This version of the form is not currently in use and is provided for reference only. Download this version of

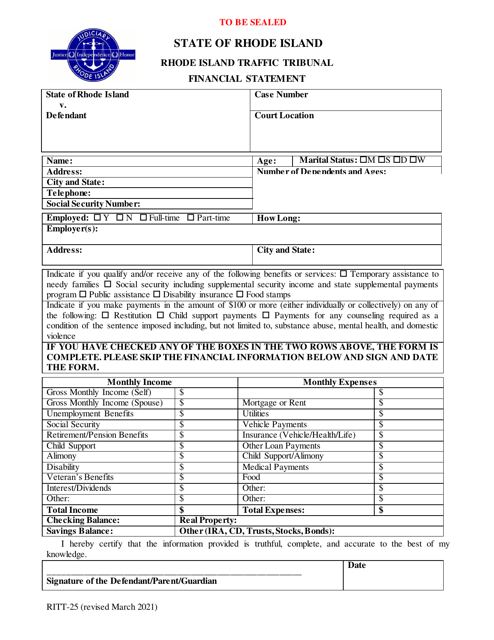

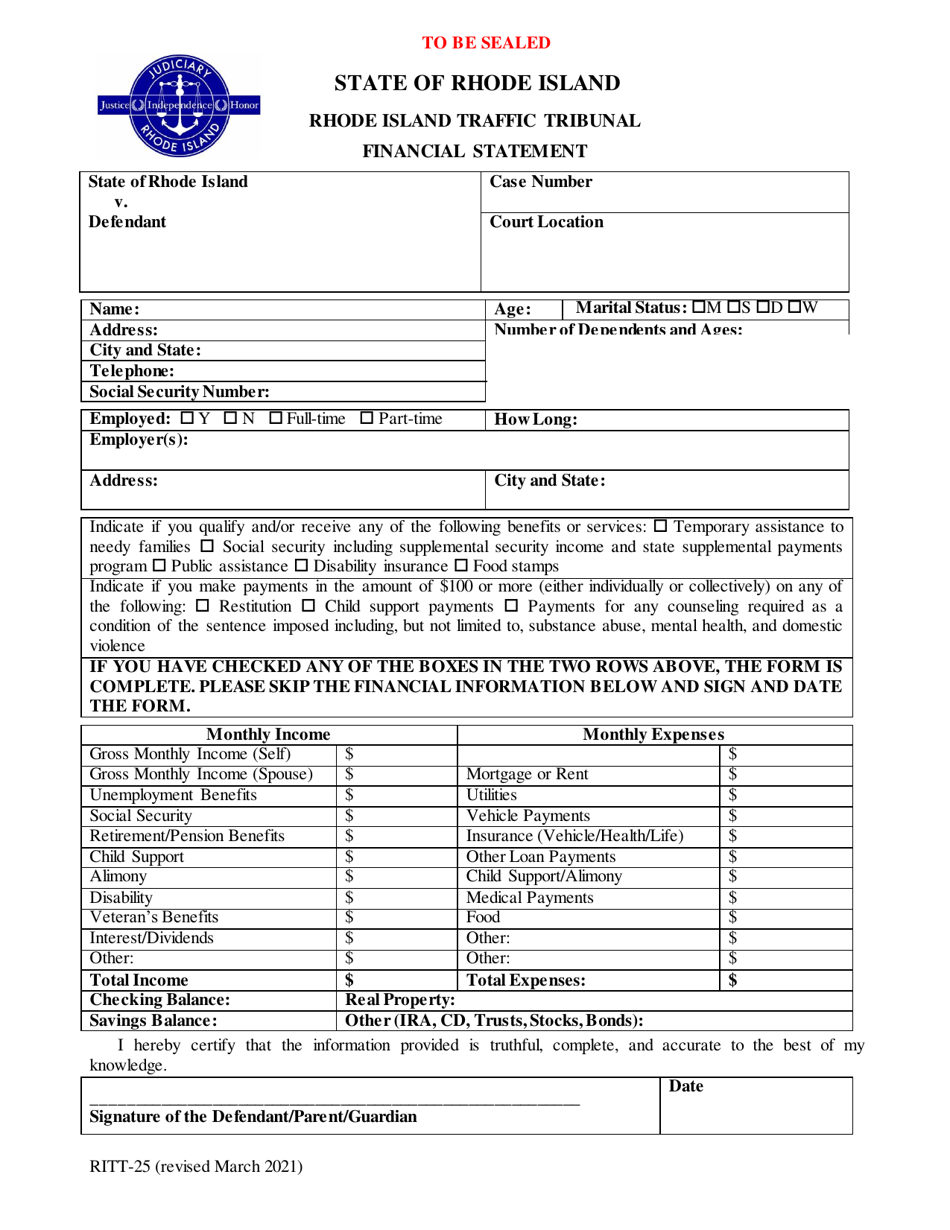

Form RITT-25

for the current year.

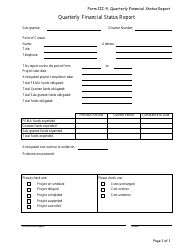

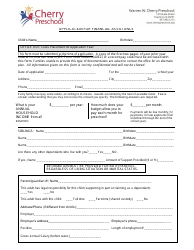

Form RITT-25 Financial Statement - Rhode Island

What Is Form RITT-25?

This is a legal form that was released by the Rhode Island Judiciary - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RITT-25?

A: Form RITT-25 is a financial statement required by the state of Rhode Island.

Q: Who needs to complete Form RITT-25?

A: Any individual or business that is subject to Rhode Island's tax laws may need to complete Form RITT-25.

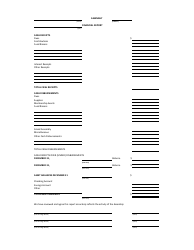

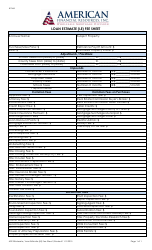

Q: What information is required on Form RITT-25?

A: Form RITT-25 requires detailed information about your income, expenses, assets, liabilities, and other financial information.

Q: When is Form RITT-25 due?

A: The due date for Form RITT-25 varies and depends on your filing status and the type of taxpayer you are. It is usually due on or around April 15th.

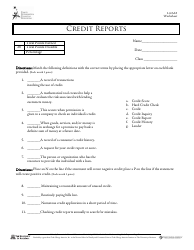

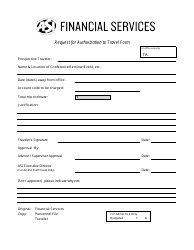

Q: Do I need to attach any supporting documents to Form RITT-25?

A: You may need to attach certain supporting documents, such as W-2 forms, 1099 forms, and schedules detailing specific deductions or credits.

Q: What happens if I don't file Form RITT-25?

A: If you are required to file Form RITT-25 and fail to do so, you may face penalties and interest charges.

Form Details:

- Released on March 1, 2021;

- The latest edition provided by the Rhode Island Judiciary;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RITT-25 by clicking the link below or browse more documents and templates provided by the Rhode Island Judiciary.