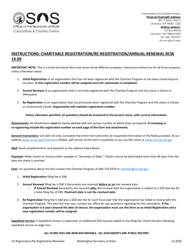

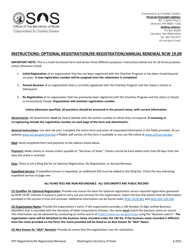

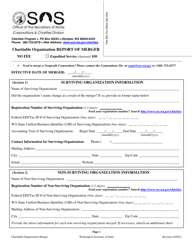

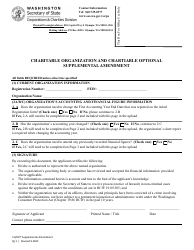

Charitable Organization Amendment - Washington

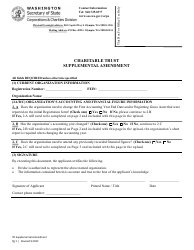

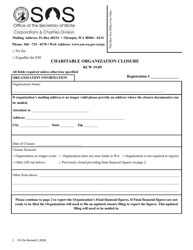

Charitable Organization Amendment is a legal document that was released by the Washington Secretary of State - a government authority operating within Washington.

FAQ

Q: What is the Charitable Organization Amendment in Washington?

A: The Charitable Organization Amendment is a law in Washington that governs charitable organizations.

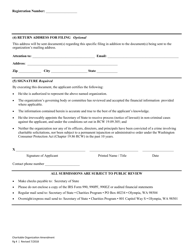

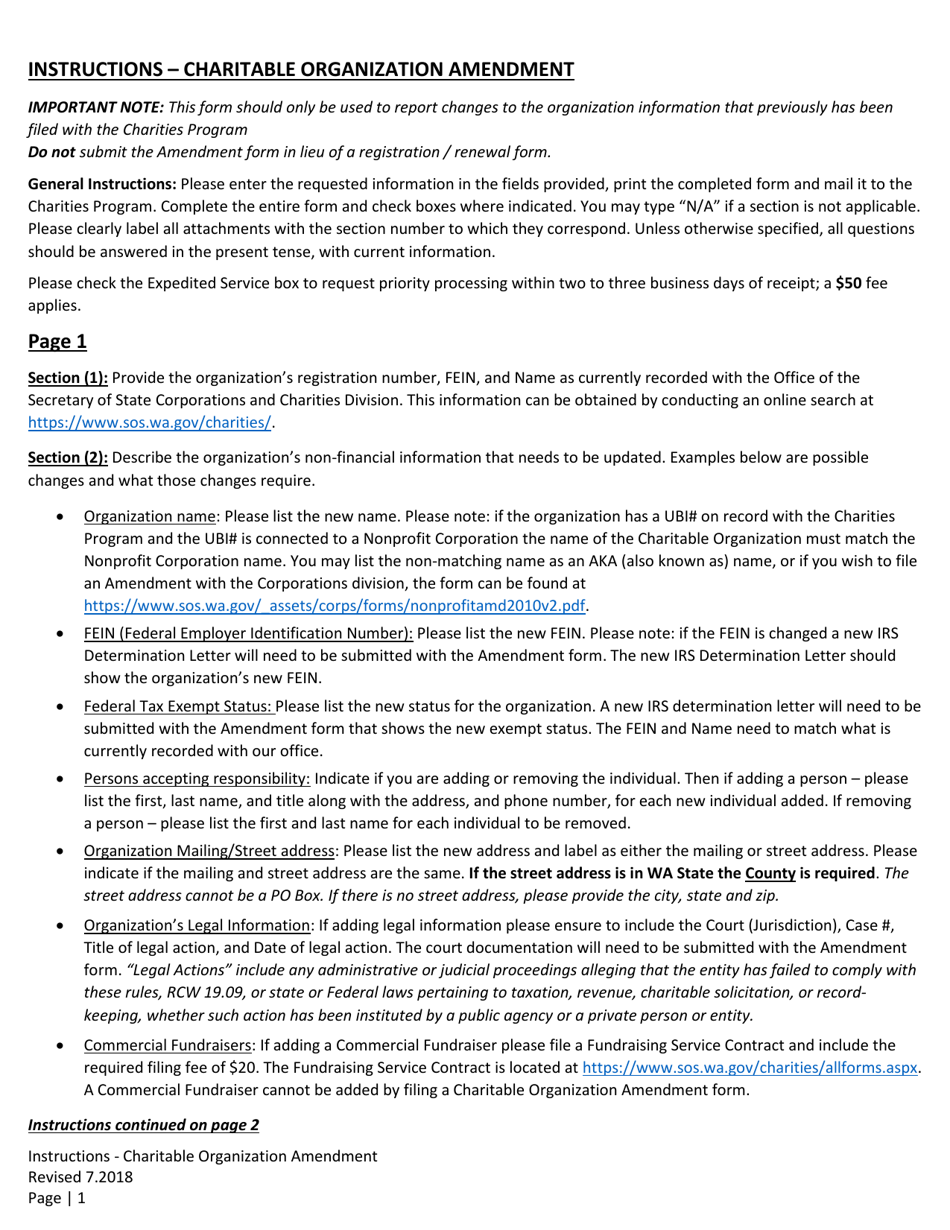

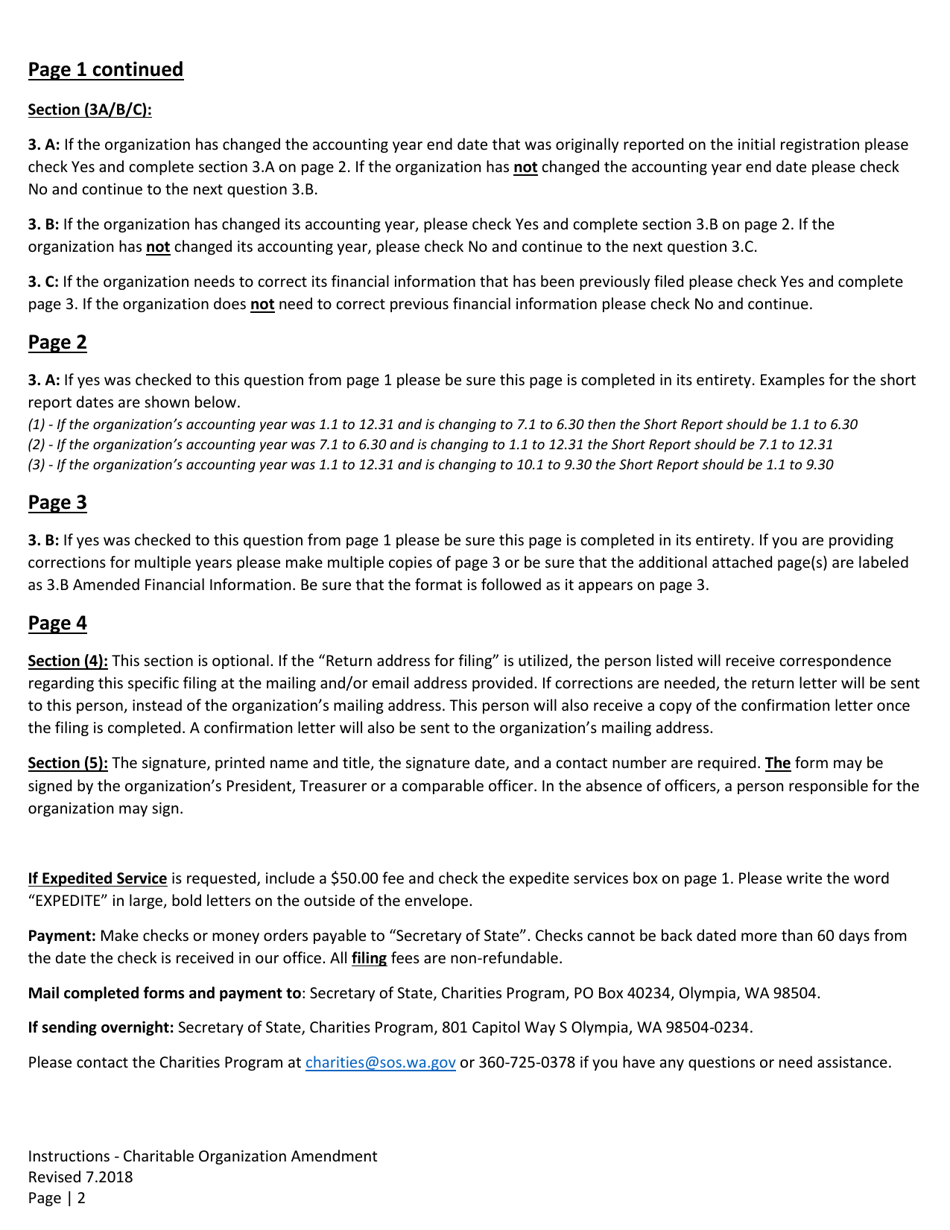

Q: What does the Charitable Organization Amendment require?

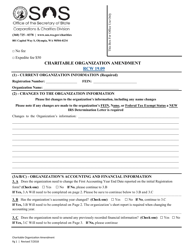

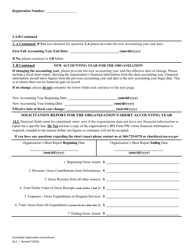

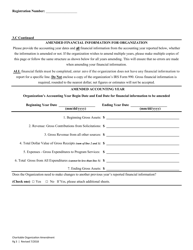

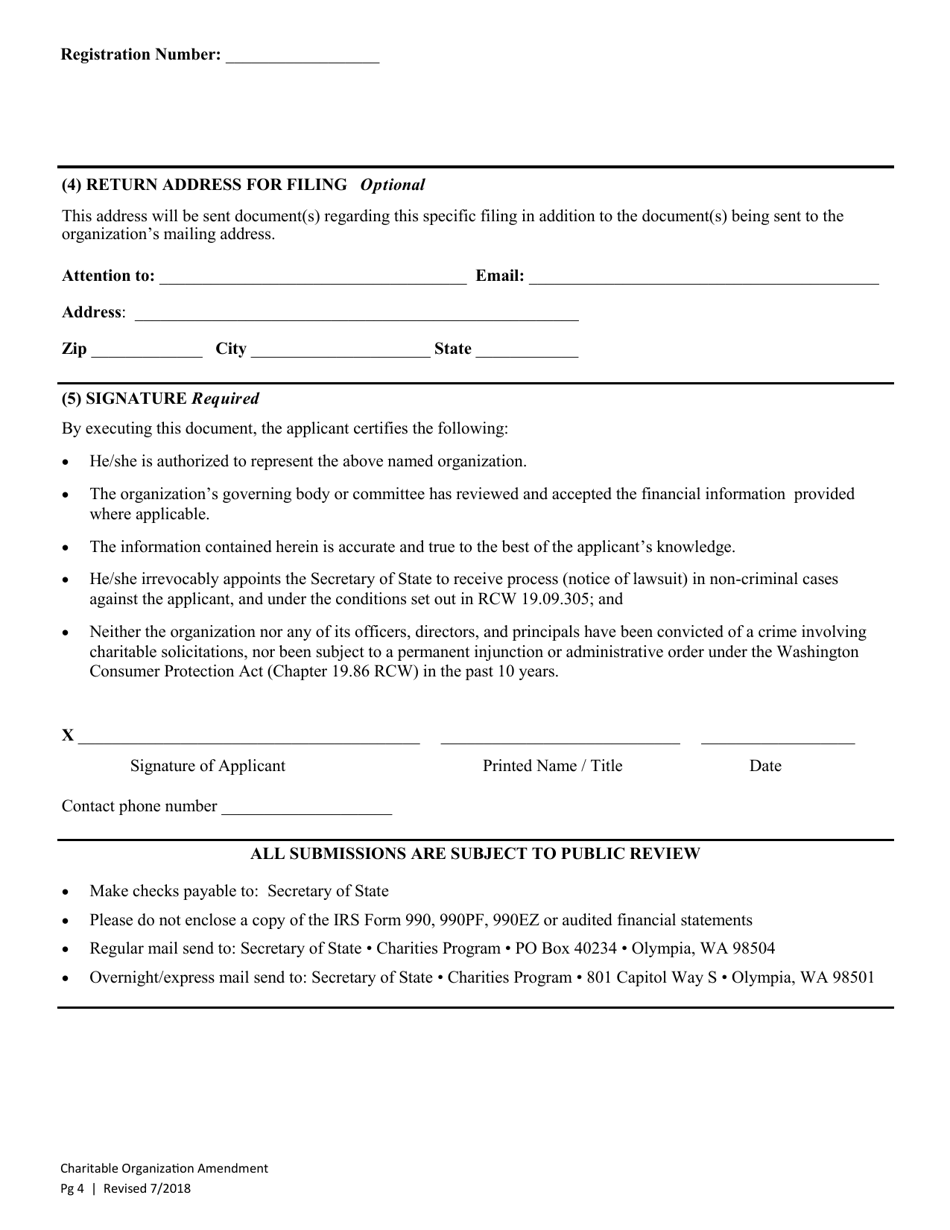

A: The Charitable Organization Amendment requires charitable organizations to register with the state and comply with certain reporting and financial disclosure requirements.

Q: Who is required to register under the Charitable Organization Amendment?

A: Charitable organizations, including nonprofits and other entities that solicit donations in Washington, are required to register under the Charitable Organization Amendment.

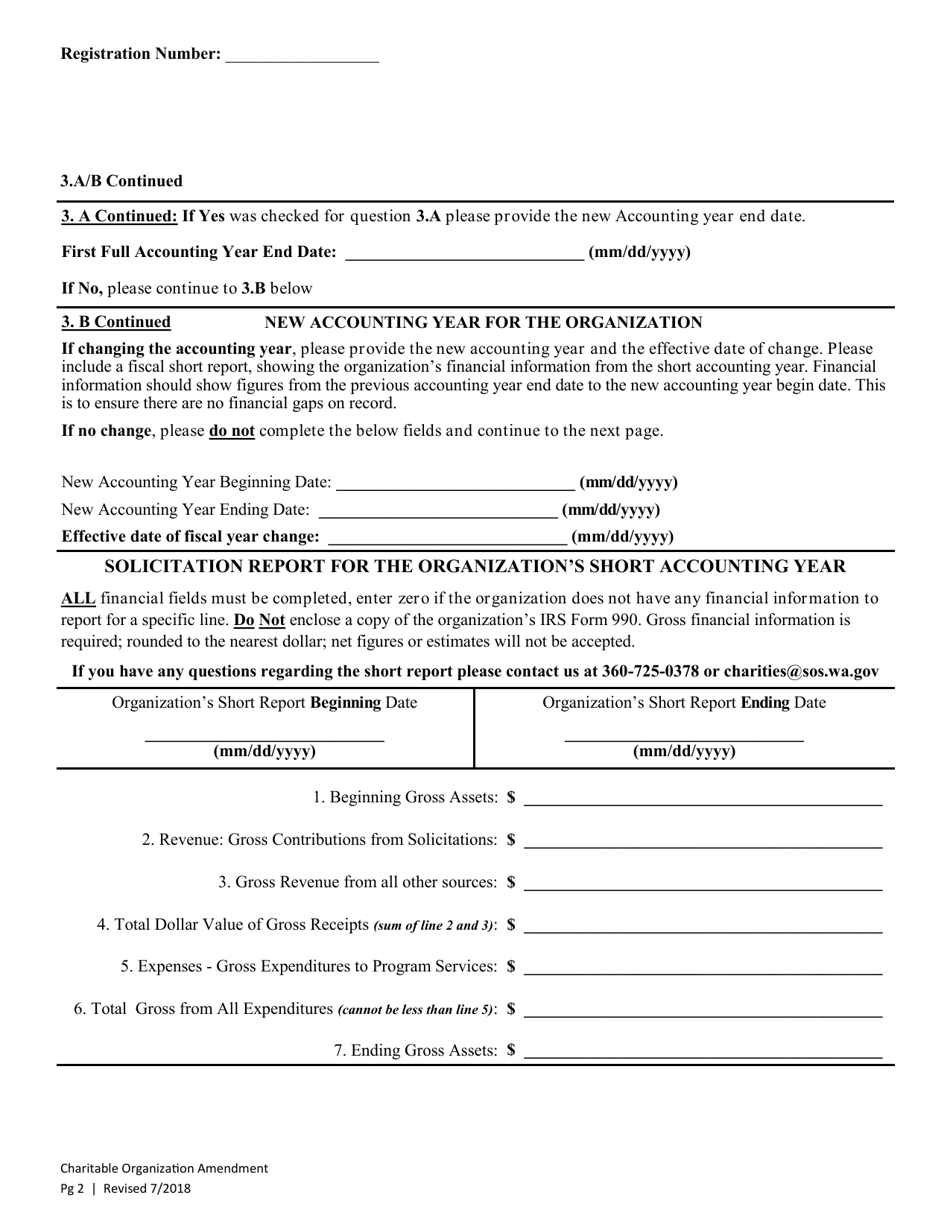

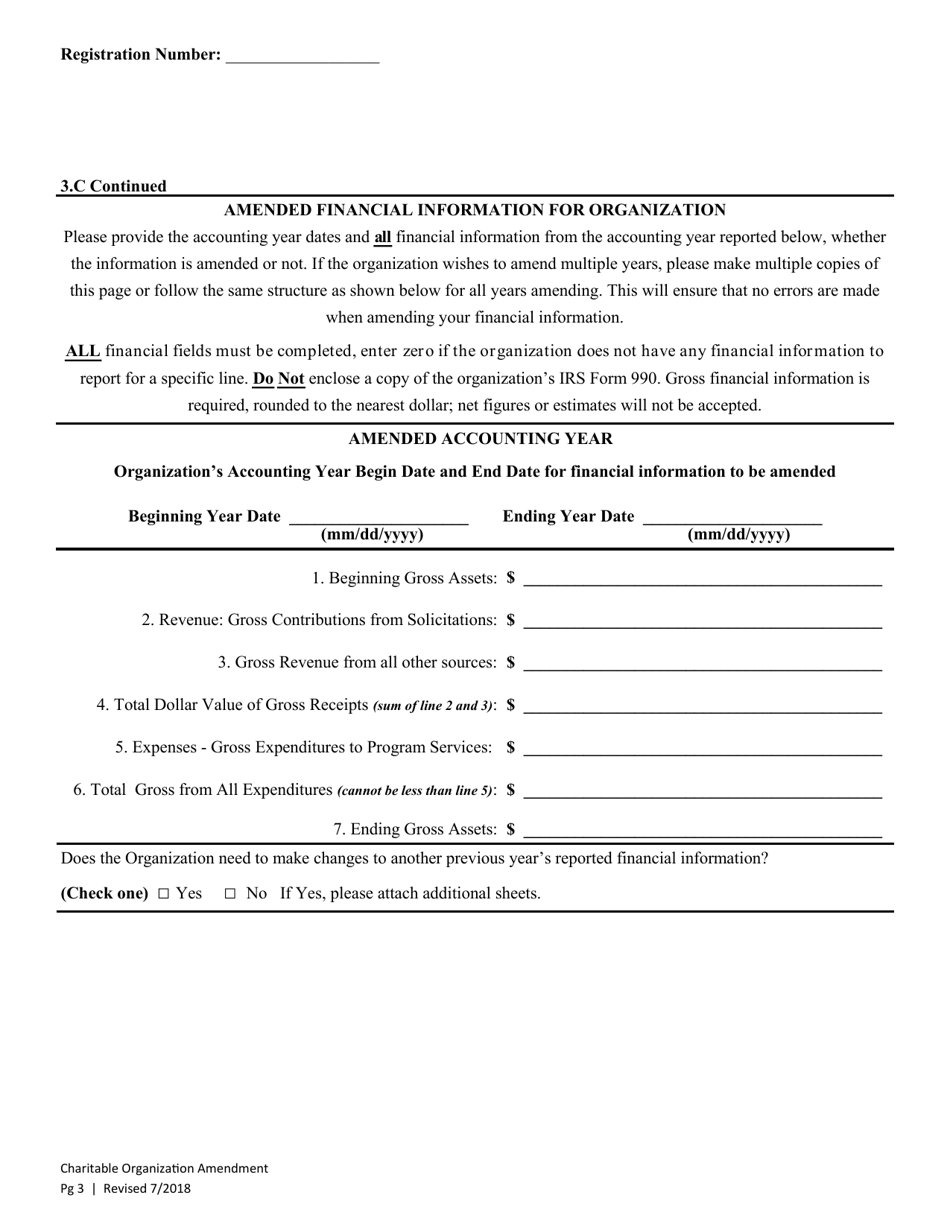

Q: What are the reporting requirements under the Charitable Organization Amendment?

A: Under the Charitable Organization Amendment, registered charitable organizations must file annual reports with the state, disclosing information about their finances, fundraising activities, and governance.

Q: Are there any exemptions to the registration requirement?

A: Yes, certain organizations are exempt from the registration requirement, including religious, educational, and governmental organizations.

Q: What are the penalties for non-compliance with the Charitable Organization Amendment?

A: Non-compliance with the Charitable Organization Amendment can result in penalties, such as fines and revocation of registration.

Form Details:

- Released on July 1, 2018;

- The latest edition currently provided by the Washington Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Washington Secretary of State.