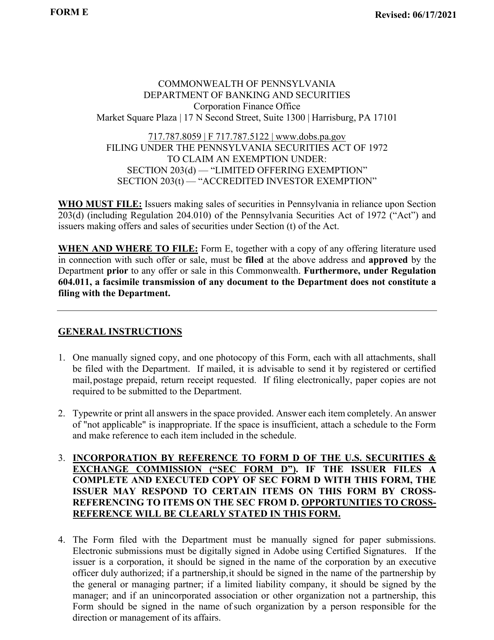

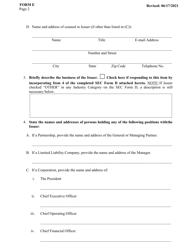

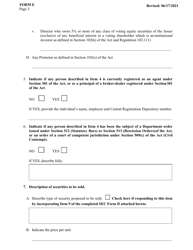

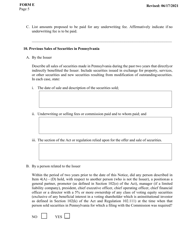

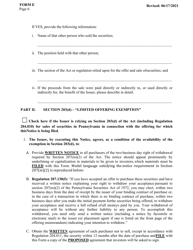

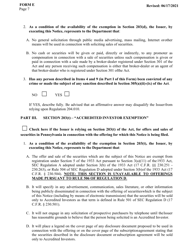

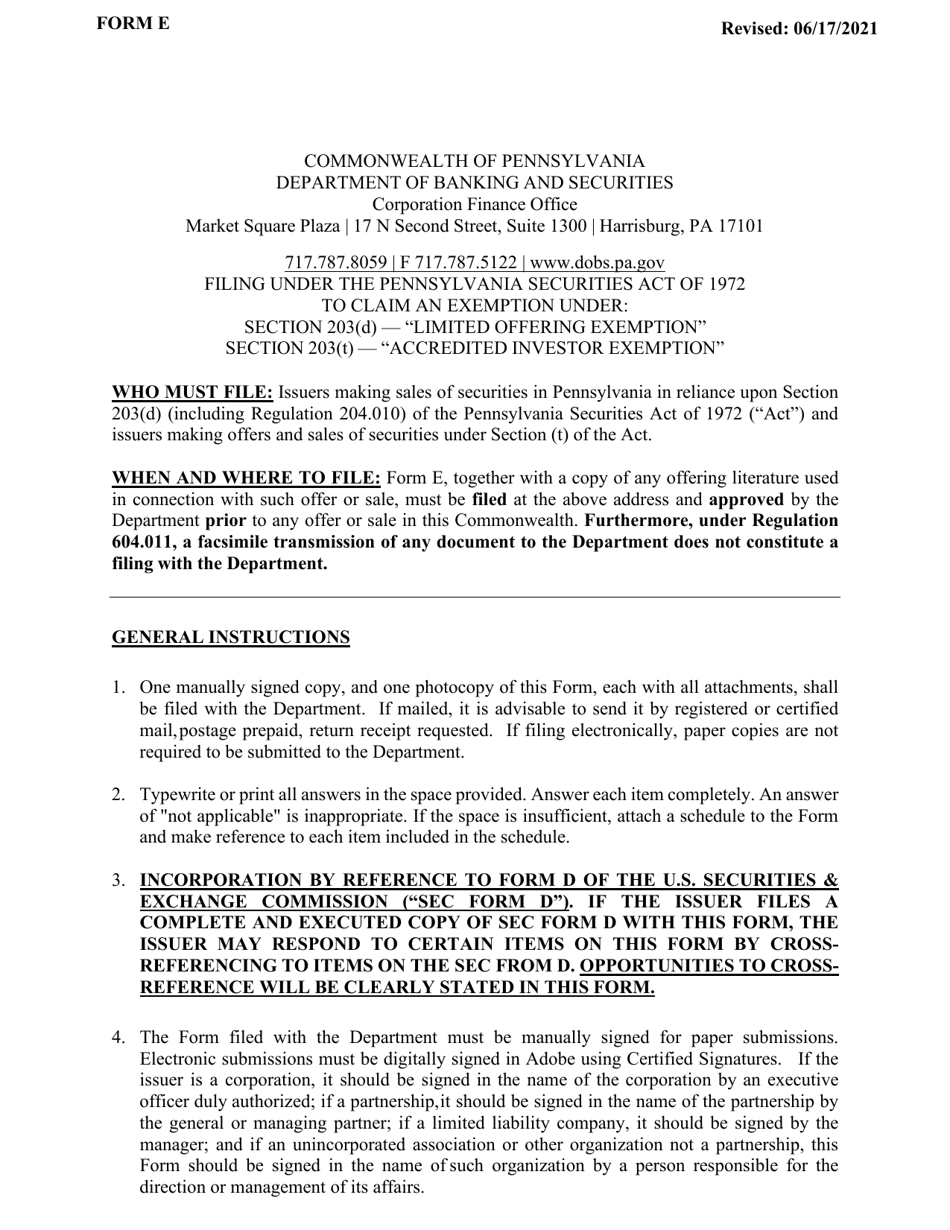

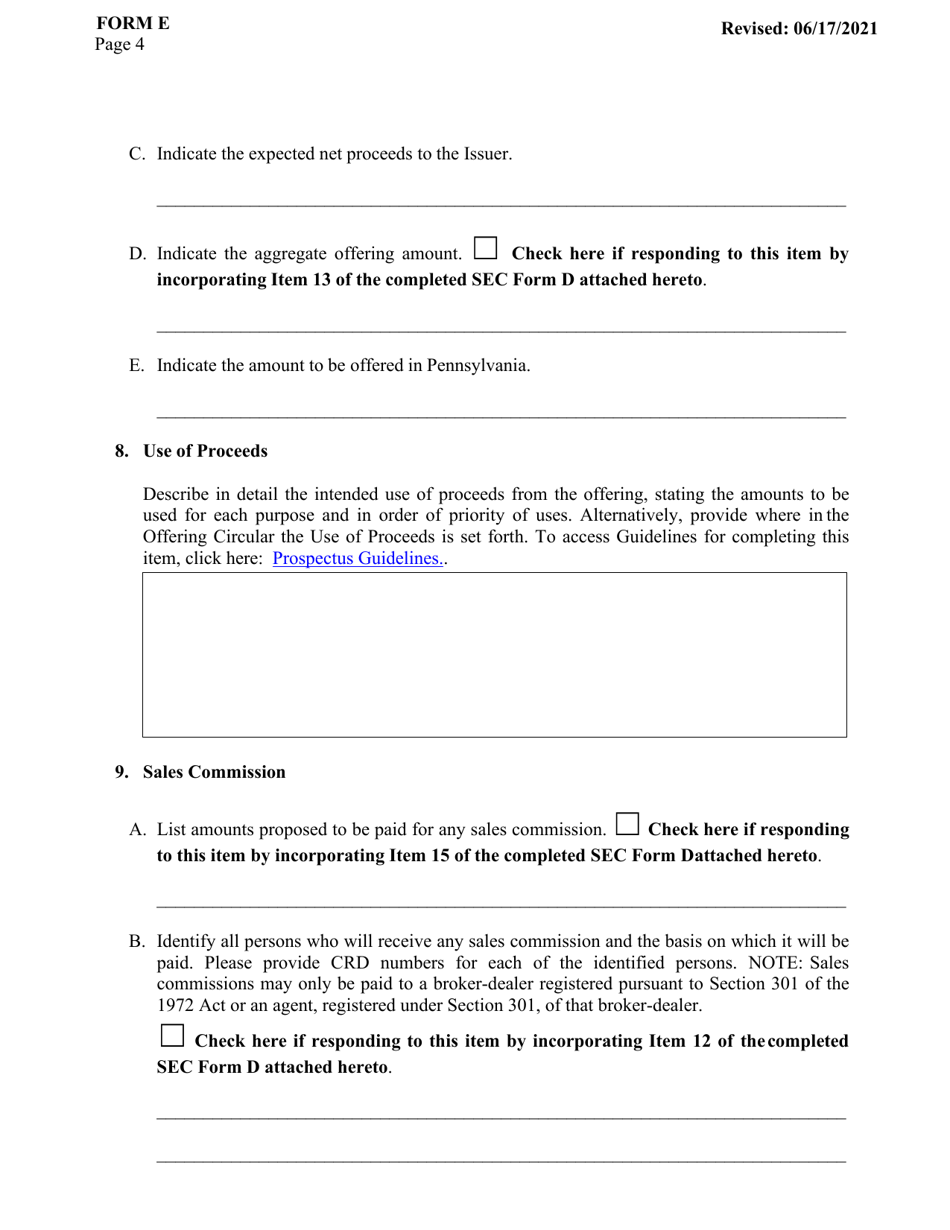

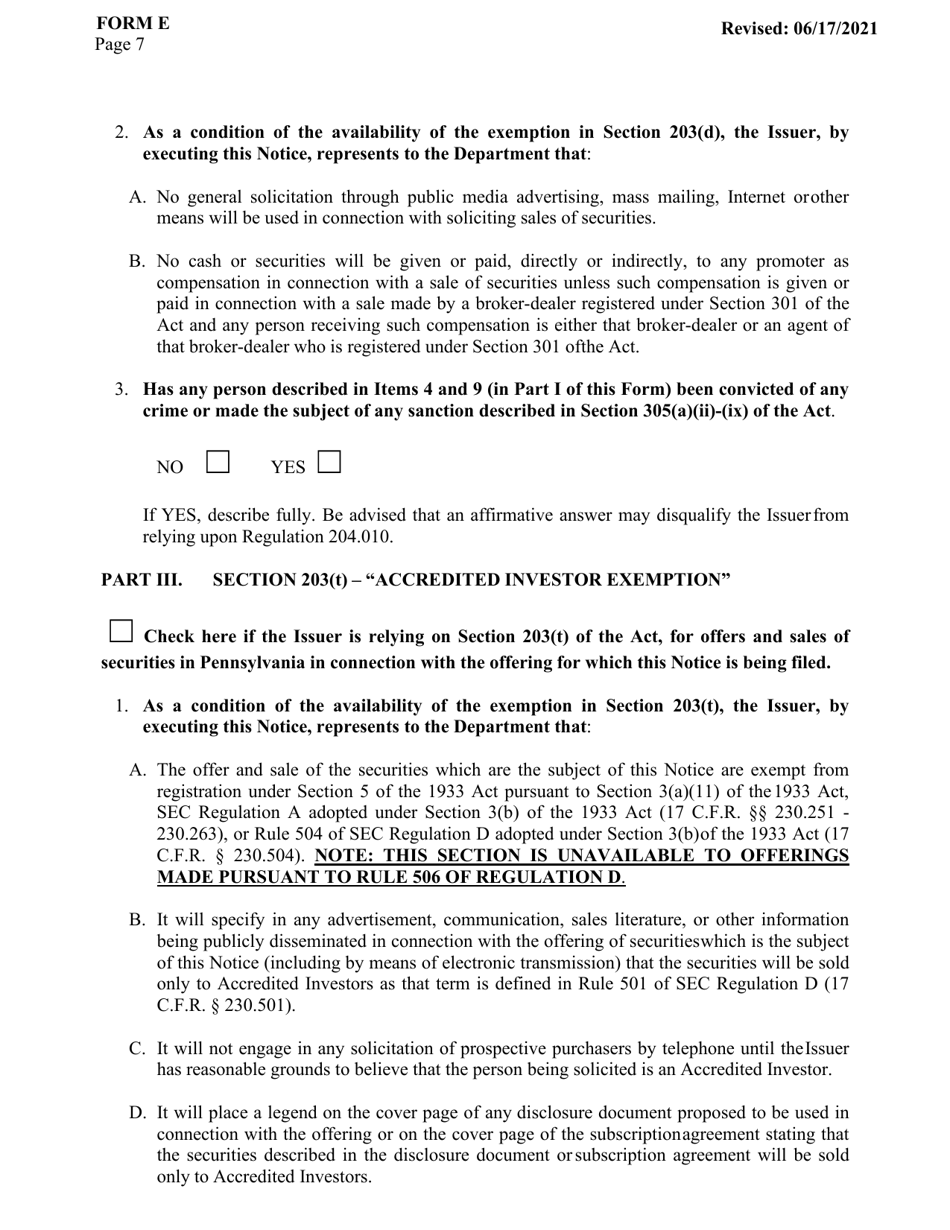

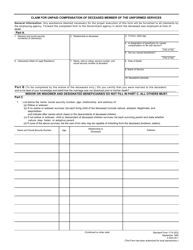

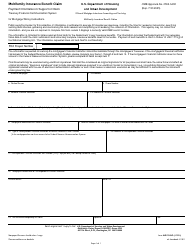

Form E Claim for Exemption Under Sections 203(D), 203(T) - Pennsylvania

What Is Form E?

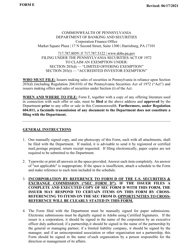

This is a legal form that was released by the Pennsylvania Department of Banking and Securities - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E?

A: Form E is a claim for exemption under Sections 203(D) and 203(T) in Pennsylvania.

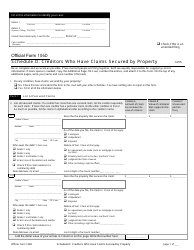

Q: What are Sections 203(D) and 203(T)?

A: Sections 203(D) and 203(T) refer to specific exemptions in the Pennsylvania tax code.

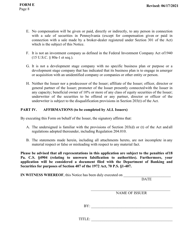

Q: Who can file Form E in Pennsylvania?

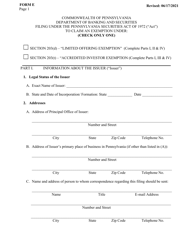

A: Any individual or organization that qualifies for an exemption under Sections 203(D) or 203(T) can file Form E in Pennsylvania.

Q: What is the purpose of filing Form E?

A: The purpose of filing Form E is to claim a tax exemption under Sections 203(D) or 203(T) in Pennsylvania.

Q: When should I file Form E?

A: You should file Form E according to the guidelines provided by the Pennsylvania Department of Revenue.

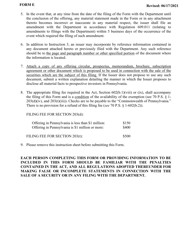

Q: Are there any fees associated with filing Form E?

A: There may be fees associated with filing Form E, depending on the specific exemption being claimed. You should consult the Pennsylvania Department of Revenue for more information.

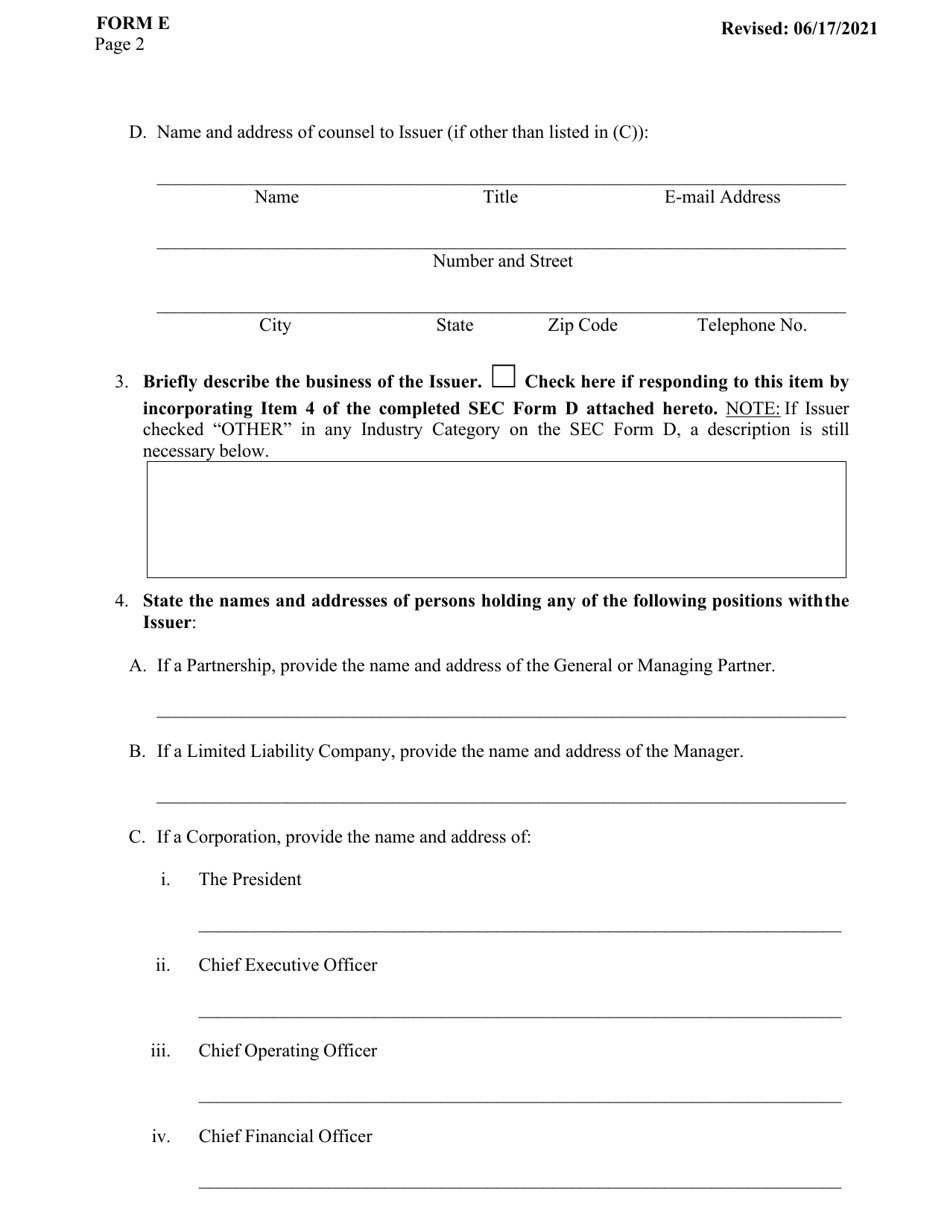

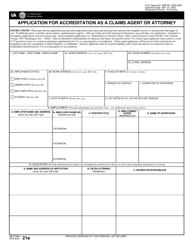

Q: What documents do I need to file Form E?

A: The specific documents required to file Form E may vary depending on the exemption being claimed. You should review the instructions provided with the form or consult the Pennsylvania Department of Revenue for more information.

Q: What happens after I file Form E?

A: After you file Form E, it will be reviewed by the Pennsylvania Department of Revenue. If approved, you will receive the tax exemption you claimed.

Q: What should I do if my Form E is denied?

A: If your Form E is denied, you should review the reasons for the denial provided by the Pennsylvania Department of Revenue and take any necessary corrective action.

Form Details:

- Released on June 17, 2021;

- The latest edition provided by the Pennsylvania Department of Banking and Securities;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form E by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Banking and Securities.