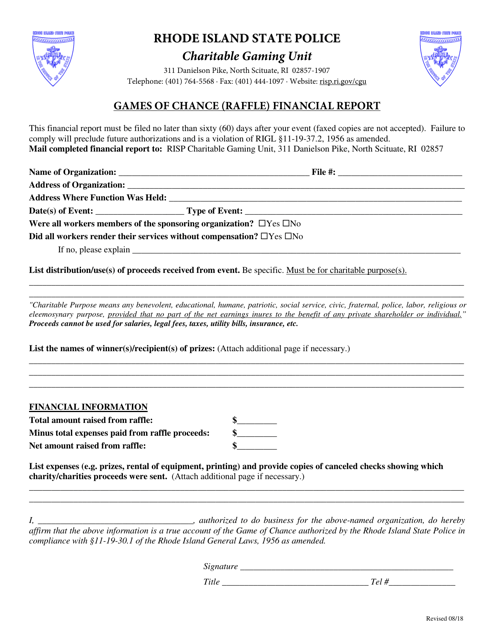

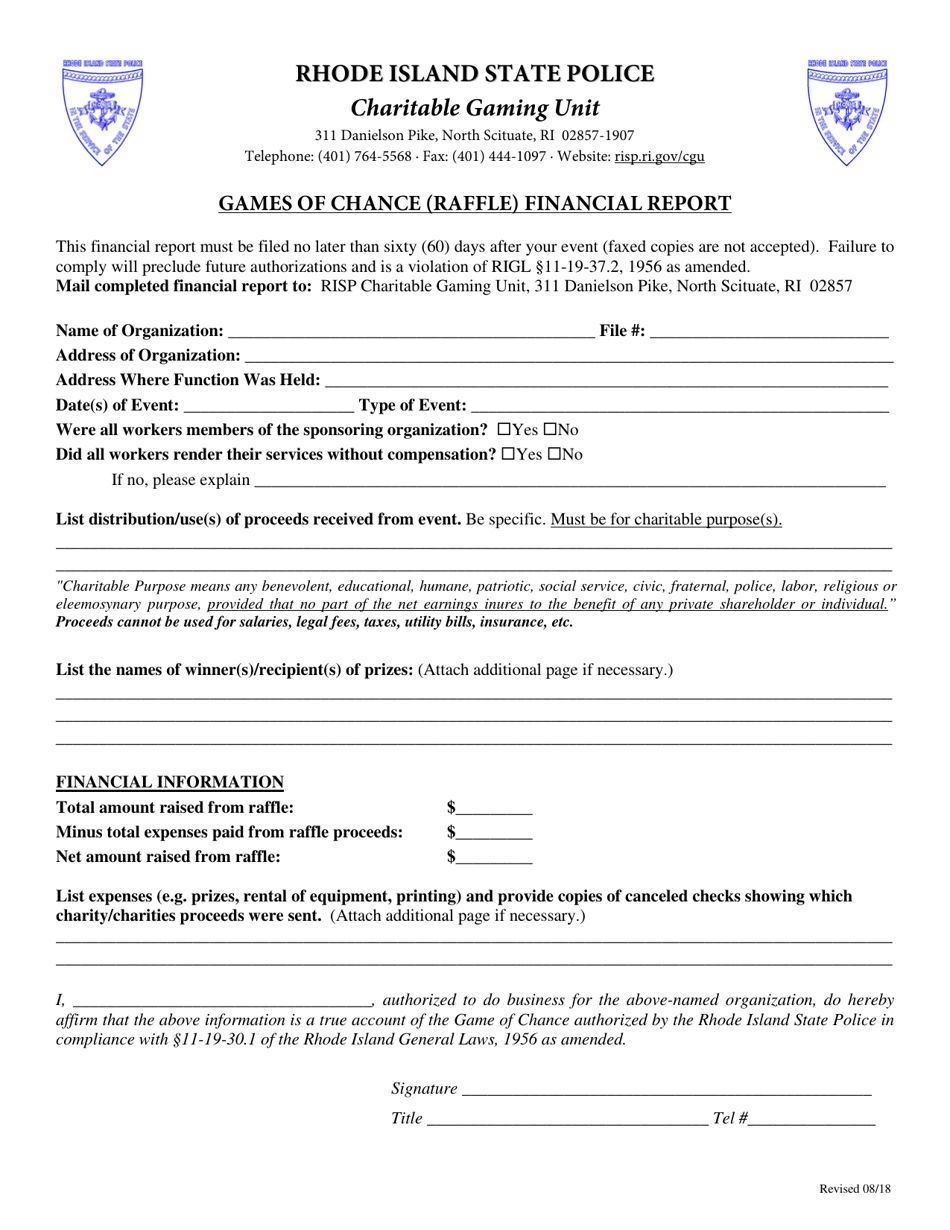

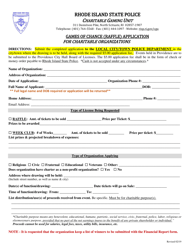

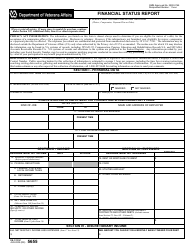

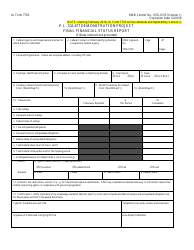

Games of Chance (Raffle) Financial Report - Rhode Island

Games of Chance (Raffle) Financial Report is a legal document that was released by the Rhode Island Department of Public Safety - State Police - a government authority operating within Rhode Island.

FAQ

Q: What is a raffle?

A: A raffle is a game of chance where participants purchase tickets for a chance to win a prize.

Q: Are raffles legal in Rhode Island?

A: Yes, raffles are legal in Rhode Island as long as they meet certain requirements and are conducted for charitable purposes.

Q: Who can hold a raffle in Rhode Island?

A: Non-profit organizations with proper licenses can hold raffles in Rhode Island.

Q: How are raffles regulated in Rhode Island?

A: Raffles in Rhode Island are regulated by the Rhode Island Division of Taxation and the Rhode Island State Police.

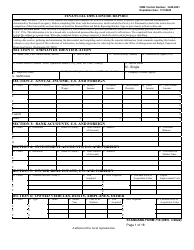

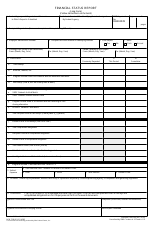

Q: What are the reporting requirements for raffles in Rhode Island?

A: Non-profit organizations must submit a financial report within 30 days of the raffle's conclusion, detailing the funds raised and how they were used.

Q: How are raffle winnings taxed in Rhode Island?

A: Raffle winnings in Rhode Island are subject to state and federal income taxes.

Q: What happens if a non-profit organization does not comply with raffle regulations in Rhode Island?

A: Non-compliance with raffle regulations can result in fines, penalties, and the loss of the organization's raffle license.

Q: Can individuals host their own raffles in Rhode Island?

A: No, only non-profit organizations with proper licenses can host raffles in Rhode Island.

Form Details:

- Released on August 1, 2018;

- The latest edition currently provided by the Rhode Island Department of Public Safety - State Police;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Public Safety - State Police.