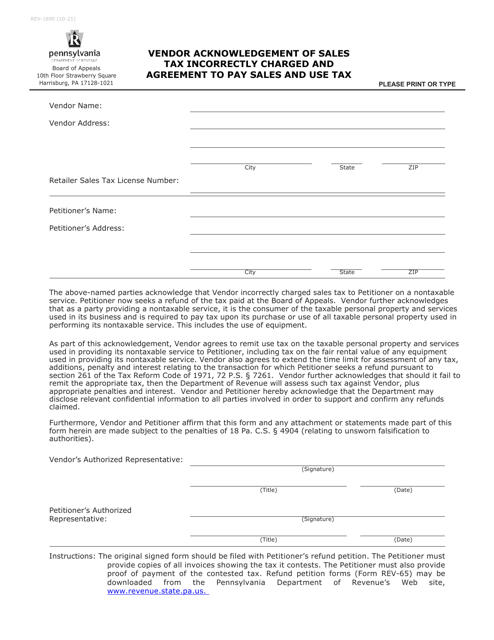

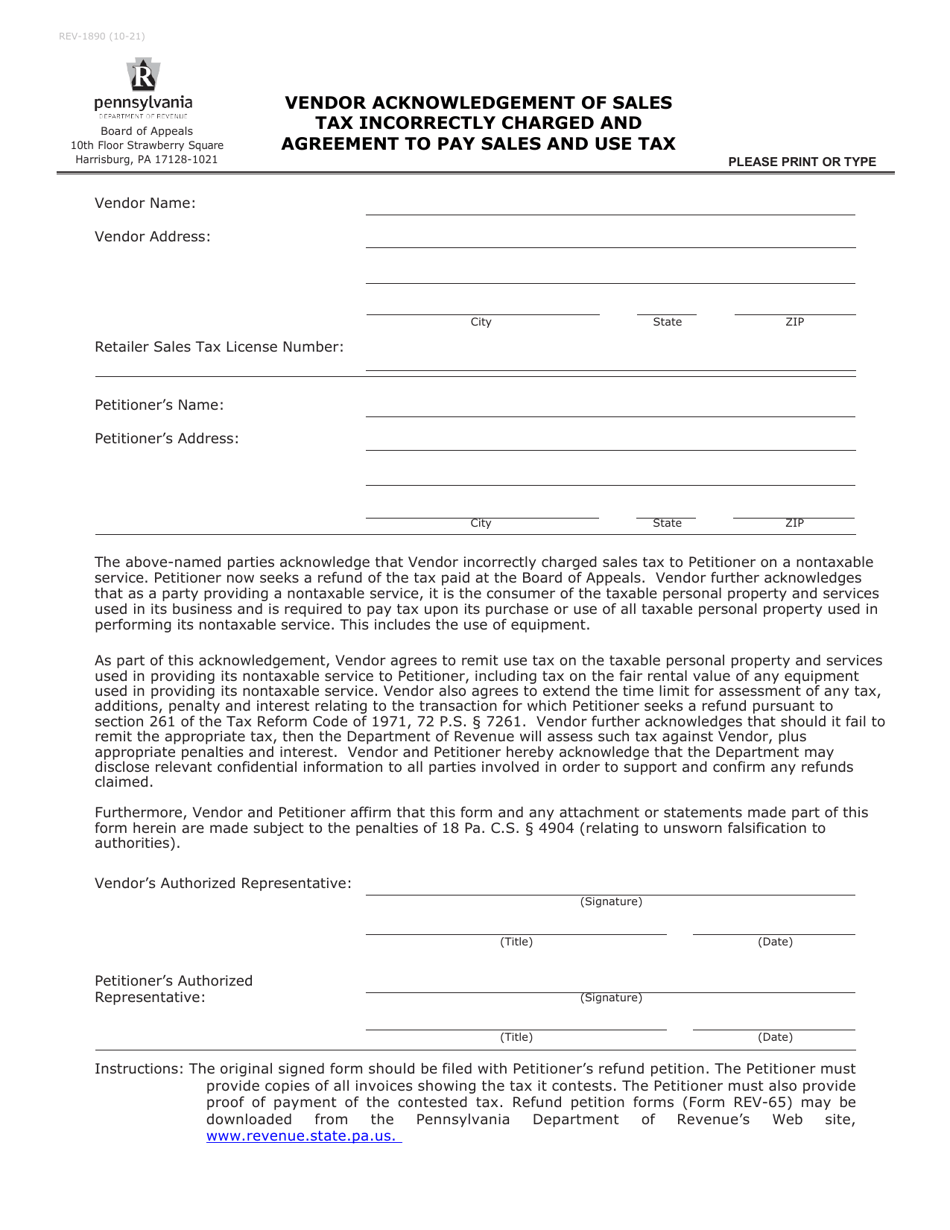

Form REV-1890 Vendor Acknowledgement of Sales Tax Incorrectly Charged and Agreement to Pay Sales and Use Tax - Pennsylvania

What Is Form REV-1890?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1890?

A: Form REV-1890 is the Vendor Acknowledgement of Sales Tax Incorrectly Charged and Agreement to Pay Sales and Use Tax form.

Q: What is the purpose of Form REV-1890?

A: The purpose of Form REV-1890 is for vendors to acknowledge their error in charging sales tax incorrectly and agree to pay the sales and use tax to the state of Pennsylvania.

Q: Who needs to fill out Form REV-1890?

A: Vendors who have incorrectly charged sales tax and need to rectify the situation by paying the sales and use tax in Pennsylvania need to fill out Form REV-1890.

Q: Are there any fees for filing Form REV-1890?

A: No, there are no fees for filing Form REV-1890.

Q: What should I do after filling out Form REV-1890?

A: After completing Form REV-1890, you should submit it to the Pennsylvania Department of Revenue along with the required payment of the sales and use tax.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV-1890 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.