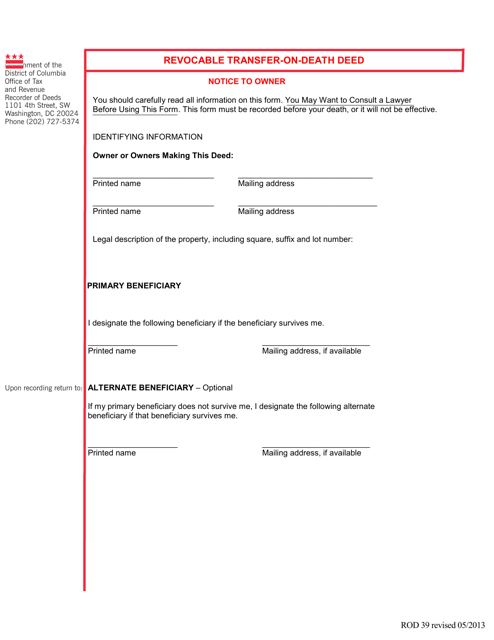

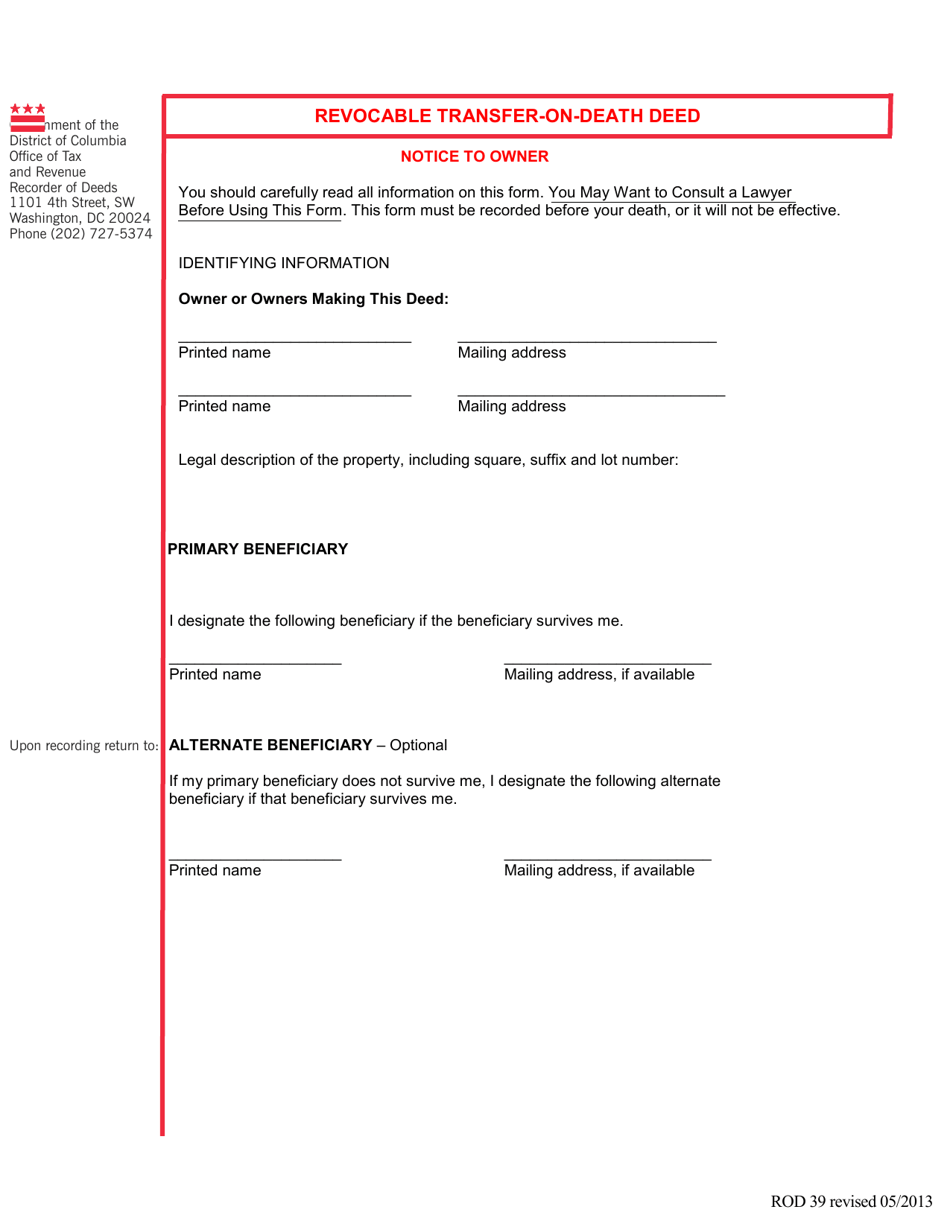

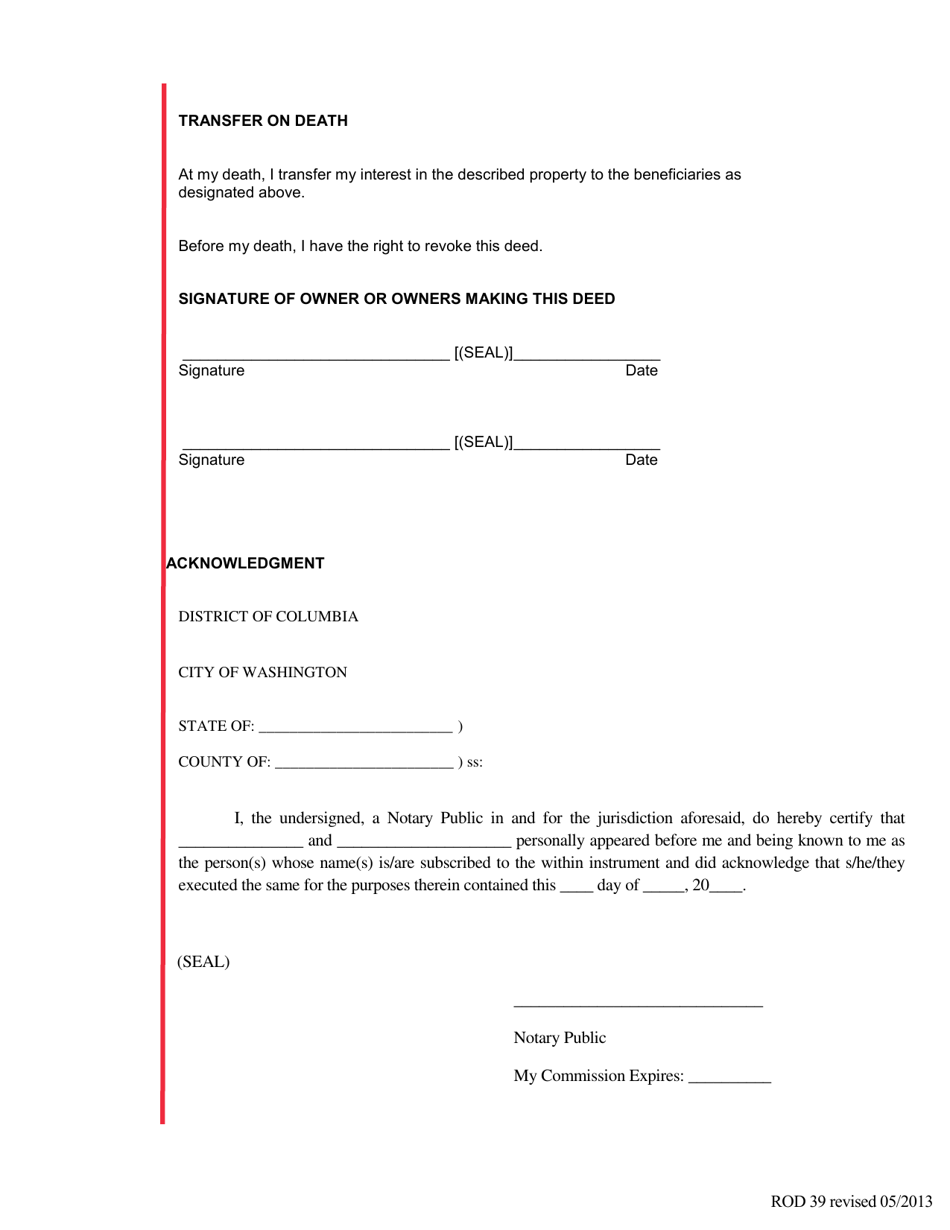

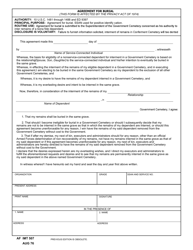

Form ROD39 Transfer-On-Death Deed - Washington, D.C.

What Is Form ROD39?

This is a legal form that was released by the Washington DC Office of Tax and Revenue - a government authority operating within Washington, D.C.. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

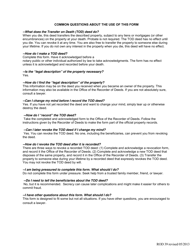

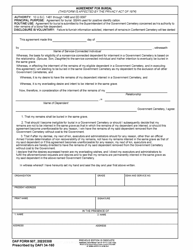

Q: What is a ROD39 Transfer-On-Death Deed?

A: ROD39 Transfer-On-Death Deed is a legal document used in Washington, D.C. to transfer real property to designated beneficiaries upon the owner's death without the need for probate.

Q: What does the ROD39 Transfer-On-Death Deed do?

A: The ROD39 Transfer-On-Death Deed allows an owner of real property in Washington, D.C. to designate beneficiaries who will receive the property upon their death.

Q: What are the benefits of using a ROD39 Transfer-On-Death Deed?

A: Using a ROD39 Transfer-On-Death Deed can help avoid probate, simplify the transfer of property after death, and provide greater control over the distribution of property.

Q: Who can use a ROD39 Transfer-On-Death Deed?

A: Any individual who owns real property in Washington, D.C. can use a ROD39 Transfer-On-Death Deed to transfer their property to designated beneficiaries.

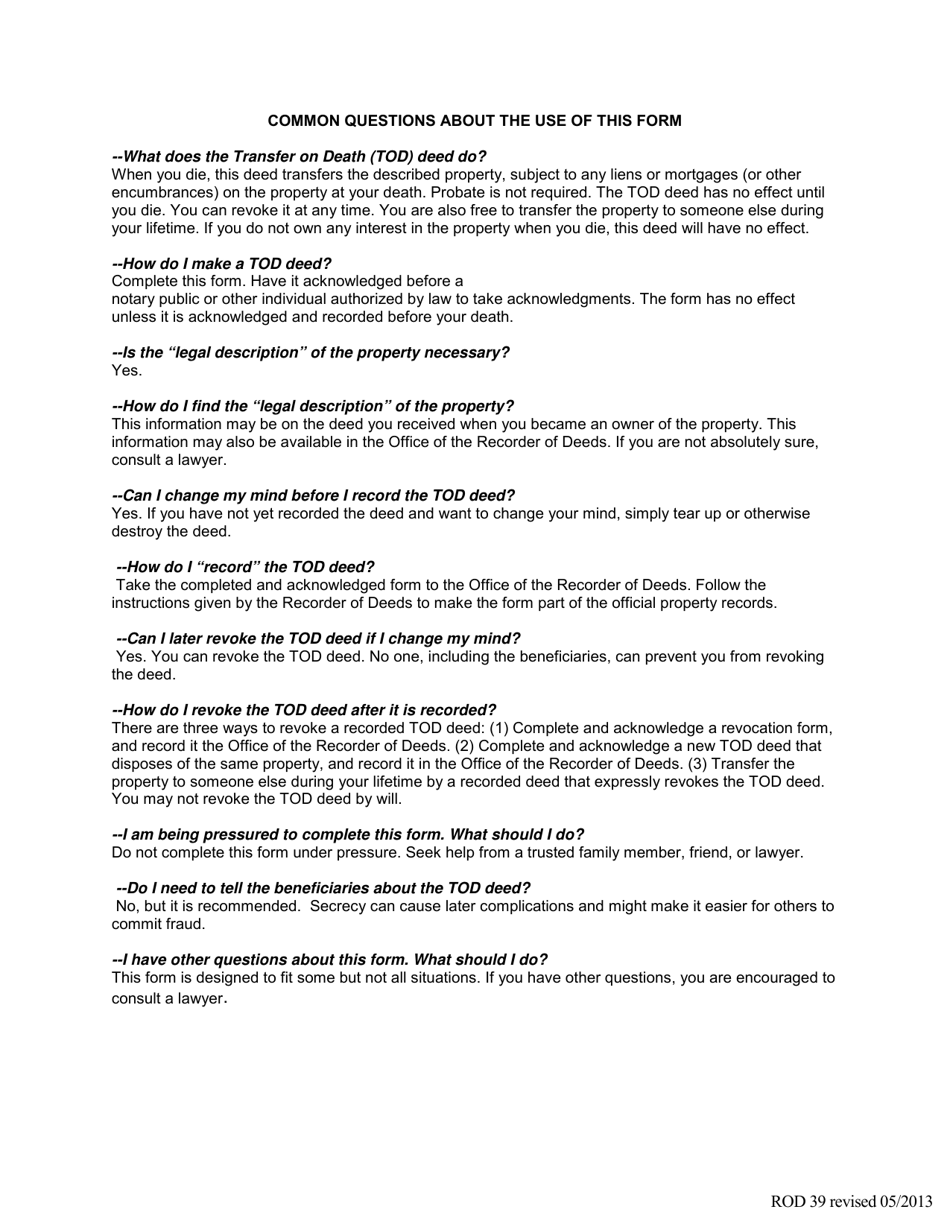

Q: Is a ROD39 Transfer-On-Death Deed revocable?

A: Yes, a ROD39 Transfer-On-Death Deed is revocable, which means the owner can change or revoke the designation of beneficiaries at any time before their death.

Q: Is a ROD39 Transfer-On-Death Deed recorded?

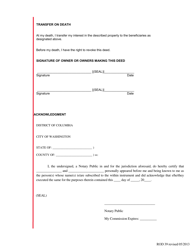

A: Yes, a ROD39 Transfer-On-Death Deed must be recorded with the District of Columbia Recorder of Deeds in order to be legally valid and effective.

Form Details:

- Released on May 1, 2013;

- The latest edition provided by the Washington DC Office of Tax and Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ROD39 by clicking the link below or browse more documents and templates provided by the Washington DC Office of Tax and Revenue.