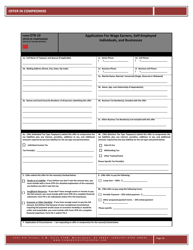

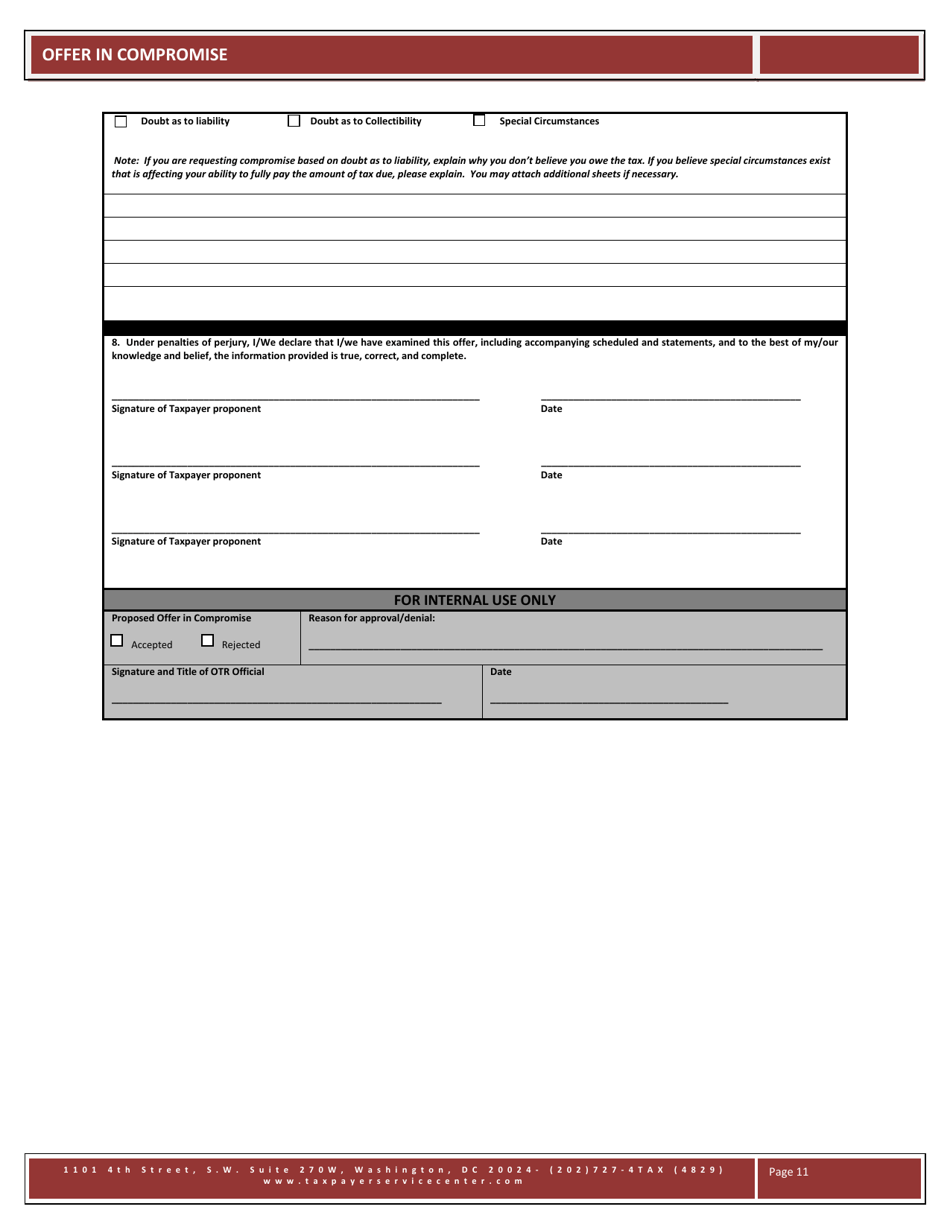

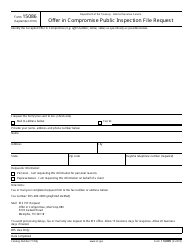

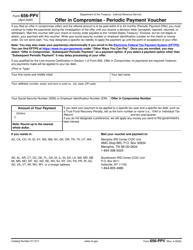

Form OTR-10 Offer in Compromise - Washington, D.C.

What Is Form OTR-10?

This is a legal form that was released by the Washington DC Office of Tax and Revenue - a government authority operating within Washington, D.C.. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

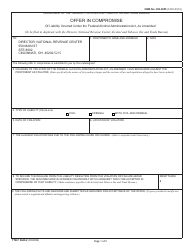

Q: What is Form OTR-10 Offer in Compromise?

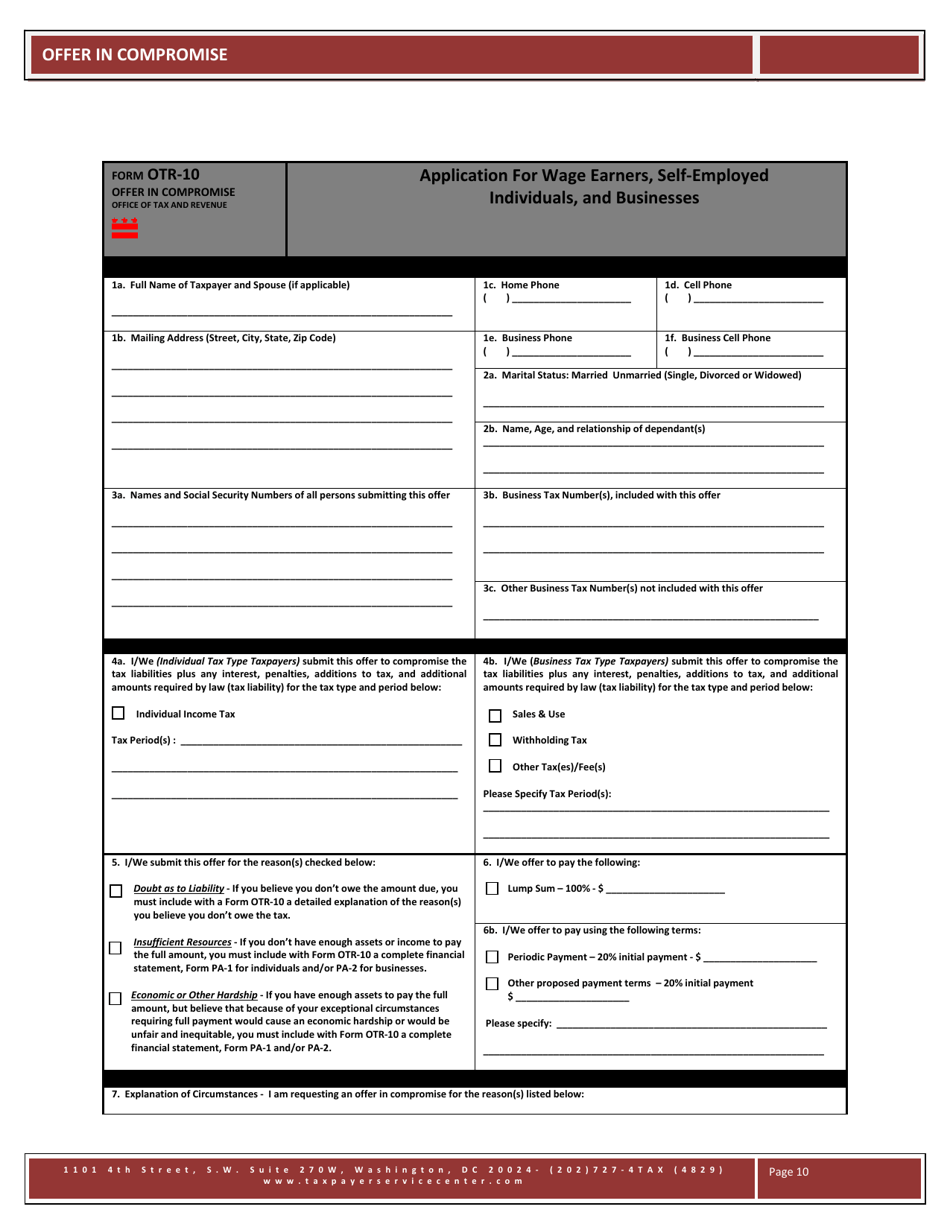

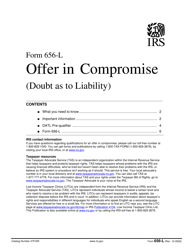

A: Form OTR-10 Offer in Compromise is a tax form used in Washington, D.C. for taxpayers to propose a settlement with the Office of Tax and Revenue (OTR) to resolve their tax debt for less than the full amount owed.

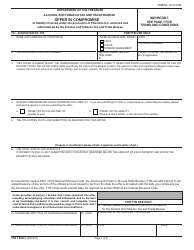

Q: Who can use Form OTR-10 Offer in Compromise?

A: Any taxpayer who has a tax debt in Washington, D.C. and is unable to pay the full amount owed may be eligible to use Form OTR-10 Offer in Compromise.

Q: What is the purpose of Form OTR-10 Offer in Compromise?

A: The purpose of Form OTR-10 Offer in Compromise is to provide taxpayers with a means to settle their tax debt with the OTR by offering a reduced amount that they are able to pay.

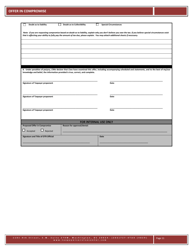

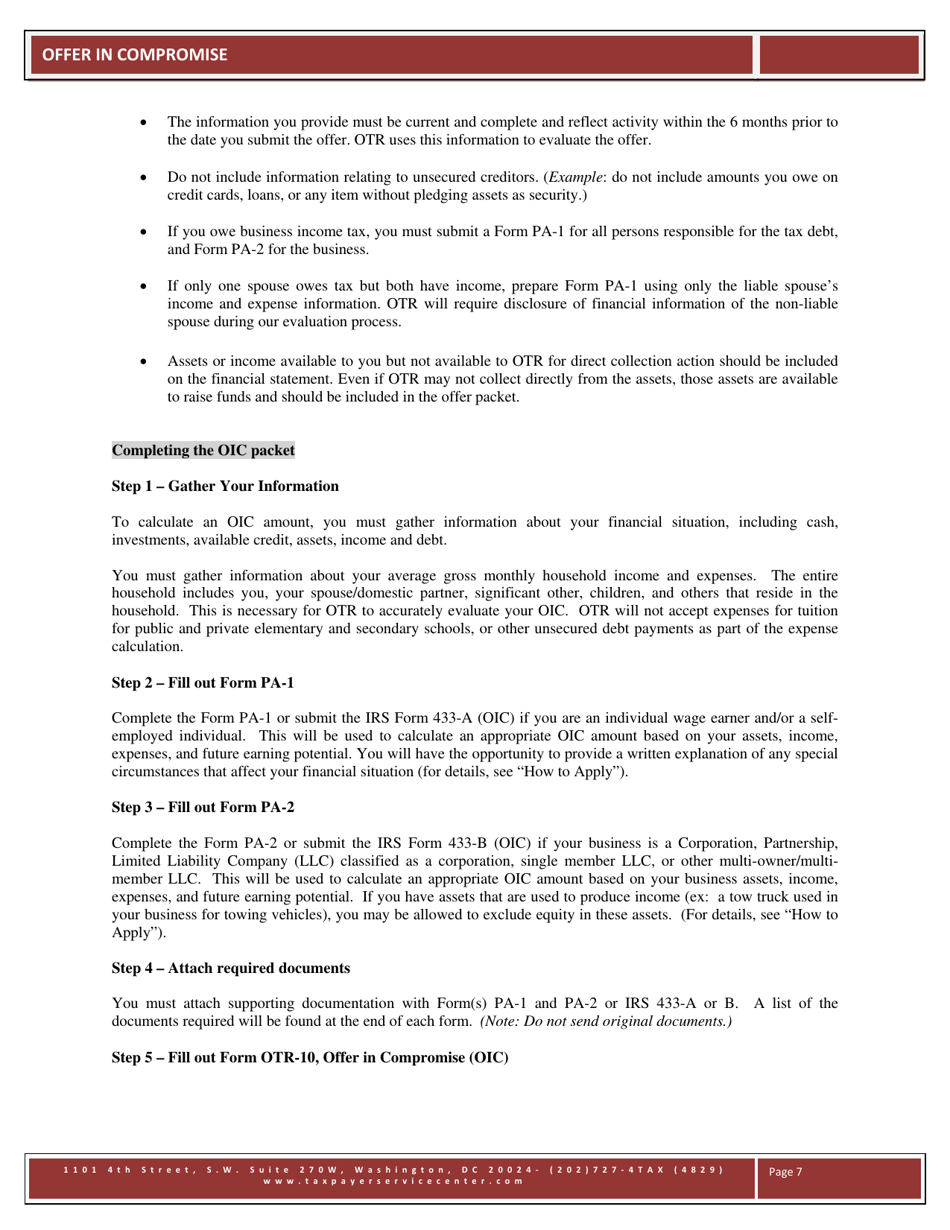

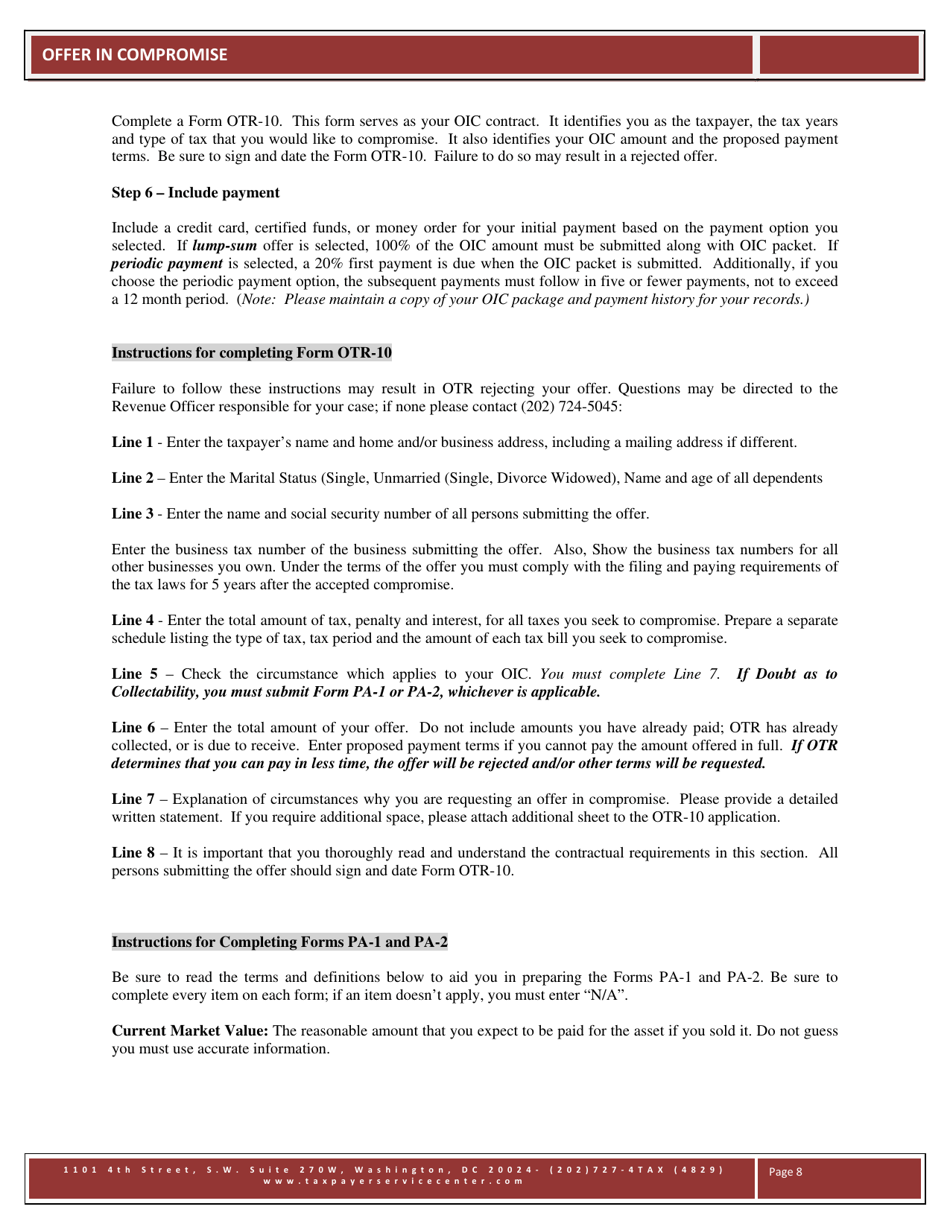

Q: How do I file Form OTR-10 Offer in Compromise?

A: To file Form OTR-10 Offer in Compromise, you need to complete the form with accurate and detailed information about your financial situation, provide supporting documentation, and submit it to the OTR.

Q: What happens after I file Form OTR-10 Offer in Compromise?

A: After you file Form OTR-10 Offer in Compromise, the OTR will review your submission, assess your financial situation, and determine if they will accept or reject your offer.

Q: Can I negotiate with the OTR regarding my tax debt?

A: Yes, you can negotiate with the OTR regarding your tax debt by submitting Form OTR-10 Offer in Compromise and proposing a settlement amount that you can afford to pay.

Form Details:

- The latest edition provided by the Washington DC Office of Tax and Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OTR-10 by clicking the link below or browse more documents and templates provided by the Washington DC Office of Tax and Revenue.