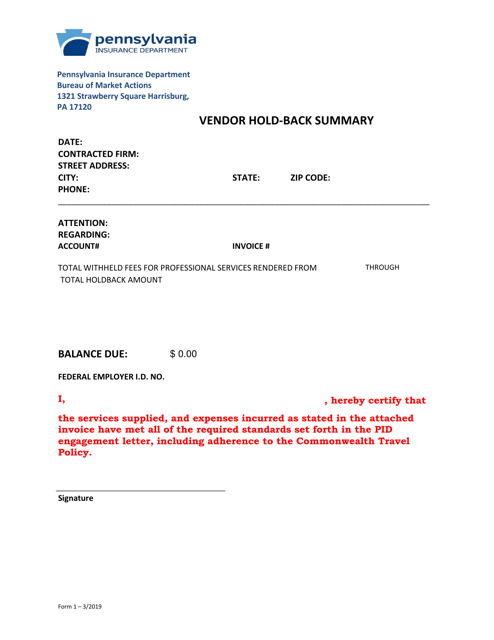

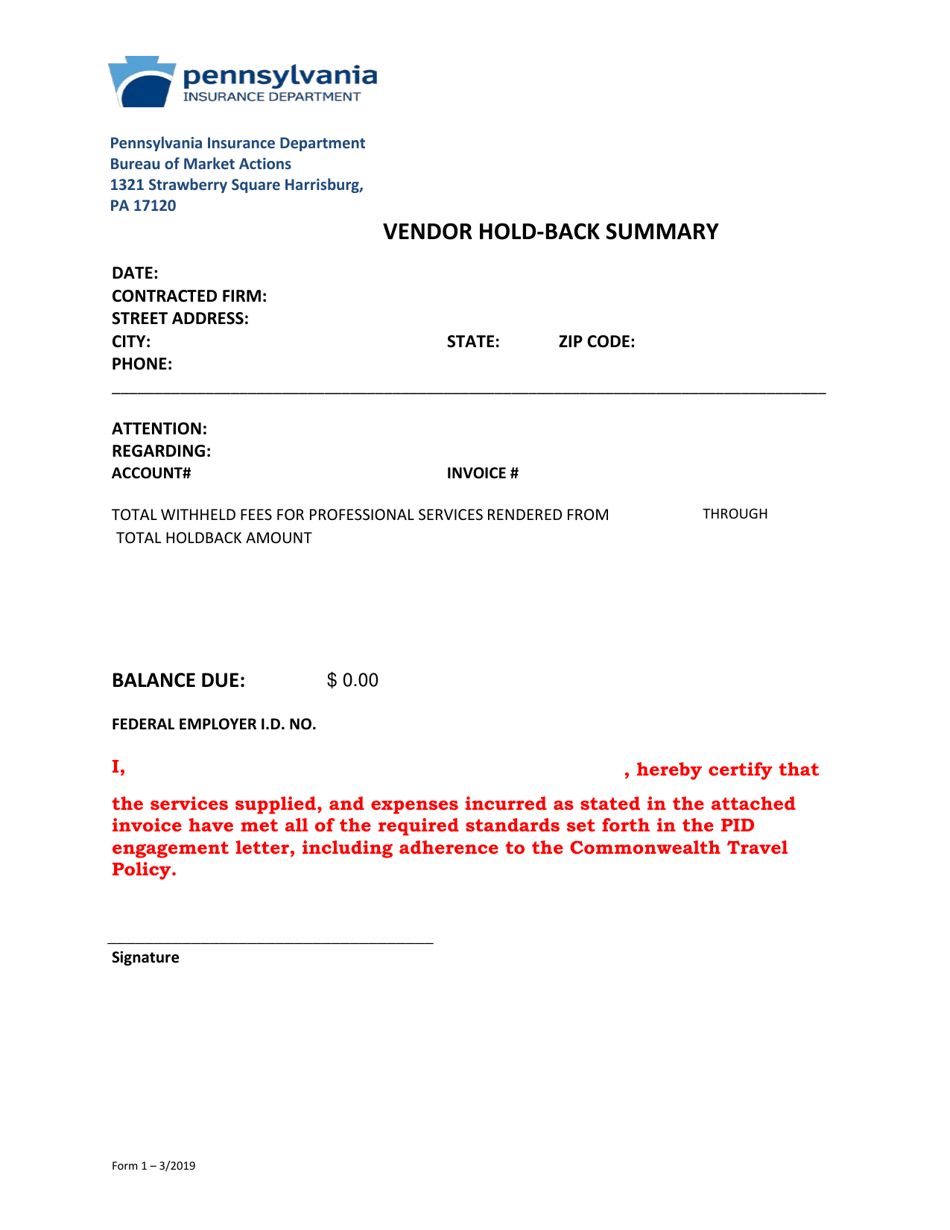

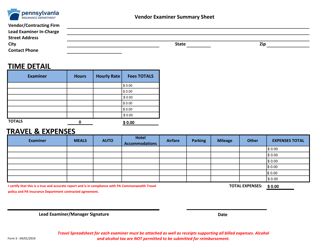

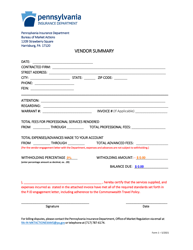

Form 1 Vendor Hold-Back Summary - Pennsylvania

What Is Form 1?

This is a legal form that was released by the Pennsylvania Insurance Department - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a vendor hold-back?

A: A vendor hold-back is a portion of the purchase price that is retained by the buyer for a specified period of time after the closing of a real estate transaction.

Q: Why is a vendor hold-back used?

A: A vendor hold-back is used to protect the buyer in case there are any outstanding issues or defects with the property that need to be addressed after the closing.

Q: How much is typically held back in a vendor hold-back?

A: The amount held back can vary depending on the specific terms of the agreement, but it is usually a percentage of the purchase price, such as 5%.

Q: How long is the vendor hold-back period?

A: The hold-back period is typically a few months, but it can vary depending on the agreement between the buyer and the seller.

Q: What happens to the hold-back funds after the hold-back period expires?

A: Once the hold-back period expires and any outstanding issues have been resolved, the hold-back funds are released to the seller.

Q: Is a vendor hold-back required in all real estate transactions?

A: No, a vendor hold-back is not required in all real estate transactions. It is typically used in situations where there are concerns or uncertainties about the property.

Q: Who holds the hold-back funds during the hold-back period?

A: The hold-back funds are usually held by a third party, such as an escrow agent or the buyer's attorney, until the hold-back period expires.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the Pennsylvania Insurance Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1 by clicking the link below or browse more documents and templates provided by the Pennsylvania Insurance Department.