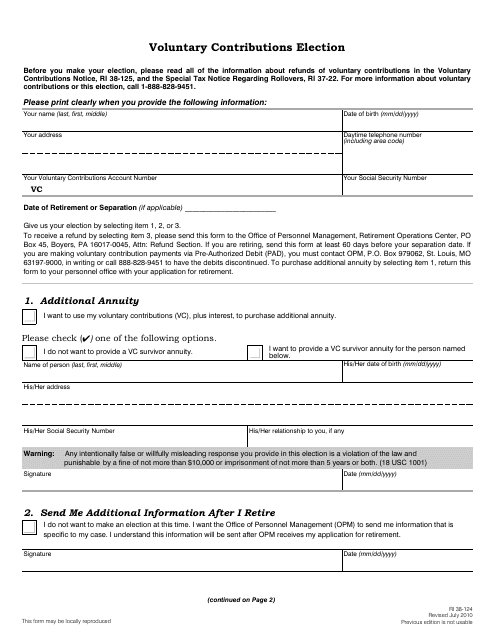

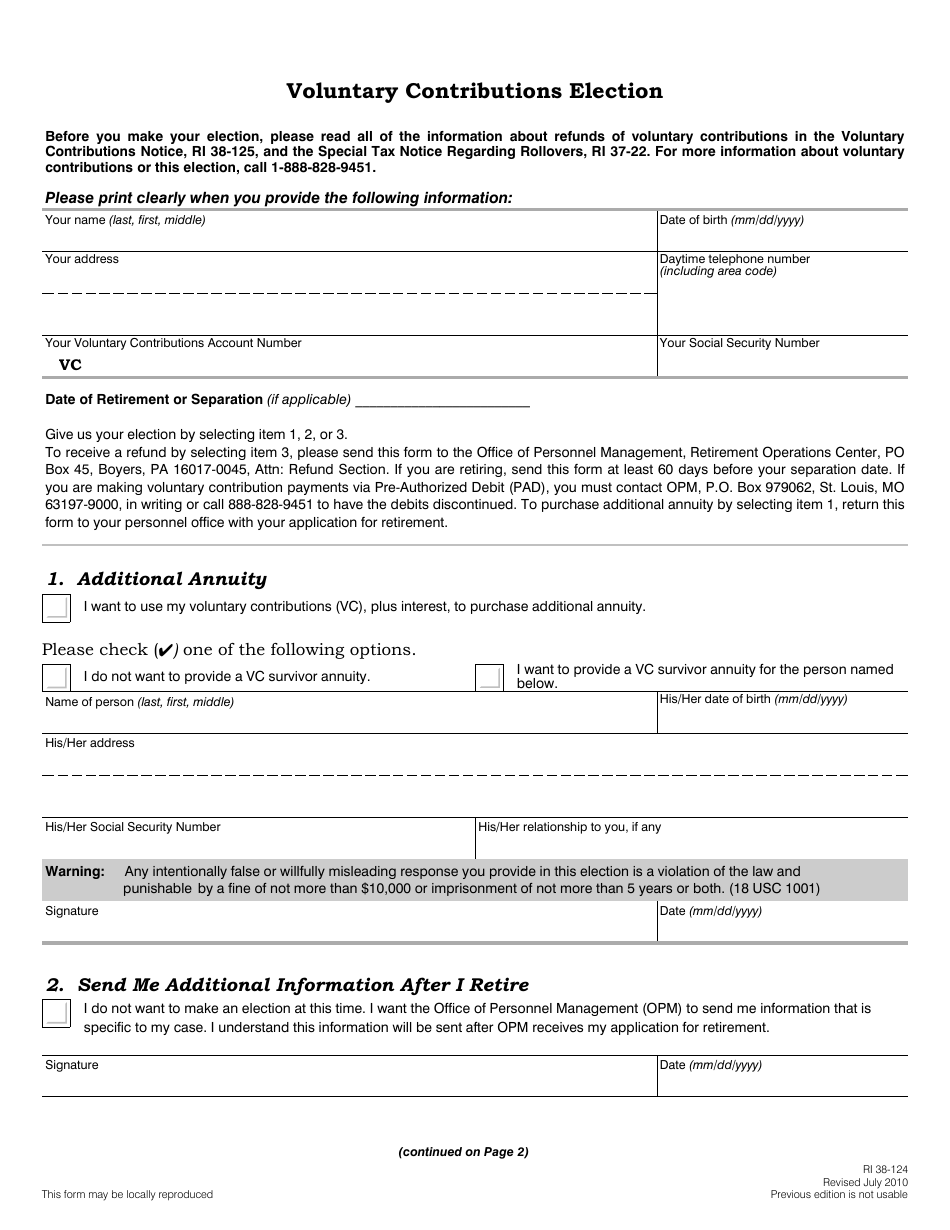

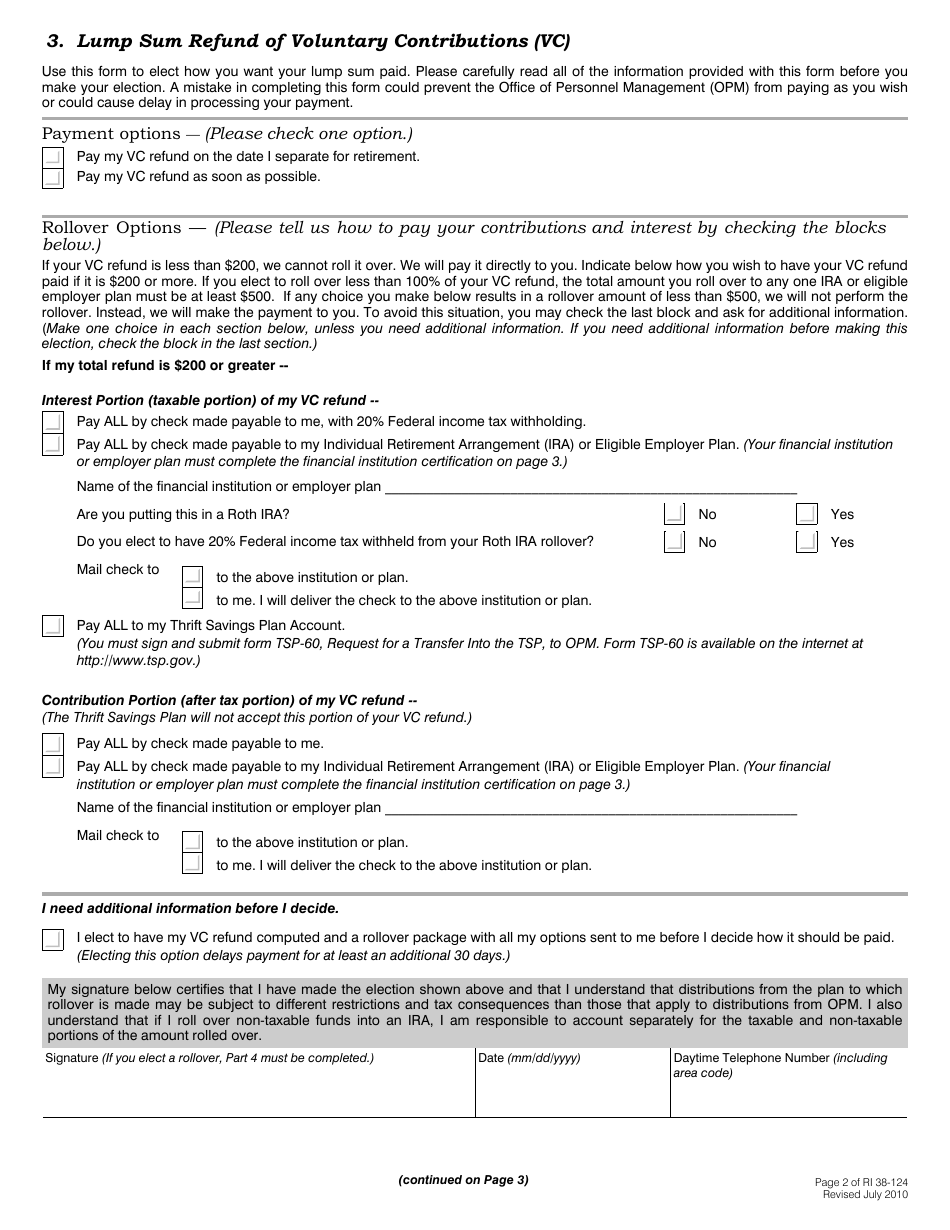

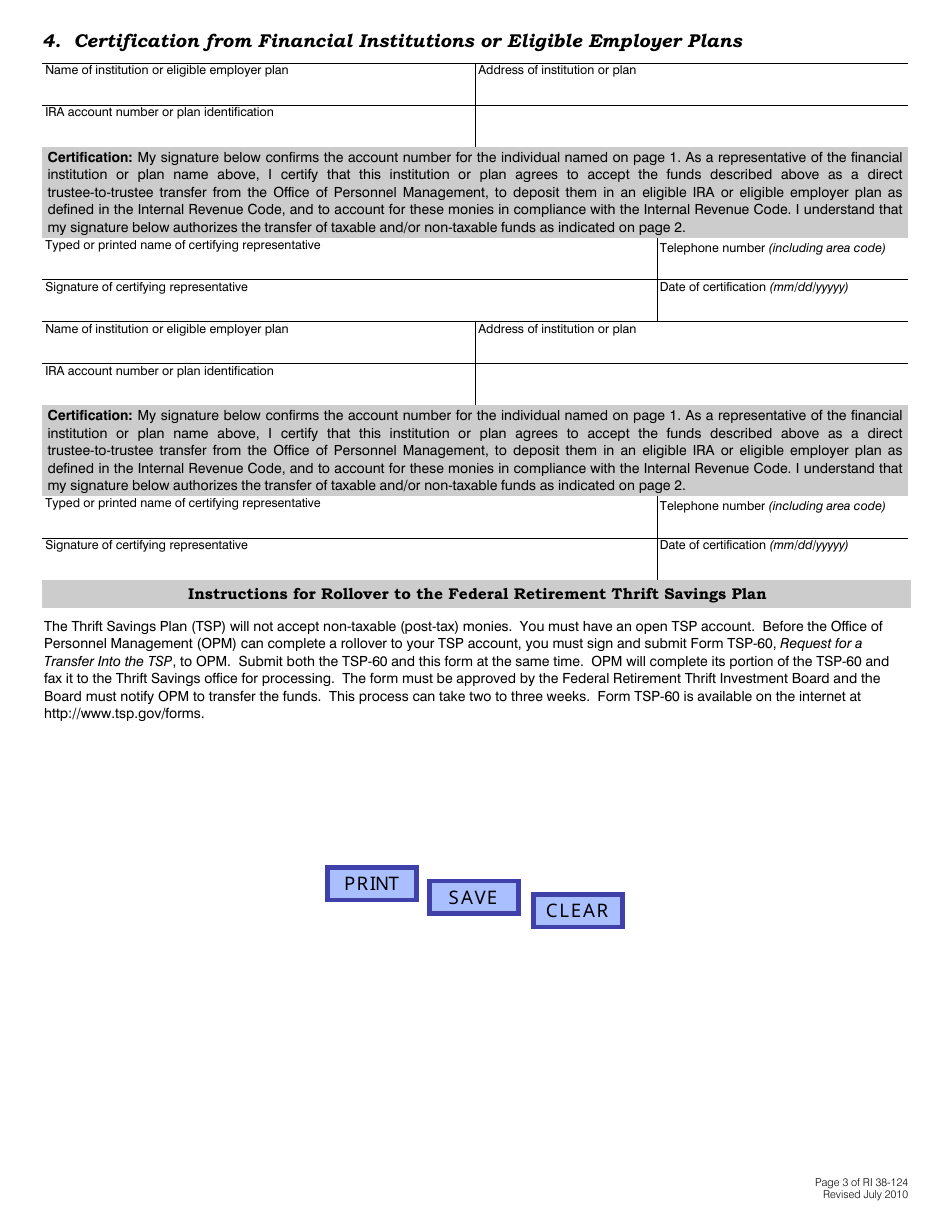

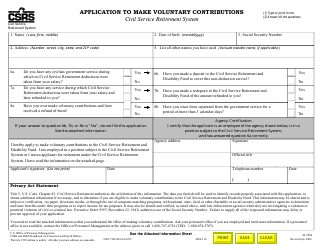

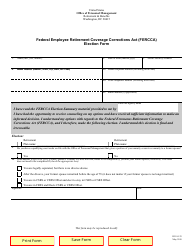

OPM Form RI38-124 Voluntary Contributions Election

What Is OPM Form RI38-124?

This is a legal form that was released by the U.S. Office of Personnel Management on July 1, 2010 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OPM Form RI38-124?

A: OPM Form RI38-124 is a form used for making voluntary contributions to your retirement account.

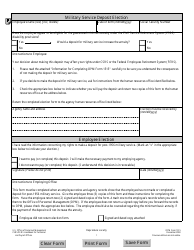

Q: What are voluntary contributions?

A: Voluntary contributions are additional contributions that you can make to your retirement account.

Q: Why would I want to make voluntary contributions?

A: Making voluntary contributions can increase your retirement savings and potentially provide you with a higher retirement income.

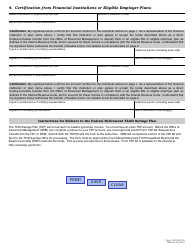

Q: How do I fill out OPM Form RI38-124?

A: To fill out OPM Form RI38-124, you will need to provide your personal information, the amount you want to contribute, and other relevant details.

Q: Are voluntary contributions tax-deductible?

A: Voluntary contributions are not tax-deductible, but they may provide certain tax advantages in the future.

Q: Can I change or cancel my voluntary contributions?

A: Yes, you can change or cancel your voluntary contributions at any time by submitting a new OPM Form RI38-124.

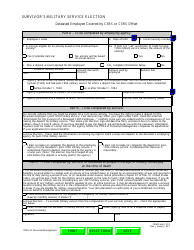

Q: Do voluntary contributions affect my retirement benefits?

A: Voluntary contributions can increase your retirement benefits and potentially provide you with a higher income during retirement.

Q: Who is eligible to make voluntary contributions?

A: Federal employees who are covered under the Civil Service Retirement System (CSRS) or the Federal Employees Retirement System (FERS) are eligible to make voluntary contributions.

Form Details:

- Released on July 1, 2010;

- The latest available edition released by the U.S. Office of Personnel Management;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OPM Form RI38-124 by clicking the link below or browse more documents and templates provided by the U.S. Office of Personnel Management.