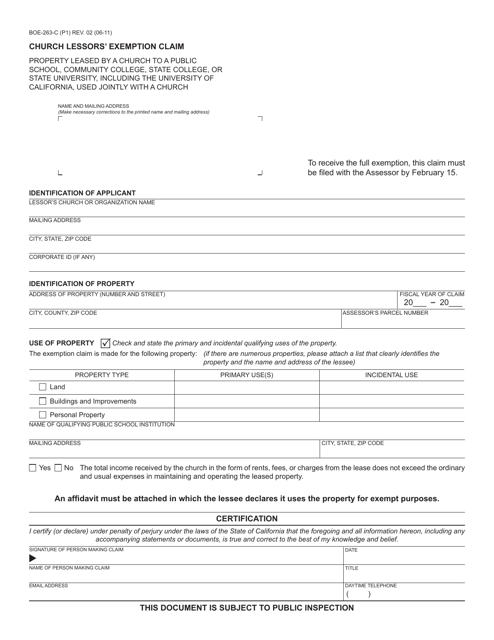

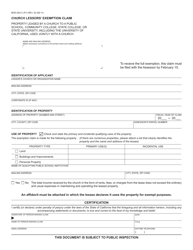

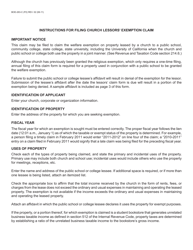

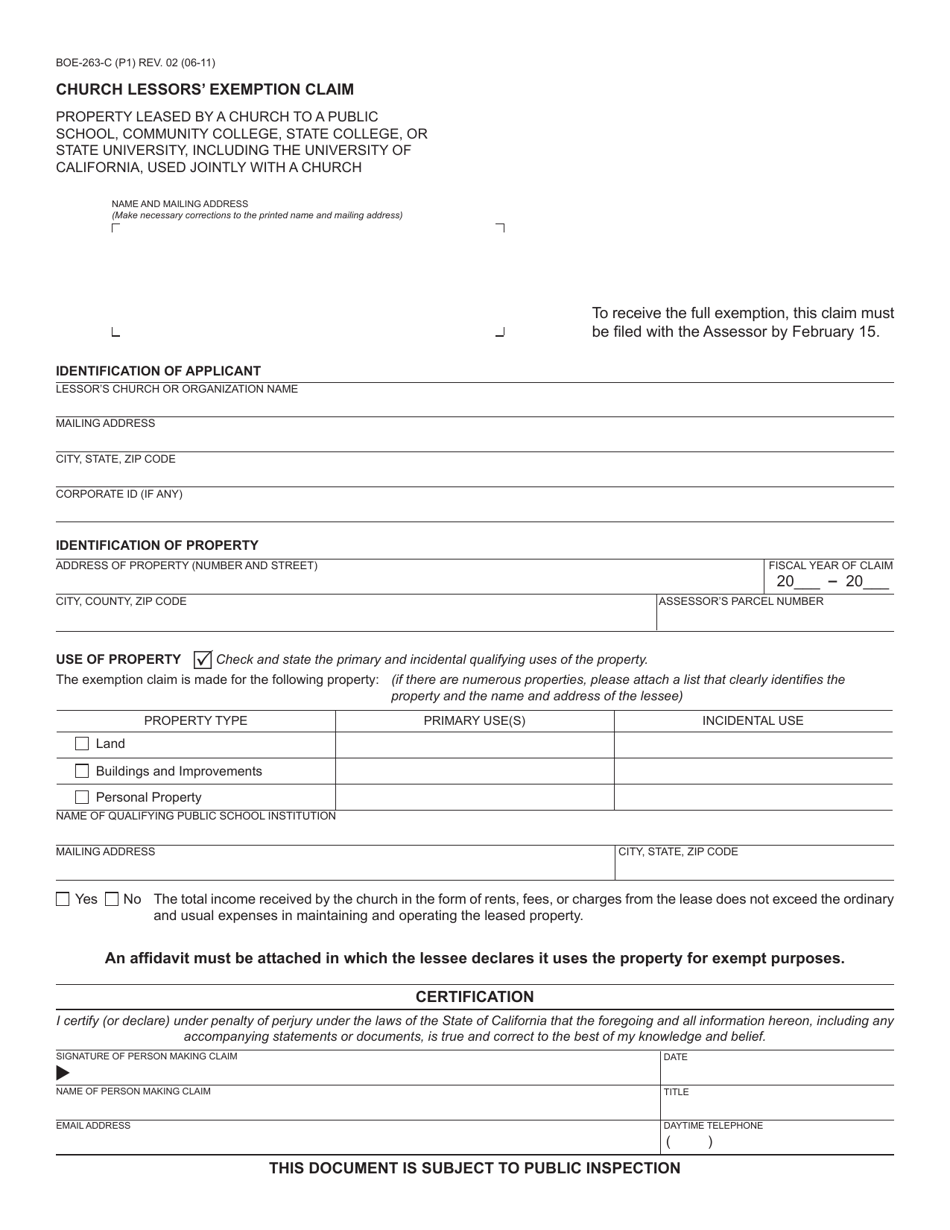

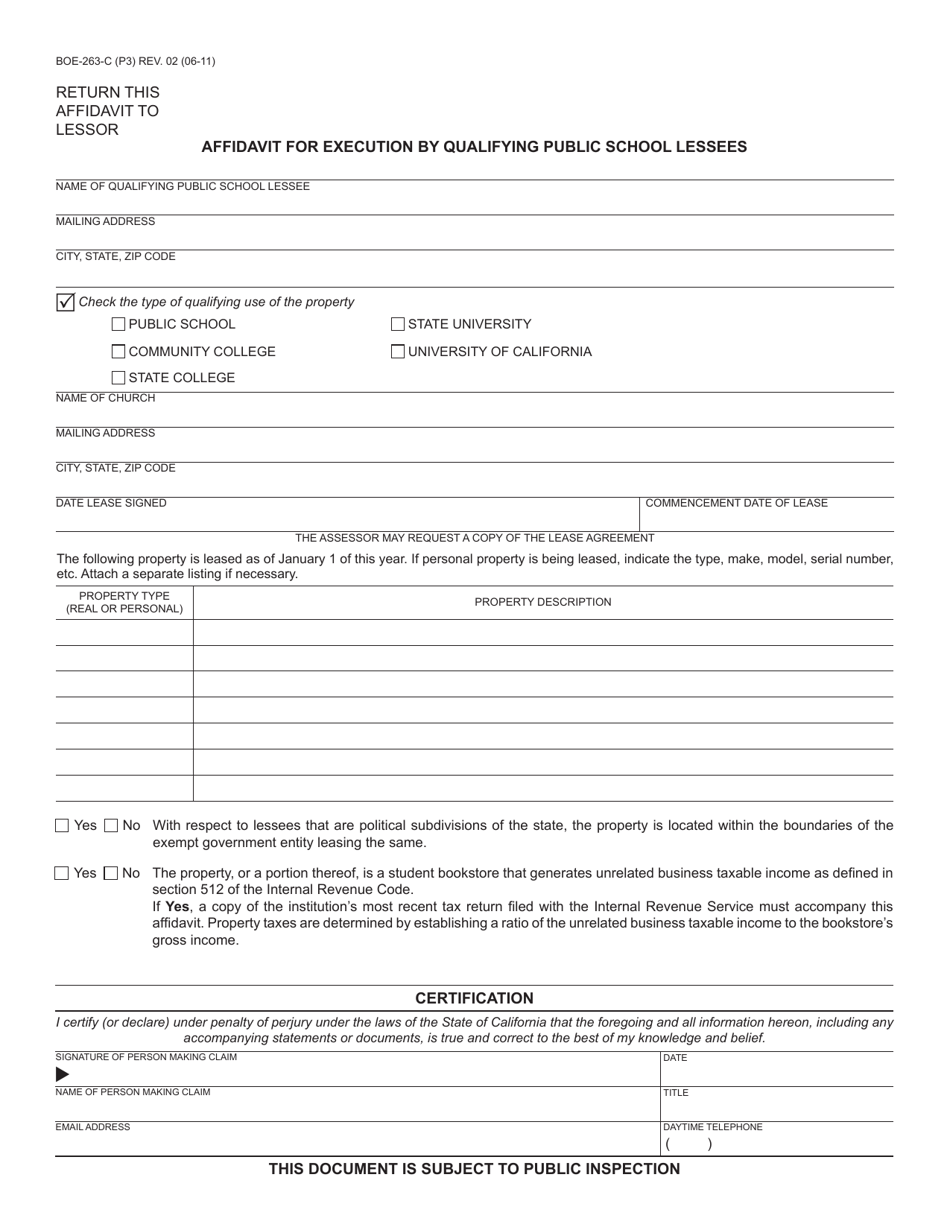

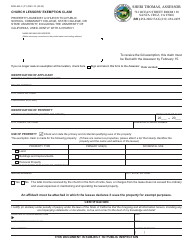

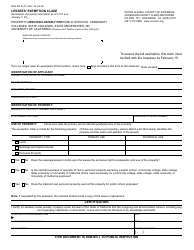

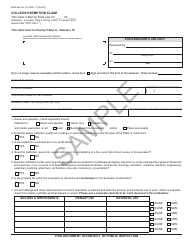

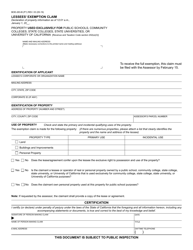

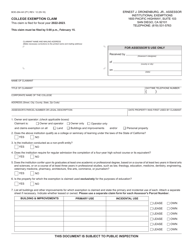

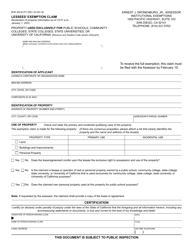

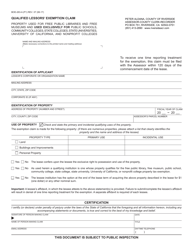

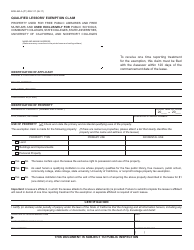

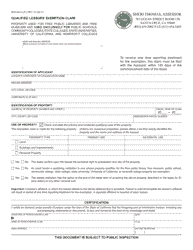

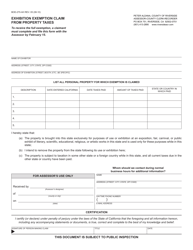

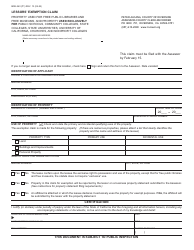

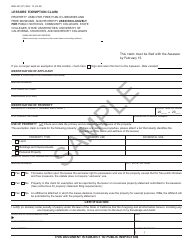

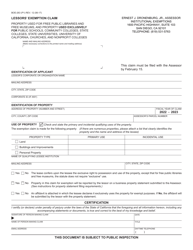

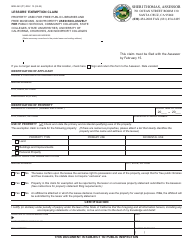

Form BOE-263-C Church Lessors' Exemption Claim - California

What Is Form BOE-263-C?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is BOE-263-C?

A: BOE-263-C is a form used to claim the Church Lessors' Exemption in California.

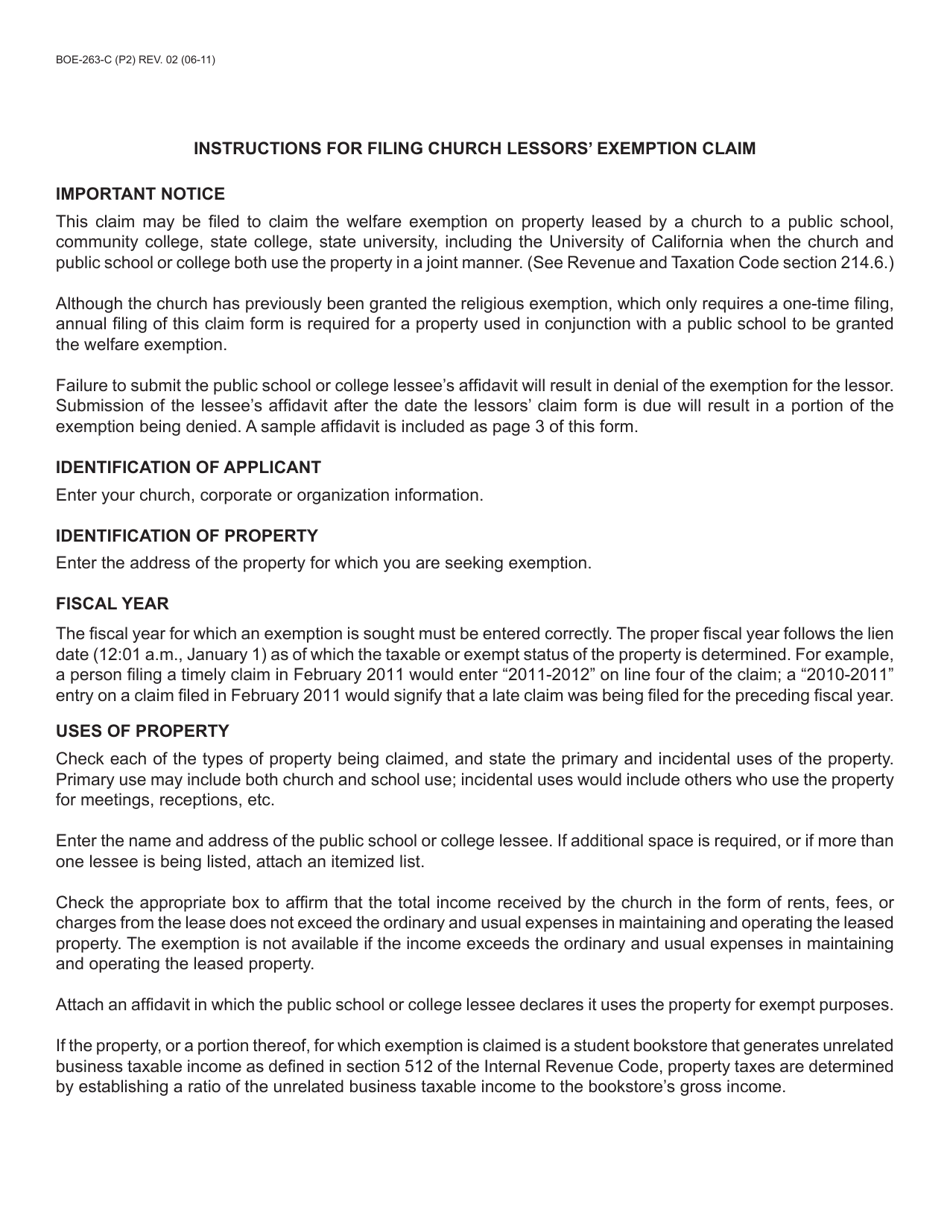

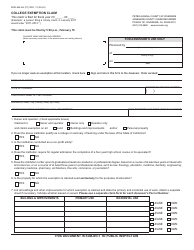

Q: What is the Church Lessors' Exemption?

A: The Church Lessors' Exemption is a tax exemption for certain leased property used by religious organizations in California.

Q: Who can claim the Church Lessors' Exemption?

A: Religious organizations that lease property in California may be eligible to claim the Church Lessors' Exemption.

Q: What is the purpose of the BOE-263-C form?

A: The purpose of the BOE-263-C form is to apply for and claim the Church Lessors' Exemption.

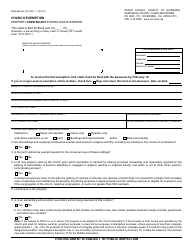

Form Details:

- Released on May 1, 2011;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-263-C by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.