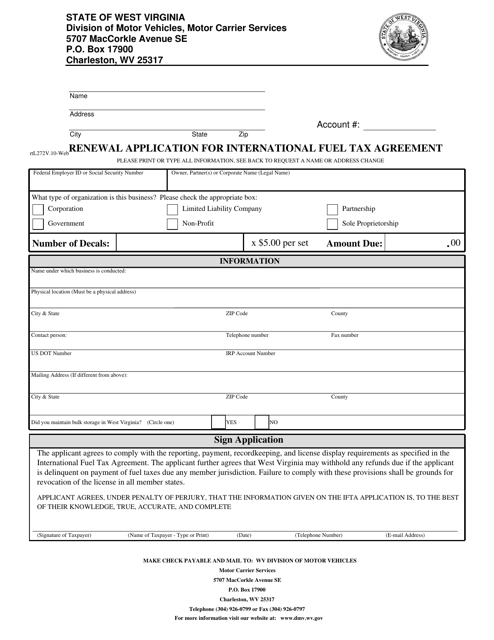

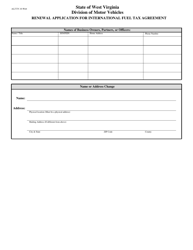

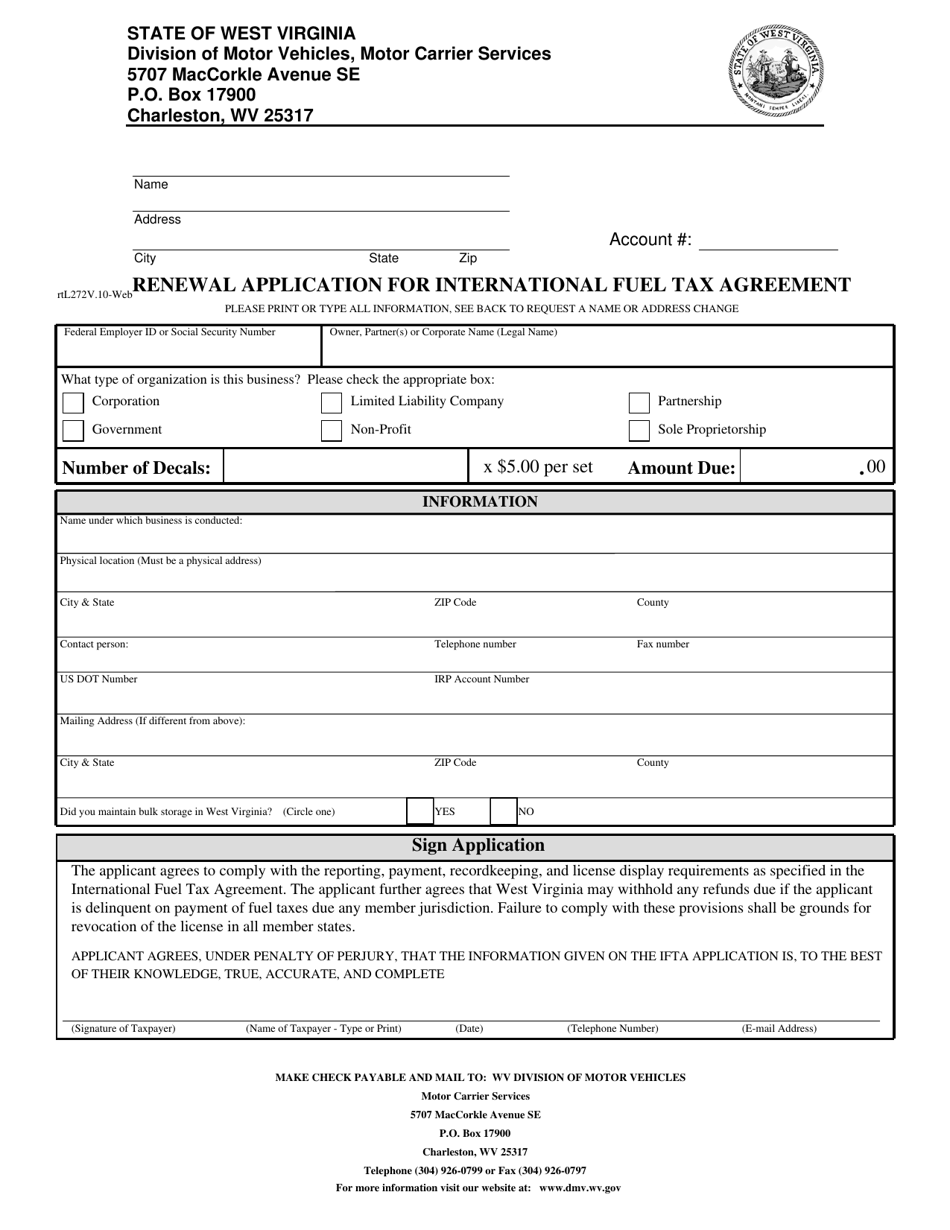

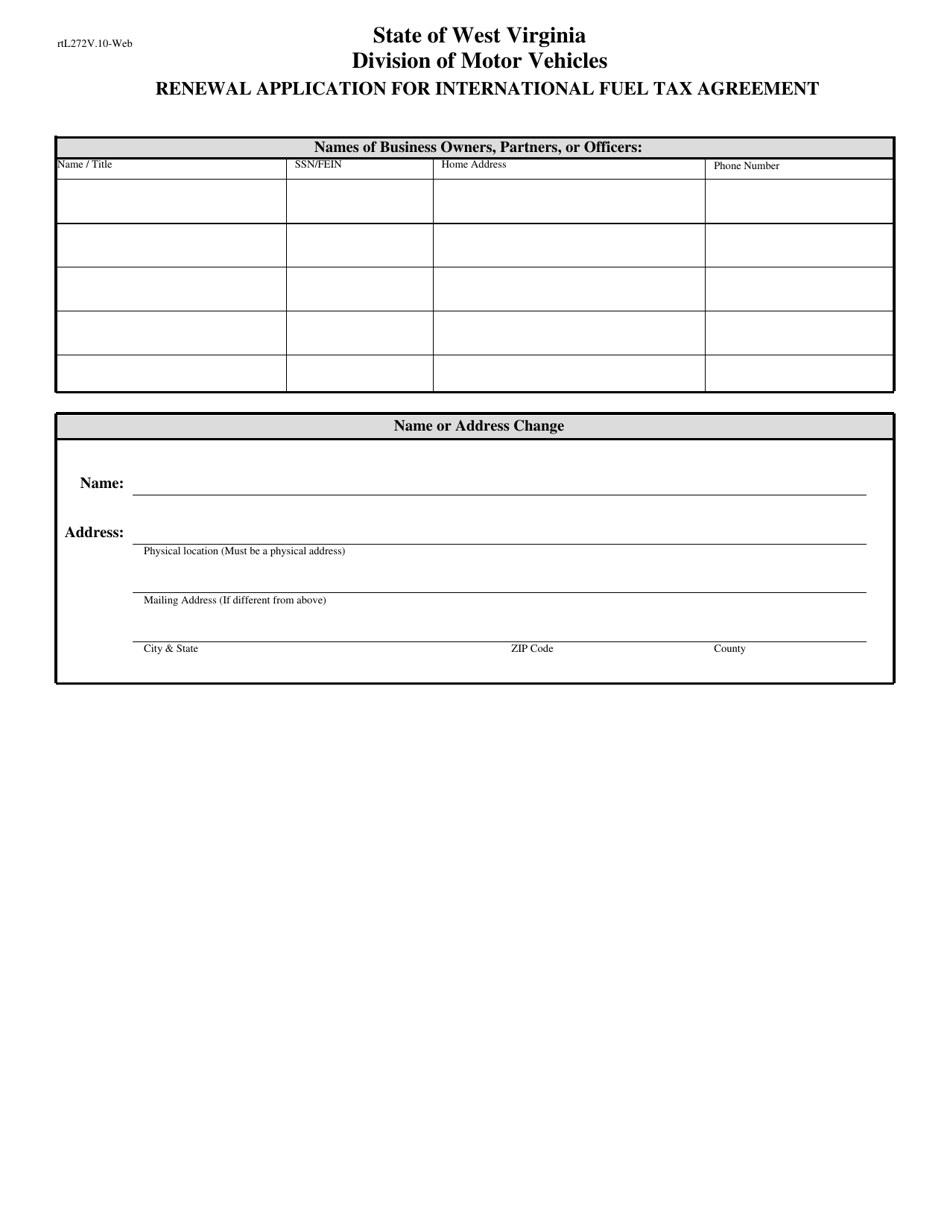

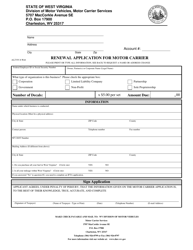

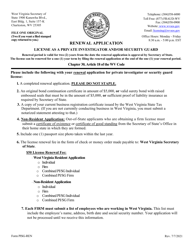

Renewal Application for International Fuel Tax Agreement - West Virginia

Renewal Application for International Fuel Tax Agreement is a legal document that was released by the West Virginia Department of Transportation - a government authority operating within West Virginia.

FAQ

Q: What is the International Fuel Tax Agreement (IFTA)?

A: IFTA is an agreement between the United States and Canada that simplifies the reporting and payment of fuel taxes for inter-jurisdictional carriers.

Q: Who is required to file an IFTA renewal application?

A: All carriers who operate qualified motor vehicles in multiple jurisdictions and are based in West Virginia must file an IFTA renewal application.

Q: When is the deadline to file an IFTA renewal application in West Virginia?

A: The IFTA renewal application must be filed by the last day of February each year.

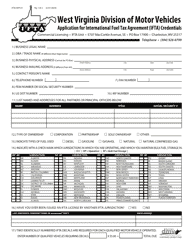

Q: What information is required to complete the IFTA renewal application?

A: The IFTA renewal application requires information such as the total miles traveled, total gallons of fuel consumed, and the tax paid for each jurisdiction.

Q: What are the consequences of not filing an IFTA renewal application?

A: Failure to file an IFTA renewal application or pay the required taxes can result in penalties, interest, and even the suspension of your IFTA license.

Q: How often do I need to renew my IFTA license?

A: Your IFTA license needs to be renewed on an annual basis, with the renewal application filed by the last day of February each year.

Q: What if I have vehicles that are only used in one jurisdiction?

A: If you have vehicles that are only used in one jurisdiction, you may be eligible for a single jurisdiction license instead of the IFTA license.

Q: What if I don't operate a qualified motor vehicle in West Virginia?

A: If you don't operate a qualified motor vehicle in West Virginia, you are not required to file an IFTA renewal application in the state.

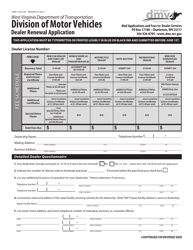

Form Details:

- The latest edition currently provided by the West Virginia Department of Transportation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the West Virginia Department of Transportation.