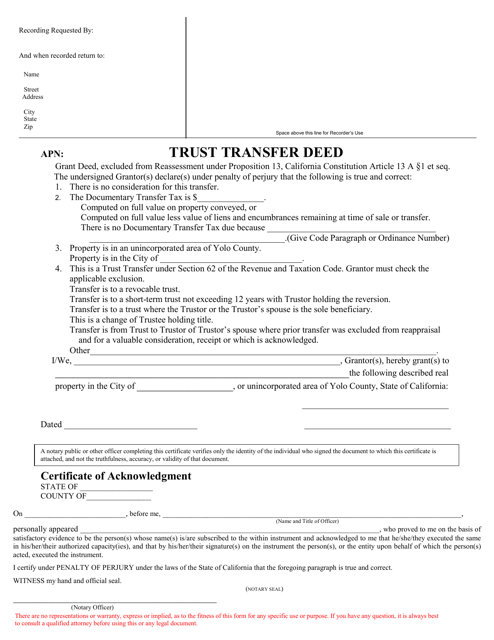

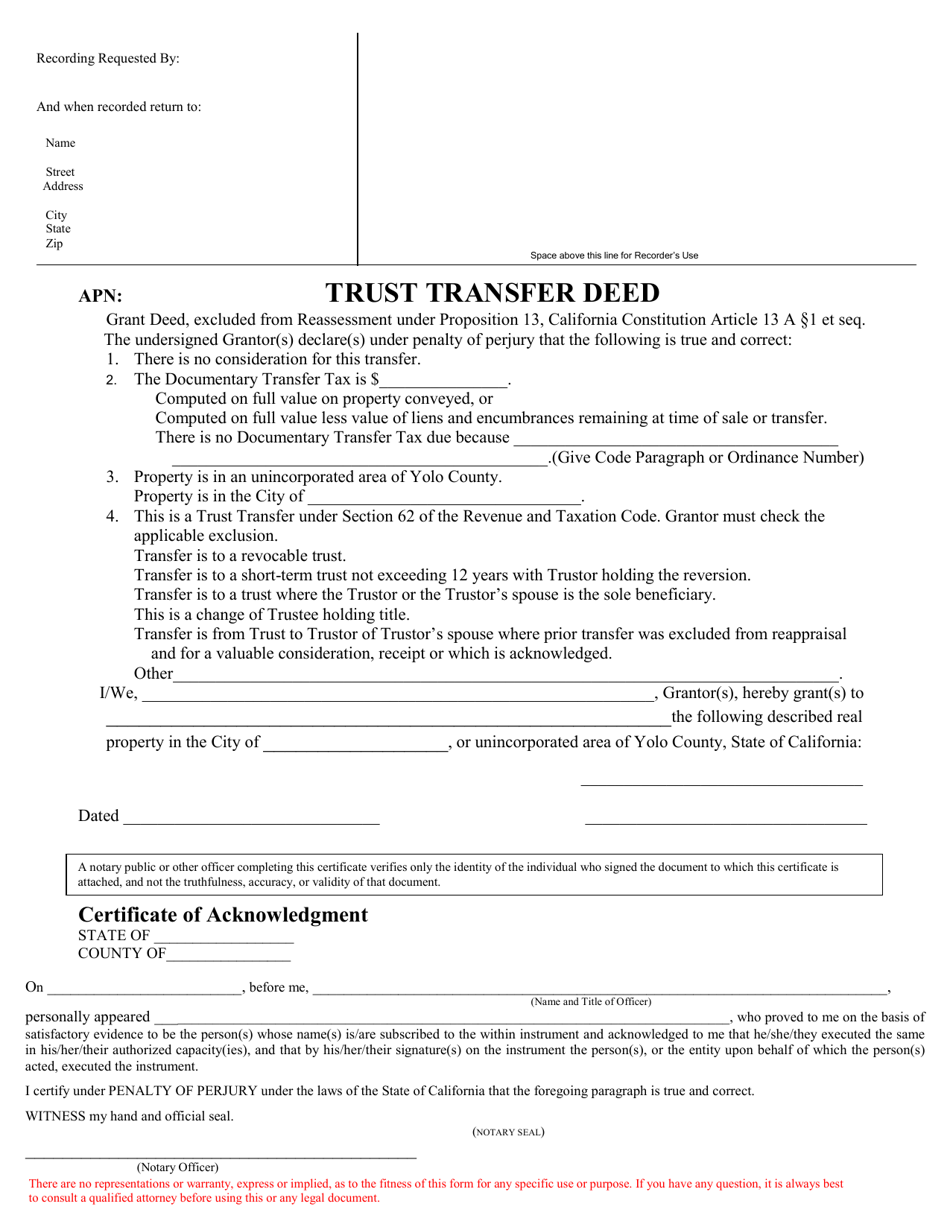

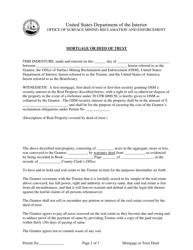

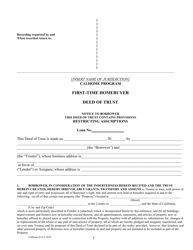

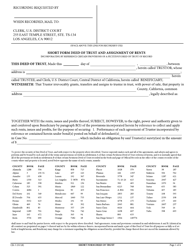

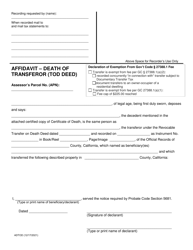

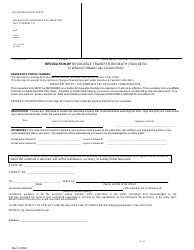

Trust Transfer Deed - California

Trust Transfer Deed is a legal document that was released by the Clerk-Recorder's Office - Yolo County, California - a government authority operating within California.

FAQ

Q: What is a Trust Transfer Deed?

A: A Trust Transfer Deed is a legal document used in California to transfer real estate from a living trust to an individual beneficiary.

Q: What is the purpose of a Trust Transfer Deed?

A: The purpose of a Trust Transfer Deed is to facilitate the transfer of real estate held in a living trust to the intended beneficiary without the need for probate.

Q: Who can use a Trust Transfer Deed?

A: Anyone who has created a living trust and wants to transfer real estate held in the trust to a beneficiary can use a Trust Transfer Deed.

Q: Do I need an attorney to prepare a Trust Transfer Deed?

A: While it is not legally required, it is highly recommended to consult with an attorney to ensure the deed is properly prepared and executed.

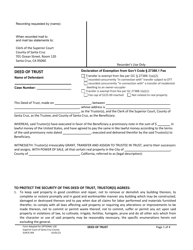

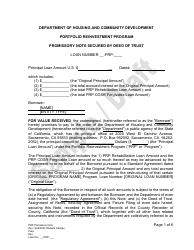

Q: What are the requirements for a valid Trust Transfer Deed?

A: A valid Trust Transfer Deed must be in writing, signed by the trustor and trustee, and include a legal description of the property.

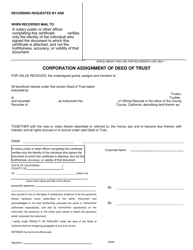

Q: Is a Trust Transfer Deed the same as a Grant Deed?

A: No, a Trust Transfer Deed is specifically used to transfer property from a living trust to a beneficiary, while a Grant Deed is more commonly used for traditional property transfers.

Q: What are the benefits of using a Trust Transfer Deed?

A: Using a Trust Transfer Deed avoids probate, allows for privacy in the transfer of real estate, and can help protect the property from potential creditors or legal disputes.

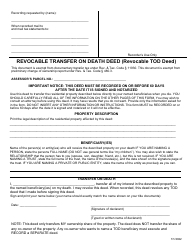

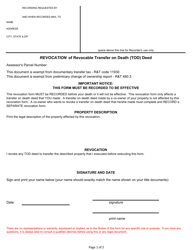

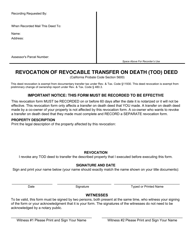

Q: Can a Trust Transfer Deed be revoked?

A: Yes, a Trust Transfer Deed can be revoked or modified if the trustor has the legal capacity to do so and follows the proper procedures.

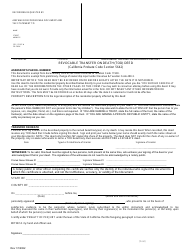

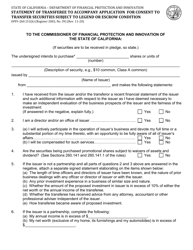

Q: What happens after a Trust Transfer Deed is recorded?

A: Once a Trust Transfer Deed is recorded with the county recorder's office, the property transfer is complete and the beneficiary becomes the legal owner of the property.

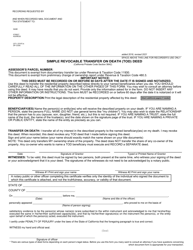

Q: Are there any taxes or fees associated with a Trust Transfer Deed?

A: There may be transfer taxes and recording fees required when recording a Trust Transfer Deed, depending on the county where the property is located.

Form Details:

- The latest edition currently provided by the Clerk-Recorder's Office - Yolo County, California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Clerk-Recorder's Office - Yolo County, California.