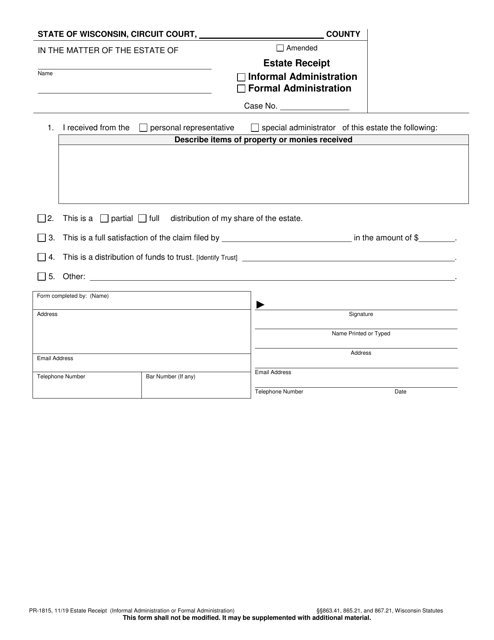

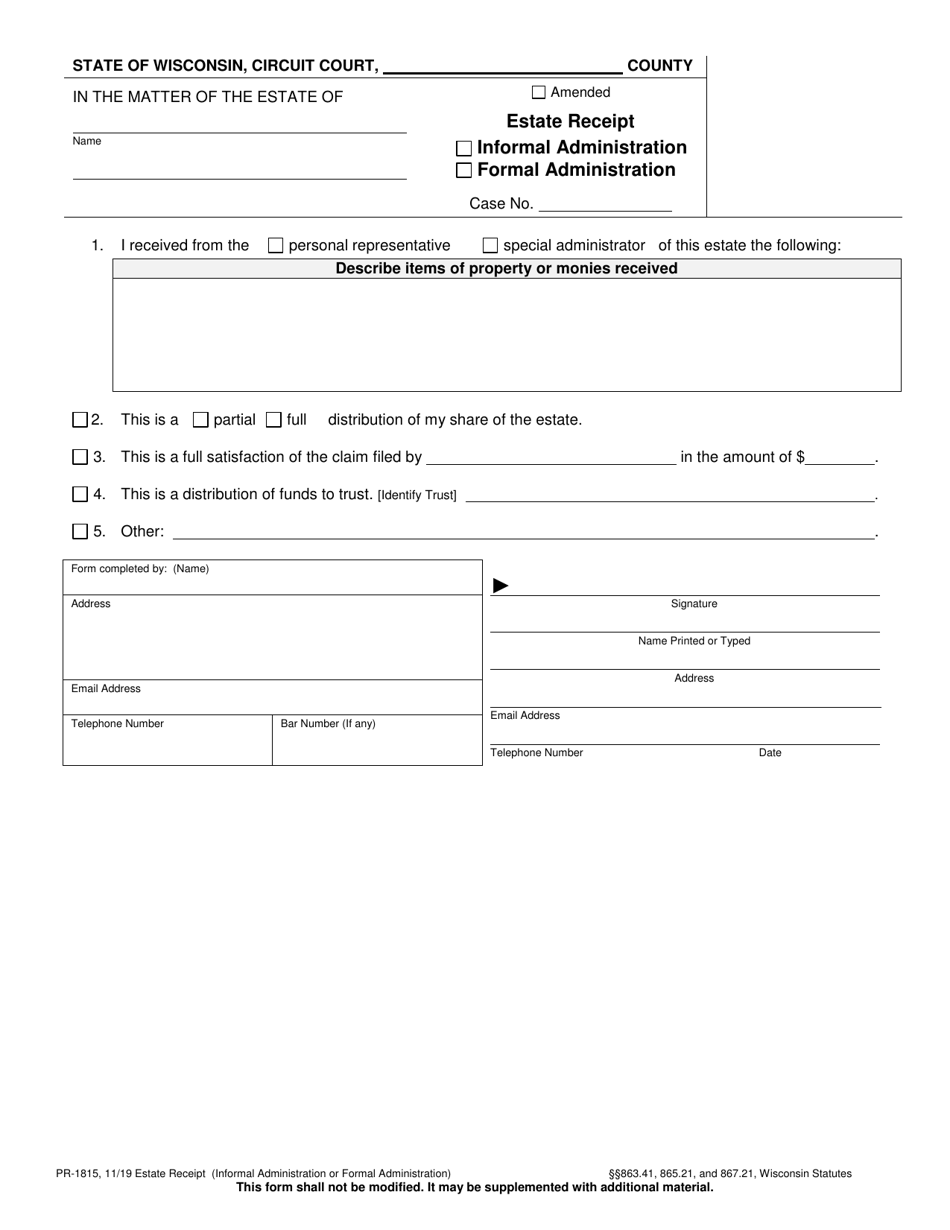

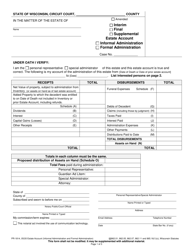

Form PR-1815 Estate Receipt (Informal and Formal Administration) - Wisconsin

What Is Form PR-1815?

This is a legal form that was released by the Wisconsin Circuit Court - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is PR-1815 Estate Receipt?

A: PR-1815 Estate Receipt is a form used in Wisconsin for both informal and formal administration of an estate.

Q: When is PR-1815 Estate Receipt used?

A: PR-1815 Estate Receipt is used when administering an estate in Wisconsin, regardless of whether it is an informal or formal administration.

Q: Who needs to fill out PR-1815 Estate Receipt?

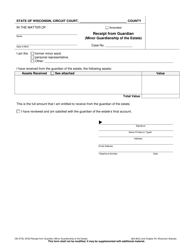

A: The personal representative or executor of the estate needs to fill out PR-1815 Estate Receipt.

Q: What information is required in PR-1815 Estate Receipt?

A: PR-1815 Estate Receipt requires information such as the personal representative's name, contact information, the decedent's name, date of death, and the estate assets and liabilities.

Q: Are there any fees associated with filing PR-1815 Estate Receipt?

A: Yes, there may be fees associated with filing PR-1815 Estate Receipt. The specific fees can vary depending on the county in Wisconsin.

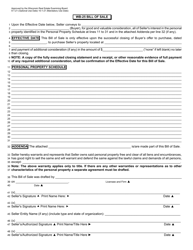

Q: What happens after submitting PR-1815 Estate Receipt?

A: After submitting PR-1815 Estate Receipt, it will be reviewed by the Probate Court. If everything is in order, the personal representative will receive a receipt confirming the filing.

Q: Is PR-1815 Estate Receipt required for all estates in Wisconsin?

A: Yes, PR-1815 Estate Receipt is required for all estates being administered in Wisconsin, whether it is an informal or formal administration.

Q: Can I get help with filling out PR-1815 Estate Receipt?

A: Yes, you can seek assistance from an attorney or a legal professional to help you fill out PR-1815 Estate Receipt correctly.

Form Details:

- Released on November 21, 2019;

- The latest edition provided by the Wisconsin Circuit Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PR-1815 by clicking the link below or browse more documents and templates provided by the Wisconsin Circuit Court.