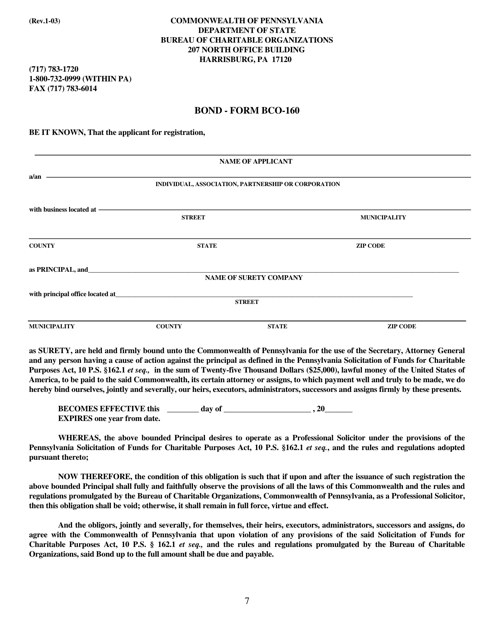

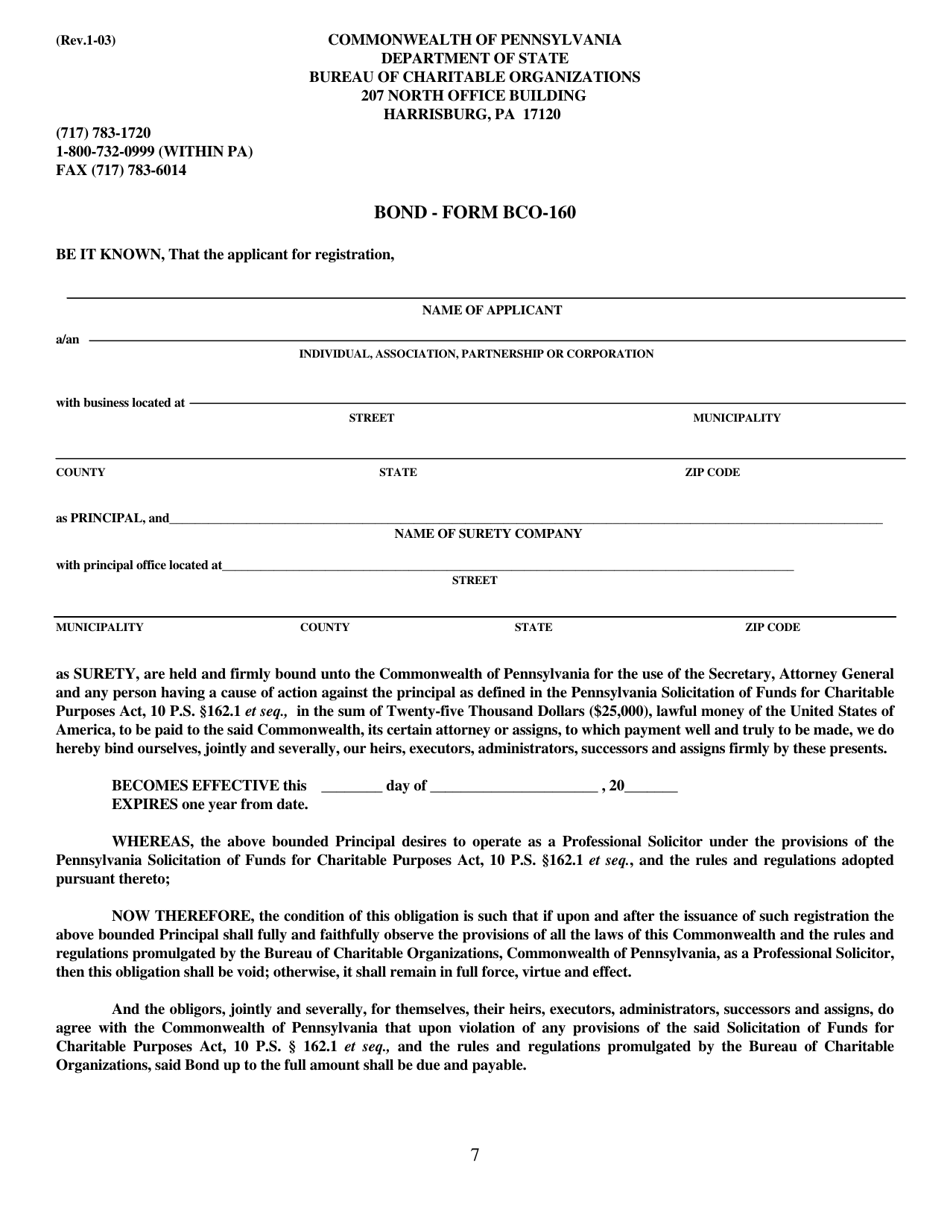

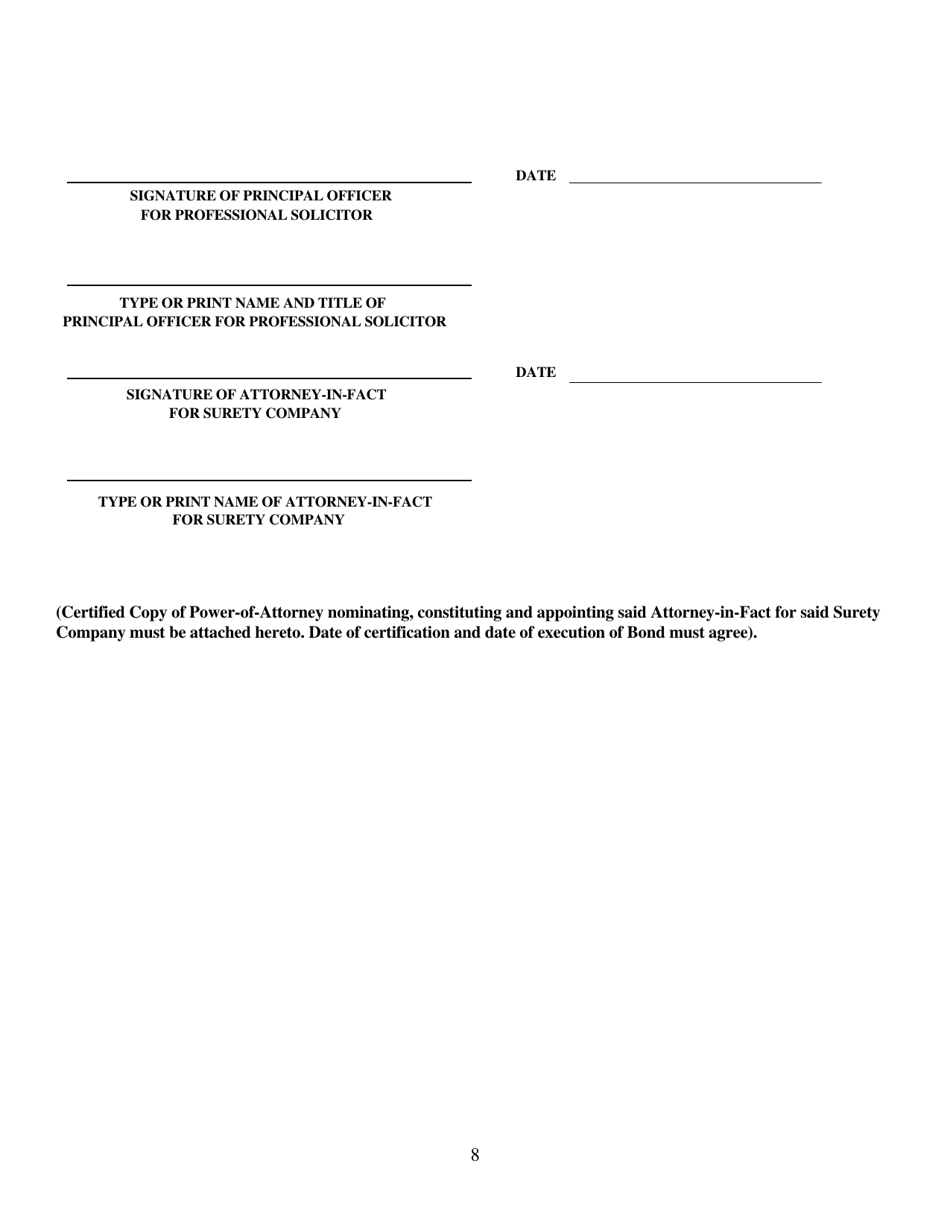

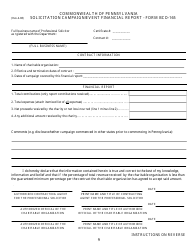

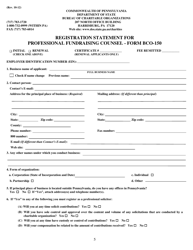

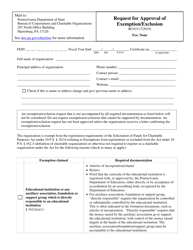

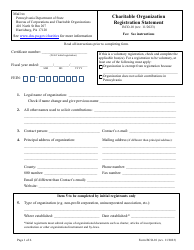

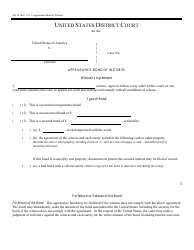

Form BCO-160 Bond - Pennsylvania

What Is Form BCO-160?

This is a legal form that was released by the Pennsylvania Department of State - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

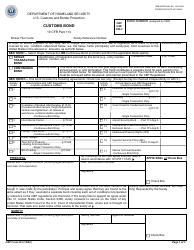

Q: What is a BCO-160 Bond?

A: A BCO-160 Bond is a type of bond required by the Pennsylvania Department of Revenue for motor carriers.

Q: Who needs to file a BCO-160 Bond?

A: Motor carriers operating in Pennsylvania need to file a BCO-160 Bond.

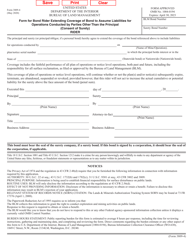

Q: What is the purpose of a BCO-160 Bond?

A: The purpose of a BCO-160 Bond is to ensure that motor carriers comply with state tax laws and pay all required taxes.

Q: How much is the bond amount for a BCO-160 Bond?

A: The bond amount for a BCO-160 Bond varies based on the motor carrier's estimated quarterly tax liability.

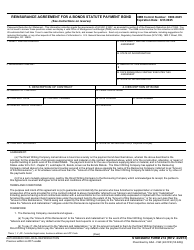

Q: How long is a BCO-160 Bond valid for?

A: A BCO-160 Bond is typically valid for one year and needs to be renewed annually.

Q: What happens if a motor carrier fails to file a BCO-160 Bond?

A: If a motor carrier fails to file a BCO-160 Bond, they may face penalties and be unable to operate legally in Pennsylvania.

Form Details:

- Released on January 1, 2003;

- The latest edition provided by the Pennsylvania Department of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BCO-160 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of State.