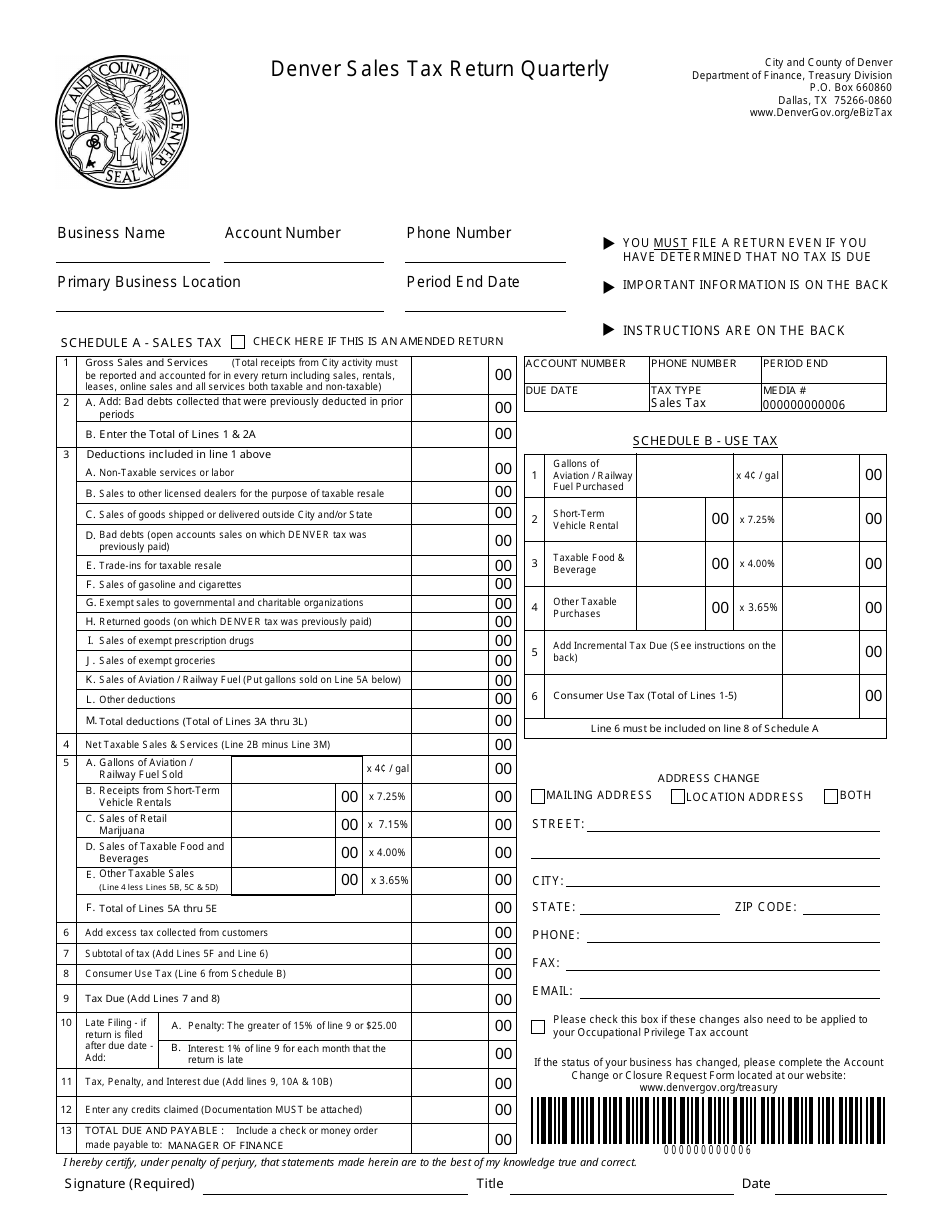

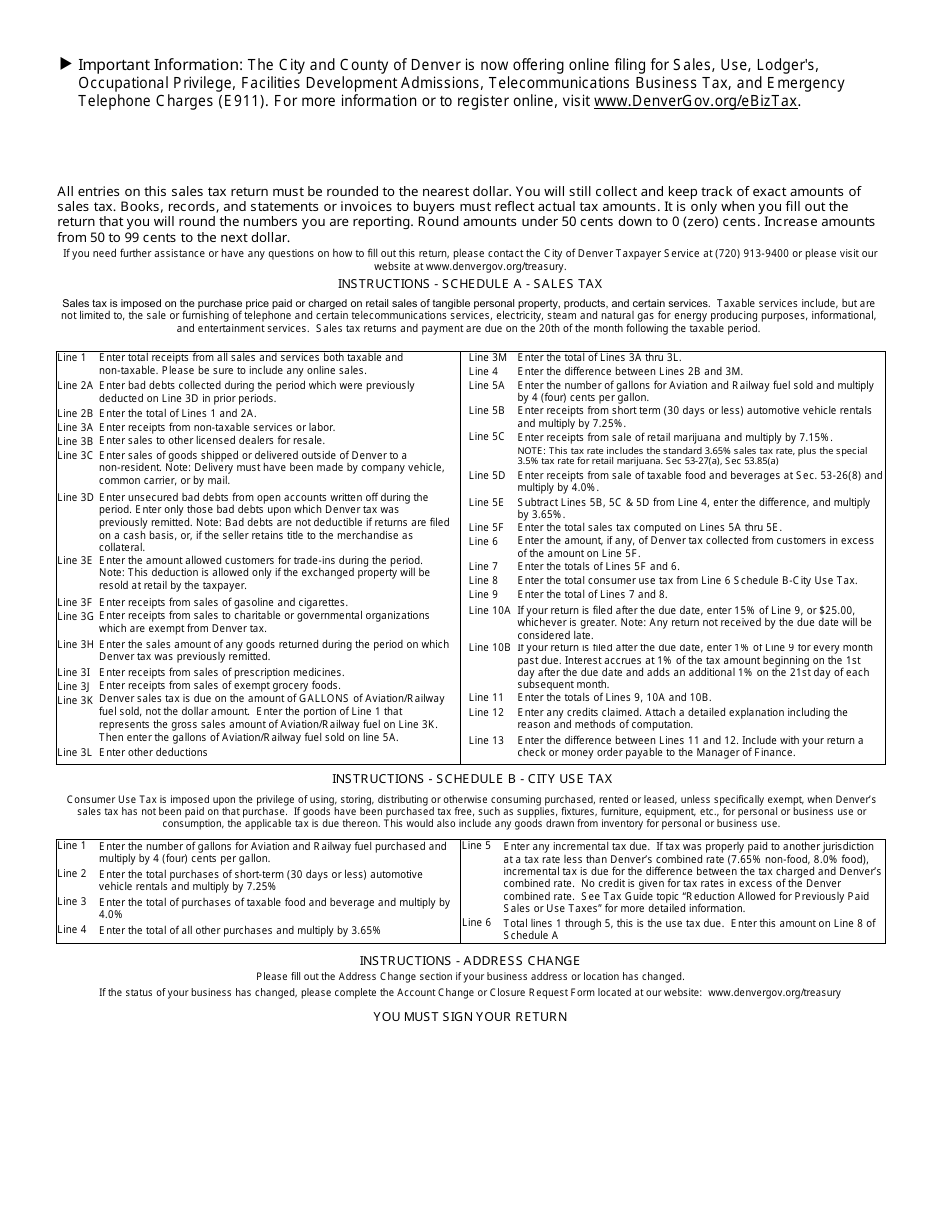

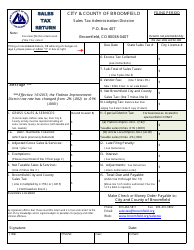

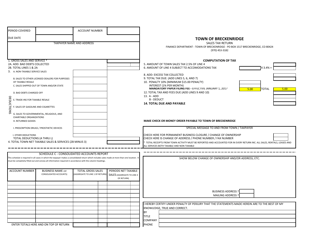

Sales Tax Return Quarterly Form - City and County of Denver, Colorado

Sales Tax Return Quarterly Form is a legal document that was released by the Colorado Department of Revenue - a government authority operating within Colorado. The form may be used strictly within City and County of Denver.

FAQ

Q: What is the Sales Tax Return Quarterly Form?

A: The Sales Tax Return Quarterly Form is a form used to report and remit sales tax to the City and County of Denver, Colorado.

Q: Who needs to file the Sales Tax Return Quarterly Form?

A: Businesses operating in the City and County of Denver, Colorado that are required to collect sales tax must file the Sales Tax Return Quarterly Form.

Q: How often do I need to file the Sales Tax Return Quarterly Form?

A: The Sales Tax Return Quarterly Form must be filed on a quarterly basis.

Q: What information is required on the Sales Tax Return Quarterly Form?

A: The Sales Tax Return Quarterly Form requires information such as gross sales, taxable sales, and the amount of sales tax collected.

Q: What happens if I fail to file the Sales Tax Return Quarterly Form?

A: Failure to file the Sales Tax Return Quarterly Form can result in penalties and interest being assessed on the outstanding tax amount.

Form Details:

- The latest edition currently provided by the Colorado Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.