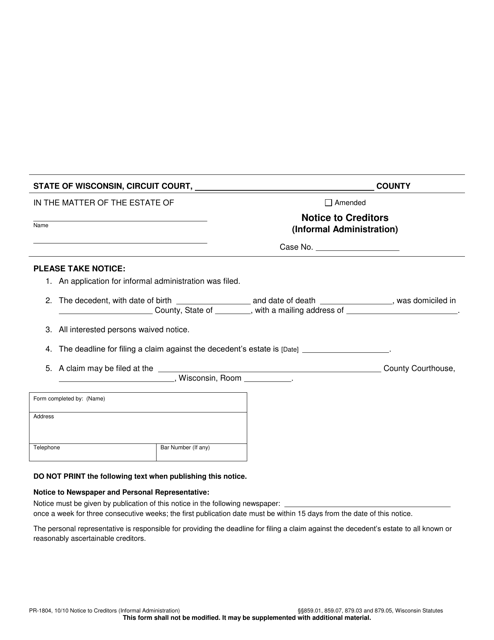

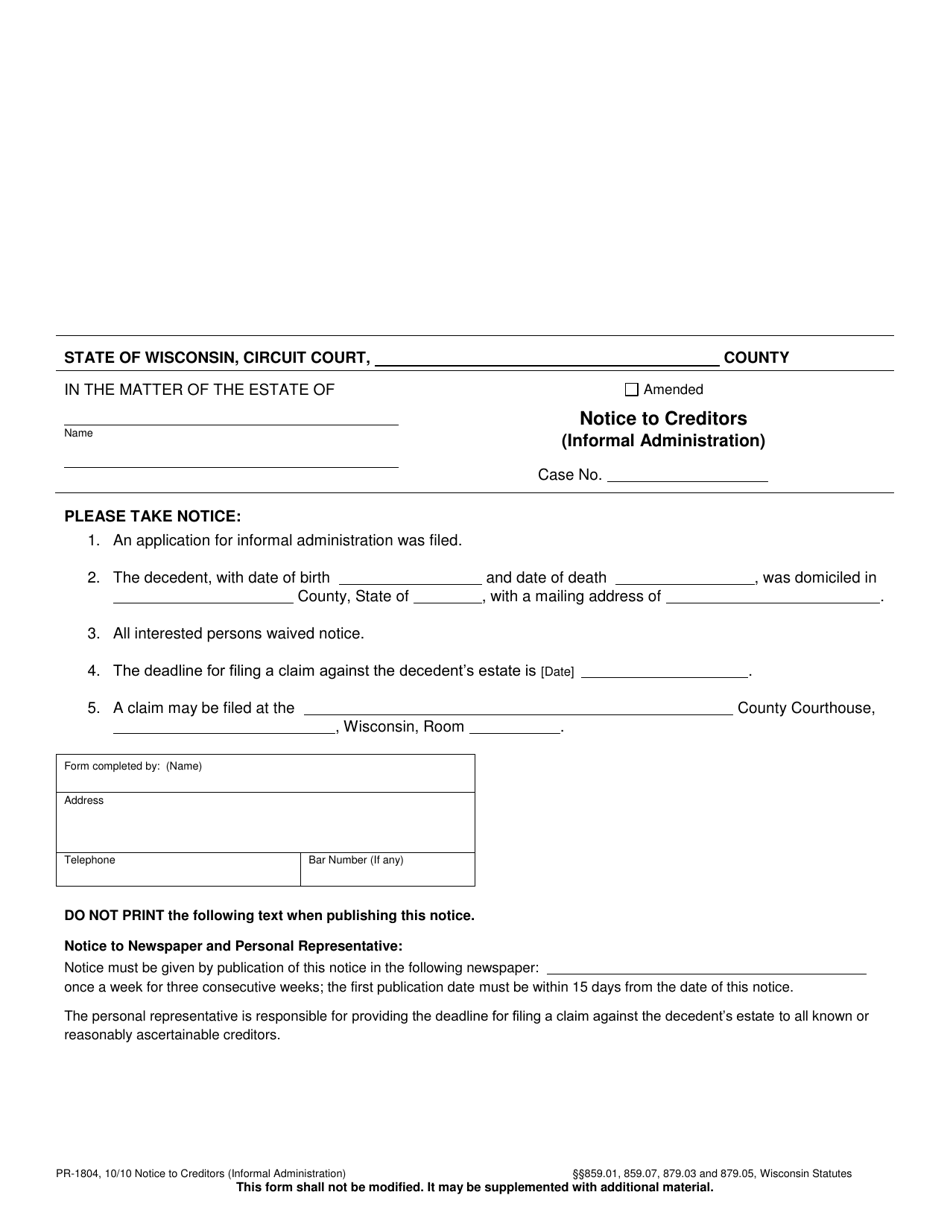

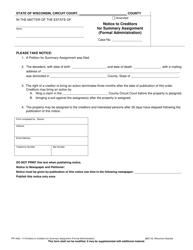

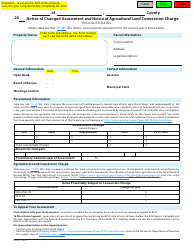

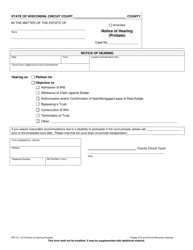

Form PR-1804 Notice to Creditors - Wisconsin

What Is Form PR-1804?

This is a legal form that was released by the Wisconsin Circuit Court - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PR-1804?

A: Form PR-1804 is a Notice to Creditors used in Wisconsin.

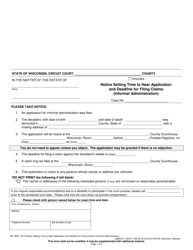

Q: When is Form PR-1804 used?

A: Form PR-1804 is used to notify creditors of a deceased person's estate in Wisconsin.

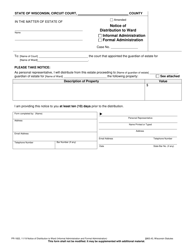

Q: Who can use Form PR-1804?

A: Form PR-1804 can be used by the personal representative or executor of the deceased person's estate.

Q: What information is required in Form PR-1804?

A: Form PR-1804 requires the name and address of the deceased person, the name and address of the personal representative, and a list of known creditors.

Q: How should Form PR-1804 be filed?

A: Form PR-1804 should be filed with the probate court in the county where the deceased person lived.

Q: Is there a deadline for filing Form PR-1804?

A: Yes, Form PR-1804 must be filed within 3 months from the date of the first published notice to creditors.

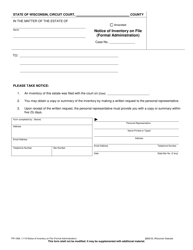

Q: What happens after Form PR-1804 is filed?

A: After Form PR-1804 is filed, the personal representative must publish a notice to creditors in a local newspaper for 3 successive weeks.

Q: Can creditors file claims against the estate after receiving Form PR-1804?

A: Yes, creditors have 4 months from the first date of publication to file claims against the estate.

Q: What should creditors do if they receive Form PR-1804?

A: Creditors should review the notice carefully and file a claim if they believe they are owed money by the deceased person.

Q: Are there any fees associated with filing Form PR-1804?

A: Yes, there may be a fee for filing Form PR-1804 with the probate court. The fee amount depends on the county.

Form Details:

- Released on October 1, 2010;

- The latest edition provided by the Wisconsin Circuit Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PR-1804 by clicking the link below or browse more documents and templates provided by the Wisconsin Circuit Court.