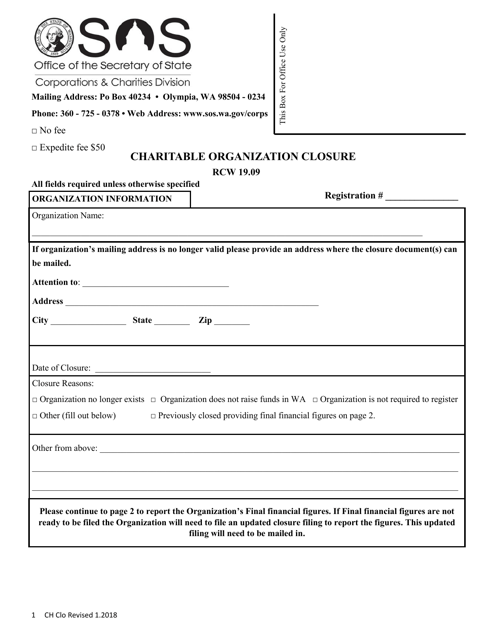

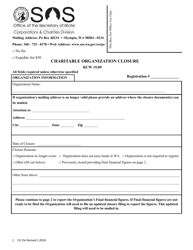

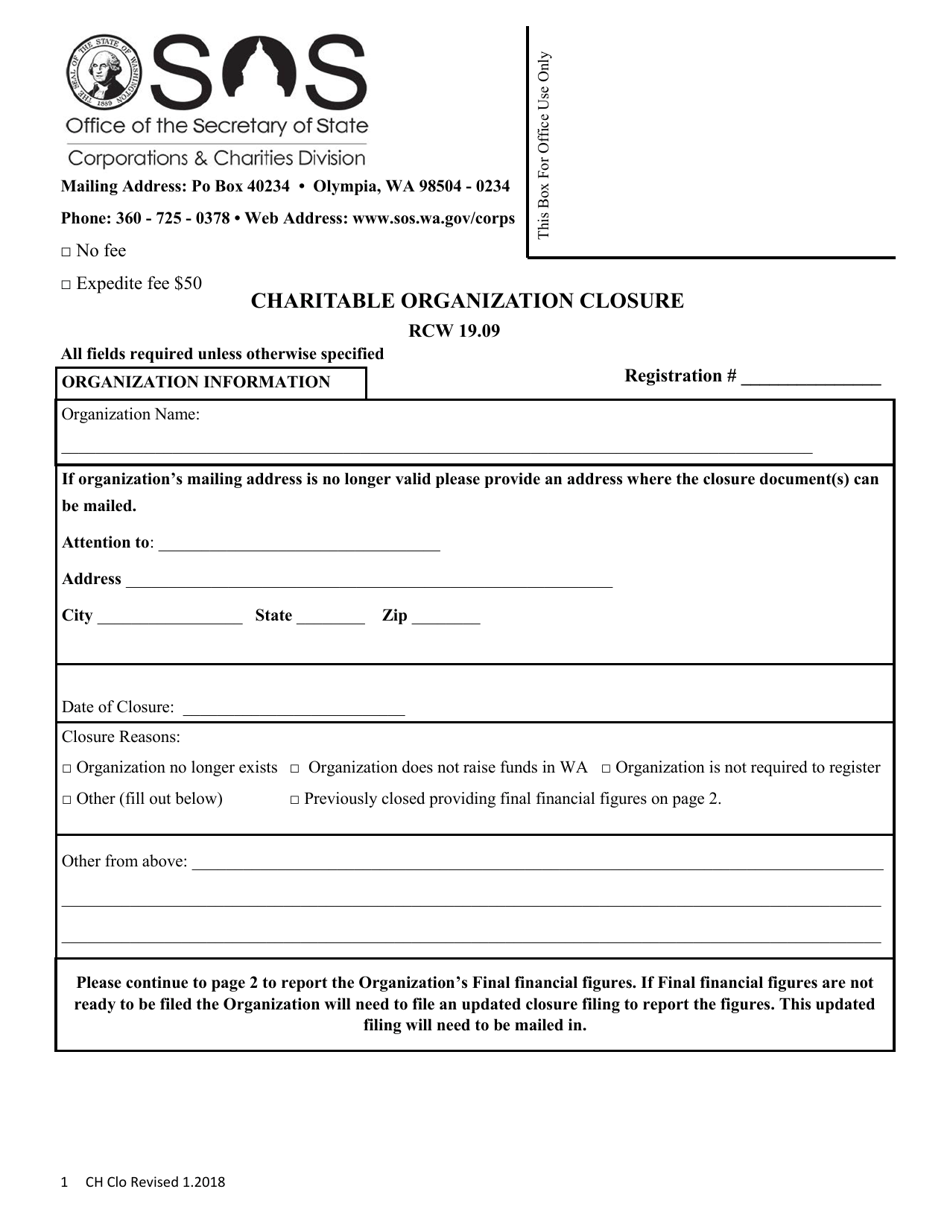

Charitable Organization Closure - Washington

Charitable Organization Closure is a legal document that was released by the Washington Secretary of State - a government authority operating within Washington.

FAQ

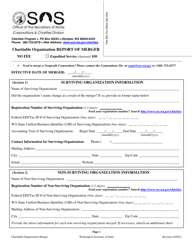

Q: How do I close a charitable organization in Washington?

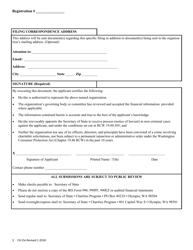

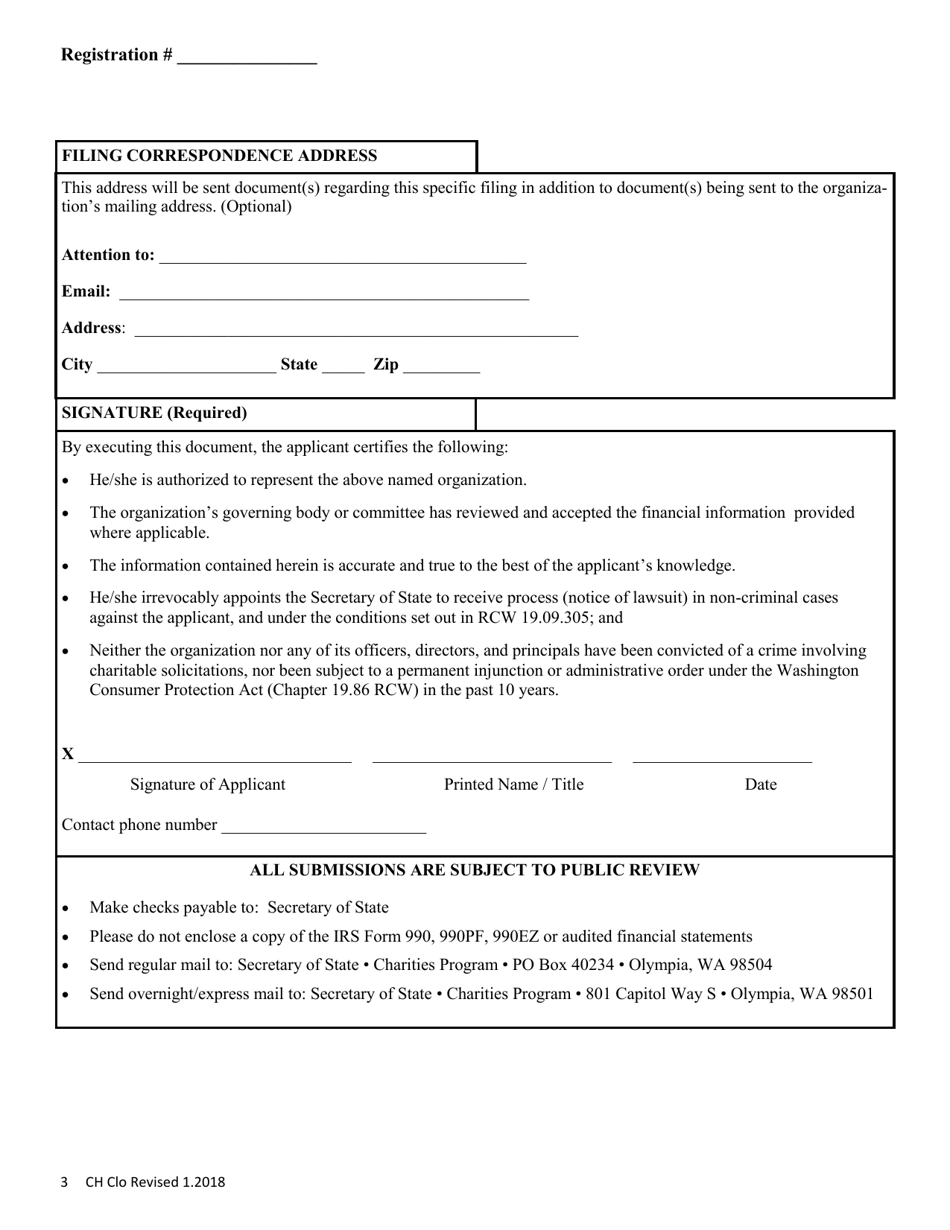

A: To close a charitable organization in Washington, you need to complete the dissolution process by submitting the necessary forms and documents to the Washington Secretary of State's office.

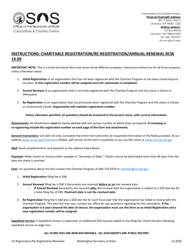

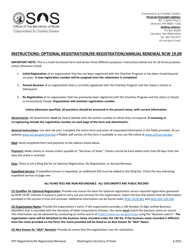

Q: What forms do I need to fill out to close a charitable organization in Washington?

A: You will need to fill out the Nonprofit Dissolution Form (Form NPCL101) provided by the Washington Secretary of State's office to officially dissolve your charitable organization.

Q: Are there any specific requirements or steps to follow when closing a charitable organization in Washington?

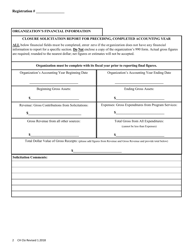

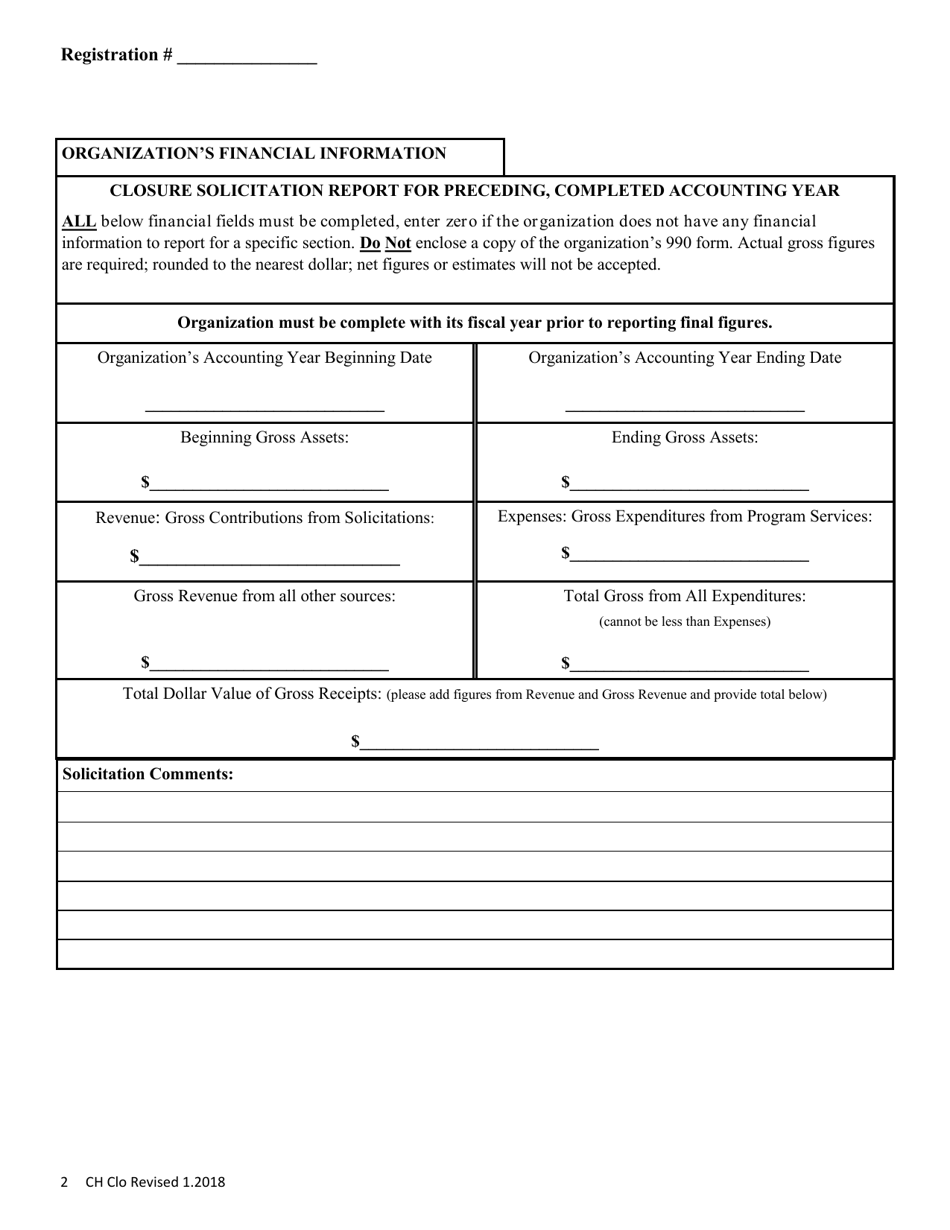

A: Yes, besides filing the Nonprofit Dissolution Form, you also need to make sure all taxes and other financial obligations are settled, notify the IRS and the Washington Department of Revenue about the closure, and properly distribute the remaining assets of the organization.

Q: Do I need to notify any government agencies or departments about the closure of my charitable organization in Washington?

A: Yes, you should notify the Internal Revenue Service (IRS) and the Washington Department of Revenue about the closure of your charitable organization. This will ensure that you fulfill all necessary tax obligations.

Q: What should I do with the remaining assets of my charitable organization when closing it in Washington?

A: When closing a charitable organization in Washington, you need to properly distribute the remaining assets to other tax-exempt organizations or charitable entities. This can be done following the guidelines provided by the Washington Secretary of State's office.

Q: Can I close a charitable organization in Washington if there are outstanding tax obligations?

A: It is important to settle all outstanding tax obligations before closing a charitable organization in Washington. Failure to do so may result in legal complications and penalties.

Q: Is there a fee for dissolving a charitable organization in Washington?

A: Yes, there is a fee associated with dissolving a charitable organization in Washington. The current fee amount can be obtained from the Washington Secretary of State's office.

Q: Can I reopen a charitable organization in Washington after closing it?

A: Yes, it is possible to reopen a charitable organization in Washington after closing it, but you would need to follow the necessary steps to register and establish the organization once again.

Q: How long does it take to close a charitable organization in Washington?

A: The timeline for closing a charitable organization in Washington can vary depending on various factors, including the processing time of the Secretary of State's office and any outstanding obligations that need to be settled. It is best to consult with the Secretary of State's office for specific information regarding the timeline.

Form Details:

- Released on January 1, 2018;

- The latest edition currently provided by the Washington Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Washington Secretary of State.