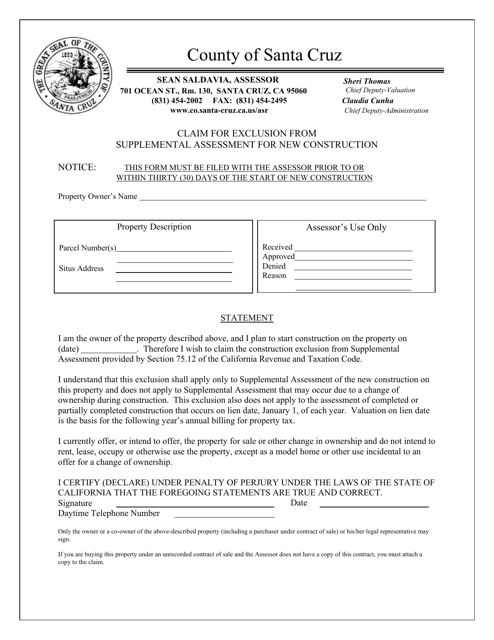

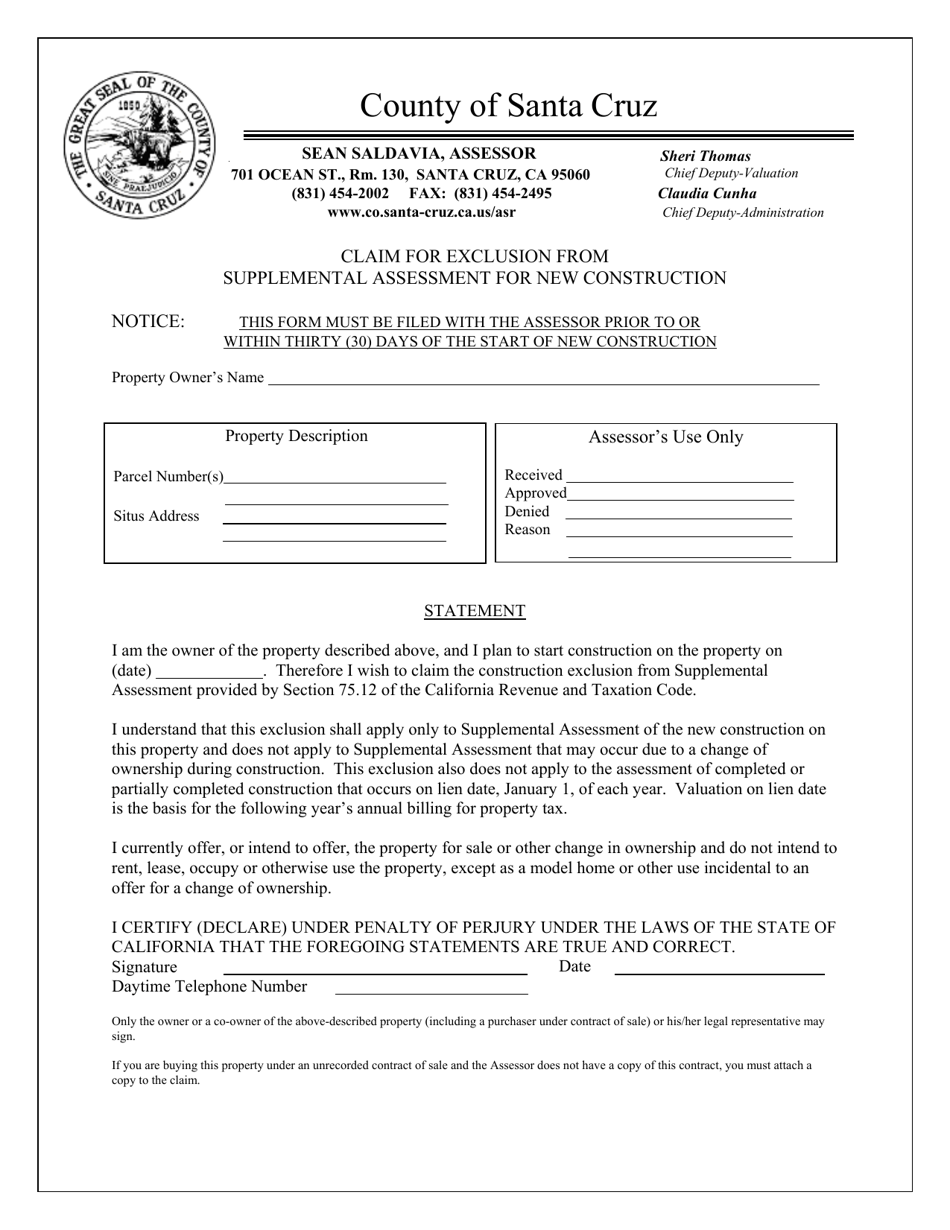

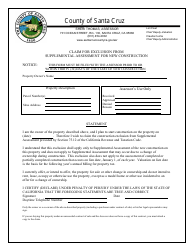

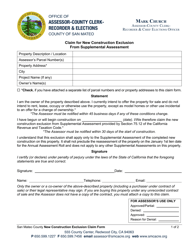

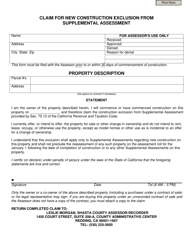

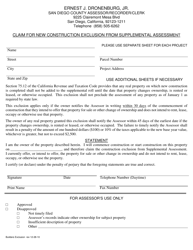

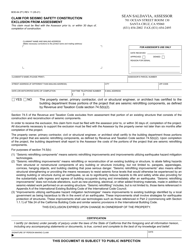

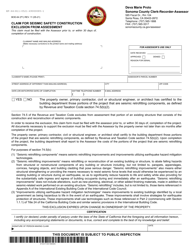

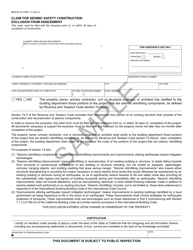

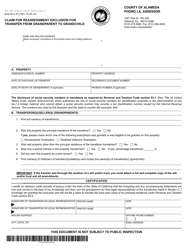

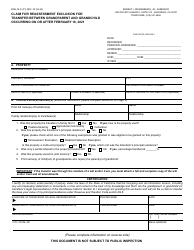

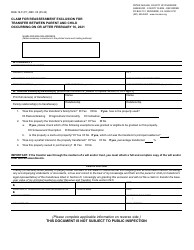

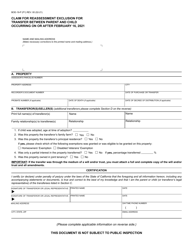

Claim for Exclusion From Supplemental Assessment for New Construction - California

Claim for Exclusion From Supplemental Assessment for New Construction is a legal document that was released by the Assessor's Office - Santa Cruz County, California - a government authority operating within California.

FAQ

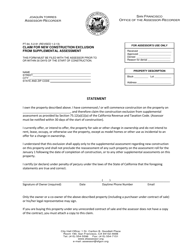

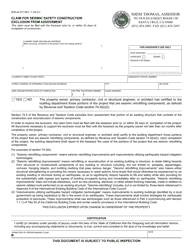

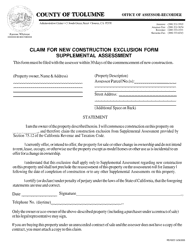

Q: What is a claim for exclusion from supplemental assessment for new construction?

A: A claim for exclusion from supplemental assessment for new construction is a request to exclude a newly constructed property from an increase in property taxes.

Q: Why would someone file a claim for exclusion from supplemental assessment for new construction?

A: Someone would file this claim to avoid paying higher property taxes on a newly constructed property.

Q: Who is eligible to file a claim for exclusion from supplemental assessment for new construction?

A: Property owners who have recently completed new construction on their property are typically eligible to file this claim.

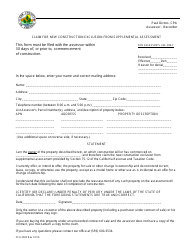

Q: What is the deadline to file a claim for exclusion from supplemental assessment for new construction?

A: The deadline to file this claim is typically within 30 days of completion of the new construction.

Q: How can someone file a claim for exclusion from supplemental assessment for new construction?

A: To file this claim, one must complete and submit the necessary forms to the county assessor's office.

Q: What happens after a claim for exclusion from supplemental assessment for new construction is approved?

A: If the claim is approved, the property owner will not be subject to an increase in property taxes for the newly constructed portion of the property for a specified period of time.

Q: What should someone do if their claim for exclusion from supplemental assessment for new construction is denied?

A: If the claim is denied, the property owner may have the option to appeal the decision to the county assessment appeals board.

Form Details:

- The latest edition currently provided by the Assessor's Office - Santa Cruz County, California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Assessor's Office - Santa Cruz County, California.