This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

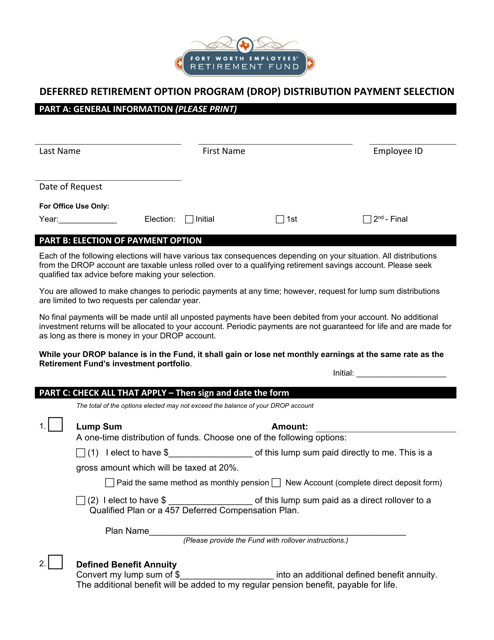

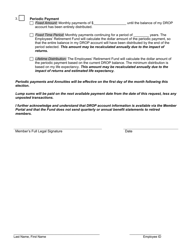

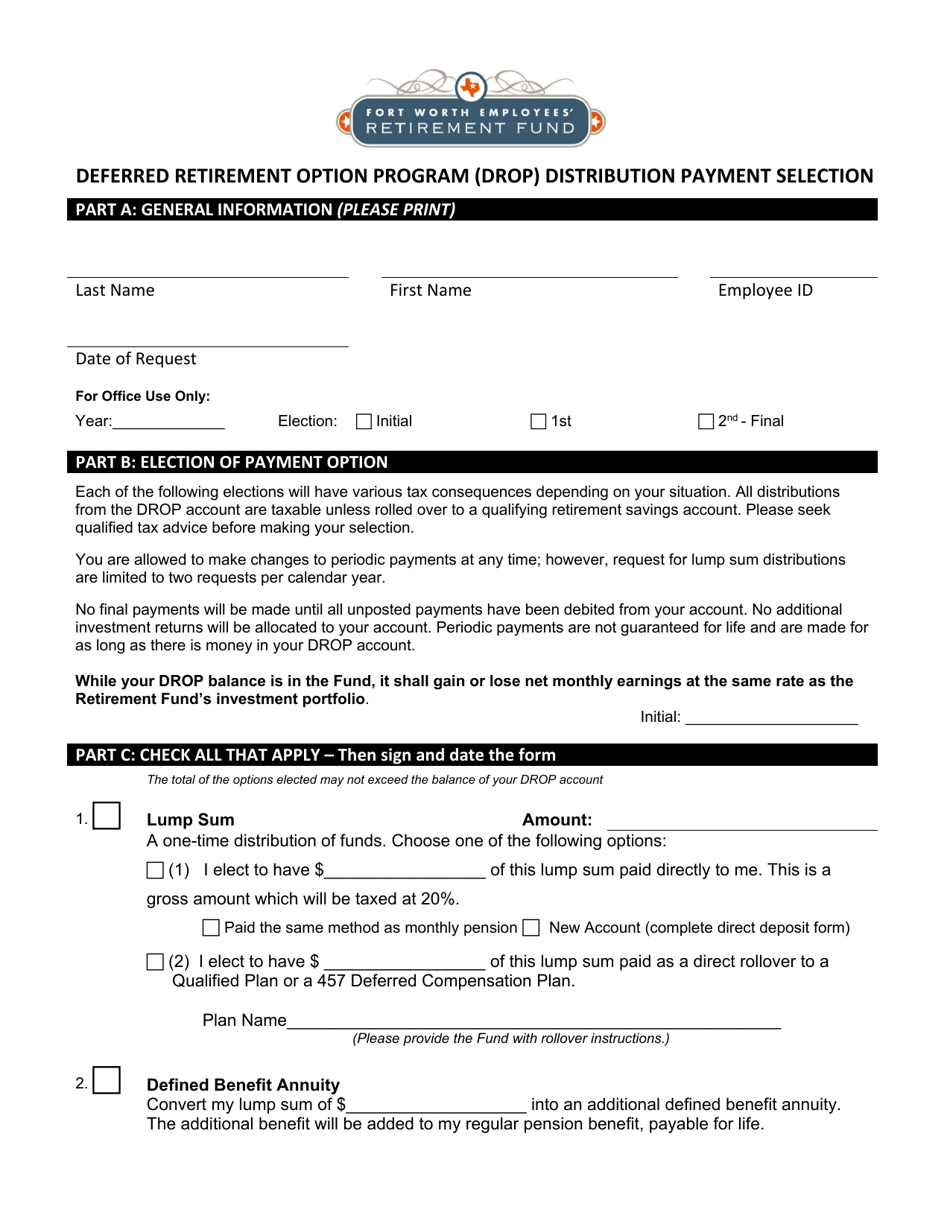

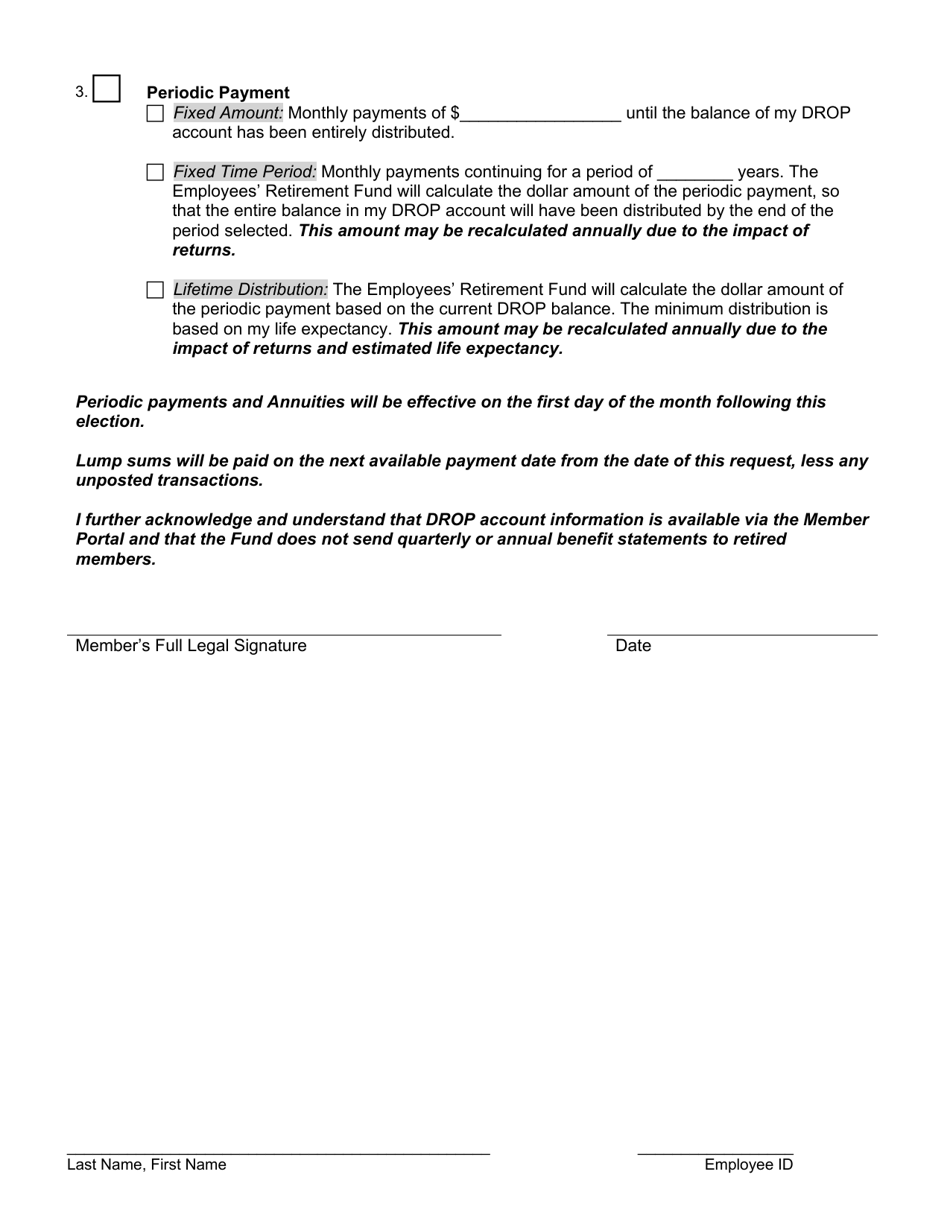

Distribution Payment Selection - Deferred Retirement Option Program (Drop) - City of Fort Worth, Texas

Distribution Payment Selection - Option Program (Drop) is a legal document that was released by the Employees’ Retirement Fund - City of Fort Worth, Texas - a government authority operating within Texas. The form may be used strictly within City of Fort Worth.

FAQ

Q: What is the Deferred Retirement Option Program (DROP)?

A: The Deferred Retirement Option Program (DROP) is a retirement benefit offered by the City of Fort Worth, Texas.

Q: How does the DROP program work?

A: Under the DROP program, eligible employees can choose to retire and continue working for a maximum period of five years. During this time, their retirement benefits are deposited into an account, which accrues interest.

Q: Who is eligible for the DROP program?

A: Employees who meet specific criteria, such as having a certain number of years of service and being of a certain age, may be eligible for the DROP program.

Q: Is participation in the DROP program mandatory?

A: No, participation in the DROP program is voluntary. Employees can choose whether or not to enroll in the program.

Q: What happens to the funds deposited into the DROP account?

A: The funds deposited into the DROP account accrue interest and are paid out to the employee upon their final separation from employment.

Q: Can DROP program participants change their minds and return to active employment?

A: No, once an employee enters the DROP program and retires, they cannot return to active employment with the City of Fort Worth, Texas.

Q: Are there any penalties or tax implications associated with the DROP program?

A: Consult a qualified tax advisor for detailed information about the potential penalties or tax implications of participating in the DROP program.

Form Details:

- The latest edition currently provided by the Employees’ Retirement Fund - City of Fort Worth, Texas;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Employees’ Retirement Fund - City of Fort Worth, Texas.