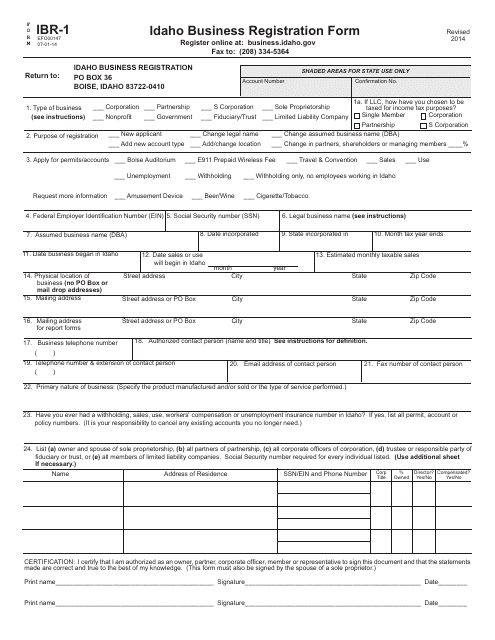

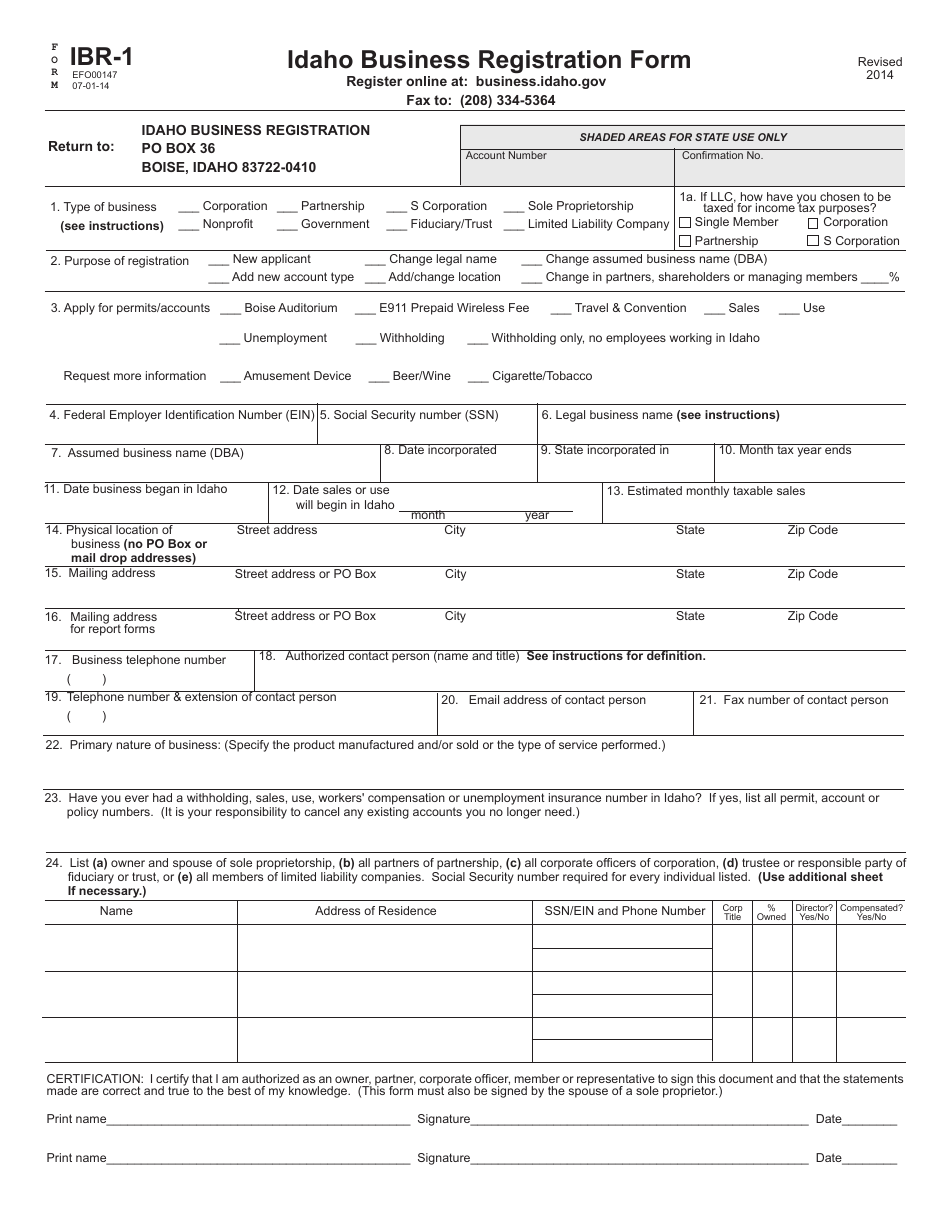

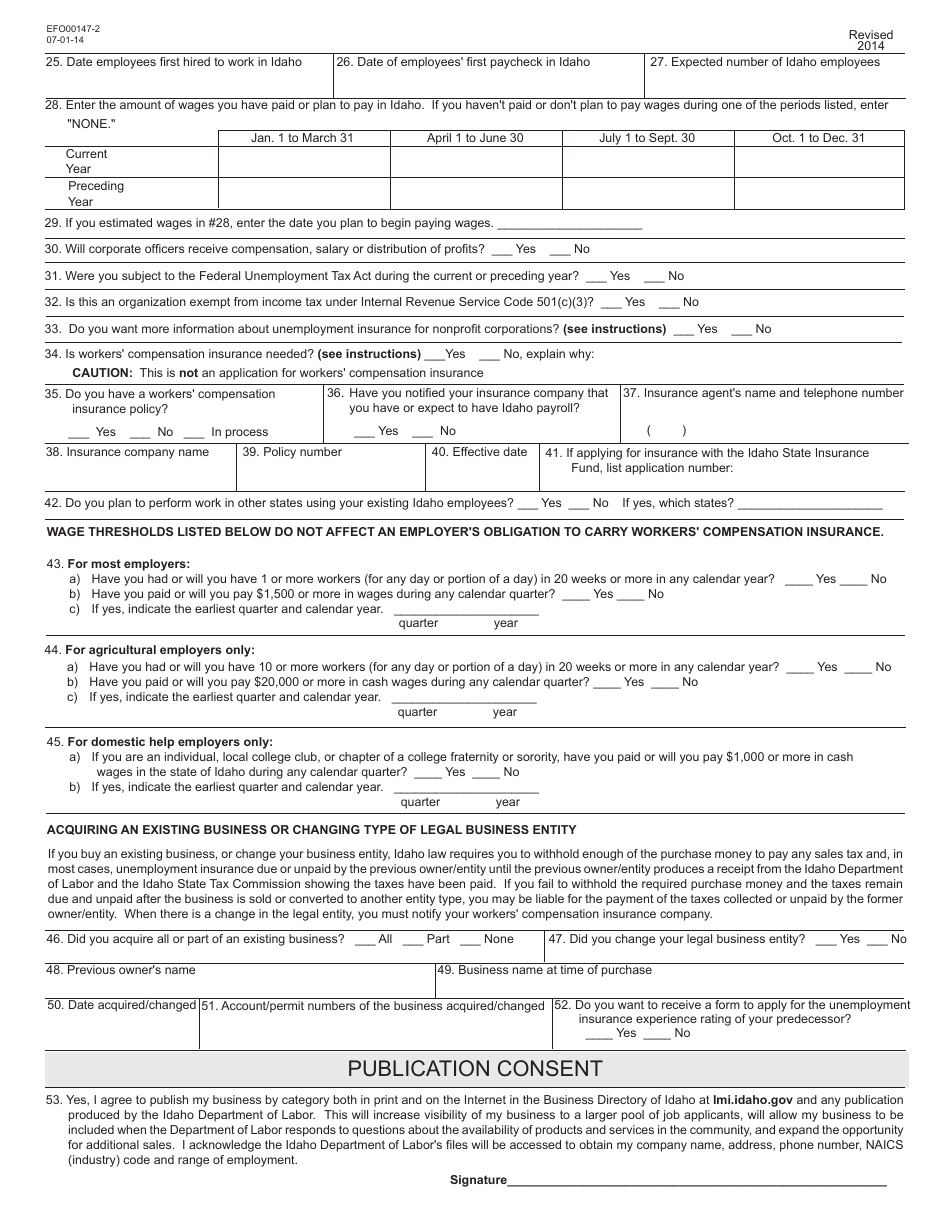

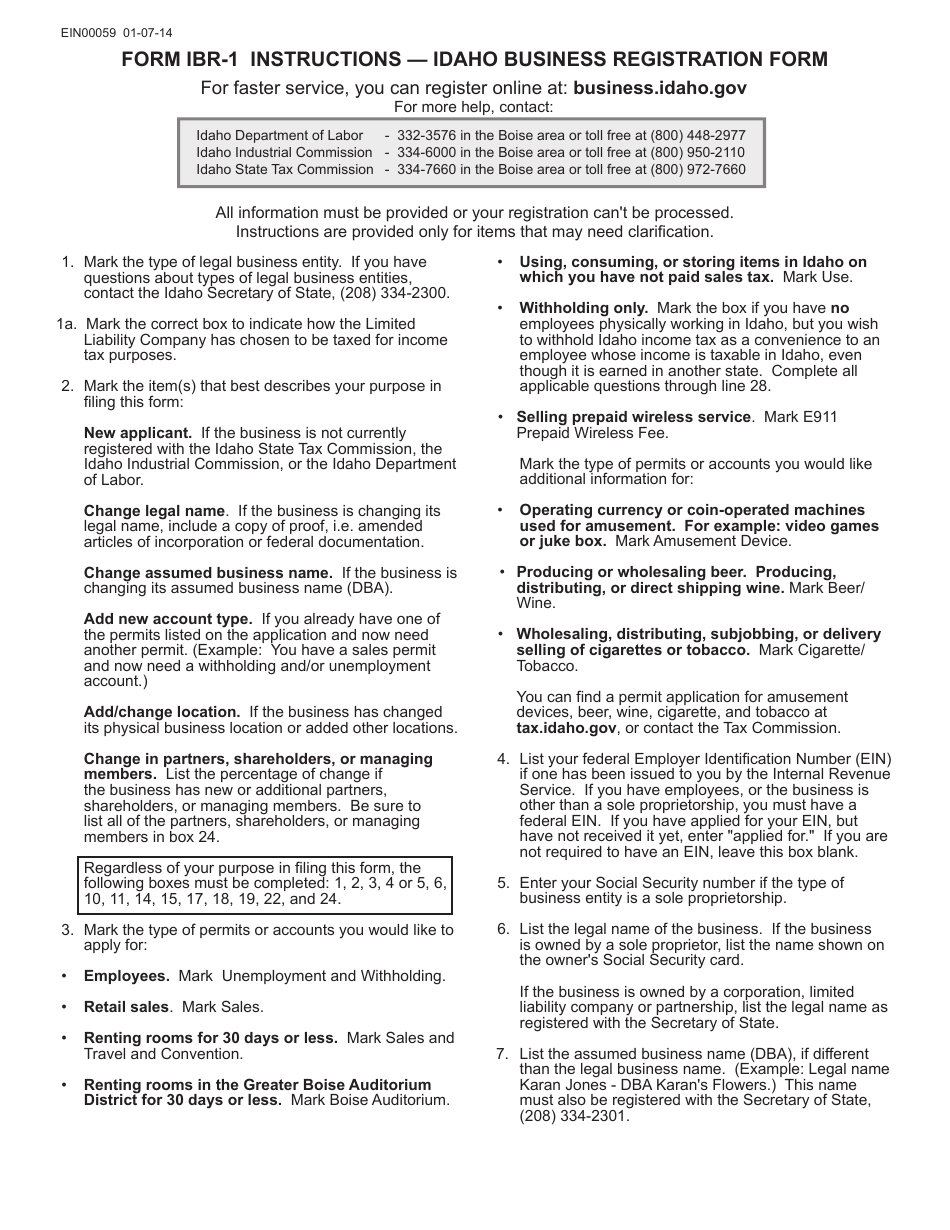

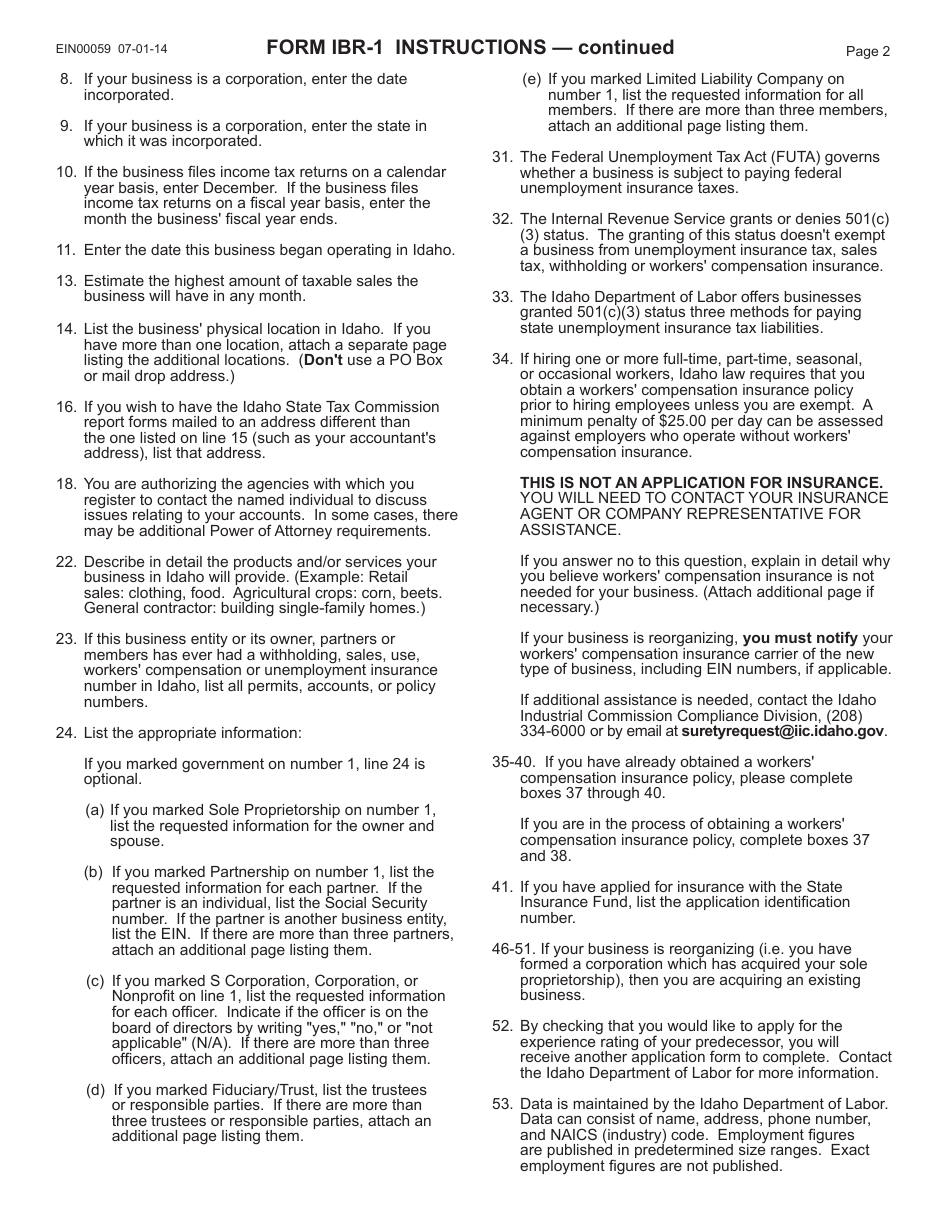

Form IBR-1 Idaho Business Registration Form - Idaho

What Is Form IBR-1?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the IBR-1 form?

A: The IBR-1 form is the Idaho Business Registration Form.

Q: Who needs to file the IBR-1 form?

A: Any individual or entity engaging in business activities in Idaho needs to file the IBR-1 form.

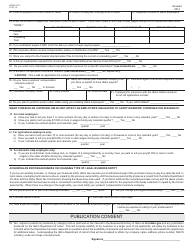

Q: What information is required in the IBR-1 form?

A: The IBR-1 form requires information such as business name, address, type of business, owner information, and more.

Q: What is the deadline for filing the IBR-1 form?

A: The IBR-1 form should be filed before starting business activities in Idaho.

Q: What happens after I file the IBR-1 form?

A: After filing the IBR-1 form, you will receive a business registration number from the Idaho Secretary of State.

Q: Do I need to renew the IBR-1 form?

A: The IBR-1 form does not need to be renewed. However, it is important to update the information if there are any changes to your business.

Q: Can I use the IBR-1 form for multiple businesses?

A: No, each business needs to file a separate IBR-1 form.

Form Details:

- Released on July 1, 2014;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IBR-1 by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.