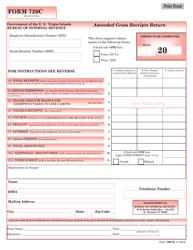

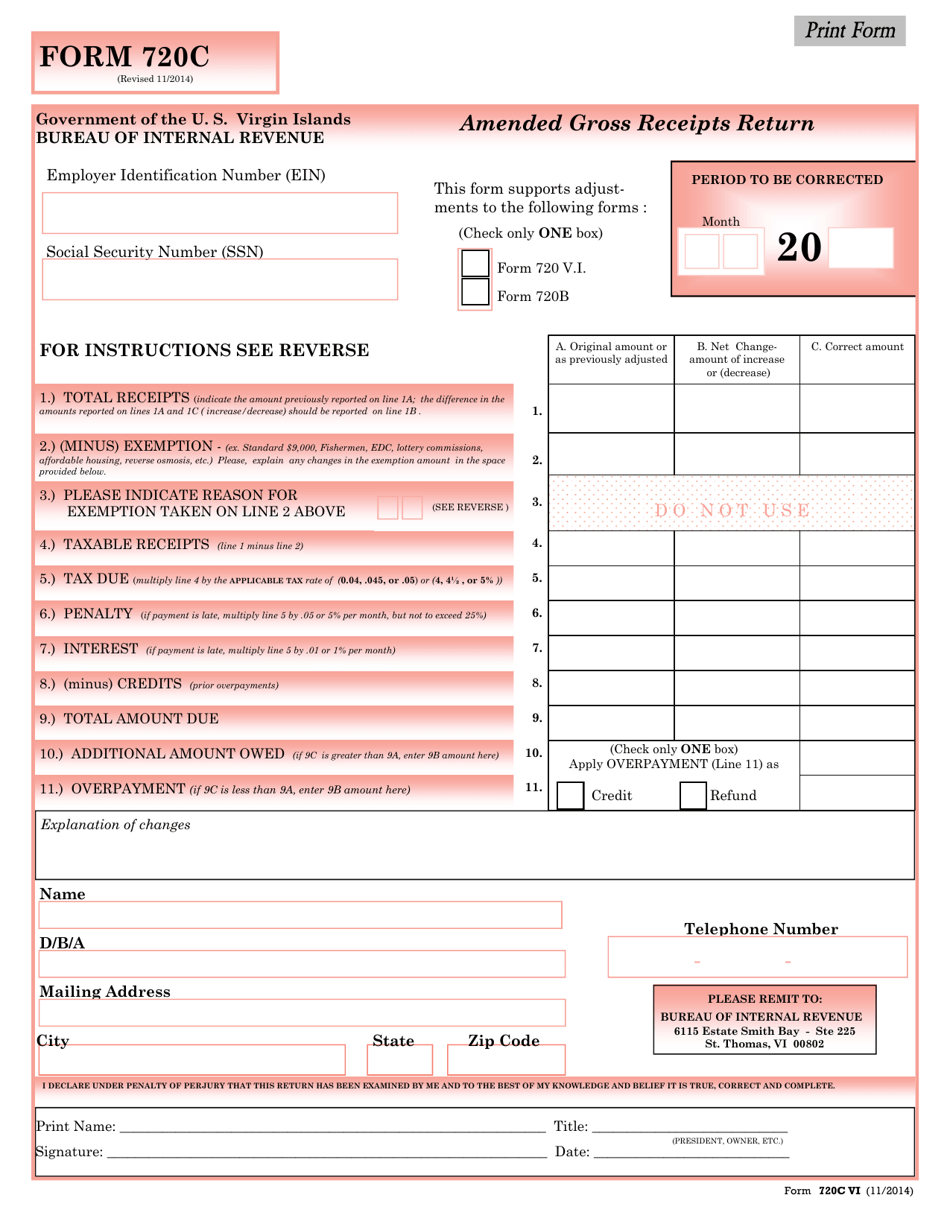

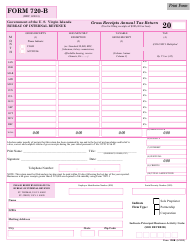

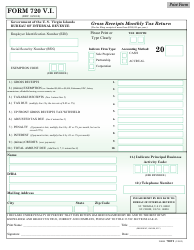

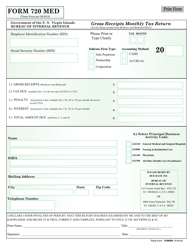

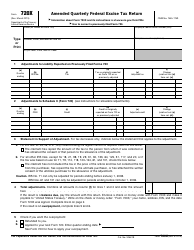

Form 720C Amended Gross Receipts Return - Virgin Islands

What Is Form 720C?

This is a legal form that was released by the Virgin Islands Bureau of Internal Revenue - a government authority operating within Virgin Islands. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 720C?

A: Form 720C is the Amended Gross Receipts Return for businesses in the Virgin Islands.

Q: Who should file Form 720C?

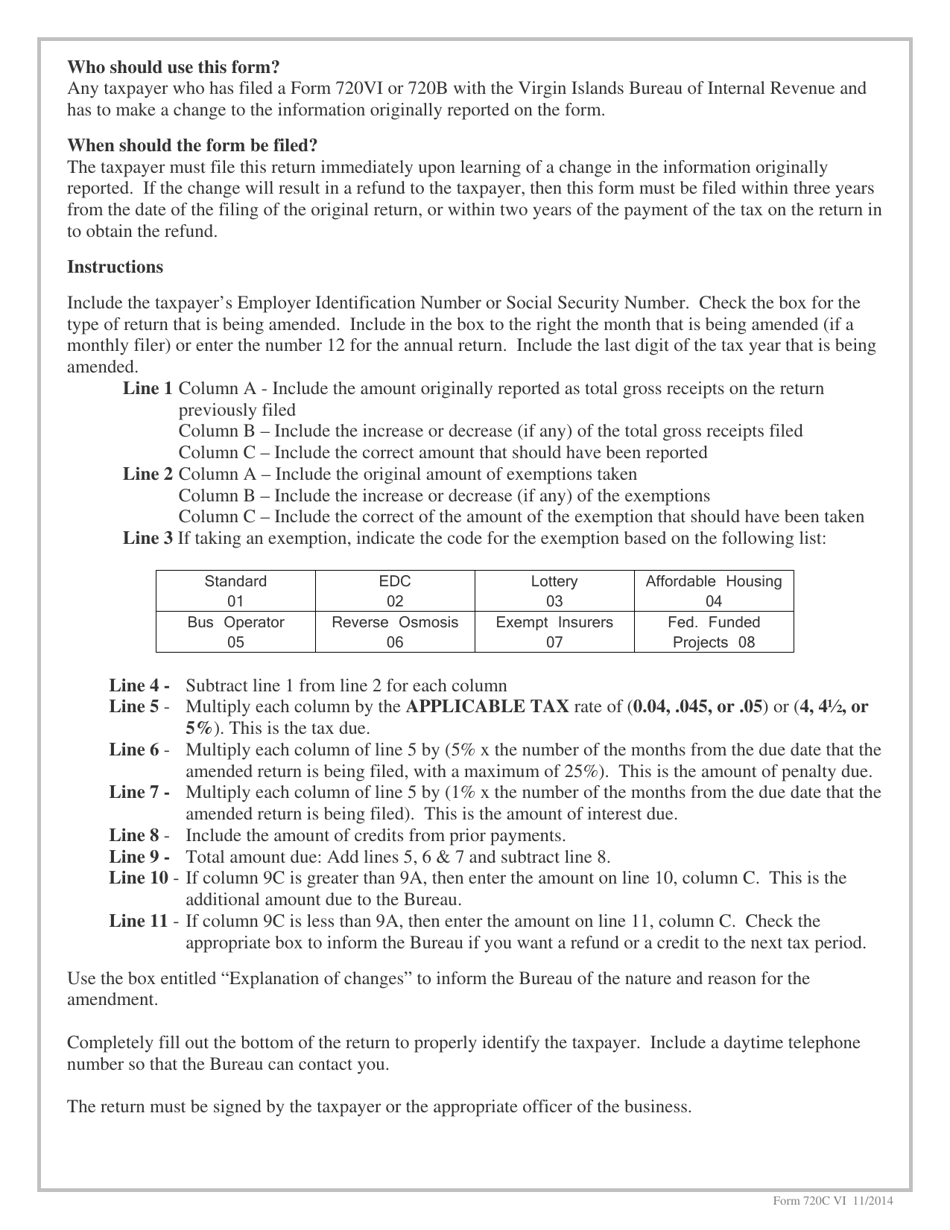

A: Businesses in the Virgin Islands that need to amend their previously filed Gross Receipts Return.

Q: What is the purpose of Form 720C?

A: Form 720C is used to correct and update information reported on a previously filed Gross Receipts Return.

Q: When should Form 720C be filed?

A: Form 720C should be filed as soon as you discover an error or omission on a previously filed Gross Receipts Return.

Form Details:

- Released on November 1, 2014;

- The latest edition provided by the Virgin Islands Bureau of Internal Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 720C by clicking the link below or browse more documents and templates provided by the Virgin Islands Bureau of Internal Revenue.