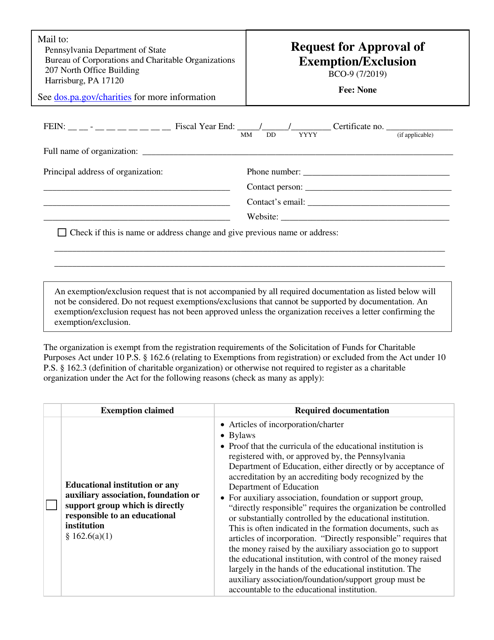

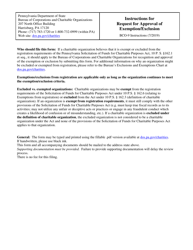

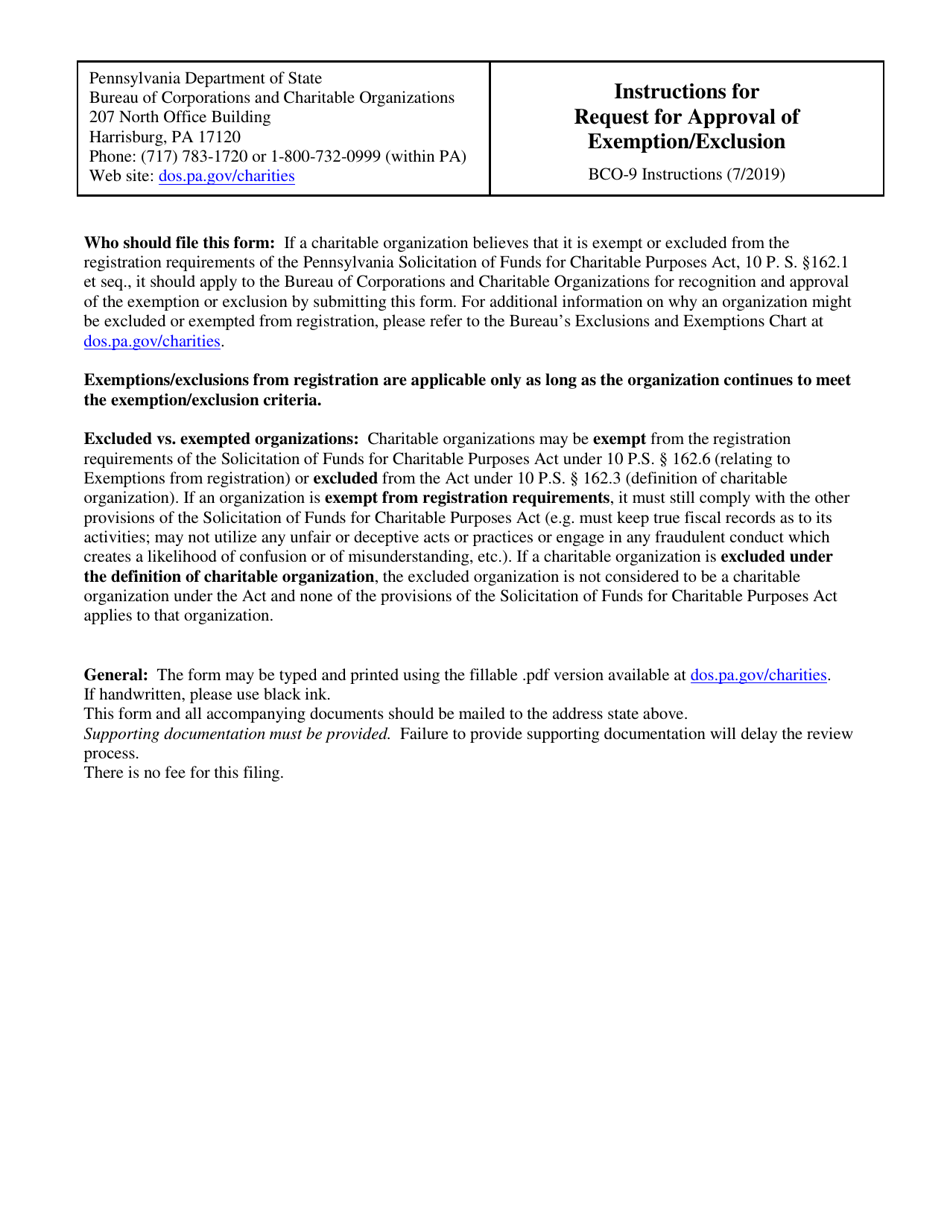

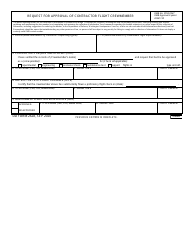

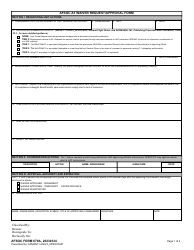

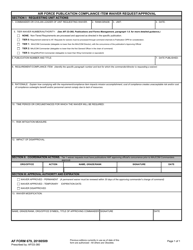

Form BCO-9 Request for Approval of Exemption / Exclusion - Pennsylvania

What Is Form BCO-9?

This is a legal form that was released by the Pennsylvania Department of State - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

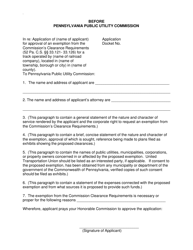

Q: What is Form BCO-9 used for?

A: Form BCO-9 is used to request approval for exemption or exclusion in Pennsylvania.

Q: Who needs to file Form BCO-9?

A: Anyone who wants to claim an exemption or exclusion in Pennsylvania needs to file Form BCO-9.

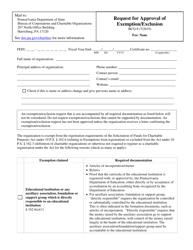

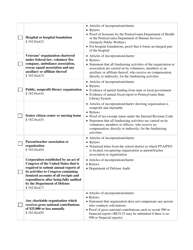

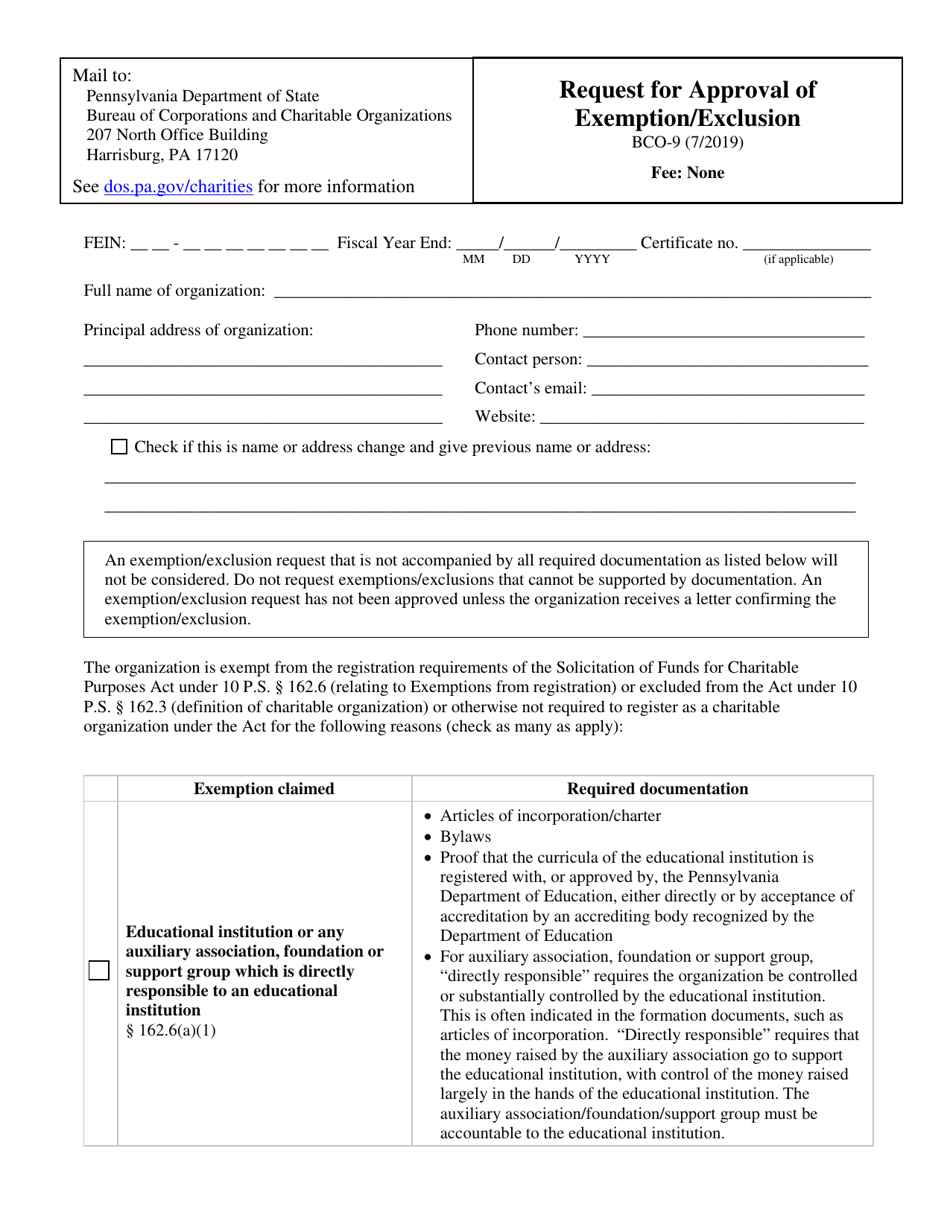

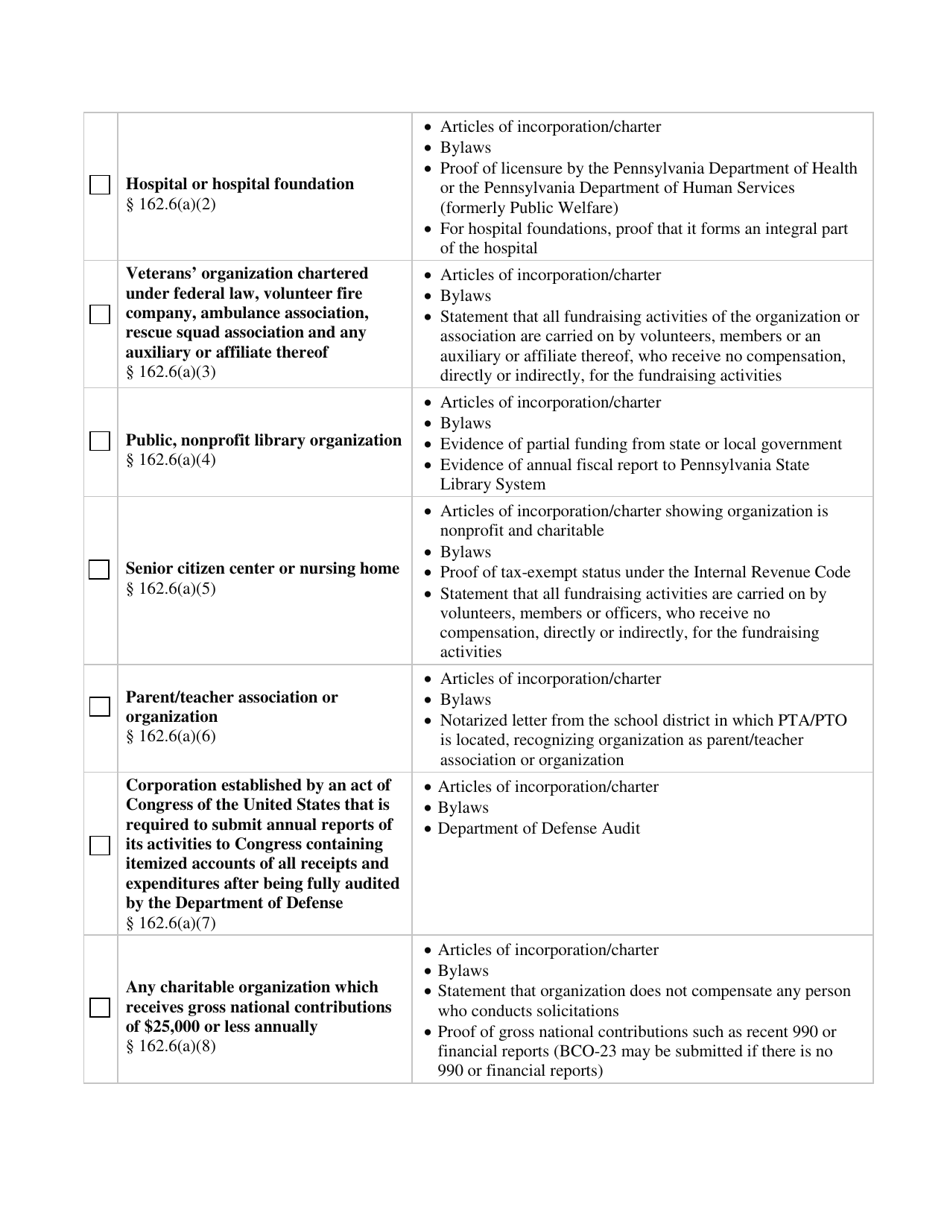

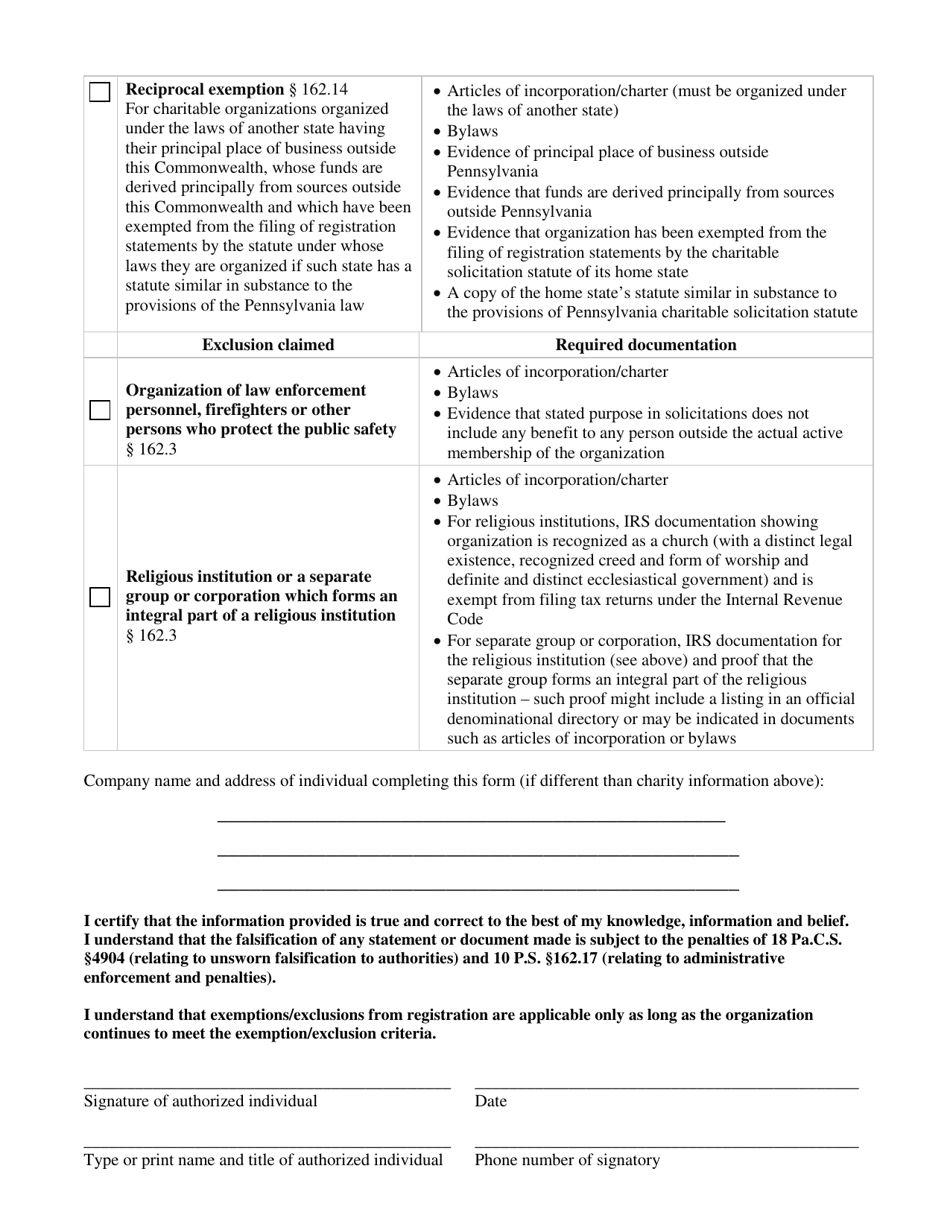

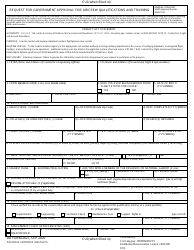

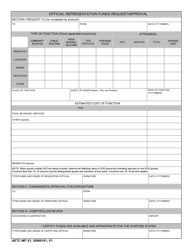

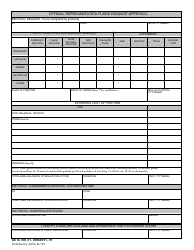

Q: What information is required on Form BCO-9?

A: Form BCO-9 requires information about the taxpayer, the exemption or exclusion being claimed, and supporting documentation.

Q: Is there a fee to file Form BCO-9?

A: No, there is no fee to file Form BCO-9.

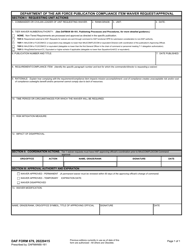

Q: How long does it take to get approval for an exemption or exclusion?

A: The processing time for Form BCO-9 varies, but it can take several weeks.

Q: What happens after I file Form BCO-9?

A: After filing Form BCO-9, the Pennsylvania Department of Revenue will review the request and notify you of their decision.

Q: Can I appeal if my request for exemption or exclusion is denied?

A: Yes, you can appeal the decision if your request for exemption or exclusion is denied.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Pennsylvania Department of State;

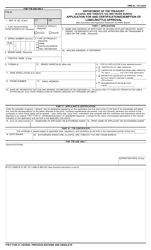

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BCO-9 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of State.