Sample Financial Commitment Letter - Georgia (United States)

Sample Financial Commitment Letter is a legal document that was released by the Georgia Department of Community Affairs - a government authority operating within Georgia (United States).

FAQ

Q: What is a financial commitment letter?

A: A financial commitment letter is a document in which a lender provides a borrower with a written commitment to provide a certain amount of funding.

Q: What is the purpose of a financial commitment letter?

A: The purpose of a financial commitment letter is to demonstrate to the borrower that a lender is willing to provide the necessary funds for a particular project or transaction.

Q: How is a financial commitment letter different from a pre-approval letter?

A: A financial commitment letter is typically more formal and binding than a pre-approval letter. It represents a lender's firm commitment to provide funding, whereas a pre-approval letter is a preliminary indication of a borrower's ability to obtain financing.

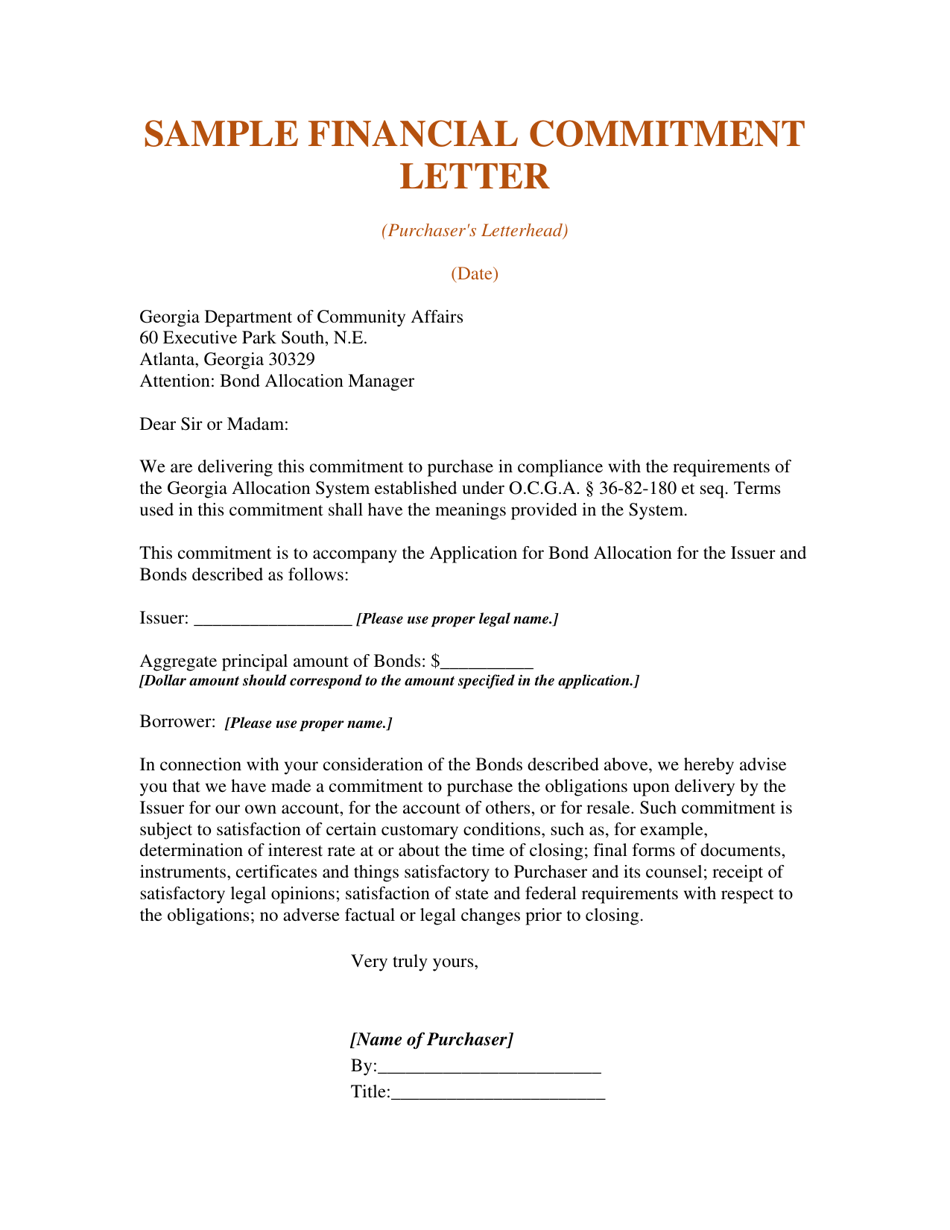

Q: What should be included in a financial commitment letter?

A: A financial commitment letter should include the loan amount, interest rate, repayment terms, any conditions or contingencies, and the lender's contact information.

Q: Is a financial commitment letter legally binding?

A: Yes, a financial commitment letter is legally binding once it is accepted and signed by both the borrower and the lender.

Q: Can a financial commitment letter be revoked?

A: In most cases, a financial commitment letter cannot be revoked unless there are specific contingencies or conditions that allow for cancellation or withdrawal of the commitment.

Form Details:

- The latest edition currently provided by the Georgia Department of Community Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Georgia Department of Community Affairs.