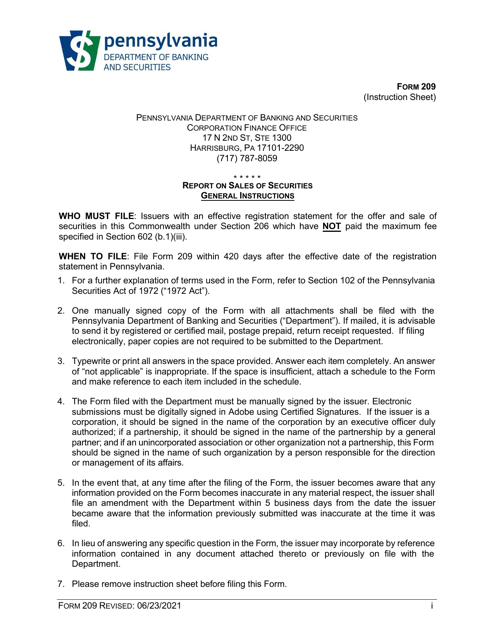

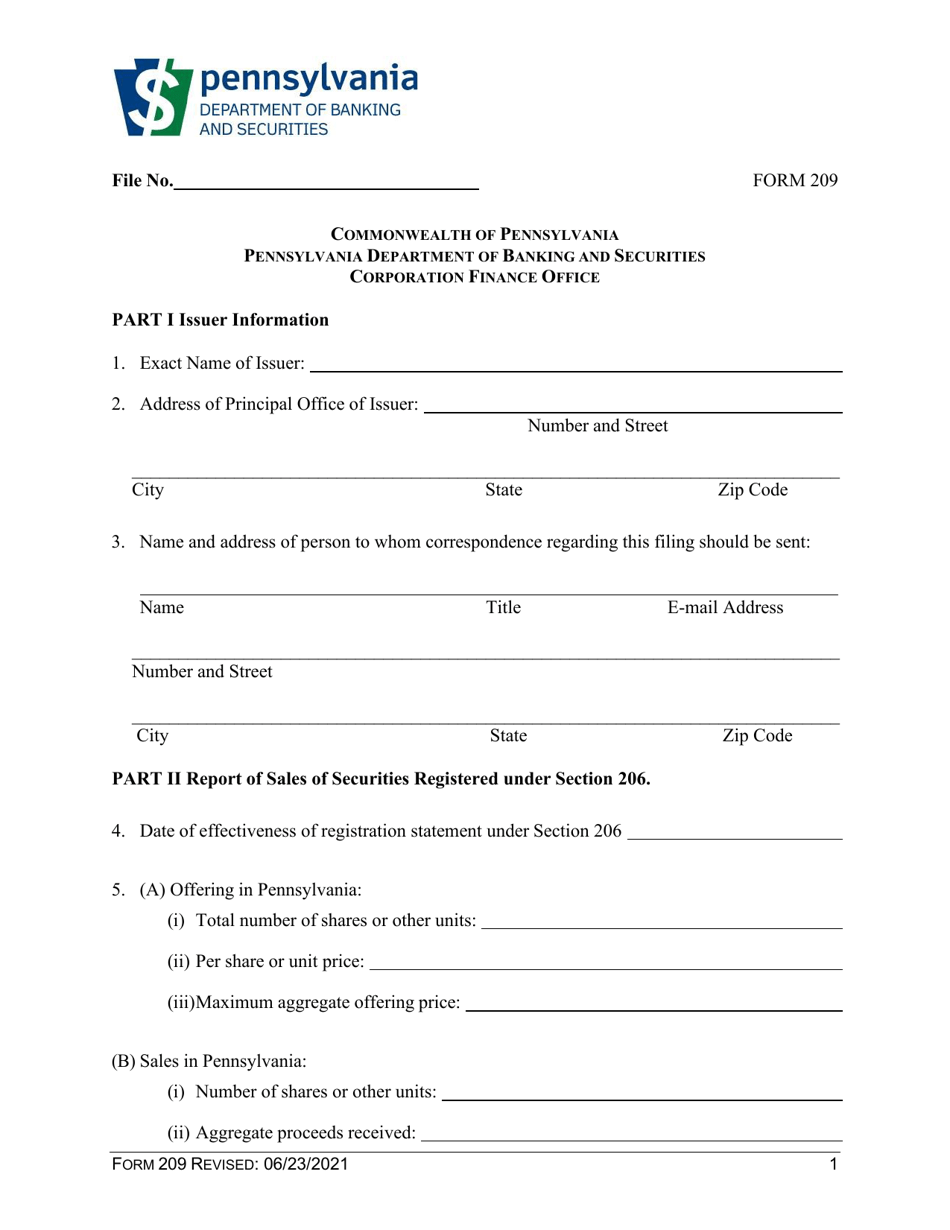

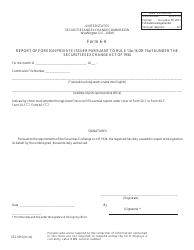

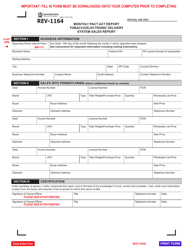

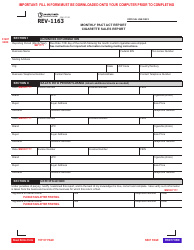

Form 209 Report on Sales of Securities - Pennsylvania

What Is Form 209?

This is a legal form that was released by the Pennsylvania Department of Banking and Securities - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

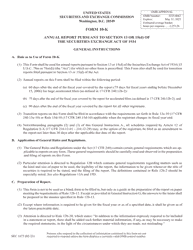

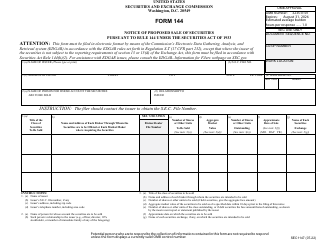

Q: What is a Form 209 report?

A: Form 209 is a report on sales of securities.

Q: Who is required to file a Form 209 report?

A: Any person or entity that engages in the sale of securities in Pennsylvania may be required to file a Form 209 report.

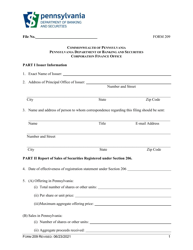

Q: What information is required on a Form 209 report?

A: A Form 209 report requires detailed information about the securities being sold, including the types of securities, the total number sold, and the total sales price.

Q: When is a Form 209 report due?

A: Form 209 reports are due within 30 days after the close of each calendar quarter.

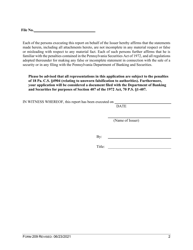

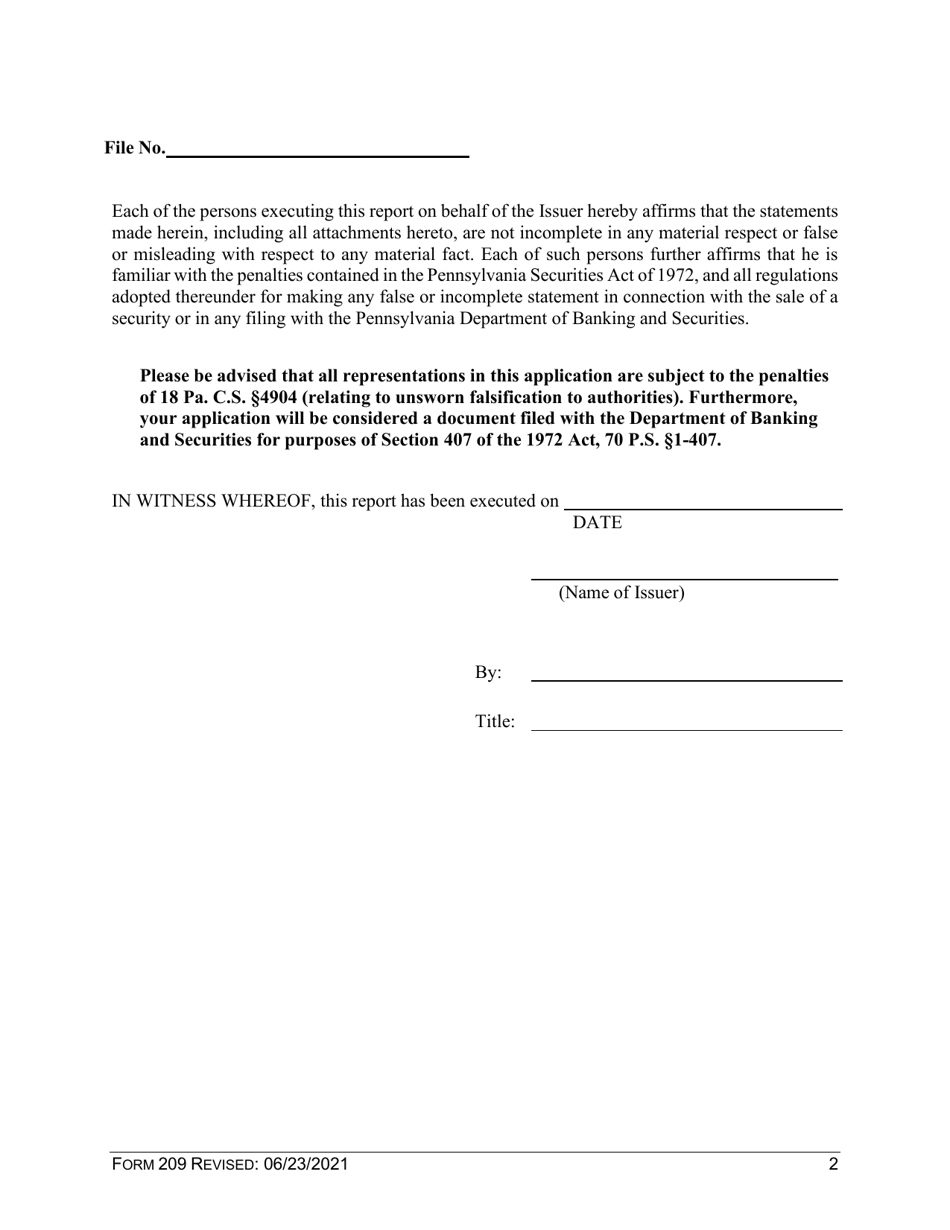

Q: What are the penalties for not filing a Form 209 report?

A: Failure to file a Form 209 report can result in civil and criminal penalties, including fines and imprisonment.

Form Details:

- Released on June 23, 2021;

- The latest edition provided by the Pennsylvania Department of Banking and Securities;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 209 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Banking and Securities.