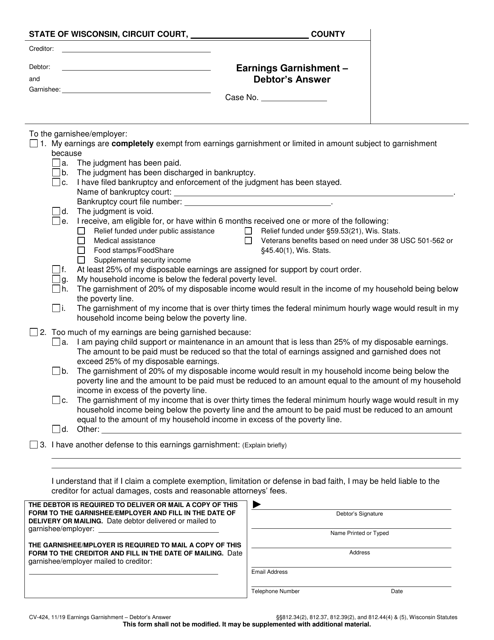

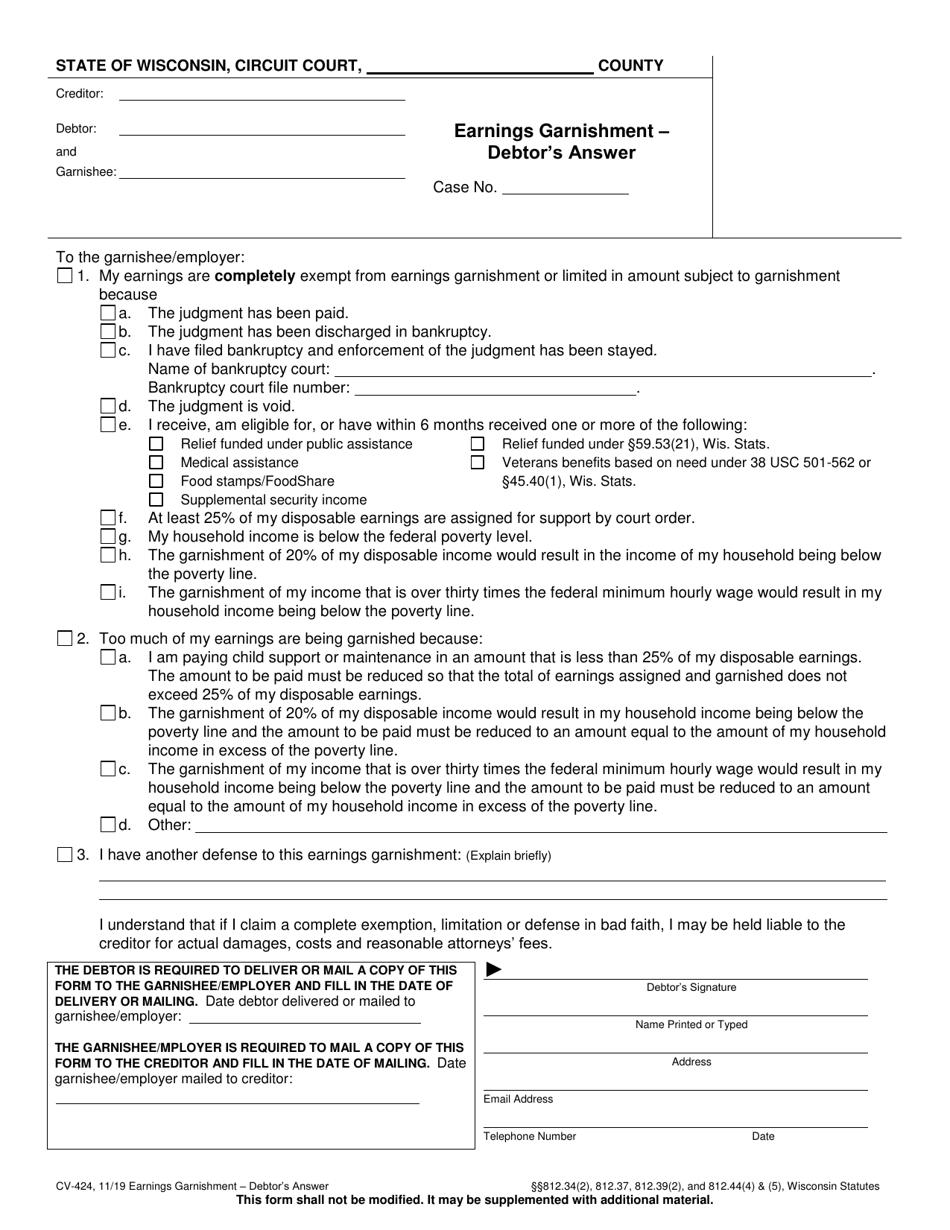

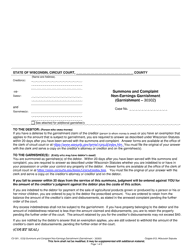

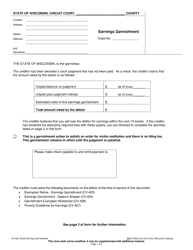

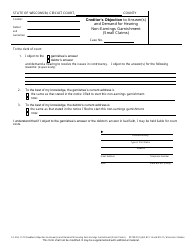

Form CV-424 Earnings Garnishment - Debtor's Answer - Wisconsin

What Is Form CV-424?

This is a legal form that was released by the Wisconsin Circuit Court - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form CV-424 Earnings Garnishment - Debtor's Answer?

A: The Form CV-424 Earnings Garnishment - Debtor's Answer is a document used in Wisconsin for debtors to respond to a garnishment action against their earnings.

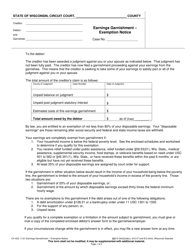

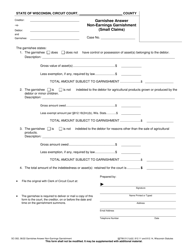

Q: What is a garnishment?

A: Garnishment is a legal process in which a creditor collects money owed by a debtor by withholding a portion of the debtor's wages directly from their employer.

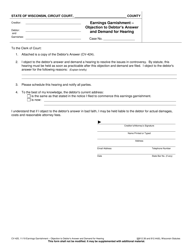

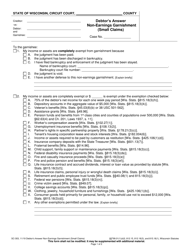

Q: Why would I need to file a Debtor's Answer?

A: You would need to file a Debtor's Answer if you are a debtor and you want to challenge the garnishment action or claim an exemption from wage garnishment.

Q: What information do I need to provide in the Debtor's Answer?

A: In the Debtor's Answer, you need to provide your personal information, details about the garnishment action, and any exemptions you are claiming.

Q: What happens after I file the Debtor's Answer?

A: After you file the Debtor's Answer, the court will review your response and make a decision regarding the garnishment action.

Q: Can I stop a garnishment by filing a Debtor's Answer?

A: Filing a Debtor's Answer may help you challenge or reduce the garnishment, but ultimately, the court will decide whether to continue or modify the garnishment action.

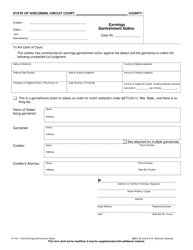

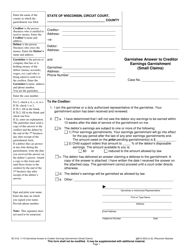

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Wisconsin Circuit Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CV-424 by clicking the link below or browse more documents and templates provided by the Wisconsin Circuit Court.