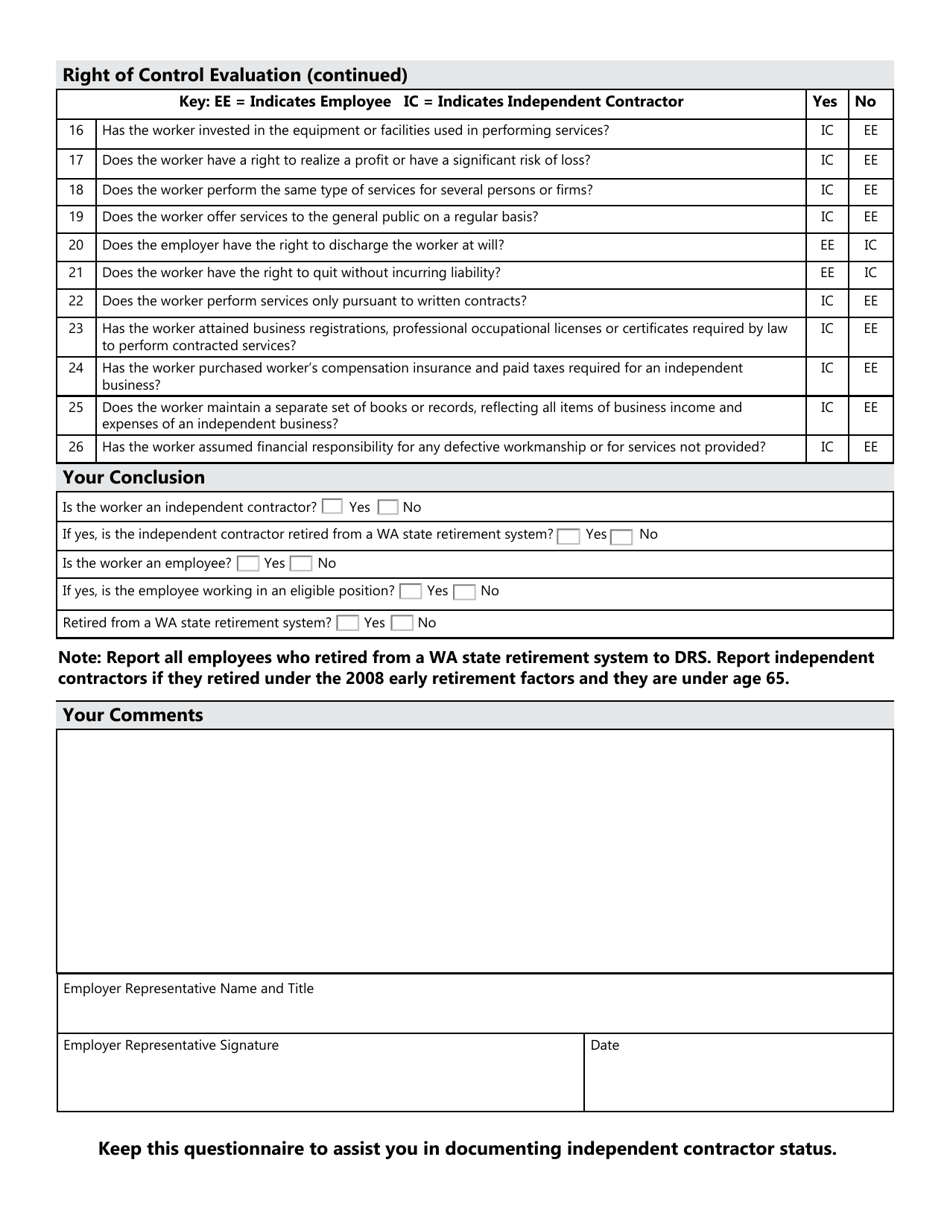

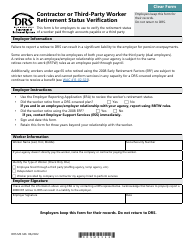

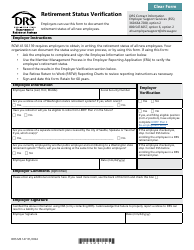

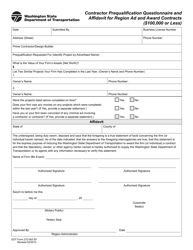

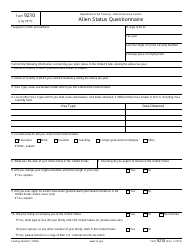

Form DRS MS344 Independent Contractor Status Questionnaire - Washington

What Is Form DRS MS344?

This is a legal form that was released by the Washington State Department of Retirement Systems - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form DRS MS344 Independent Contractor Status Questionnaire?

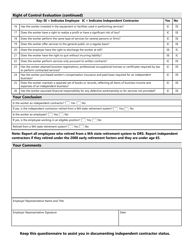

A: The purpose of Form DRS MS344 is to determine the independent contractor status of a worker in Washington.

Q: Who needs to complete Form DRS MS344?

A: Both businesses and workers may need to complete this form.

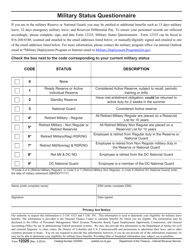

Q: What is the significance of determining independent contractor status?

A: Determining independent contractor status helps determine the rights and obligations of workers and businesses, such as tax obligations and worker protections.

Q: Why is it important to correctly classify a worker as an independent contractor or an employee?

A: Correctly classifying a worker ensures compliance with employment laws, such as minimum wage, overtime pay, and benefits.

Q: Are there any penalties for misclassifying a worker?

A: Yes, there can be penalties for misclassifying a worker, including fines and back payment of taxes.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Washington State Department of Retirement Systems;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DRS MS344 by clicking the link below or browse more documents and templates provided by the Washington State Department of Retirement Systems.