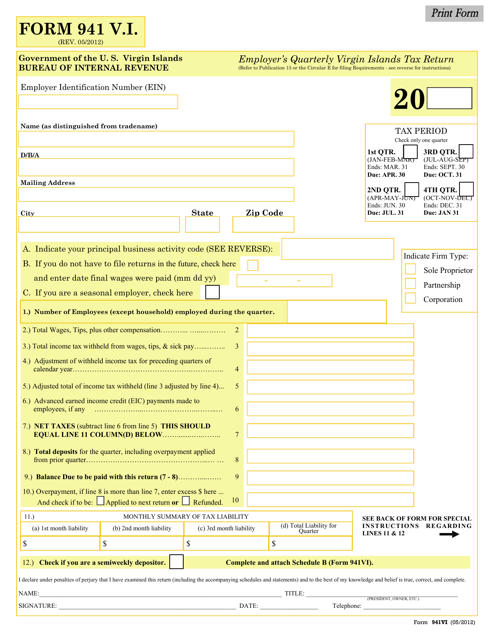

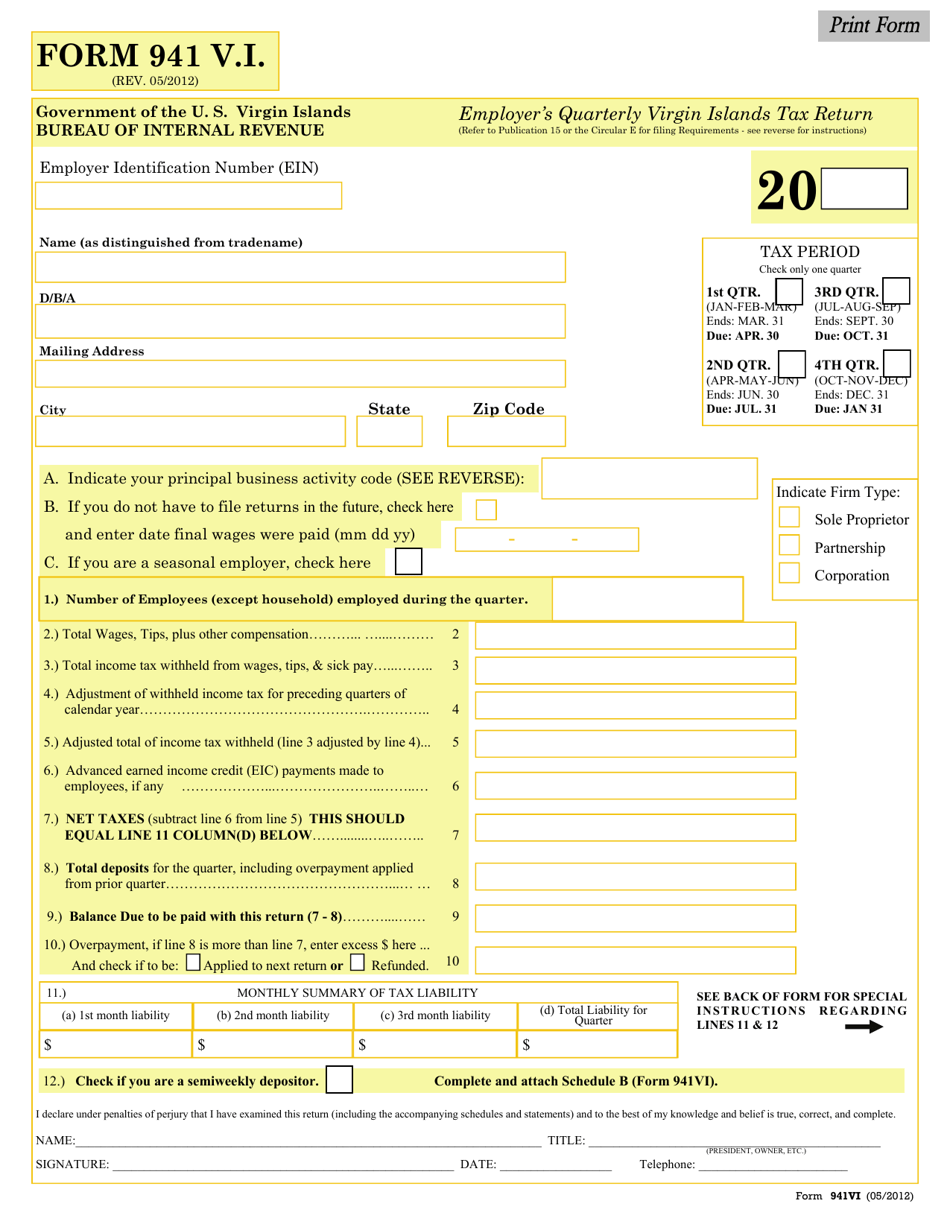

Form 941 V.I. Employer's Quarterly Virgin Islands Tax Return - Virgin Islands

What Is Form 941 V.I.?

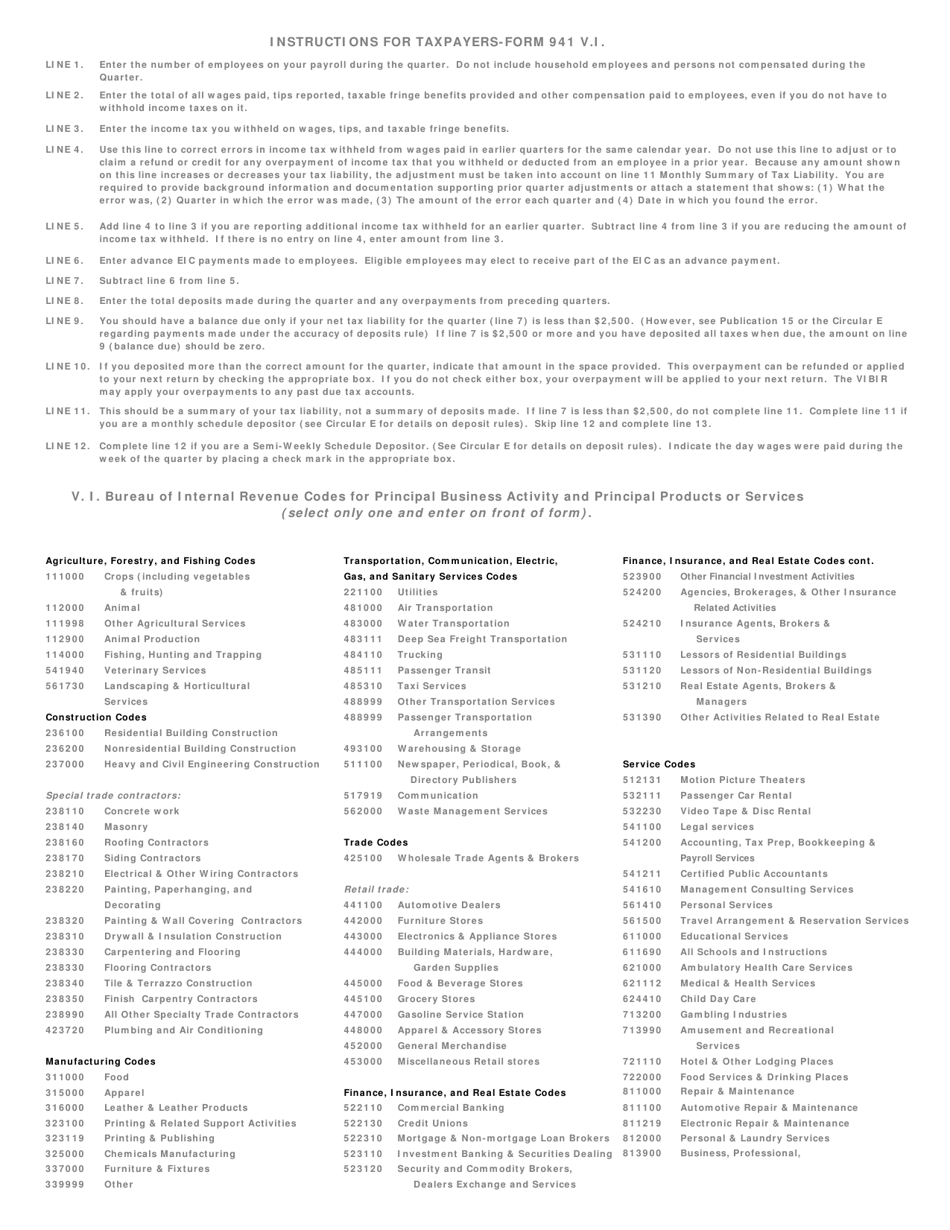

This is a legal form that was released by the Virgin Islands Bureau of Internal Revenue - a government authority operating within Virgin Islands. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 941 V.I.?

A: Form 941 V.I. is the Employer's Quarterly Virgin Islands Tax Return for employers in the Virgin Islands.

Q: Who should use Form 941 V.I.?

A: Employers in the Virgin Islands should use Form 941 V.I. to report their quarterly tax liabilities.

Q: What is the purpose of Form 941 V.I.?

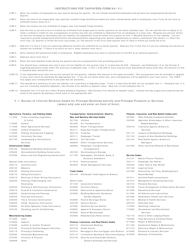

A: The purpose of Form 941 V.I. is to report employment taxes, such as federal incometax withholding, Social Security tax, and Medicare tax, for employees in the Virgin Islands.

Q: What information is required on Form 941 V.I.?

A: Form 941 V.I. requires information about the employer, the number of employees, wages paid, and taxes withheld.

Q: When is Form 941 V.I. due?

A: Form 941 V.I. is due quarterly, by the last day of the month following the end of the quarter.

Form Details:

- Released on May 1, 2012;

- The latest edition provided by the Virgin Islands Bureau of Internal Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 941 V.I. by clicking the link below or browse more documents and templates provided by the Virgin Islands Bureau of Internal Revenue.