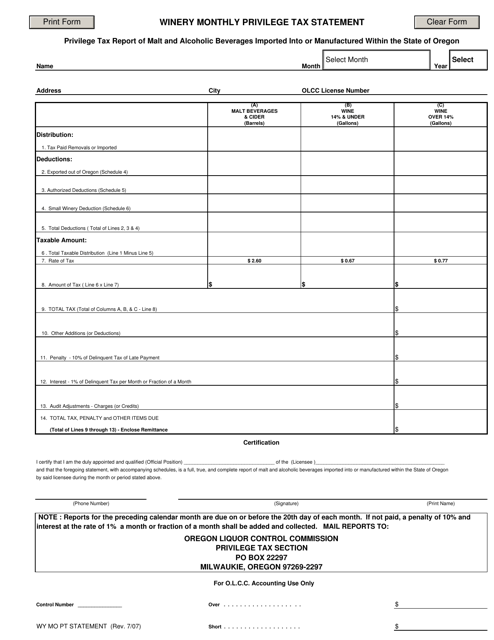

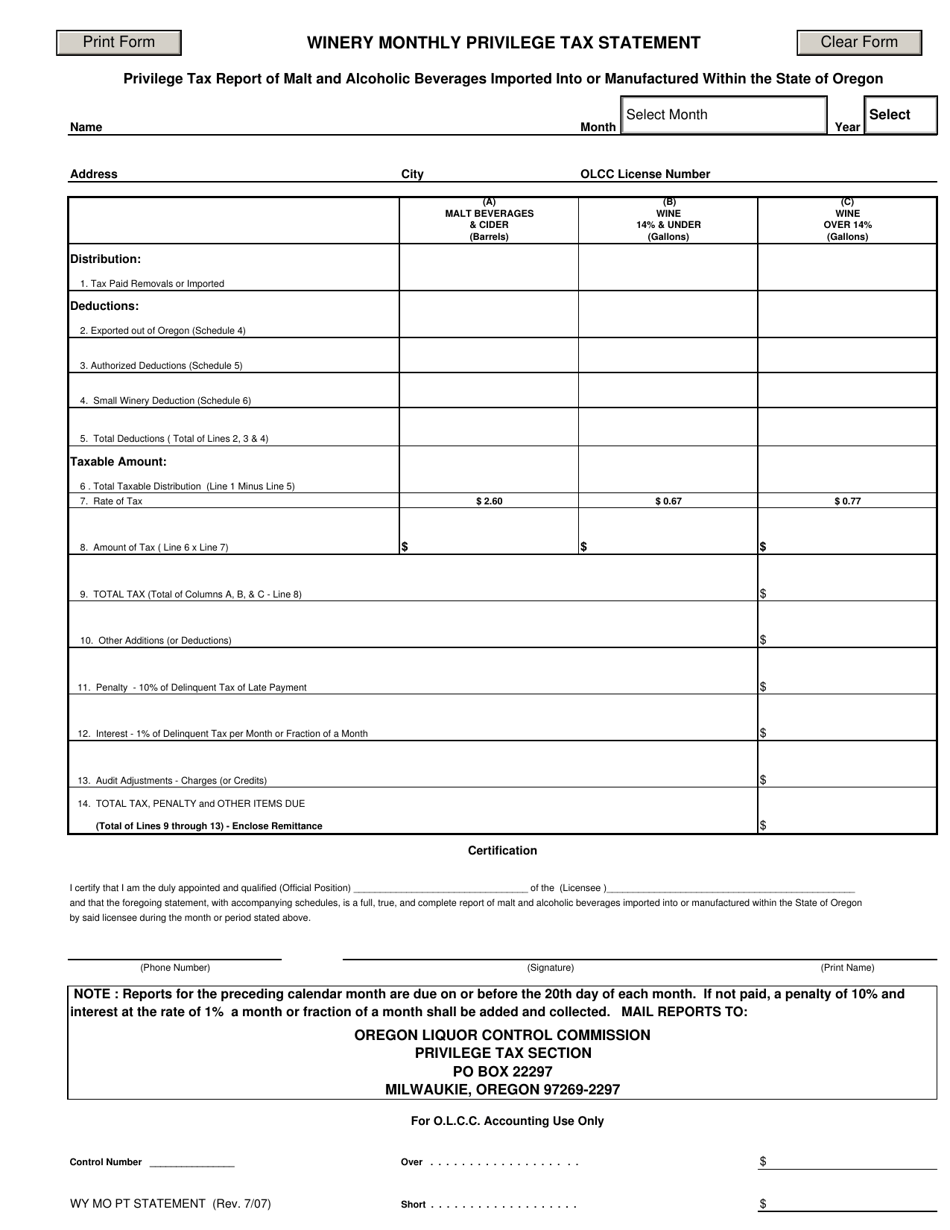

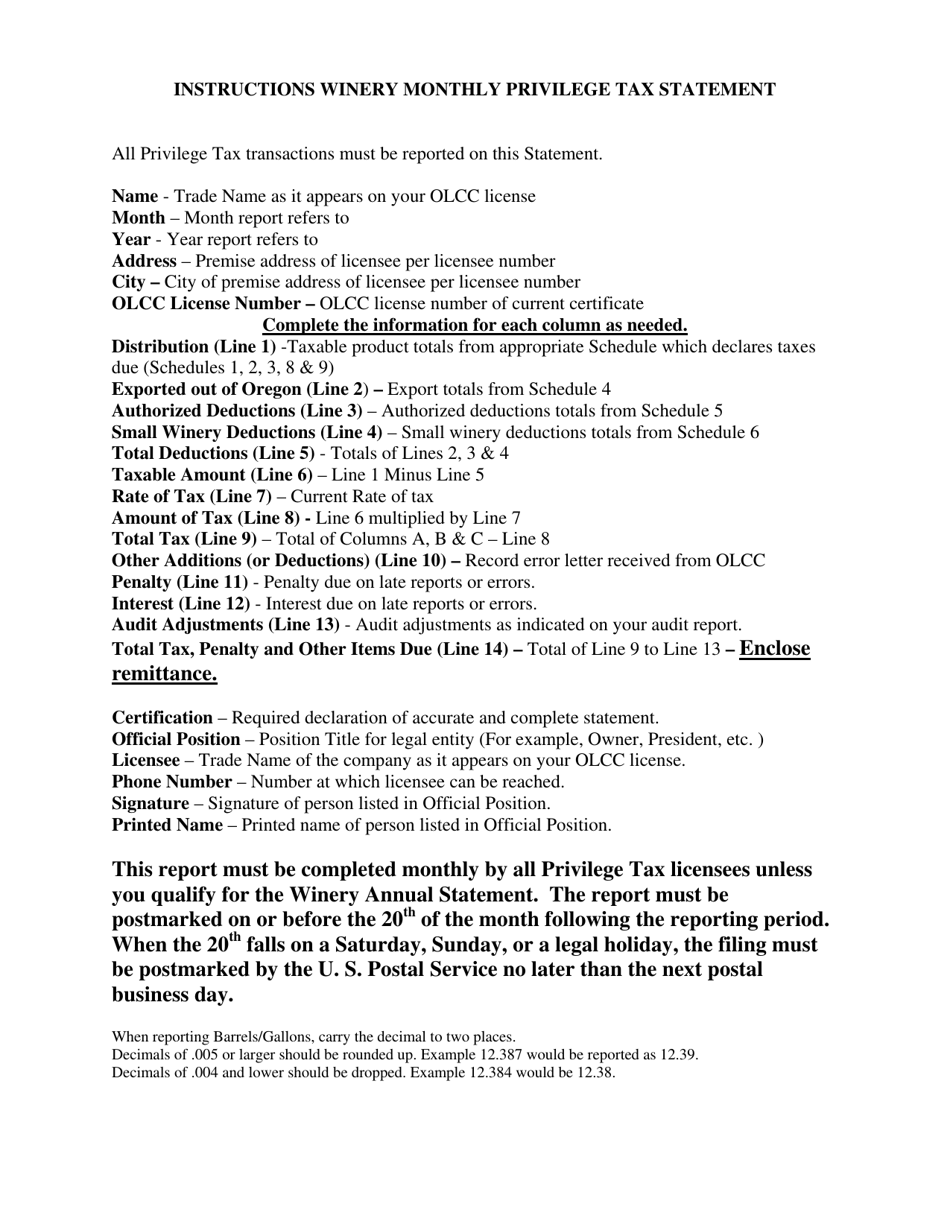

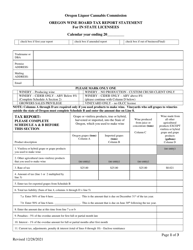

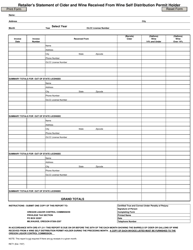

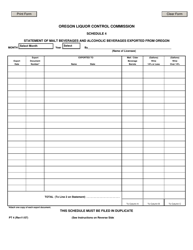

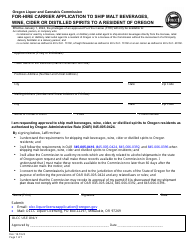

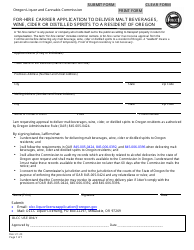

Winery Monthly Privilege Tax Statement - Oregon

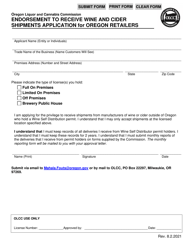

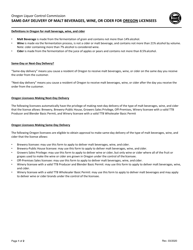

Winery Monthly Privilege Tax Statement is a legal document that was released by the Oregon Liquor and Cannabis Commission - a government authority operating within Oregon.

FAQ

Q: What is the Winery Monthly Privilege Tax Statement?

A: The Winery Monthly Privilege Tax Statement is a tax form that wineries in Oregon must submit on a monthly basis.

Q: Who needs to submit the Winery Monthly Privilege Tax Statement?

A: Wineries in Oregon need to submit the Winery Monthly Privilege Tax Statement.

Q: How often does the Winery Monthly Privilege Tax Statement need to be submitted?

A: The Winery Monthly Privilege Tax Statement needs to be submitted on a monthly basis.

Q: What is the purpose of the Winery Monthly Privilege Tax Statement?

A: The purpose of the Winery Monthly Privilege Tax Statement is to report and pay the privilege tax on wine sales in Oregon.

Q: Is the Winery Monthly Privilege Tax Statement specific to Oregon?

A: Yes, the Winery Monthly Privilege Tax Statement is specific to wineries in Oregon.

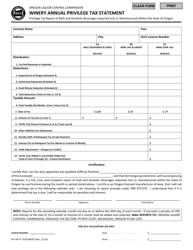

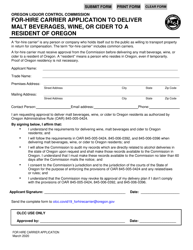

Form Details:

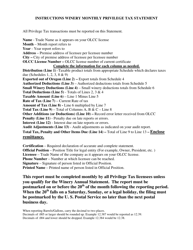

- Released on July 1, 2007;

- The latest edition currently provided by the Oregon Liquor and Cannabis Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oregon Liquor and Cannabis Commission.