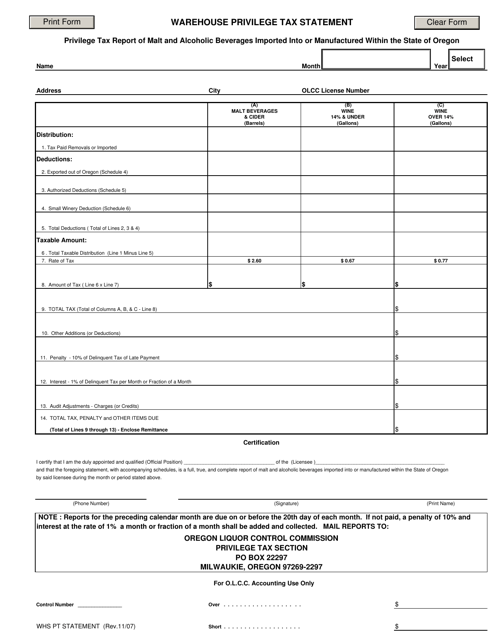

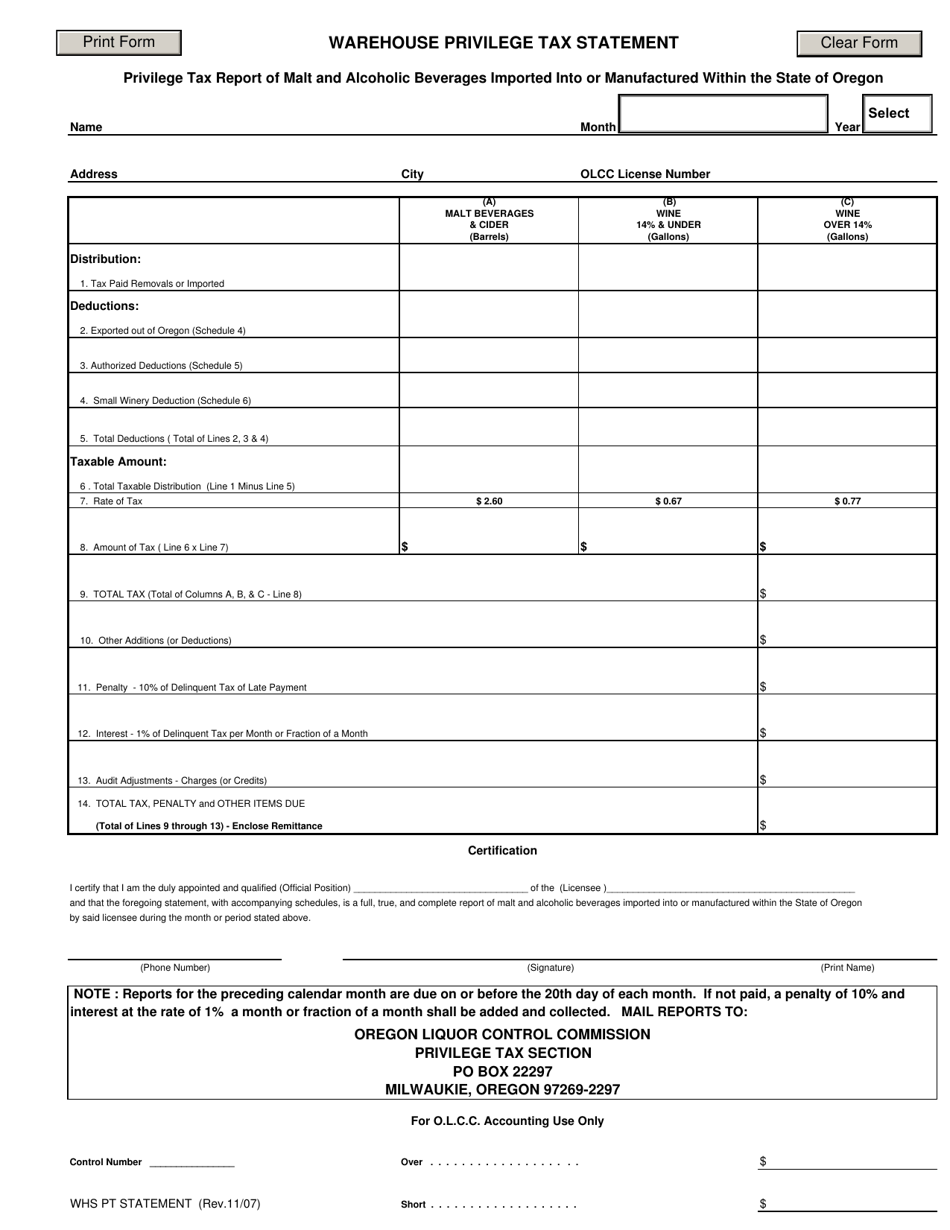

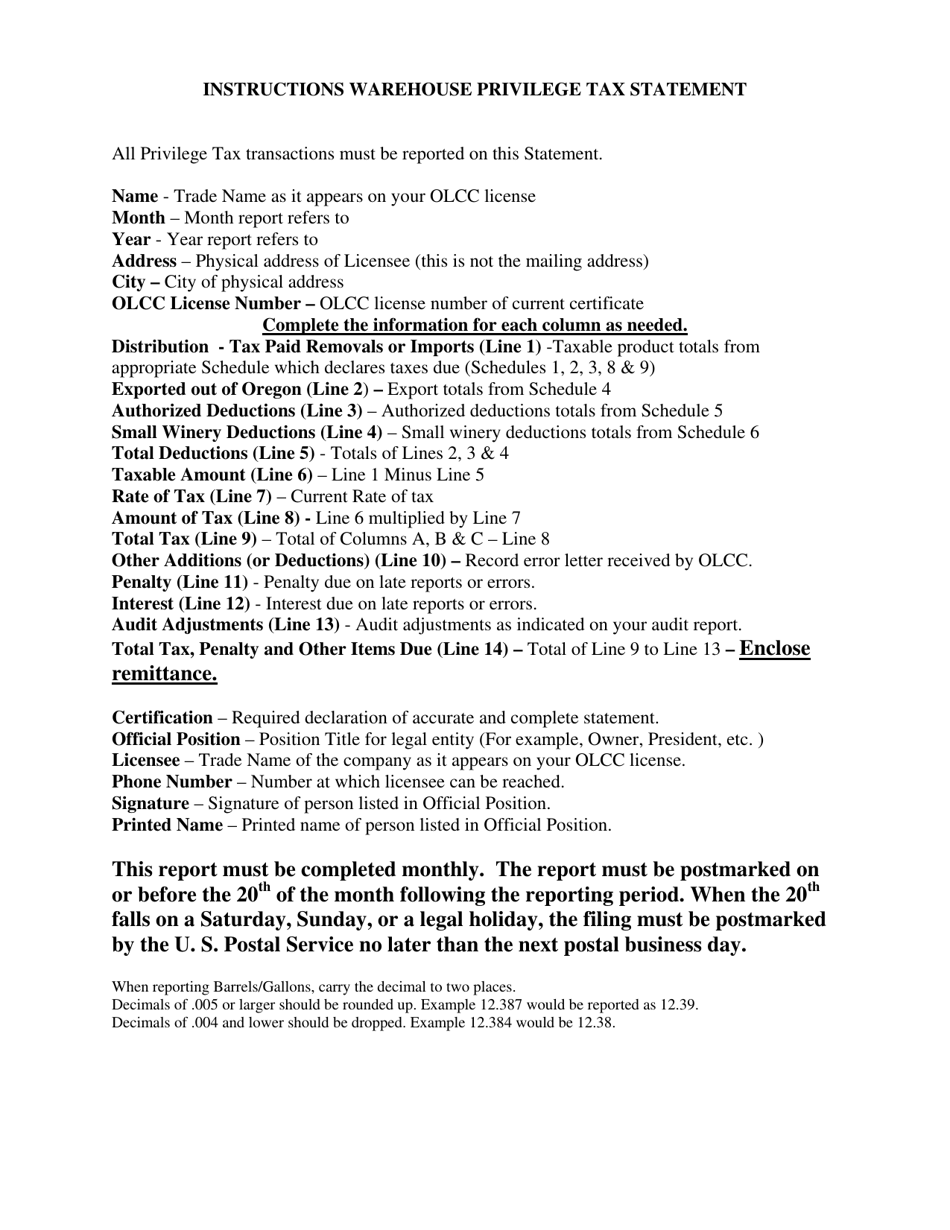

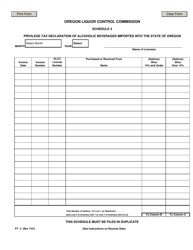

Warehouse Privilege Tax Statement - Oregon

Warehouse Privilege Tax Statement is a legal document that was released by the Oregon Liquor and Cannabis Commission - a government authority operating within Oregon.

FAQ

Q: What is the Warehouse Privilege Tax Statement?

A: The Warehouse Privilege Tax Statement is a tax statement issued by the state of Oregon for warehouse operators.

Q: Who needs to file the Warehouse Privilege Tax Statement?

A: Warehouse operators in Oregon are required to file the Warehouse Privilege Tax Statement.

Q: How often is the Warehouse Privilege Tax Statement filed?

A: The Warehouse Privilege Tax Statement is filed annually.

Q: What is the purpose of the Warehouse Privilege Tax?

A: The Warehouse Privilege Tax is collected to support various state programs and services.

Q: How is the Warehouse Privilege Tax calculated?

A: The Warehouse Privilege Tax is calculated based on the total value of goods stored in the warehouse.

Q: When is the deadline to file the Warehouse Privilege Tax Statement?

A: The deadline to file the Warehouse Privilege Tax Statement is typically April 1st of each year.

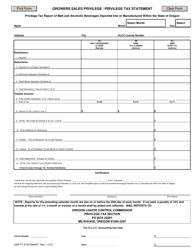

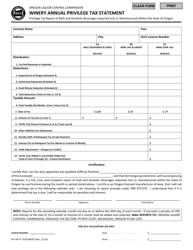

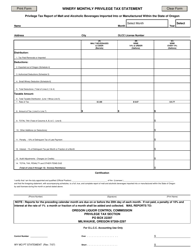

Form Details:

- Released on November 1, 2007;

- The latest edition currently provided by the Oregon Liquor and Cannabis Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oregon Liquor and Cannabis Commission.