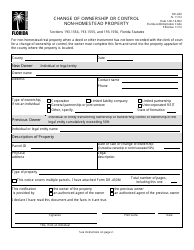

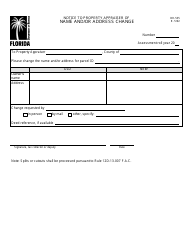

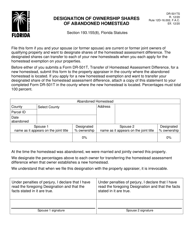

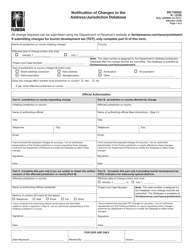

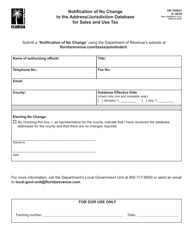

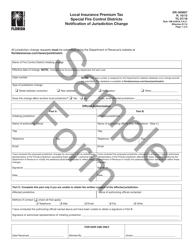

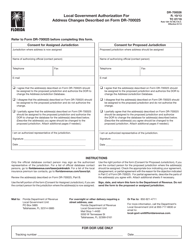

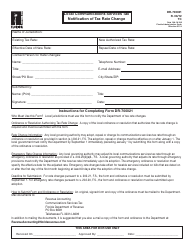

Form DR-430 Change of Ownership or Control Non-homestead Property - Florida

What Is Form DR-430?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-430?

A: Form DR-430 is a document used to report a change of ownership or control for non-homestead property in Florida.

Q: When should I use Form DR-430?

A: You should use Form DR-430 when there is a change in ownership or control of non-homestead property in Florida.

Q: What is considered non-homestead property?

A: Non-homestead property refers to property that is not used as the owner's primary residence, such as commercial properties or rental properties.

Q: Do I have to submit Form DR-430 if I sell my primary residence?

A: No, Form DR-430 is only required for non-homestead property. If you sell your primary residence, you do not need to submit this form.

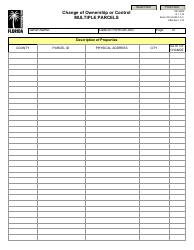

Q: What information do I need to provide on Form DR-430?

A: You will need to provide information about the property, the new owner or controlling party, and details of the change in ownership or control.

Q: Is there a deadline for submitting Form DR-430?

A: Yes, Form DR-430 must be submitted within 30 days of the change in ownership or control of the non-homestead property.

Q: Are there any fees associated with filing Form DR-430?

A: As of the time of this document, there are no fees associated with filing Form DR-430 in Florida.

Q: What happens after I submit Form DR-430?

A: After submitting Form DR-430, the relevant authorities will update their records to reflect the change in ownership or control of the non-homestead property.

Form Details:

- Released on November 1, 2012;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-430 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.