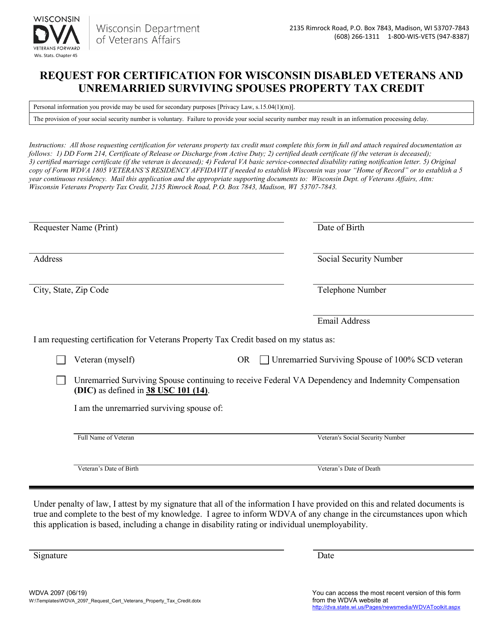

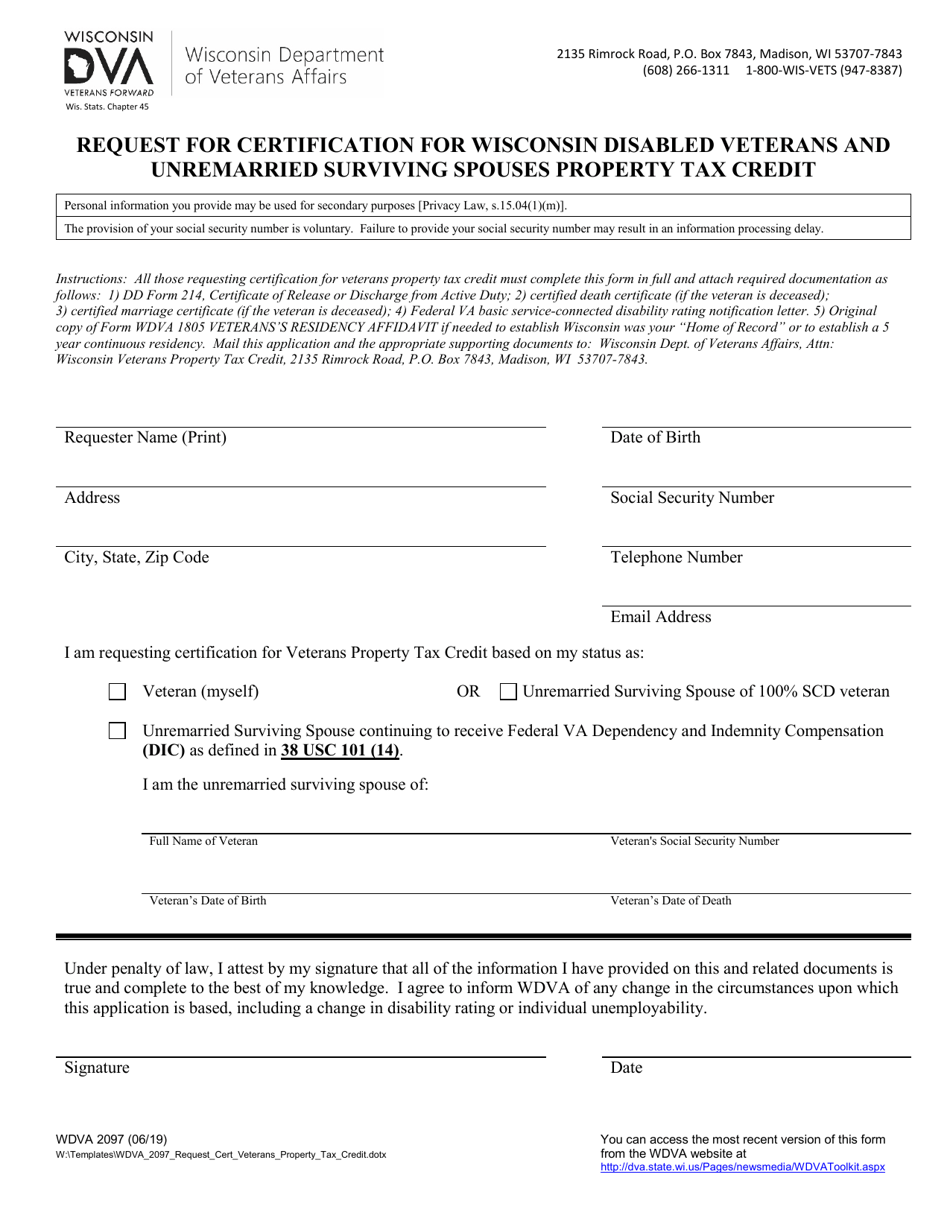

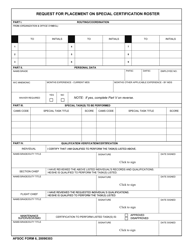

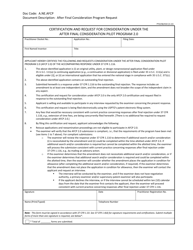

Form WDVA2097 Request for Certification for Wisconsin Disabled Veterans and Unremarried Surviving Spouses Property Tax Credit - Washington

What Is Form WDVA2097?

This is a legal form that was released by the Washington State Department of Veterans Affairs - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WDVA2097?

A: Form WDVA2097 is the Request for Certification for Wisconsin Disabled Veterans and Unremarried Surviving SpousesProperty Tax Credit.

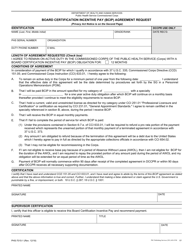

Q: Who is eligible to use Form WDVA2097?

A: Wisconsin disabled veterans and unremarried surviving spouses are eligible to use Form WDVA2097 to apply for the property tax credit.

Q: What is the purpose of Form WDVA2097?

A: The purpose of Form WDVA2097 is to certify the eligibility of disabled veterans and unremarried surviving spouses for the property tax credit in Wisconsin.

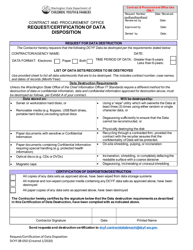

Q: How do I fill out Form WDVA2097?

A: To fill out Form WDVA2097, you need to provide your personal information, including your name, address, and social security number, as well as the required documentation to certify your eligibility for the property tax credit.

Q: How do I submit Form WDVA2097?

A: You can submit Form WDVA2097 to the Wisconsin Department of Veterans Affairs (WDVA) by mail or in person at their office.

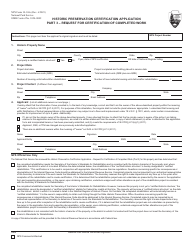

Q: When is the deadline to submit Form WDVA2097?

A: The deadline to submit Form WDVA2097 for the property tax credit in Wisconsin is determined by the WDVA and may vary each year.

Q: Is there a fee to submit Form WDVA2097?

A: There is no fee to submit Form WDVA2097 for the property tax credit in Wisconsin.

Q: What if I have questions or need assistance with Form WDVA2097?

A: If you have questions or need assistance with Form WDVA2097, you can contact the Wisconsin Department of Veterans Affairs (WDVA) for support.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Washington State Department of Veterans Affairs;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WDVA2097 by clicking the link below or browse more documents and templates provided by the Washington State Department of Veterans Affairs.