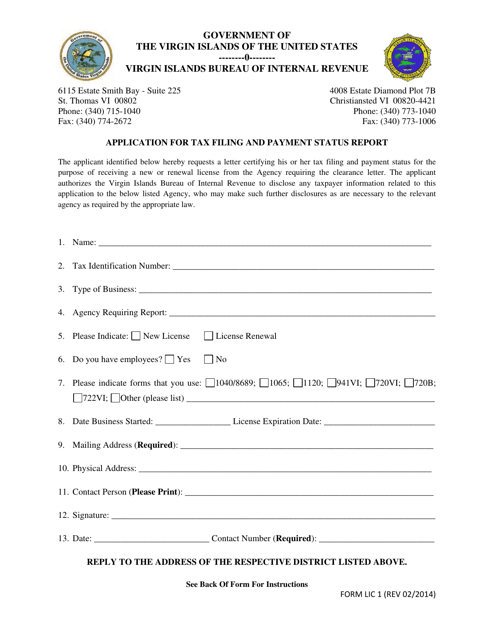

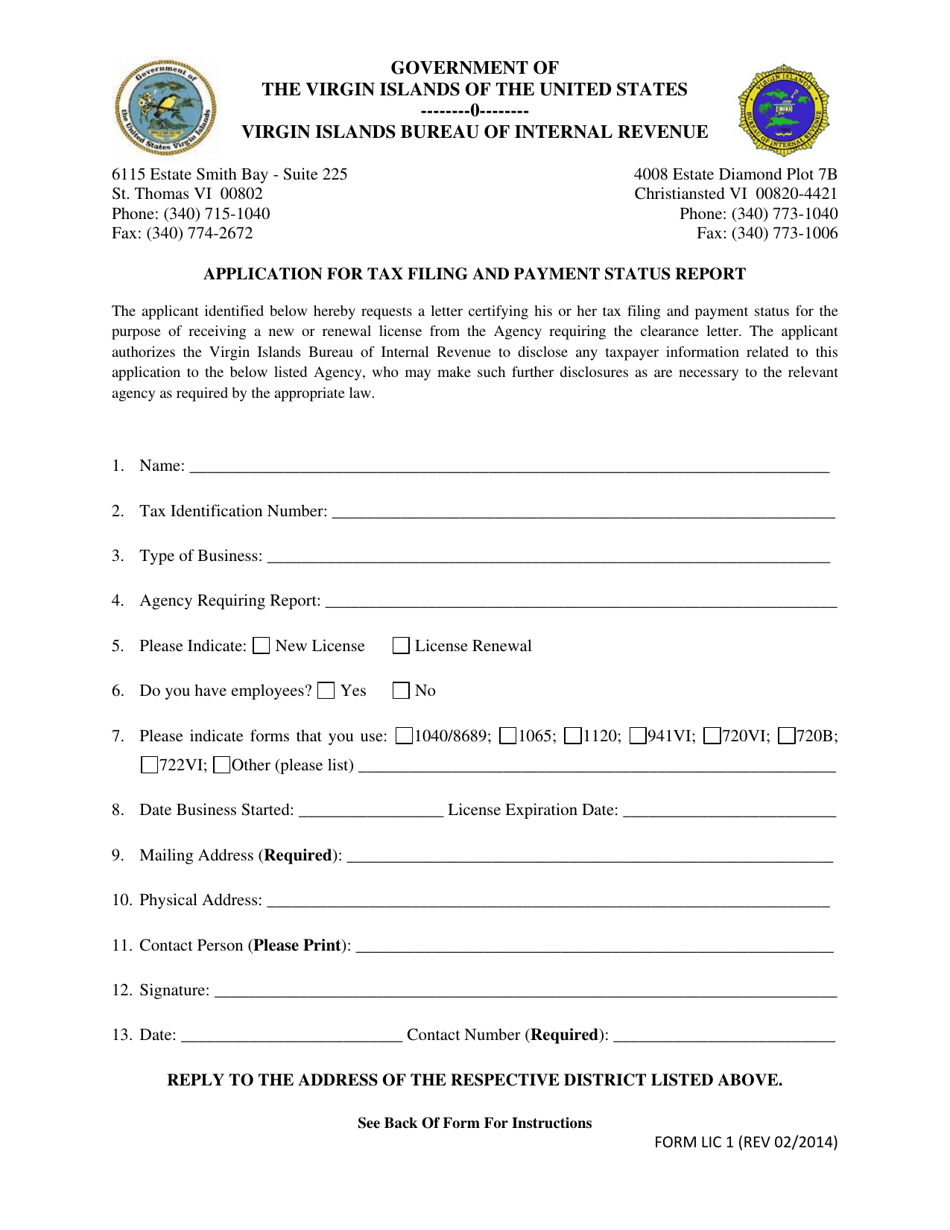

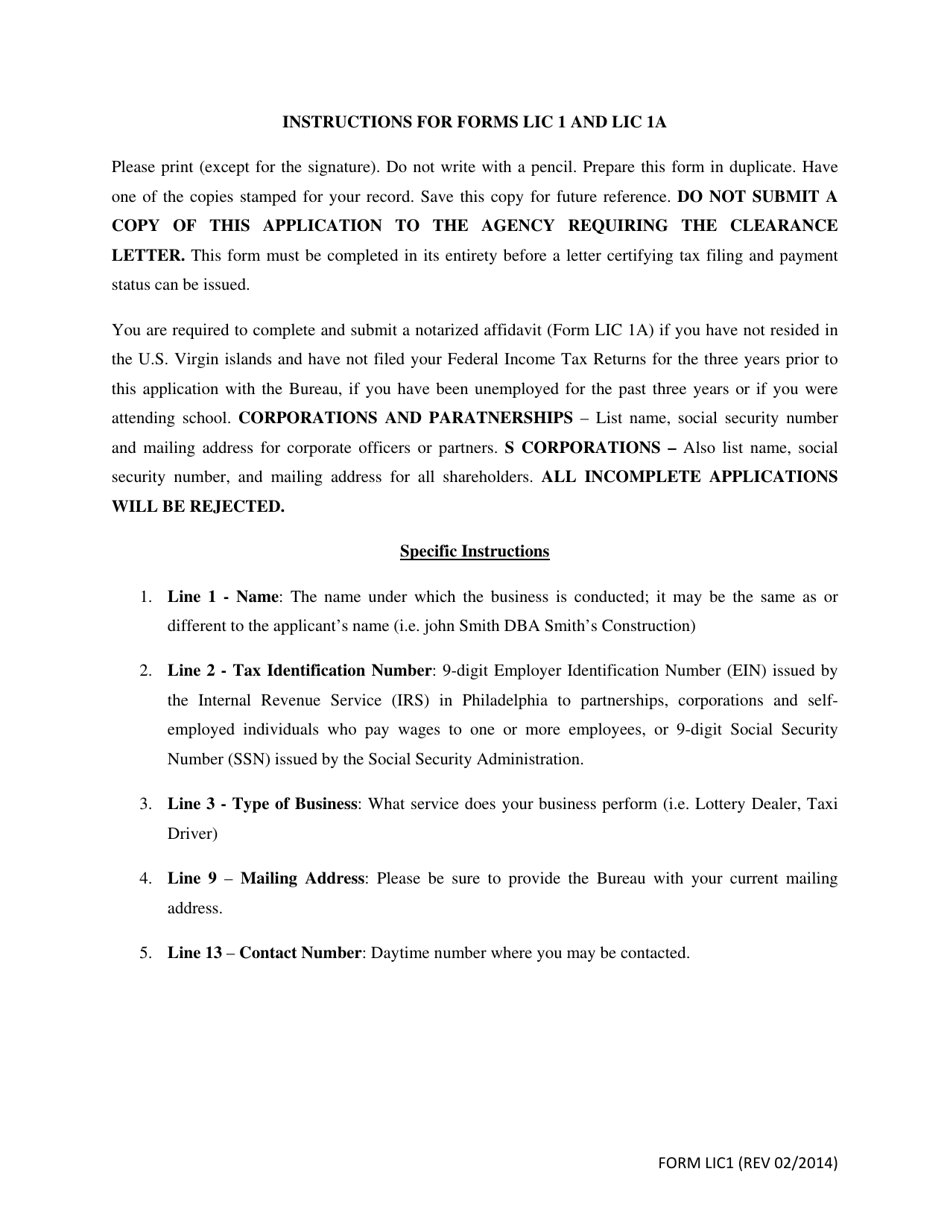

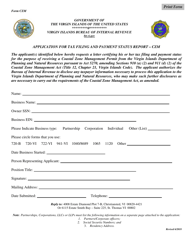

Form LIC1 Application for Tax Filing and Payment Status Report - Virgin Islands

What Is Form LIC1?

This is a legal form that was released by the Virgin Islands Bureau of Internal Revenue - a government authority operating within Virgin Islands. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the LIC1 form?

A: The LIC1 form is an application for tax filing and payment status report.

Q: Who can use the LIC1 form?

A: Residents of the Virgin Islands who need to report their tax filing and payment status can use the LIC1 form.

Q: What is the purpose of the LIC1 form?

A: The purpose of the LIC1 form is to provide information about your tax filing and payment status to the authorities.

Q: What do I need to include in the LIC1 form?

A: You need to include your personal information, details about your income and deductions, and information about your tax payments in the LIC1 form.

Form Details:

- Released on February 1, 2014;

- The latest edition provided by the Virgin Islands Bureau of Internal Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LIC1 by clicking the link below or browse more documents and templates provided by the Virgin Islands Bureau of Internal Revenue.