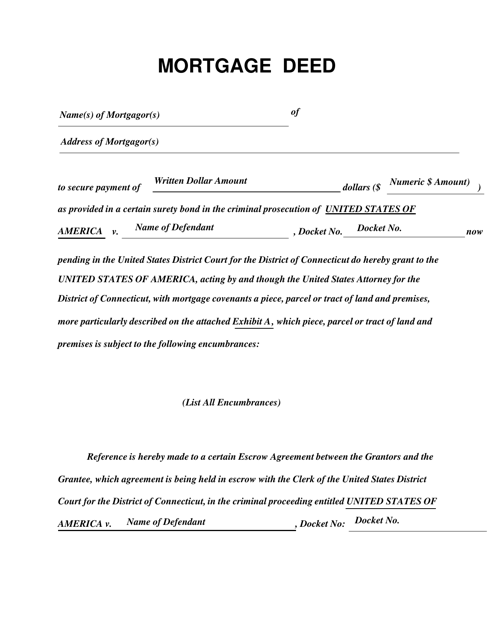

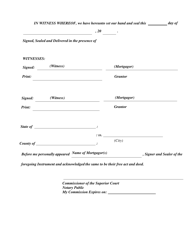

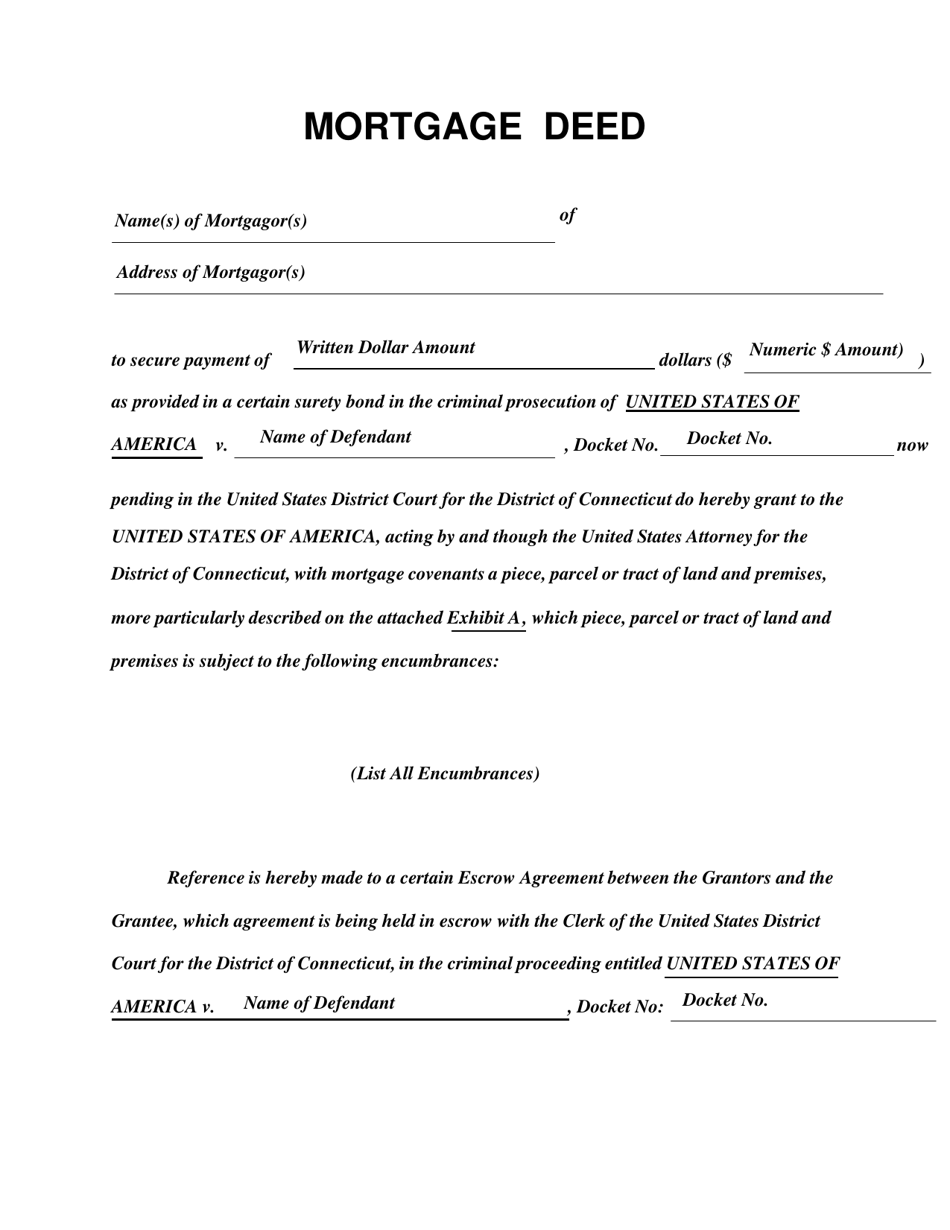

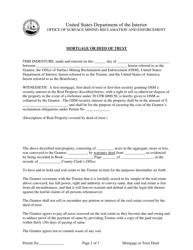

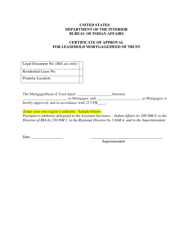

Mortgage Deed - Connecticut

Mortgage Deed is a legal document that was released by the United States District Court - District of Connecticut - a government authority operating within Connecticut.

FAQ

Q: What is a mortgage deed?

A: A mortgage deed is a legal document that provides a lender with security for a loan by using a property as collateral.

Q: What is the purpose of a mortgage deed?

A: The purpose of a mortgage deed is to establish a lien on a property as security for a mortgage loan.

Q: How does a mortgage deed work?

A: When a borrower gets a mortgage loan, they sign a mortgage deed that gives the lender the right to take ownership of the property if the borrower fails to repay the loan.

Q: What are the key elements of a mortgage deed?

A: The key elements of a mortgage deed include the names of the borrower and lender, a description of the property, the loan amount, and the terms and conditions of the loan.

Q: What happens after a mortgage loan is repaid?

A: Once a mortgage loan is fully repaid, the lender will release the mortgage deed, and the borrower will have full ownership of the property without any liens or encumbrances.

Q: Can a mortgage deed be transferred to another person?

A: Yes, a mortgage deed can be transferred to another person through a process called assigning the mortgage.

Q: What are the consequences of defaulting on a mortgage loan?

A: If a borrower defaults on a mortgage loan, the lender can initiate foreclosure proceedings and take possession of the property.

Q: What are the rights and responsibilities of the borrower and lender under a mortgage deed?

A: The rights and responsibilities of the borrower and lender under a mortgage deed include the borrower's responsibility to make timely loan payments and the lender's right to foreclose on the property in case of default.

Q: Is a mortgage deed the same as a promissory note?

A: No, a mortgage deed and a promissory note are two separate documents. A mortgage deed establishes a lien on the property, while a promissory note is a written promise to repay the loan.

Q: Do I need a lawyer to create a mortgage deed in Connecticut?

A: It is advisable to consult a lawyer when creating a mortgage deed in Connecticut to ensure that all legal requirements are met and the document is properly drafted.

Form Details:

- The latest edition currently provided by the United States District Court - District of Connecticut;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the United States District Court - District of Connecticut.