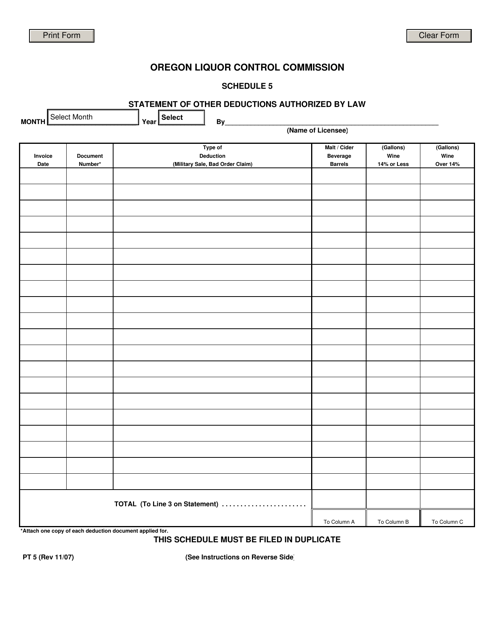

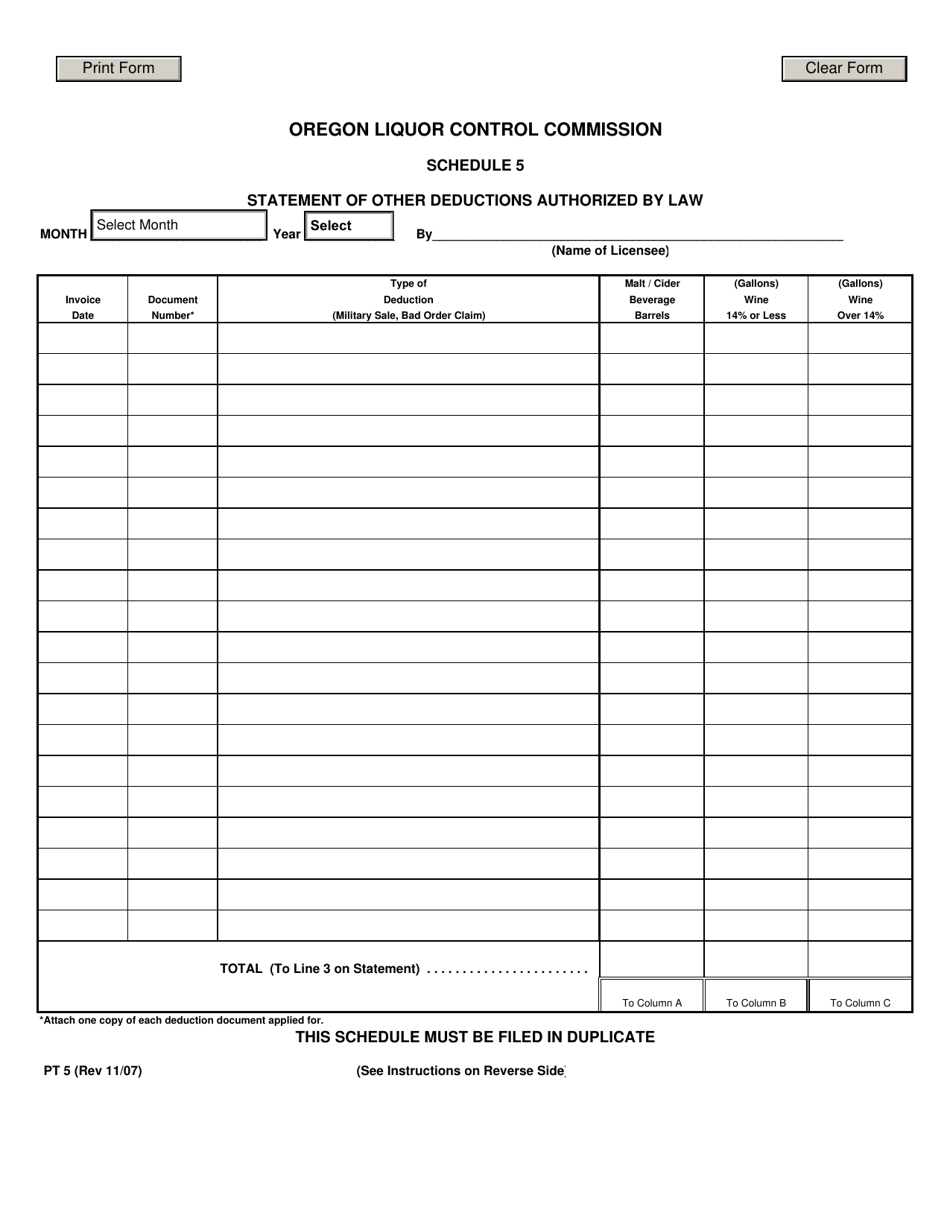

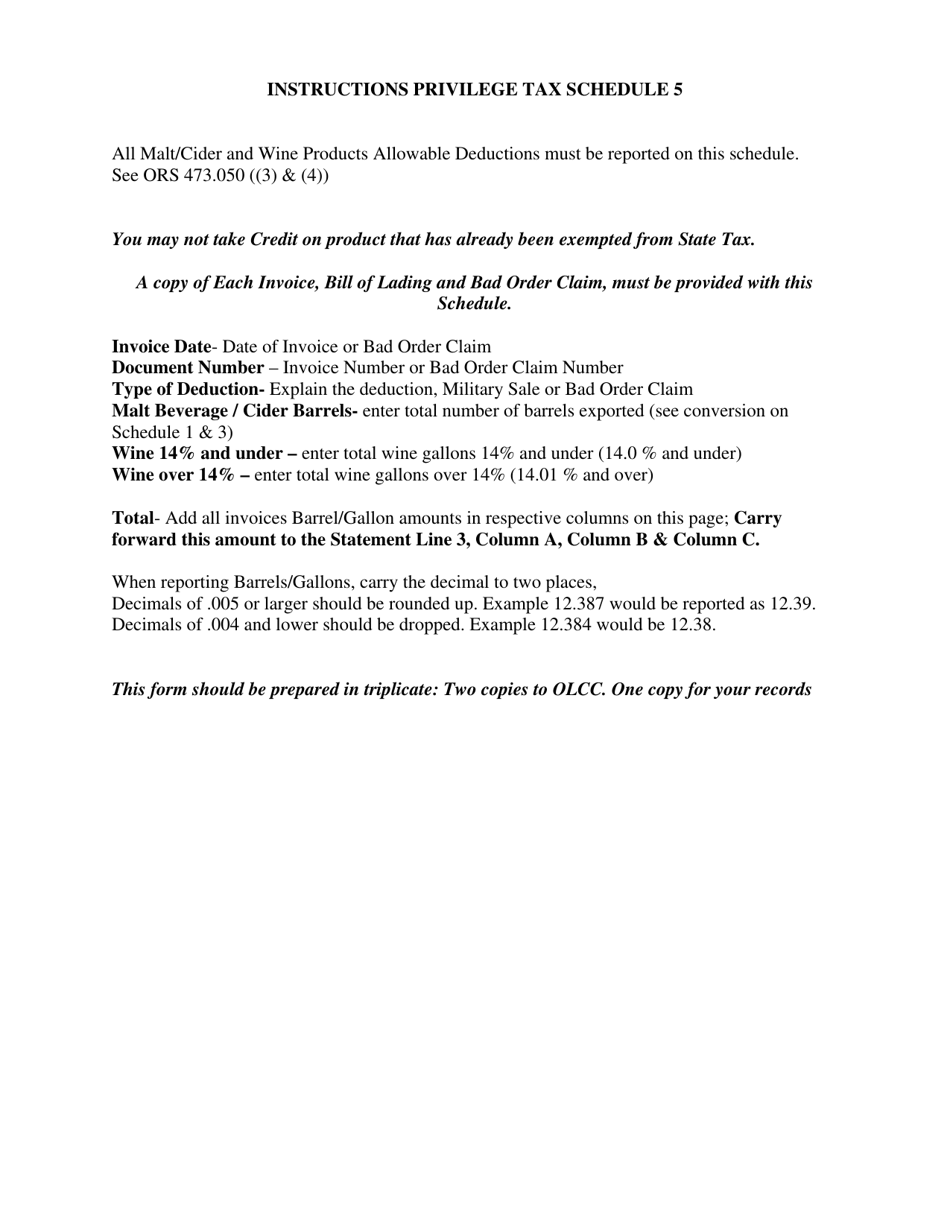

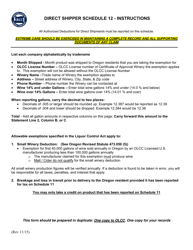

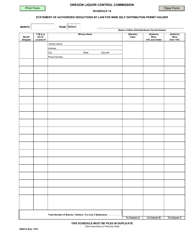

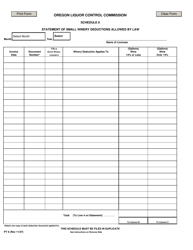

Form PT5 Schedule 5 Statement of Other Deductions Authorized by Law - Oregon

What Is Form PT5 Schedule 5?

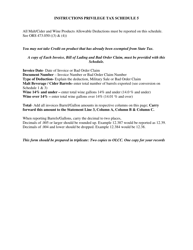

This is a legal form that was released by the Oregon Liquor and Cannabis Commission - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT5 Schedule 5?

A: Form PT5 Schedule 5 is a statement of other deductions authorized by law in Oregon.

Q: What is the purpose of Form PT5 Schedule 5?

A: The purpose of Form PT5 Schedule 5 is to report deductions authorized by law in Oregon.

Q: Who needs to file Form PT5 Schedule 5?

A: Anyone who qualifies for deductions authorized by law in Oregon needs to file Form PT5 Schedule 5.

Q: What deductions can be reported on Form PT5 Schedule 5?

A: Form PT5 Schedule 5 is used to report deductions authorized by law in Oregon.

Q: When is the deadline to file Form PT5 Schedule 5?

A: The deadline to file Form PT5 Schedule 5 is usually the same as the deadline for filing your Oregon state tax return.

Q: Are there any fees associated with filing Form PT5 Schedule 5?

A: There are no fees associated with filing Form PT5 Schedule 5.

Q: Can I file Form PT5 Schedule 5 electronically?

A: Yes, you can file Form PT5 Schedule 5 electronically if you are e-filing your Oregon state tax return.

Q: Can I claim deductions authorized by law in Oregon without filing Form PT5 Schedule 5?

A: No, you must file Form PT5 Schedule 5 to claim deductions authorized by law in Oregon.

Form Details:

- Released on November 1, 2007;

- The latest edition provided by the Oregon Liquor and Cannabis Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PT5 Schedule 5 by clicking the link below or browse more documents and templates provided by the Oregon Liquor and Cannabis Commission.