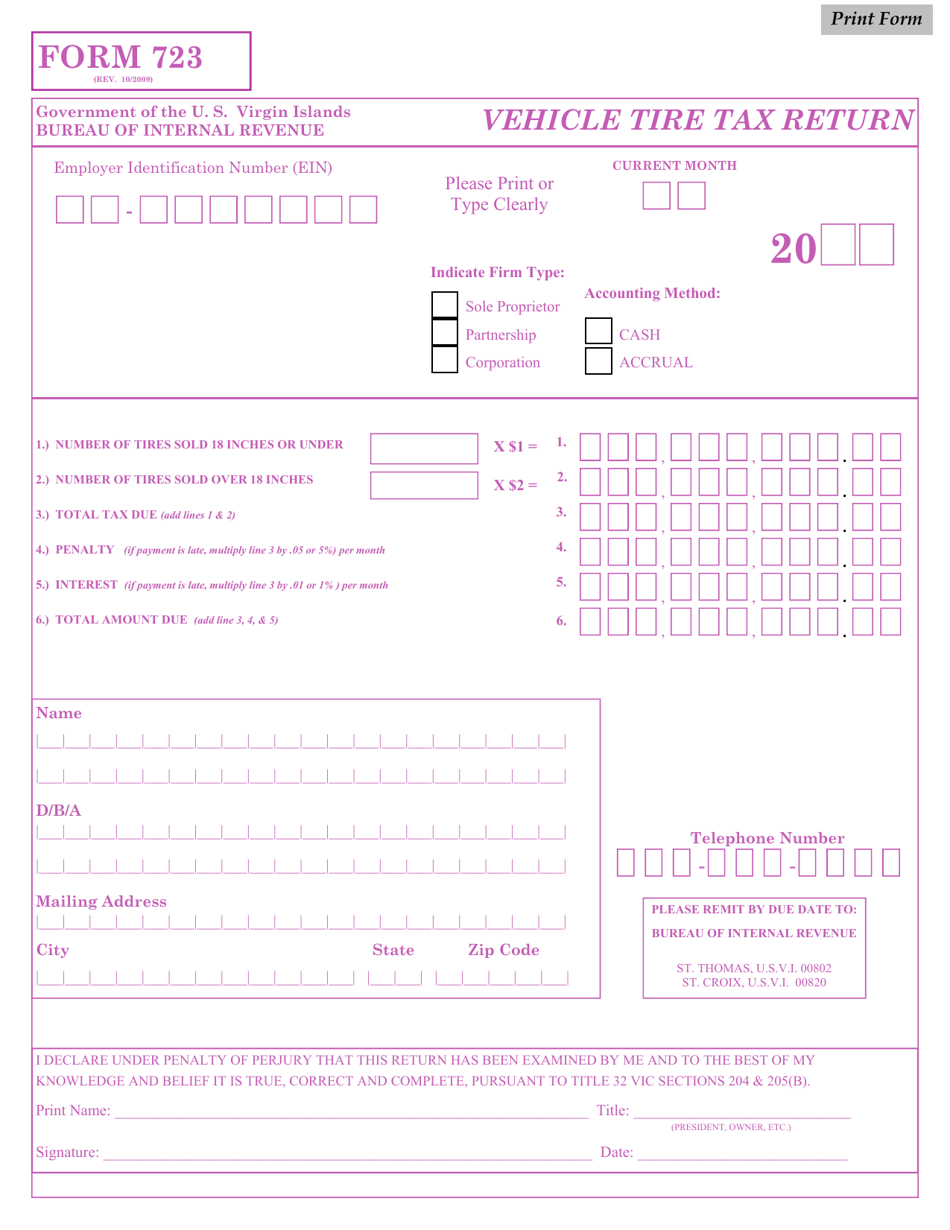

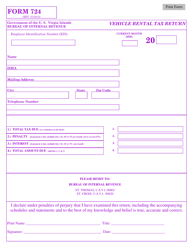

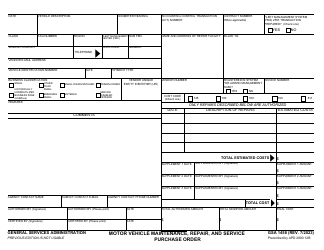

Form 723 Vehicle Tire Tax Return - Virgin Islands

What Is Form 723?

This is a legal form that was released by the Virgin Islands Bureau of Internal Revenue - a government authority operating within Virgin Islands. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

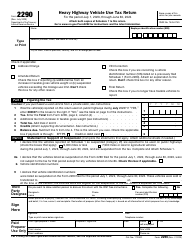

Q: What is Form 723?

A: Form 723 is the Vehicle Tire Tax Return form specifically for the Virgin Islands.

Q: What is the purpose of Form 723?

A: The purpose of Form 723 is to report and pay the vehicle tire tax in the Virgin Islands.

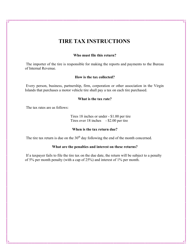

Q: Who needs to file Form 723?

A: Anyone who owns or operates a motor vehicle in the Virgin Islands and is subject to the vehicle tire tax needs to file Form 723.

Q: When is the due date for Form 723?

A: The due date for Form 723 varies, so it is important to check with the Virgin Islands government for the specific due date.

Q: Is Form 723 the same for all states?

A: No, Form 723 is specific to the Virgin Islands and is not used for any other states or territories.

Q: What happens if I don't file Form 723?

A: If you don't file Form 723 or pay the vehicle tire tax, you may be subject to penalties and interest charges.

Q: Are there any exceptions or exemptions for the vehicle tire tax?

A: There may be exceptions or exemptions from the vehicle tire tax in the Virgin Islands. It is best to consult with the Virgin Islands government for specific details.

Q: Can I e-file Form 723?

A: It is best to check with the Virgin Islands government to see if e-filing is available for Form 723.

Q: What should I do if I have questions about Form 723?

A: If you have questions about Form 723 or need assistance, you should contact the Virgin Islands government or a local tax office for guidance.

Form Details:

- Released on October 1, 2009;

- The latest edition provided by the Virgin Islands Bureau of Internal Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 723 by clicking the link below or browse more documents and templates provided by the Virgin Islands Bureau of Internal Revenue.