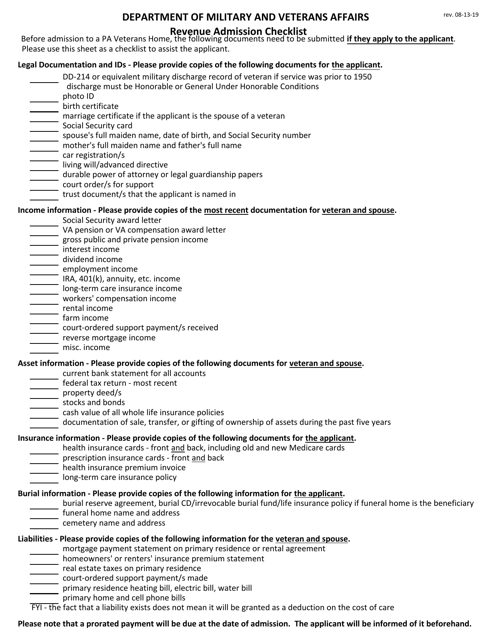

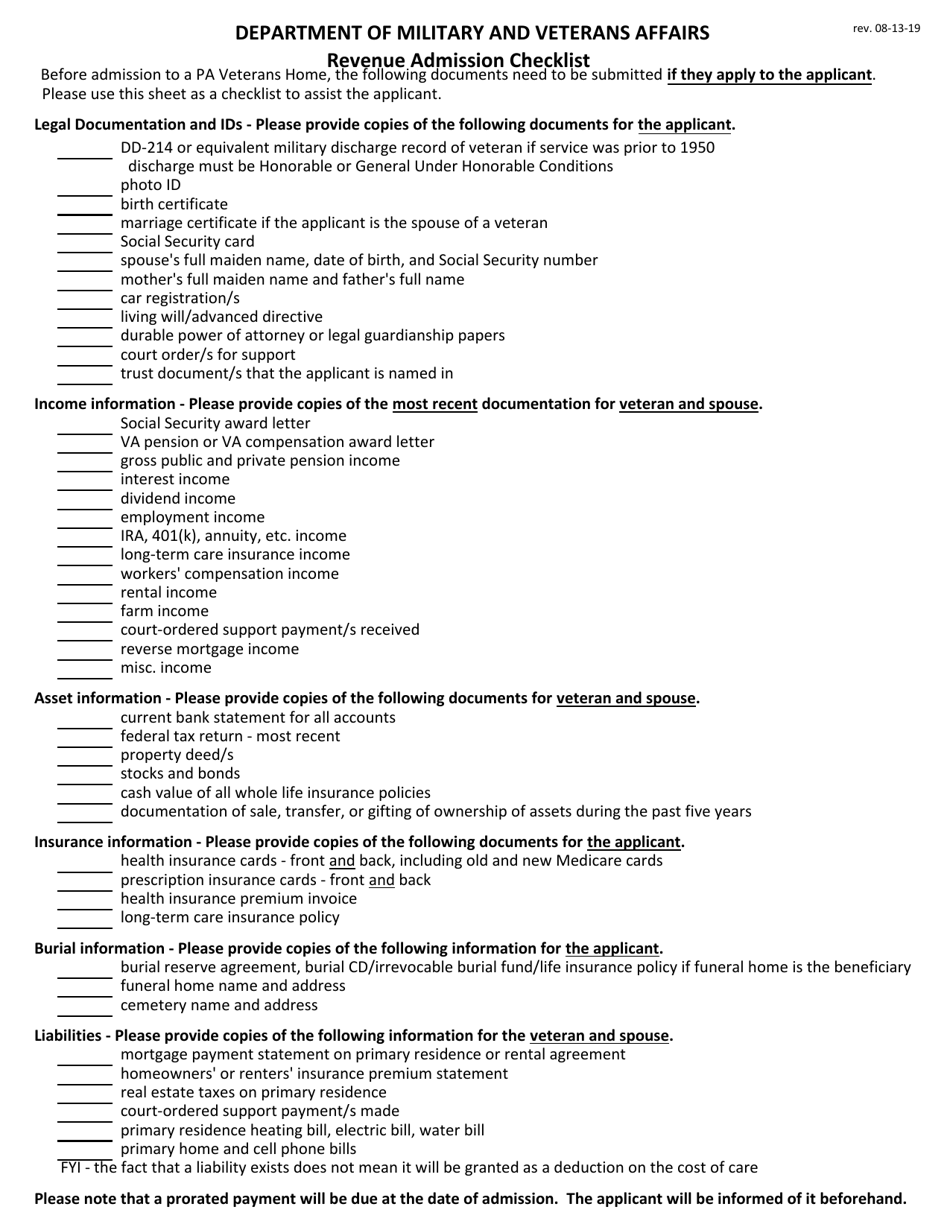

Revenue Admission Checklist - Pennsylvania

Revenue Admission Checklist is a legal document that was released by the Pennsylvania Department of Military and Veterans Affairs - a government authority operating within Pennsylvania.

FAQ

Q: What is the Revenue Admission Checklist?

A: The Revenue Admission Checklist is a series of requirements and guidelines to help businesses and organizations comply with Pennsylvania's revenue admission laws.

Q: Who needs to use the Revenue Admission Checklist?

A: Any business or organization that sells admission tickets or charges a fee for entry to an event or facility in Pennsylvania needs to use the Revenue Admission Checklist.

Q: What are the requirements for using the Revenue Admission Checklist?

A: The requirements include obtaining the necessary licenses and permits, properly collecting and remitting sales tax, keeping accurate records, and complying with reporting obligations.

Q: What sales tax is applicable to admission tickets?

A: The sales tax applicable to admission tickets in Pennsylvania is 6%.

Q: What records do I need to keep for revenue admission?

A: You need to keep accurate records of ticket sales, including the number of tickets sold, ticket prices, and any applicable discounts or exemptions.

Q: What are the reporting obligations for revenue admission?

A: You are required to file returns and report your sales tax collections on a regular basis, typically on a monthly or quarterly basis.

Q: What are the consequences of non-compliance with revenue admission laws?

A: Non-compliance with revenue admission laws may result in penalties, fines, and potential legal action.

Form Details:

- Released on August 13, 2019;

- The latest edition currently provided by the Pennsylvania Department of Military and Veterans Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Military and Veterans Affairs.