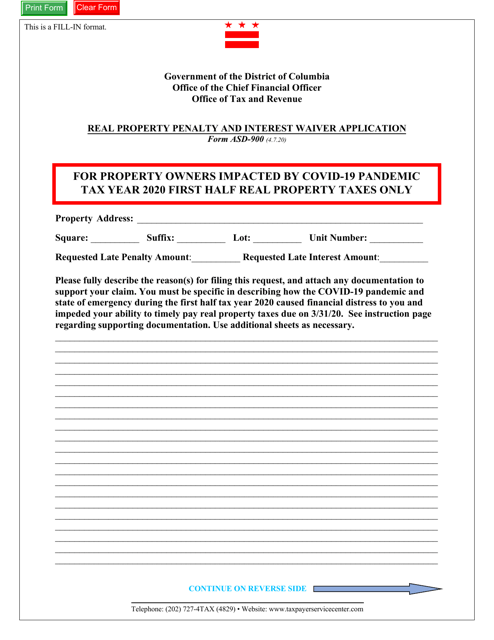

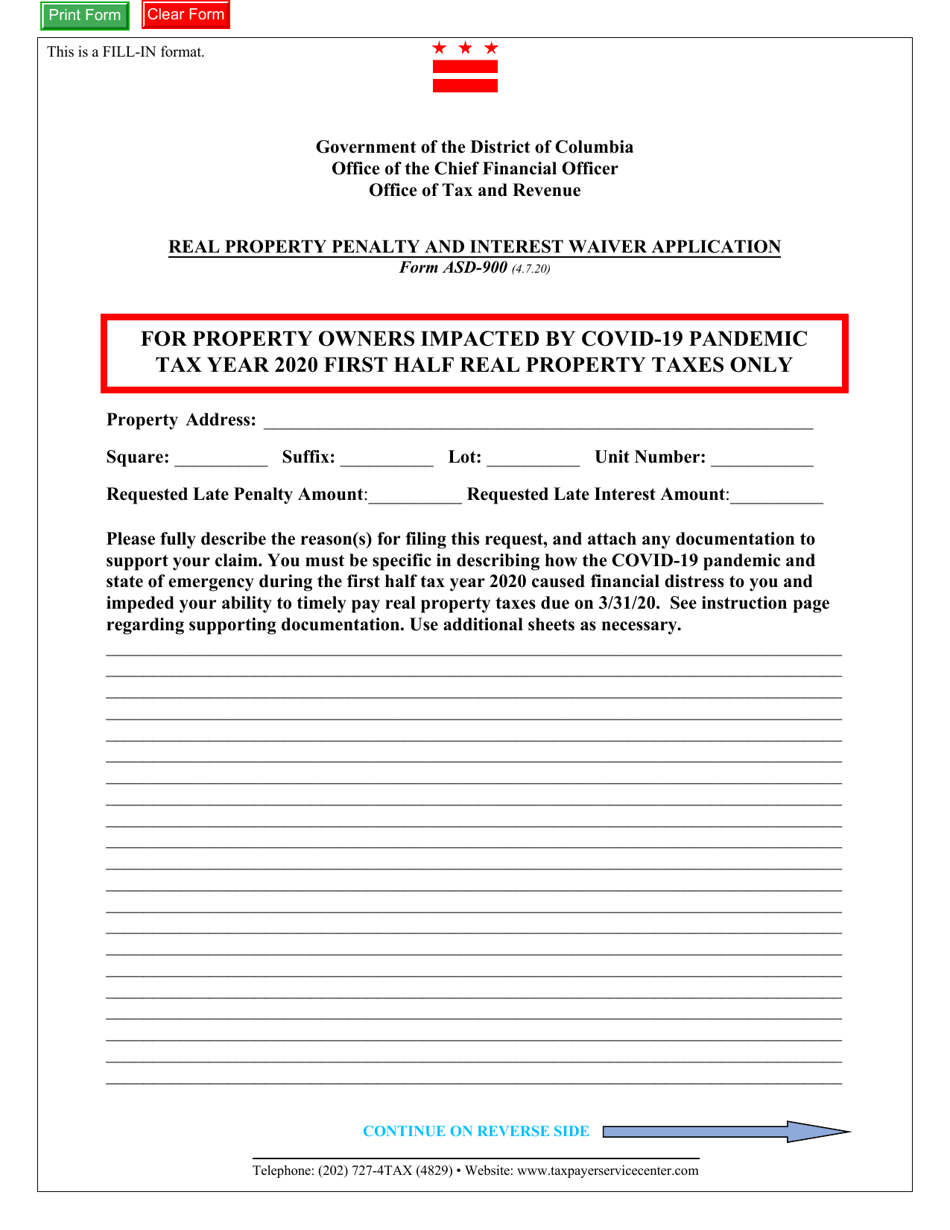

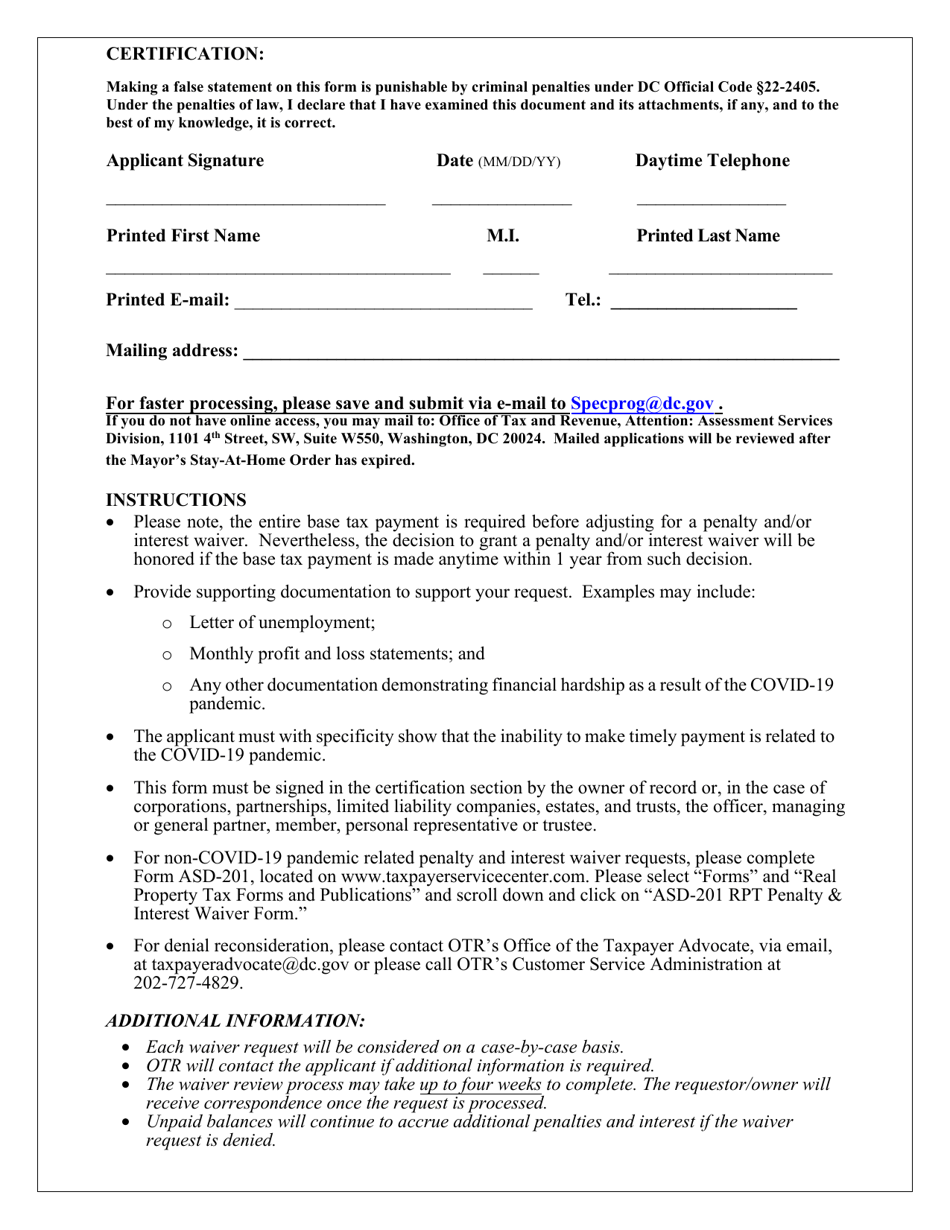

Form ASD-900 Real Property Penalty and Interest Waiver Application - Washington, D.C.

What Is Form ASD-900?

This is a legal form that was released by the Washington DC Office of Tax and Revenue - a government authority operating within Washington, D.C.. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the form ASD-900?

A: The form ASD-900 is the Real Property Penalty and Interest Waiver Application.

Q: What does the form ASD-900 waive?

A: The form ASD-900 waives penalties and interest on real property.

Q: Who can use the form ASD-900?

A: Any property owner in Washington, D.C. can use the form ASD-900 to apply for penalty and interest waiver.

Q: What is the purpose of the form ASD-900?

A: The purpose of the form ASD-900 is to request waiver of penalties and interest on real property in Washington, D.C.

Form Details:

- Released on April 7, 2020;

- The latest edition provided by the Washington DC Office of Tax and Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ASD-900 by clicking the link below or browse more documents and templates provided by the Washington DC Office of Tax and Revenue.