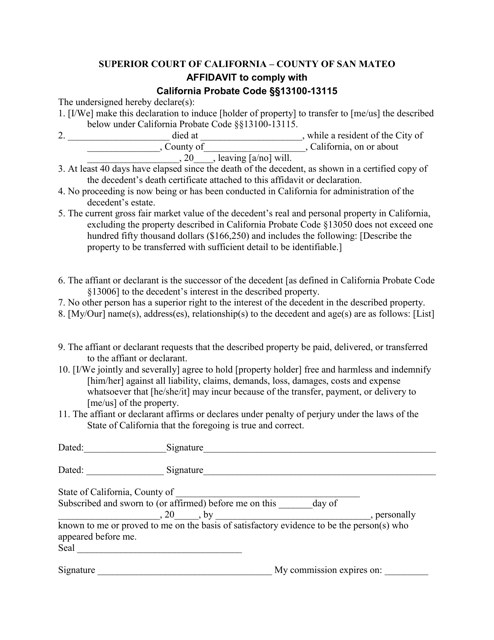

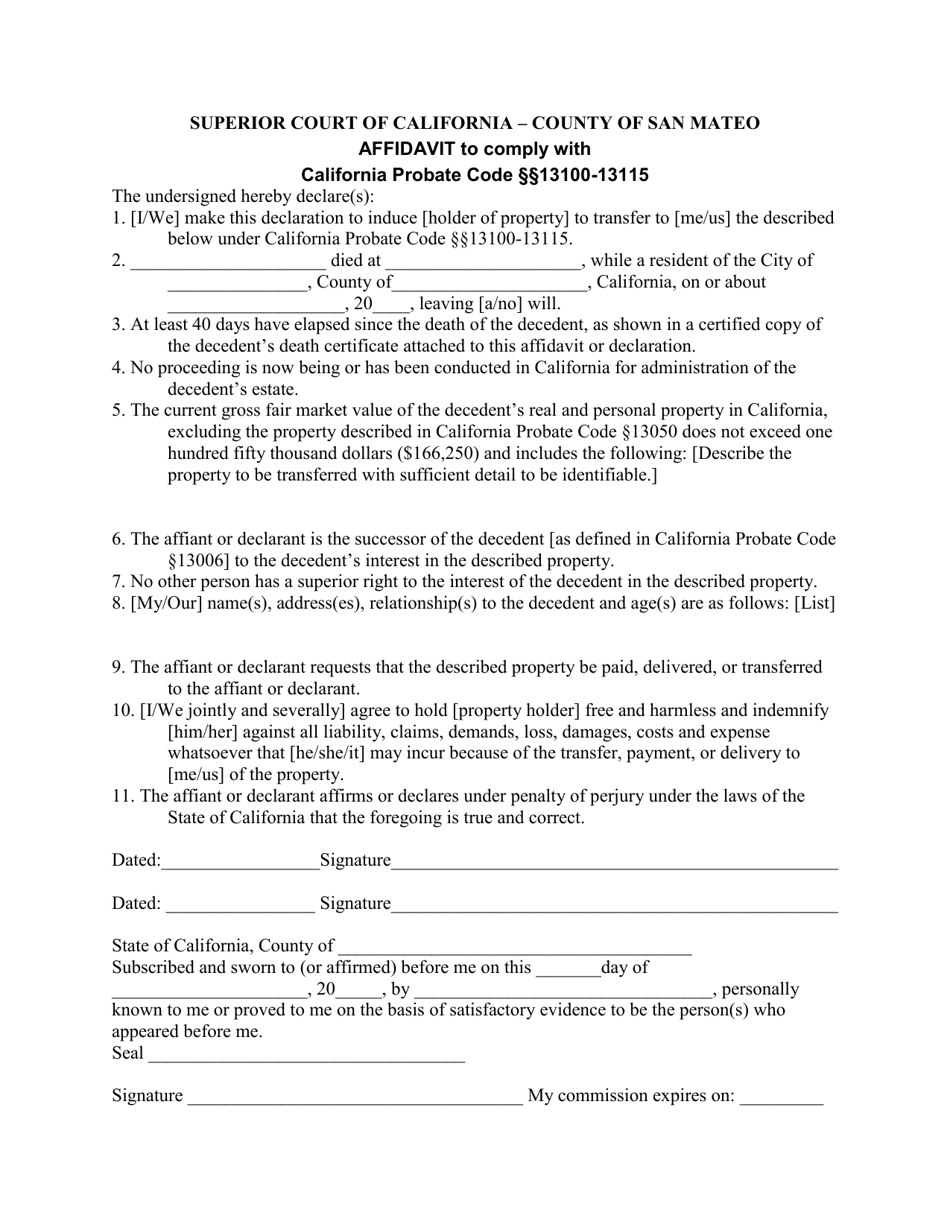

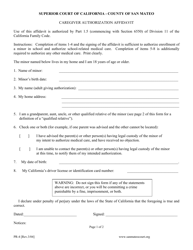

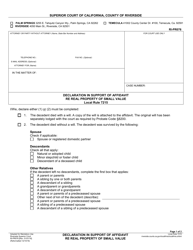

Form PR-8 Affidavit to Comply With California Probate Code 13100-13115 - County of San Mateo, California

What Is Form PR-8?

This is a legal form that was released by the Superior Court - County of San Mateo, California - a government authority operating within California. The form may be used strictly within County of San Mateo. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PR-8?

A: Form PR-8 is an affidavit to comply with California Probate Code 13100-13115.

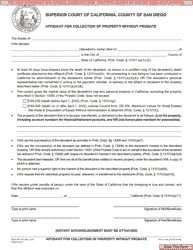

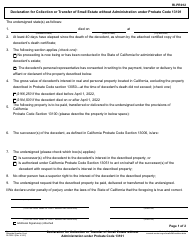

Q: What is California Probate Code 13100-13115?

A: California Probate Code 13100-13115 is a set of laws related to the transfer of small estates without probate.

Q: Who needs to use Form PR-8?

A: Individuals who are seeking to transfer small estates without probate in the County of San Mateo, California need to use Form PR-8.

Q: What is the purpose of Form PR-8?

A: The purpose of Form PR-8 is to declare that the assets of a deceased person qualify as a small estate and can be transferred without probate.

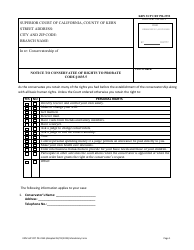

Q: Is Form PR-8 specific to San Mateo County?

A: Yes, Form PR-8 is specific to the County of San Mateo, California.

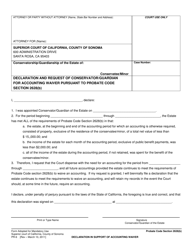

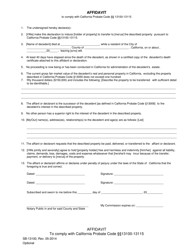

Q: Are there any filing fees associated with Form PR-8?

A: Yes, there may be filing fees associated with Form PR-8. The exact amount can be obtained from the probate court in San Mateo County.

Q: Do I need an attorney to complete Form PR-8?

A: You are not required to have an attorney to complete Form PR-8, but it is recommended to seek legal advice if you are unsure about the process.

Q: Can Form PR-8 be used for estates outside of San Mateo County?

A: No, Form PR-8 is specific to the County of San Mateo, California and cannot be used for estates in other counties.

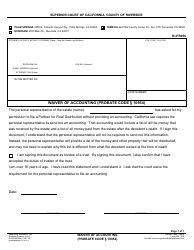

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Superior Court - County of San Mateo, California;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PR-8 by clicking the link below or browse more documents and templates provided by the Superior Court - County of San Mateo, California.