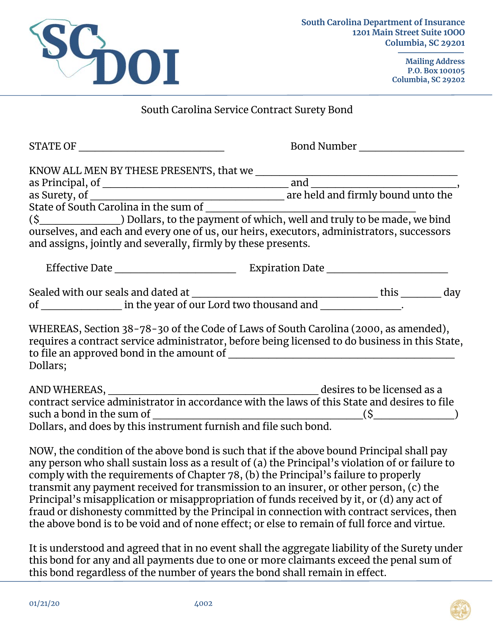

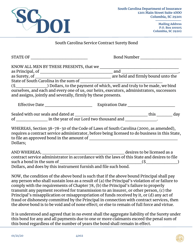

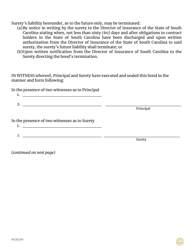

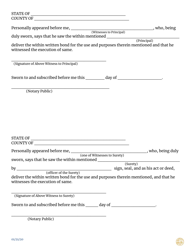

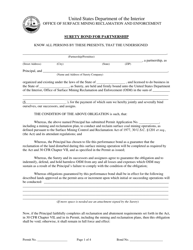

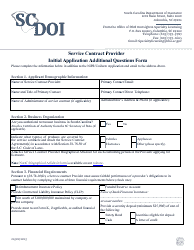

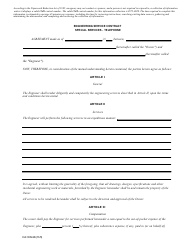

South Carolina Service Contract Surety Bond - South Carolina

South Carolina Service Contract Surety Bond is a legal document that was released by the South Carolina Department of Insurance - a government authority operating within South Carolina.

FAQ

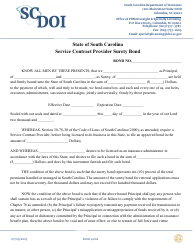

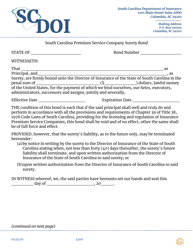

Q: What is a South Carolina Service Contract Surety Bond?

A: A South Carolina Service Contract Surety Bond is a type of bond required by the state of South Carolina for companies that offer service contracts.

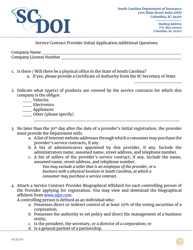

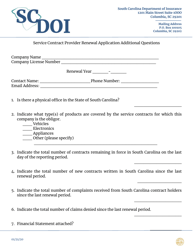

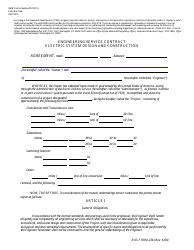

Q: What is a service contract?

A: A service contract is a contract between a service provider and a customer that outlines the terms and conditions of the services being provided.

Q: Why is a surety bond required for service contracts in South Carolina?

A: A surety bond is required to ensure that the service provider fulfills their obligations under the service contract and compensates the customer for any damages or losses.

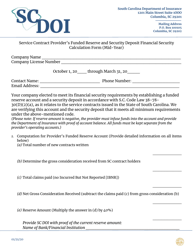

Q: How does a South Carolina Service Contract Surety Bond work?

A: If a service provider fails to fulfill their obligations under the service contract, the customer can make a claim on the surety bond to receive compensation for any damages or losses.

Q: How much does a South Carolina Service Contract Surety Bond cost?

A: The cost of a South Carolina Service Contract Surety Bond can vary depending on factors such as the bond amount and the financial stability of the service provider.

Form Details:

- Released on January 21, 2020;

- The latest edition currently provided by the South Carolina Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the South Carolina Department of Insurance.