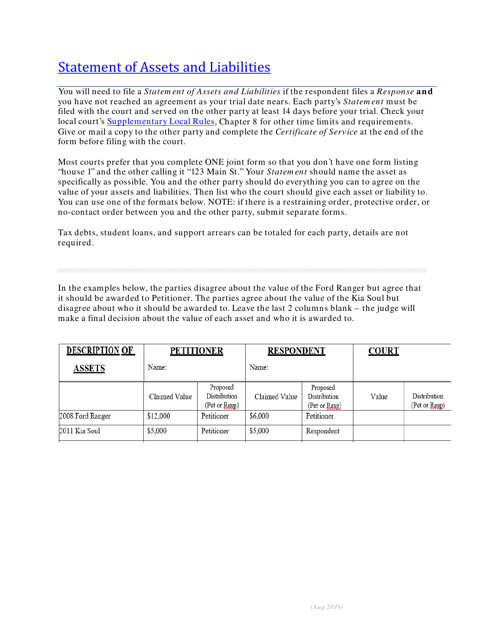

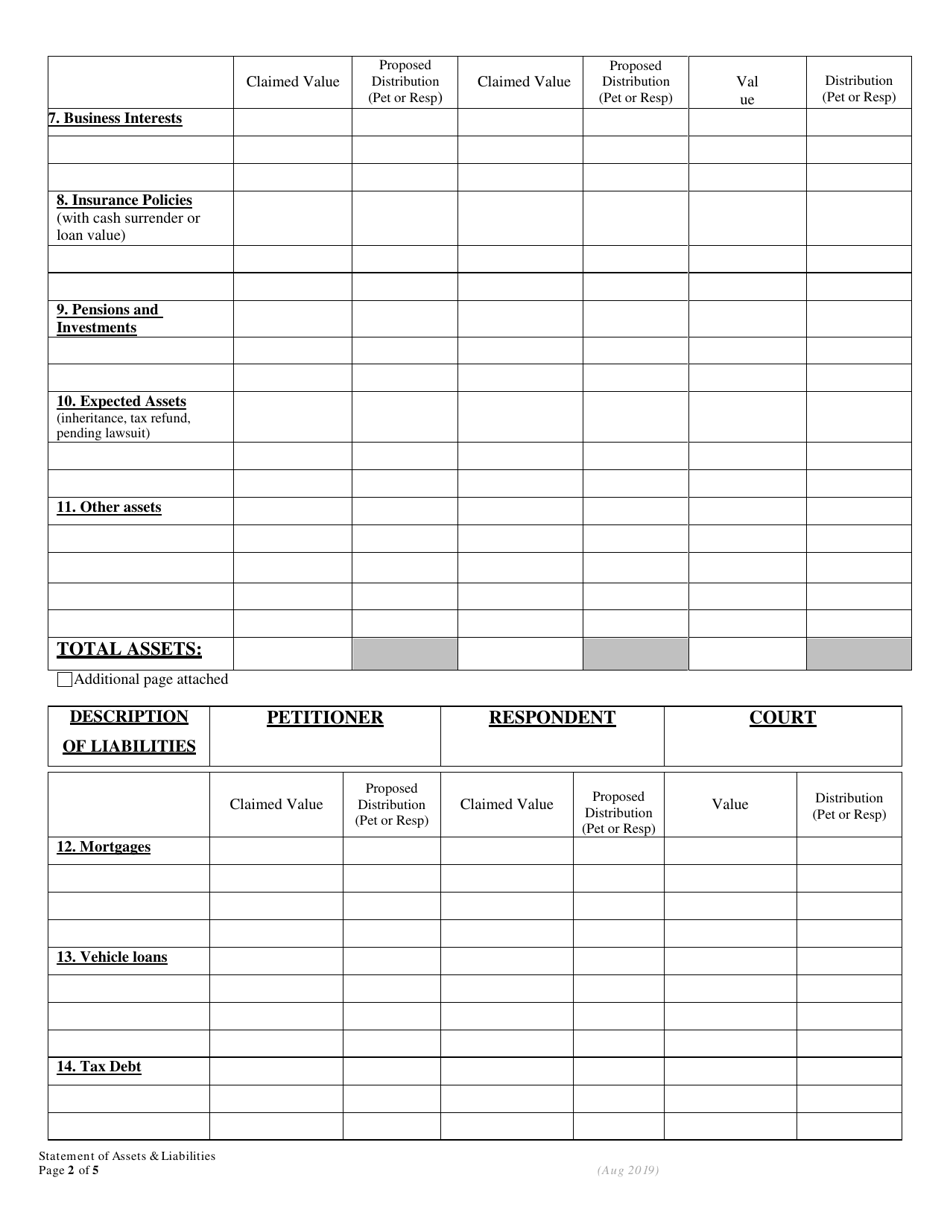

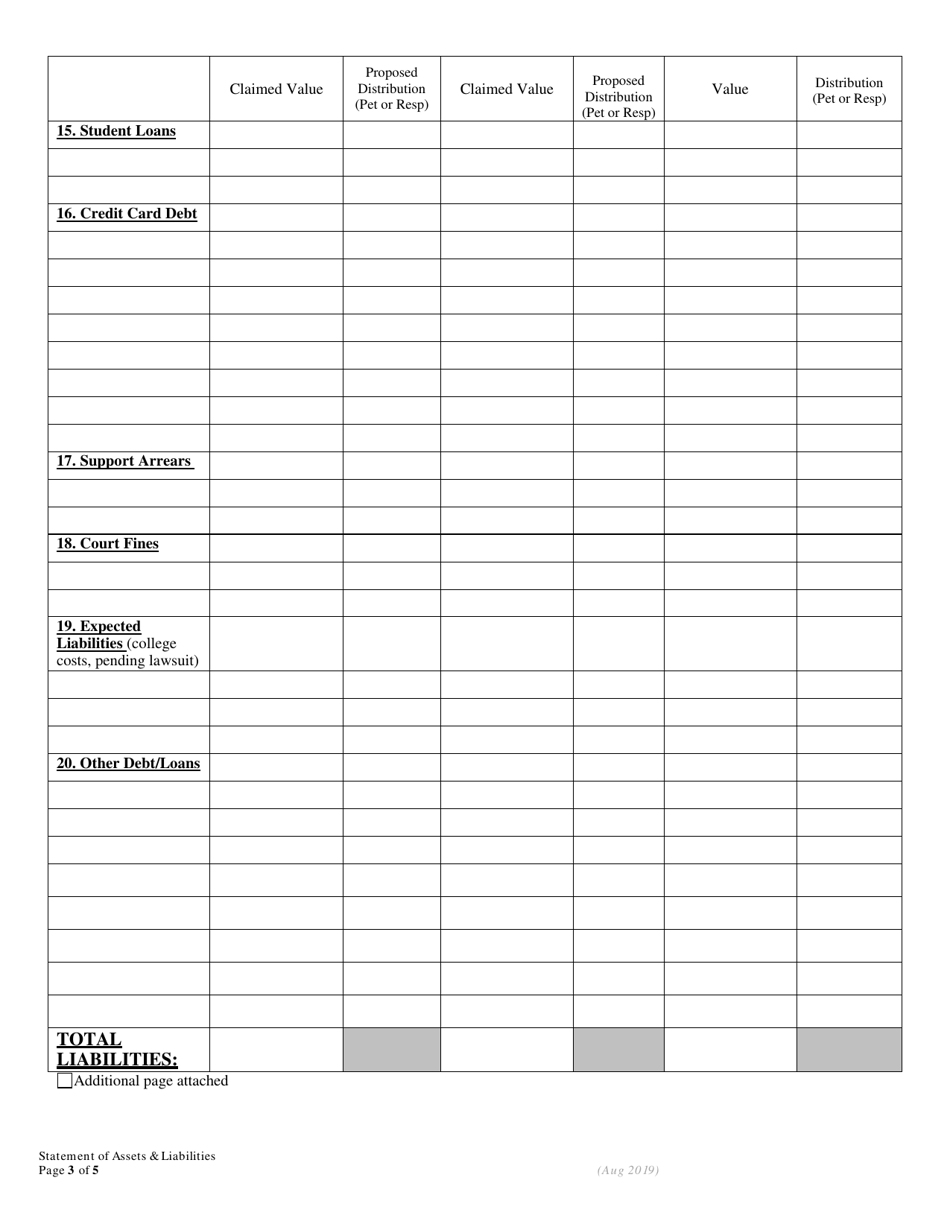

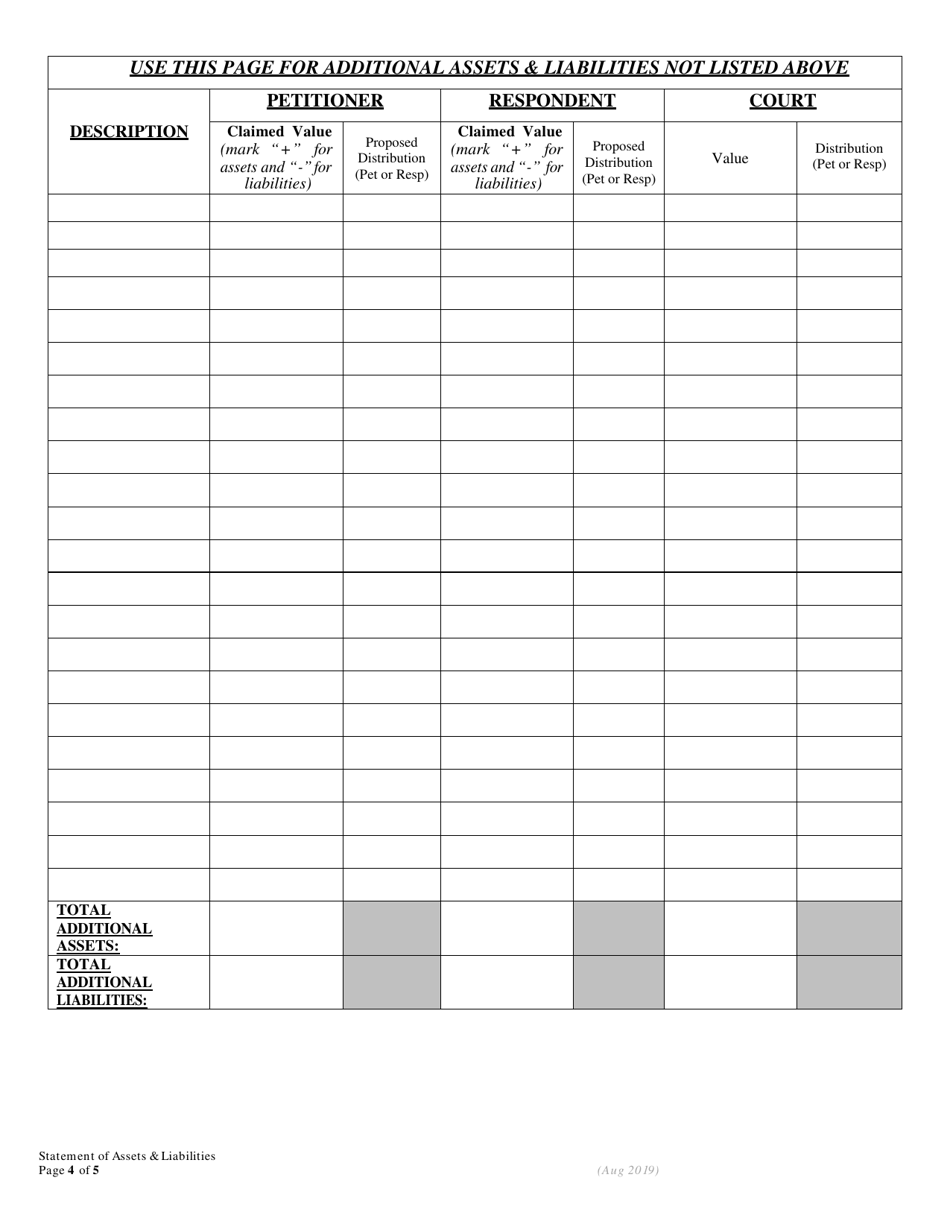

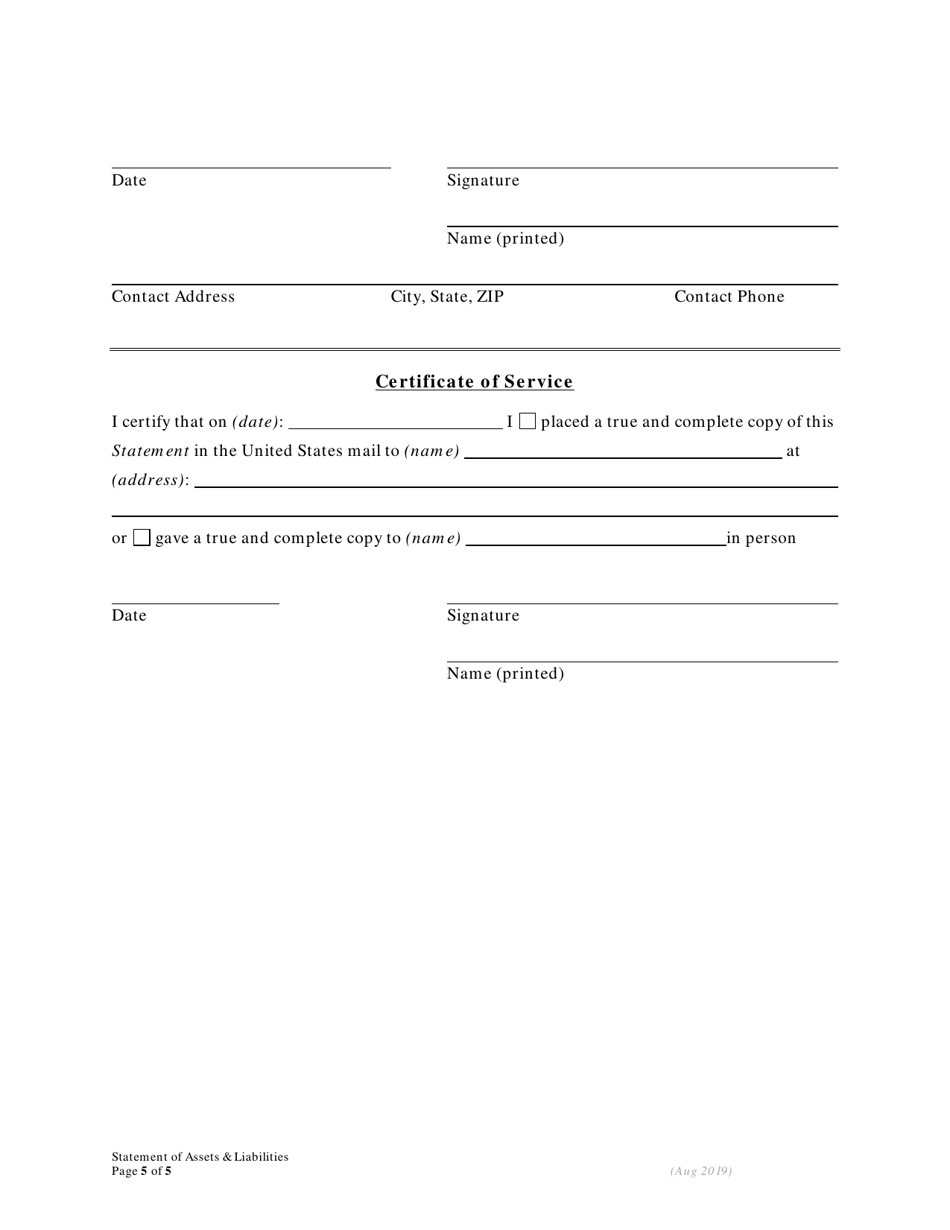

Statement of Assets and Liabilities - Oregon

Statement of Assets and Liabilities is a legal document that was released by the Oregon Judicial Department - a government authority operating within Oregon.

FAQ

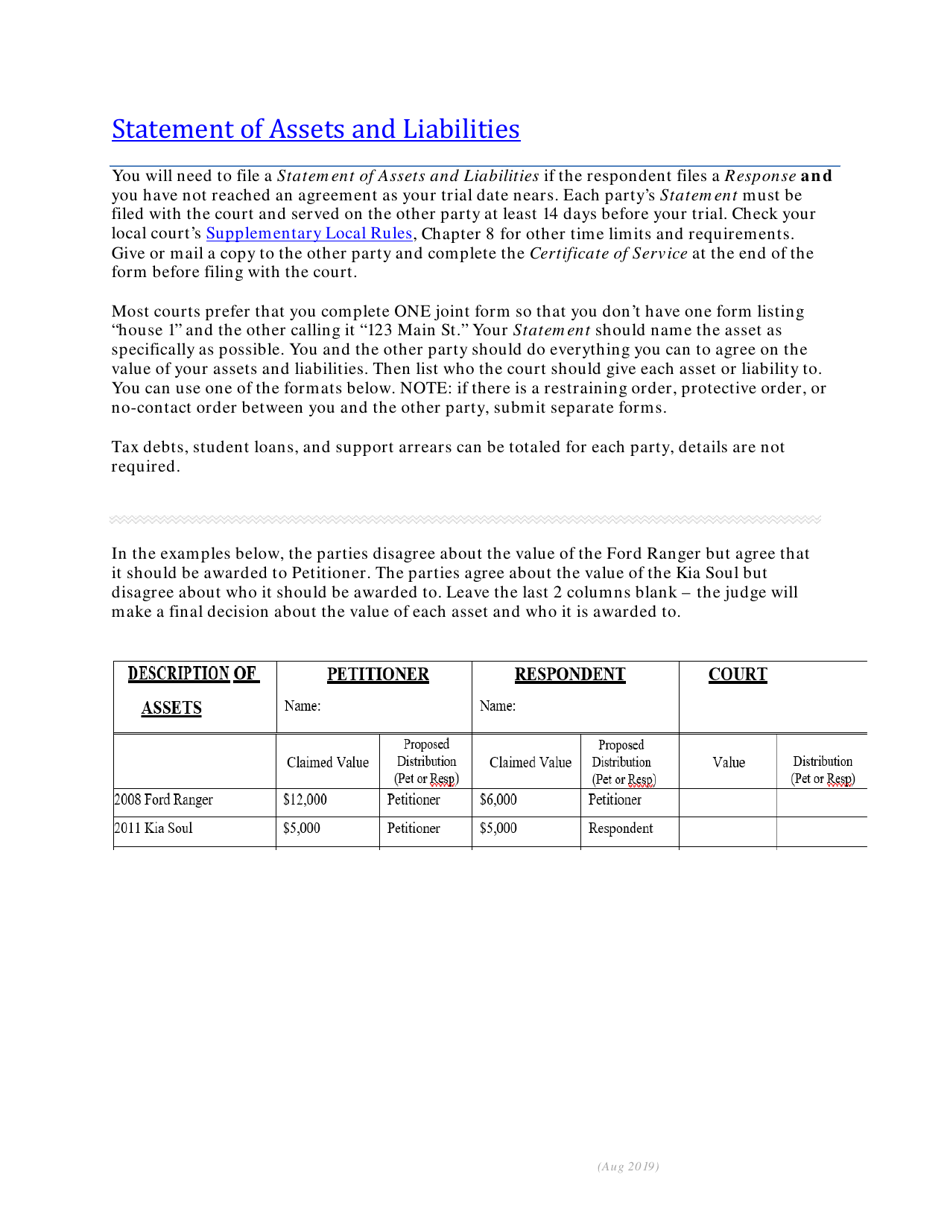

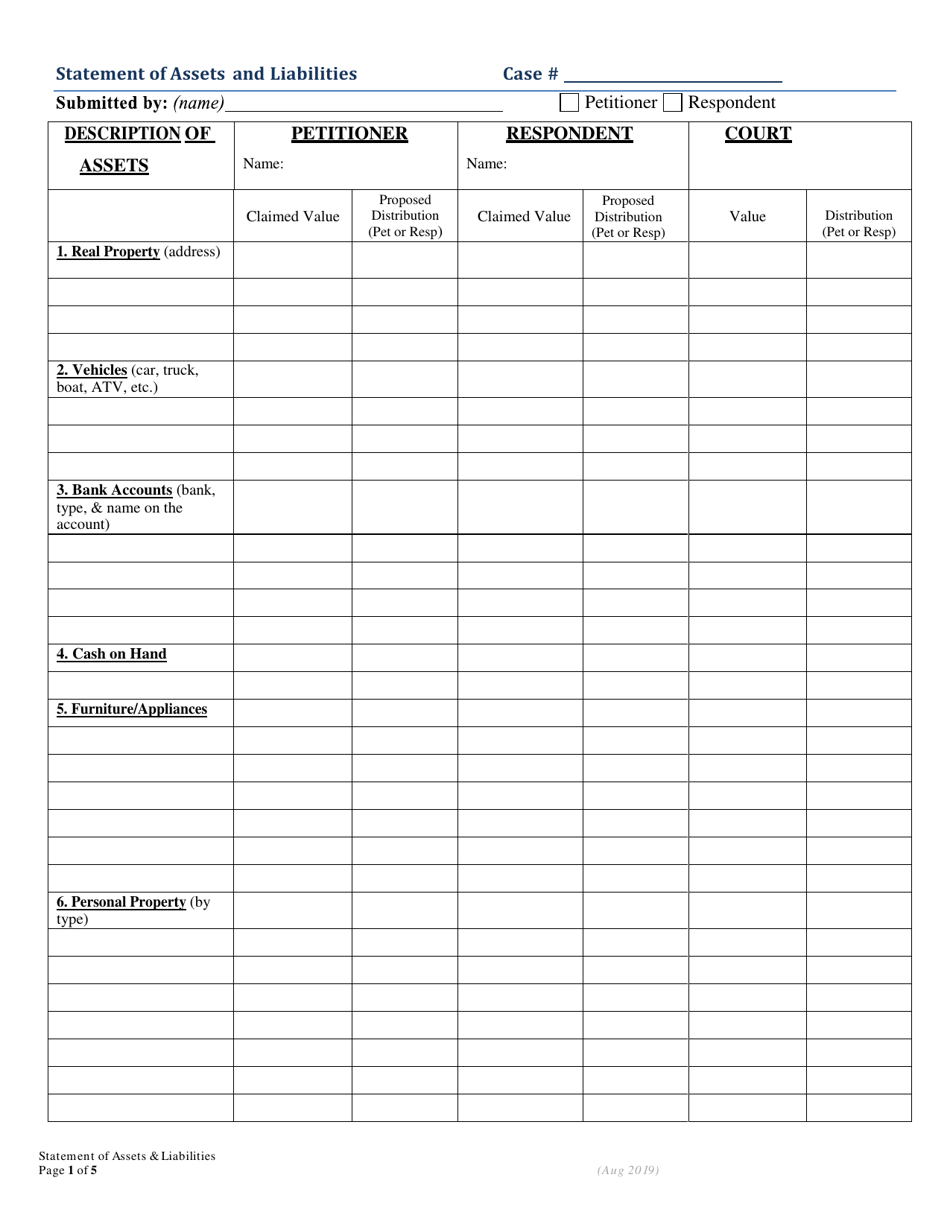

Q: What is a Statement of Assets and Liabilities?

A: A Statement of Assets and Liabilities is a financial document that lists an individual's or organization's assets (what they own) and liabilities (what they owe).

Q: Why is a Statement of Assets and Liabilities important?

A: A Statement of Assets and Liabilities is important because it provides a snapshot of an individual's or organization's financial situation at a specific point in time. It can be used to assess net worth, track financial progress or identify areas of financial concern.

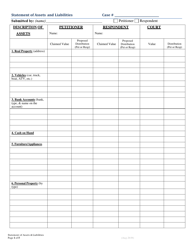

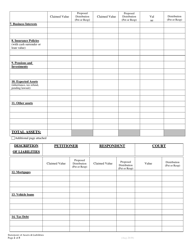

Q: What are assets?

A: Assets are things of value that an individual or organization owns, such as cash, investments, real estate, vehicles, or personal belongings.

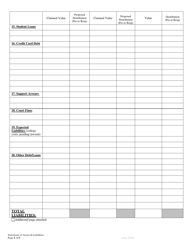

Q: What are liabilities?

A: Liabilities are debts or obligations that an individual or organization owes, such as mortgages, loans, credit card debt, or outstanding bills.

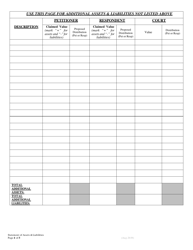

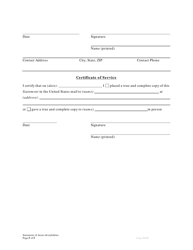

Q: How do I create a Statement of Assets and Liabilities?

A: To create a Statement of Assets and Liabilities, you need to make a comprehensive list of all your assets and their estimated values, as well as a list of all your liabilities and their outstanding balances.

Q: Do I need professional help to create a Statement of Assets and Liabilities?

A: While you can create a Statement of Assets and Liabilities on your own, it may be helpful to seek professional help from a financial advisor or accountant, especially if you have complex financial assets or liabilities.

Q: How often should I update my Statement of Assets and Liabilities?

A: It is recommended to update your Statement of Assets and Liabilities annually or whenever there are significant changes in your financial circumstances.

Q: What can I learn from a Statement of Assets and Liabilities?

A: A Statement of Assets and Liabilities can provide insight into your overall financial health, help you assess your net worth, identify areas of improvement, or modify your financial goals.

Q: Can a Statement of Assets and Liabilities be used for loan applications?

A: Yes, a Statement of Assets and Liabilities is often required when applying for loans or credit, as it provides lenders with information about your financial standing.

Form Details:

- Released on August 1, 2019;

- The latest edition currently provided by the Oregon Judicial Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Oregon Judicial Department.