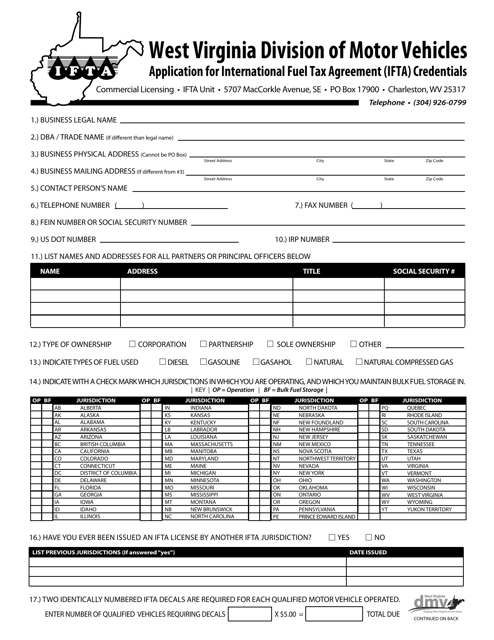

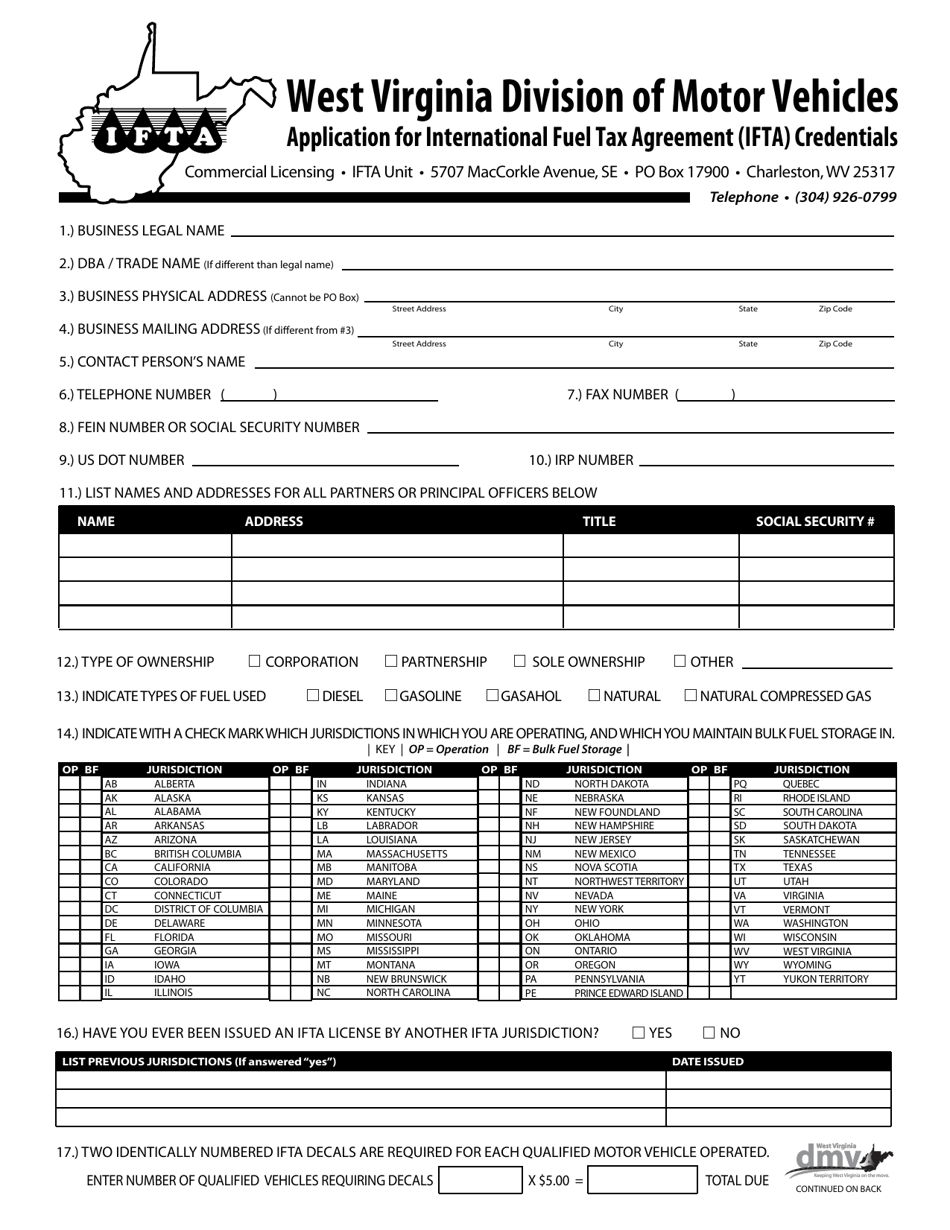

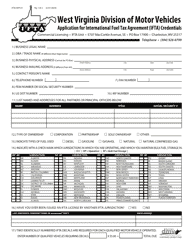

Application for International Fuel Tax Agreement (Ifta) Credentials - West Virginia

Application for International Fuel Tax Agreement (Ifta) Credentials is a legal document that was released by the West Virginia Department of Transportation - a government authority operating within West Virginia.

FAQ

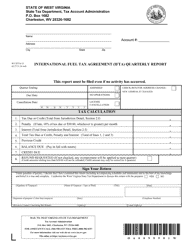

Q: What is the International Fuel Tax Agreement (IFTA)?

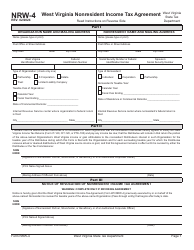

A: The International Fuel Tax Agreement (IFTA) is an agreement among the United States and Canadian provinces that simplifies the reporting and payment of fuel taxes for interstate motor carriers.

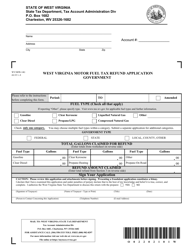

Q: Who needs IFTA credentials in West Virginia?

A: Motor carriers operating qualified motor vehicles in West Virginia and engaging in interstate travel need IFTA credentials.

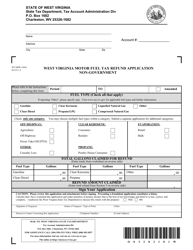

Q: How do I apply for IFTA credentials in West Virginia?

A: To apply for IFTA credentials in West Virginia, you need to complete the IFTA application form and submit it to the West Virginia State Tax Department.

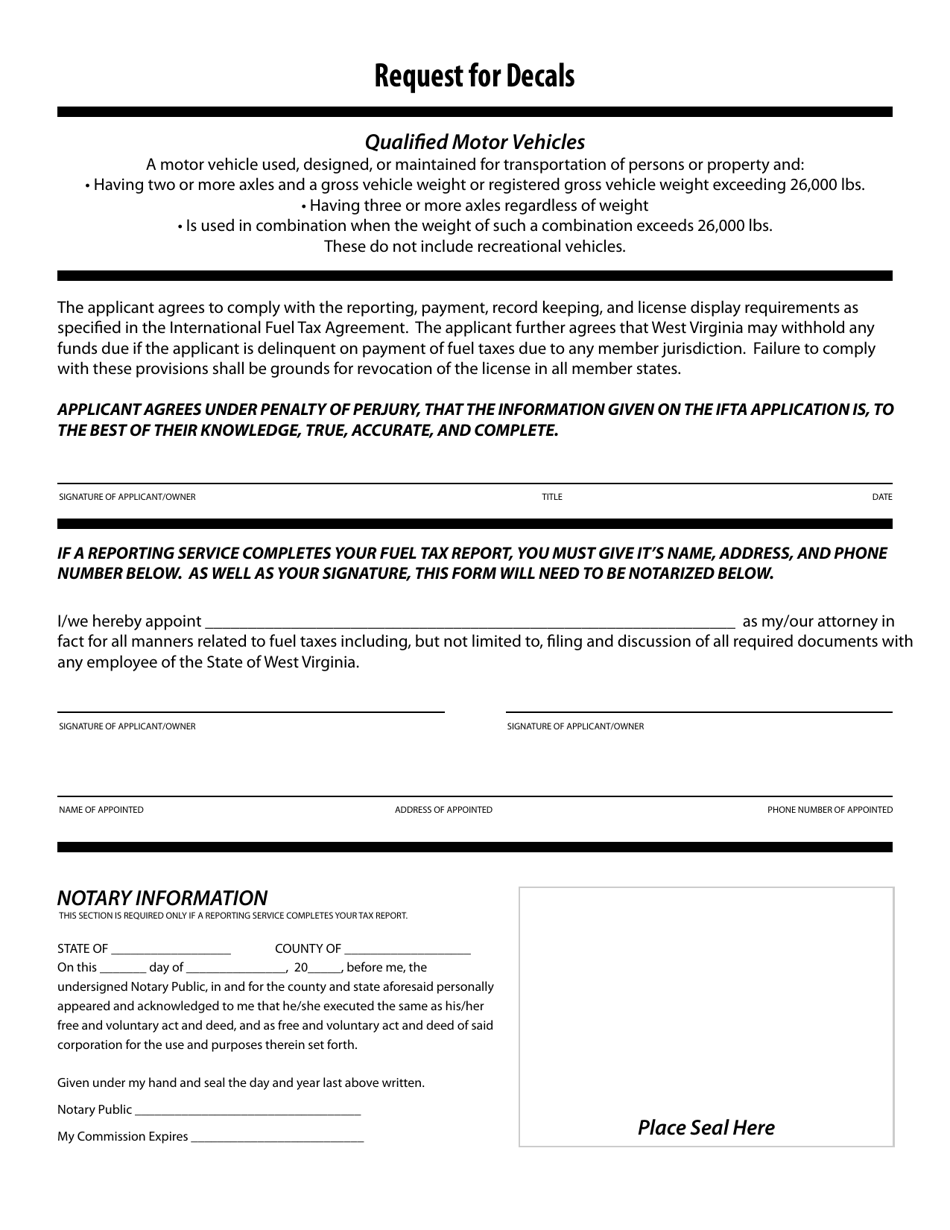

Q: What are the requirements to qualify for IFTA credentials?

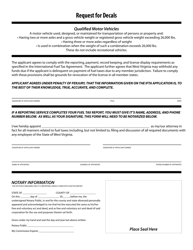

A: To qualify for IFTA credentials, you must have a qualified motor vehicle, maintain operational control and records, and operate in at least one IFTA jurisdiction.

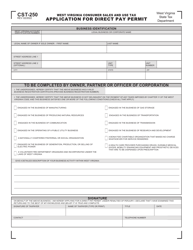

Q: What information do I need to provide on the IFTA application?

A: On the IFTA application, you will need to provide information about your business, vehicles, and trip miles.

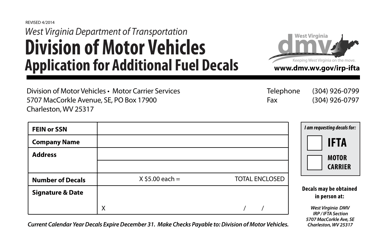

Q: What are the fees associated with IFTA credentials in West Virginia?

A: The fees for IFTA credentials in West Virginia include an annual license fee and a decal fee for each qualified motor vehicle.

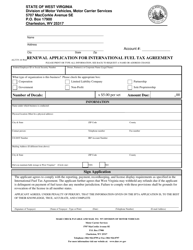

Q: How often do I need to renew my IFTA credentials?

A: IFTA credentials in West Virginia need to be renewed on an annual basis by December 31st of each year.

Q: What are the consequences of not having IFTA credentials?

A: Operating without valid IFTA credentials may result in penalties, fines, and the suspension of your motor carrier operating privileges.

Form Details:

- The latest edition currently provided by the West Virginia Department of Transportation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the West Virginia Department of Transportation.