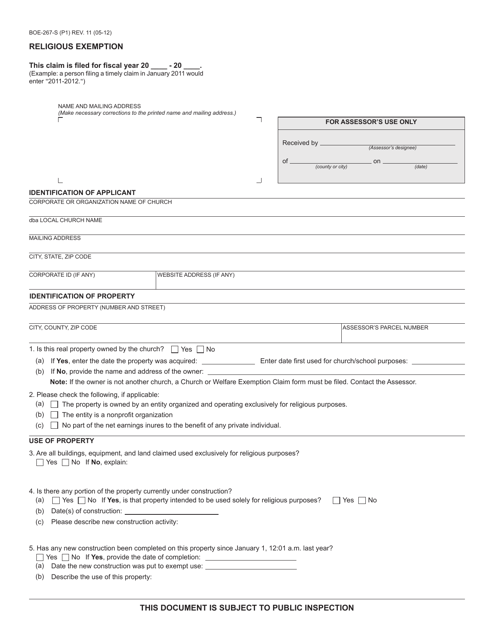

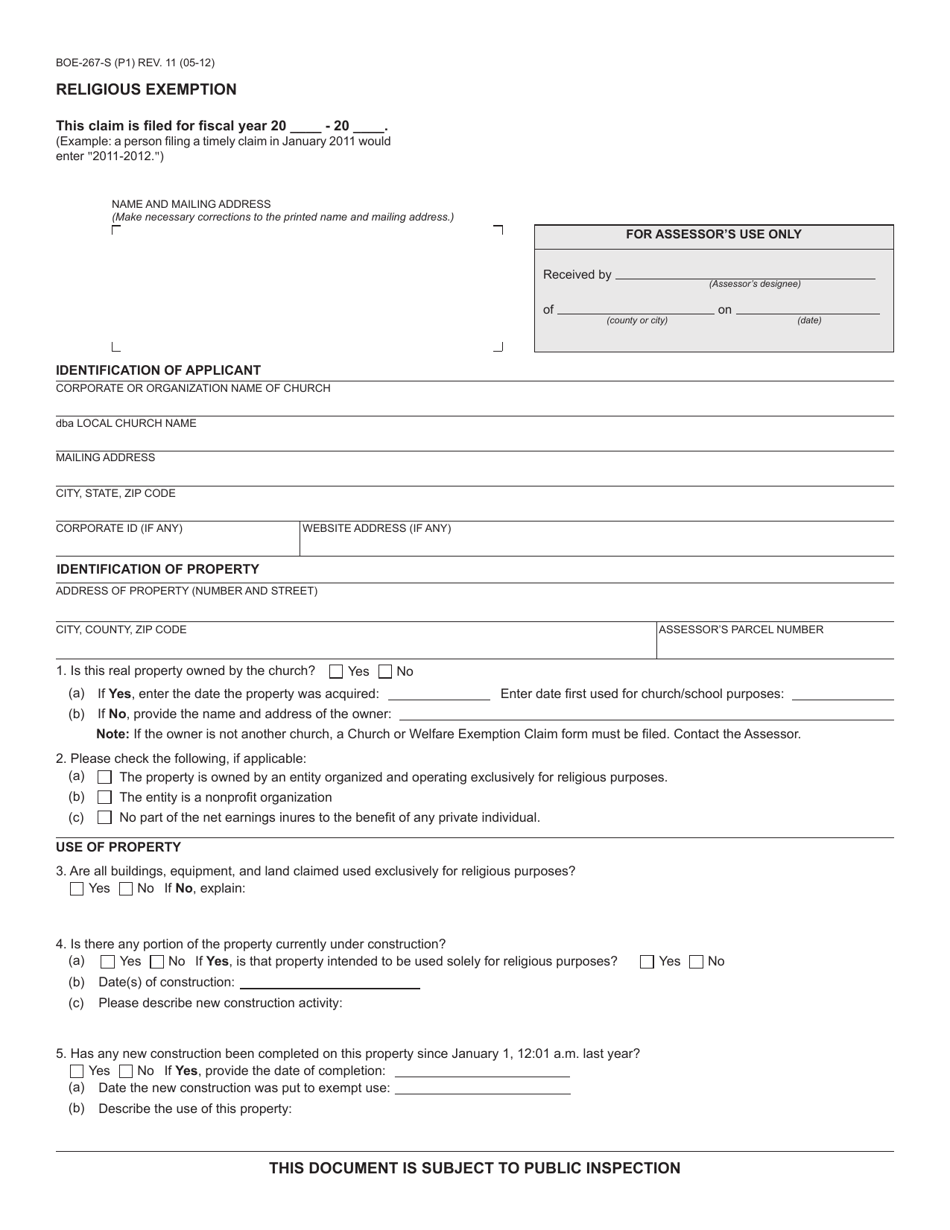

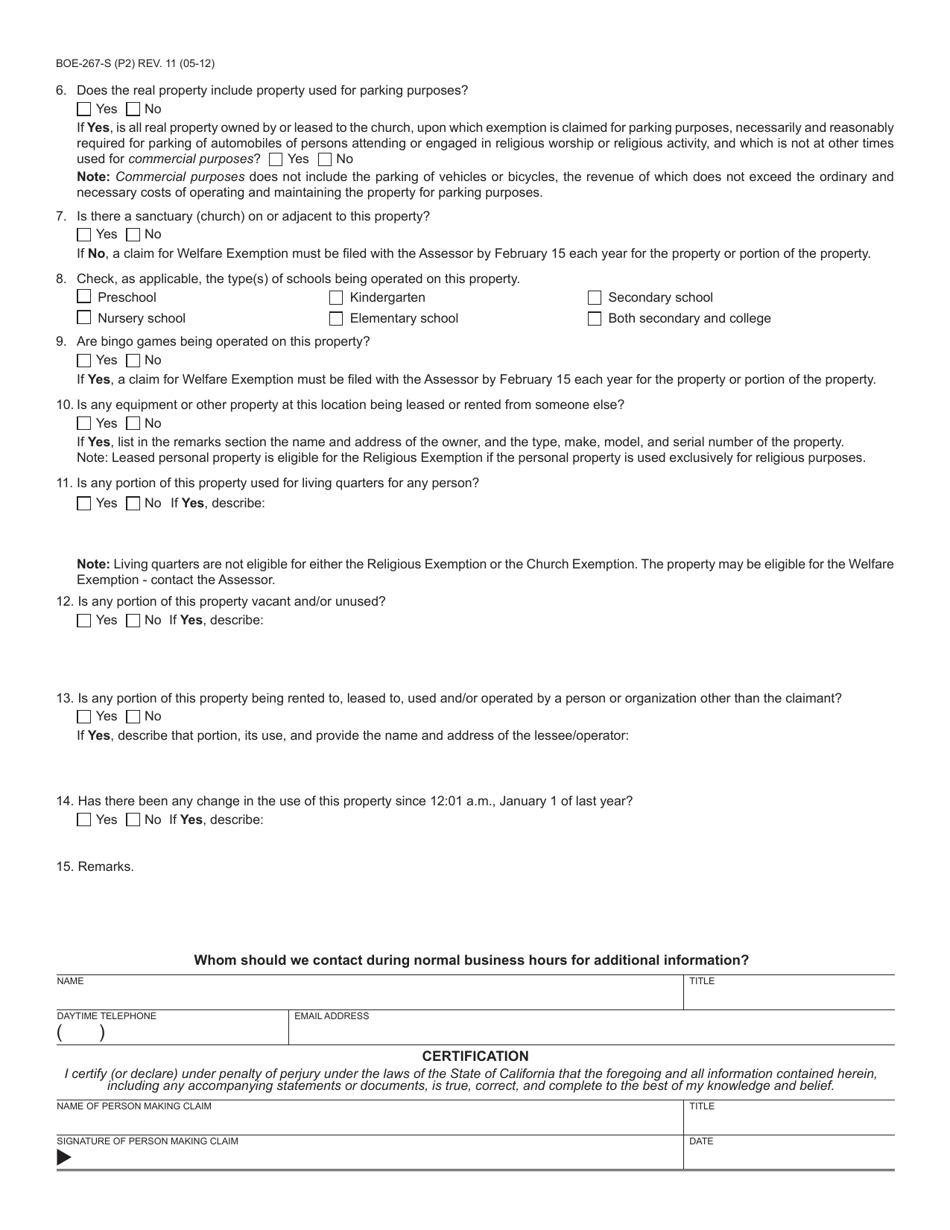

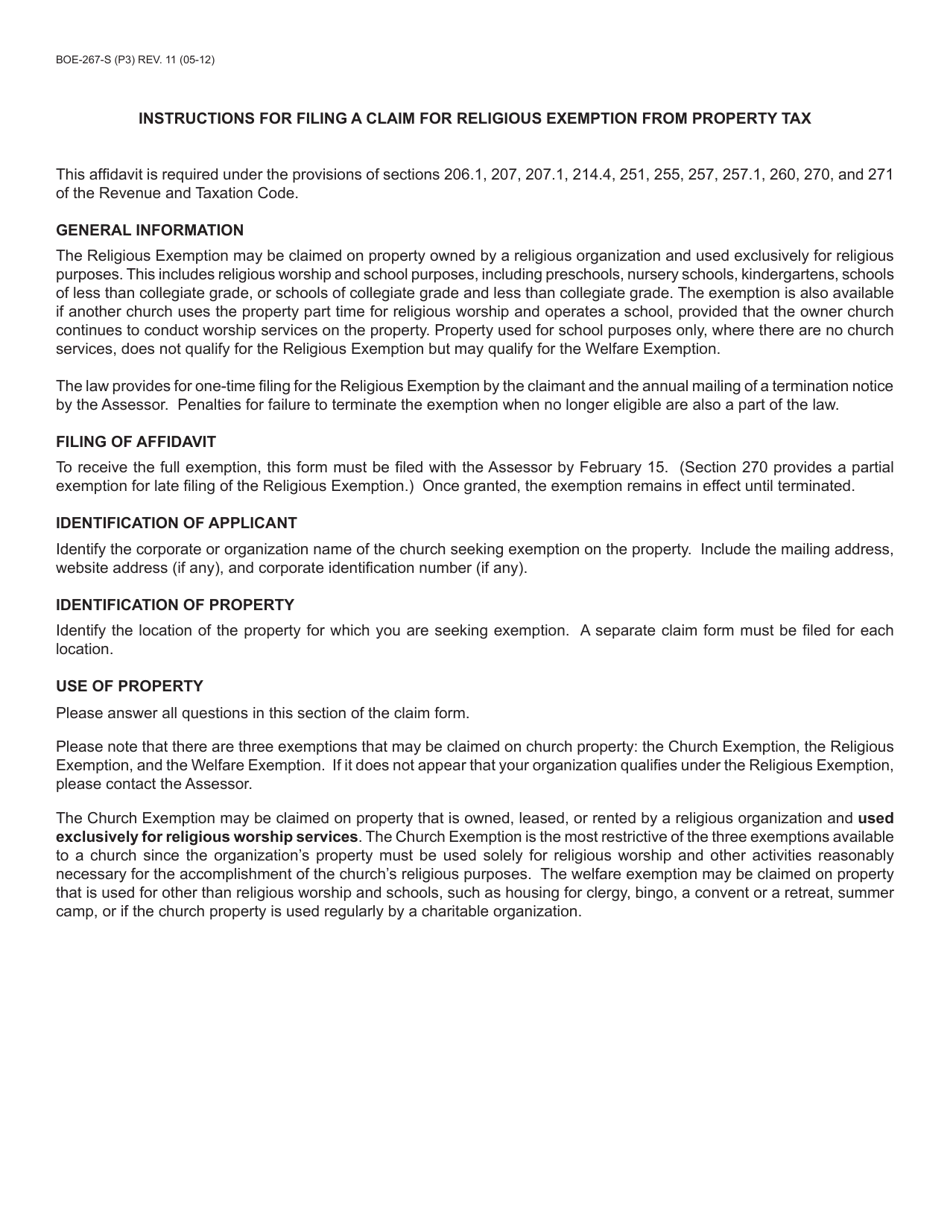

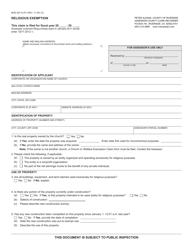

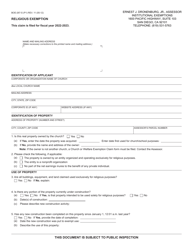

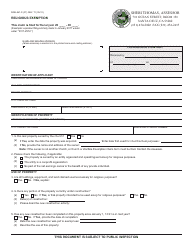

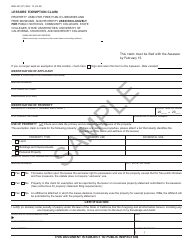

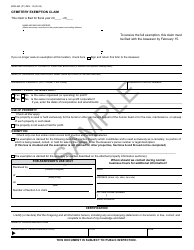

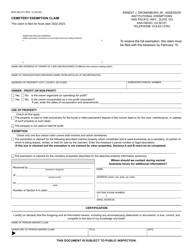

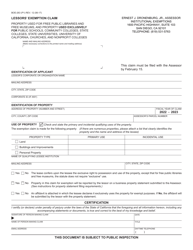

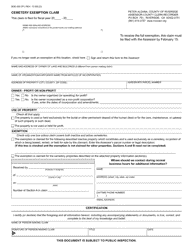

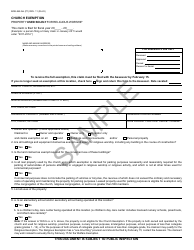

Form BOE-267-S Religious Exemption - California

What Is Form BOE-267-S?

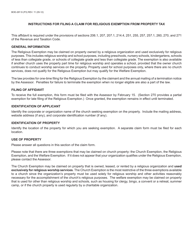

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BOE-267-S?

A: Form BOE-267-S is a religious exemption form in California.

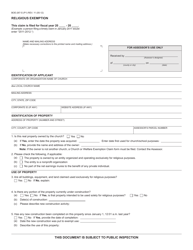

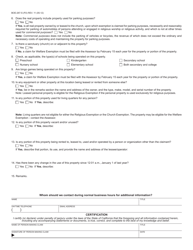

Q: What is the purpose of Form BOE-267-S?

A: The purpose of Form BOE-267-S is to claim a religious exemption from certain taxes.

Q: Who is eligible to use Form BOE-267-S?

A: Individuals who are members of religious organizations and meet certain criteria may be eligible to use Form BOE-267-S.

Q: What taxes can be exempted with Form BOE-267-S?

A: Form BOE-267-S can be used to claim a religious exemption from California state sales and use taxes.

Q: What criteria must be met to claim the religious exemption?

A: To claim the religious exemption, the individual must be a member of a religious organization that meets certain requirements and have religious tenets and practices that include the payment of taxes being contrary to the faith.

Q: Is there a deadline for submitting Form BOE-267-S?

A: Yes, Form BOE-267-S must be submitted to the California State Board of Equalization by the filing deadline for the applicable tax period.

Q: What happens after submitting Form BOE-267-S?

A: After submitting Form BOE-267-S, the California State Board of Equalization will review the application and notify the applicant of their eligibility for the religious exemption.

Q: Can I claim a refund for taxes paid prior to submitting Form BOE-267-S?

A: No, Form BOE-267-S can only be used for prospective exemption from taxes; it cannot be used to claim a refund for taxes already paid.

Q: What should I do if my application for the religious exemption is denied?

A: If your application for the religious exemption is denied, you may appeal the decision to the California State Board of Equalization.

Form Details:

- Released on May 1, 2012;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-267-S by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.