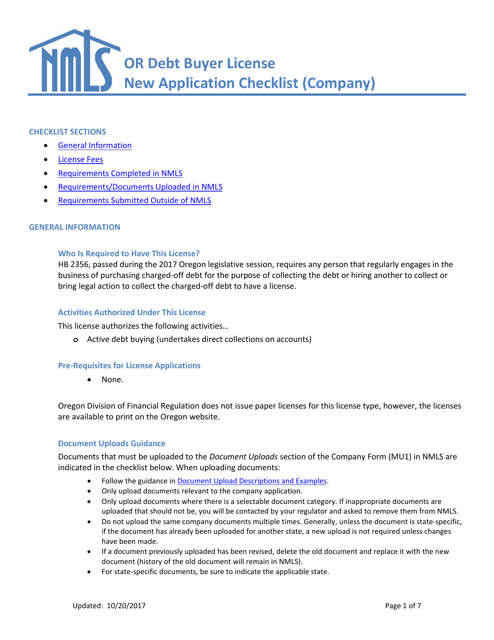

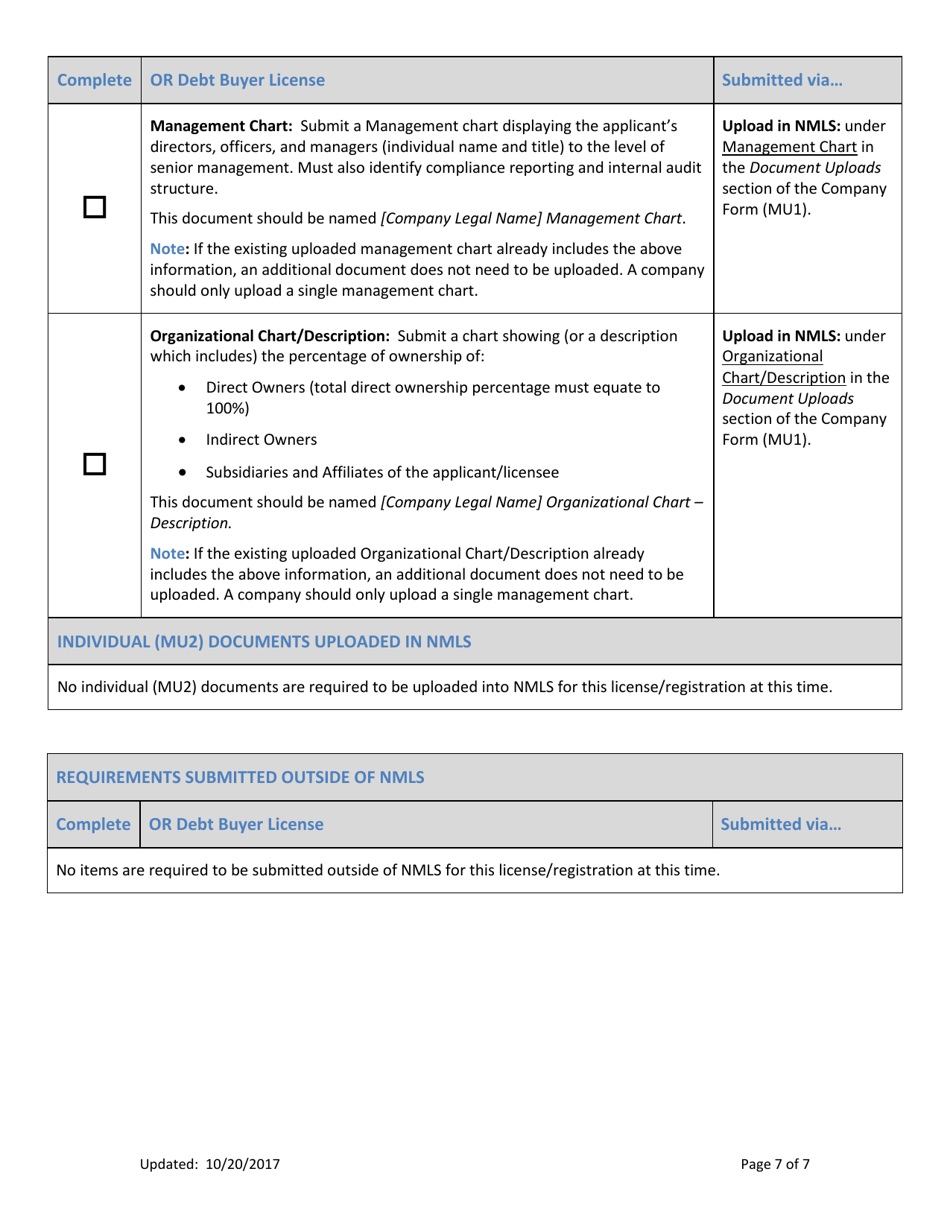

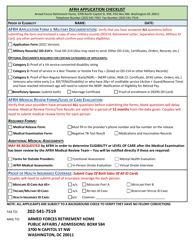

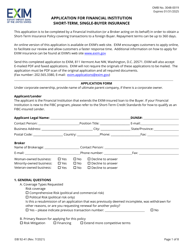

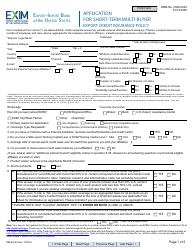

Debt Buyer License New Application Checklist - Oregon

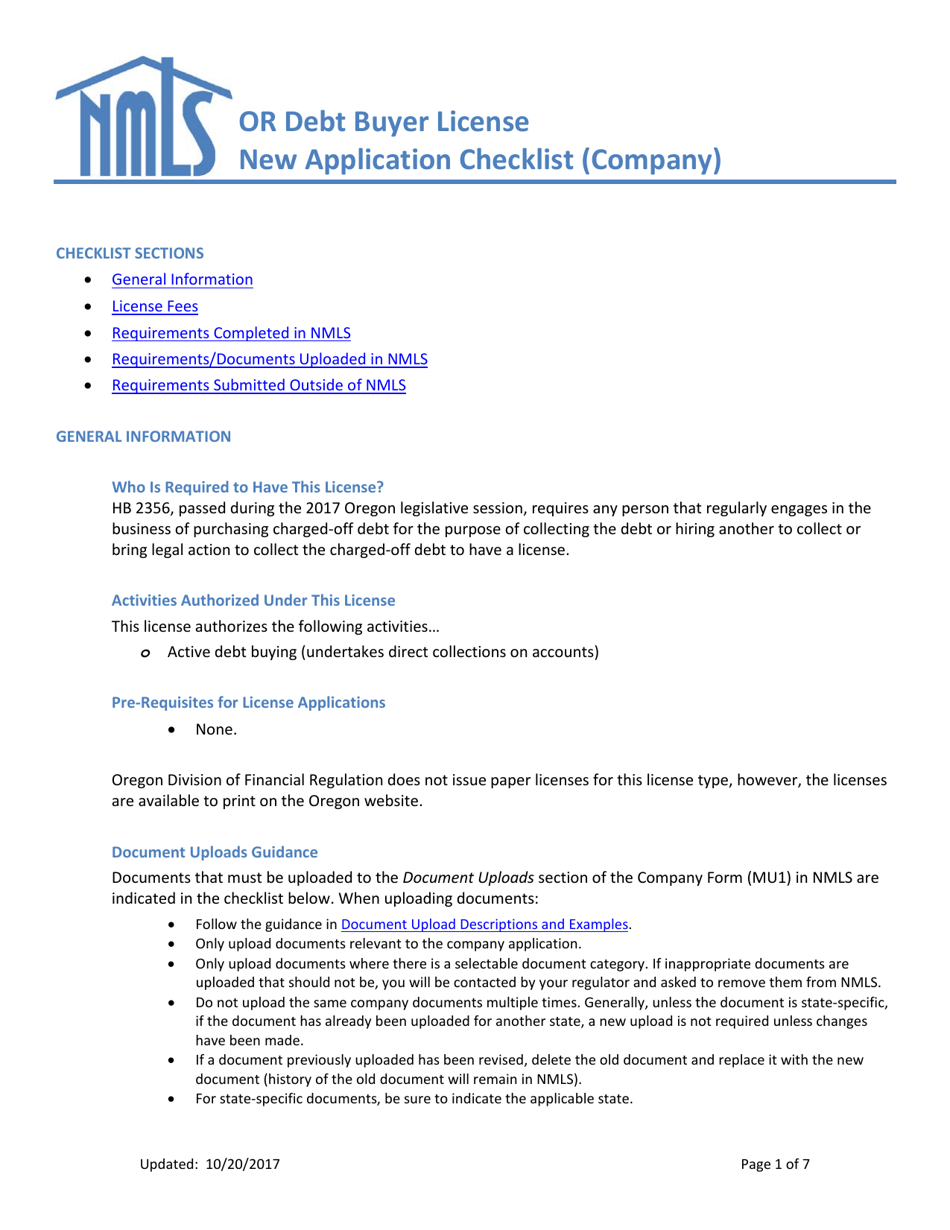

Debt Buyer License New Application Checklist is a legal document that was released by the Oregon Department of Consumer and Business Services - Division of Financial Regulations - a government authority operating within Oregon.

FAQ

Q: What is a debt buyer license?

A: A debt buyer license is a license required by the state of Oregon for anyone who purchases delinquent or charged-off debt.

Q: Who needs to apply for a debt buyer license in Oregon?

A: Anyone who intends to purchase delinquent or charged-off debt in Oregon needs to apply for a debt buyer license.

Q: What is the purpose of the debt buyer license application checklist?

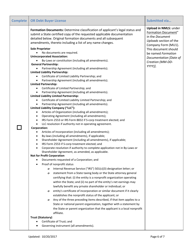

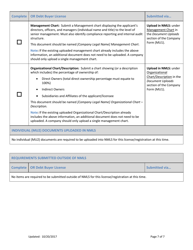

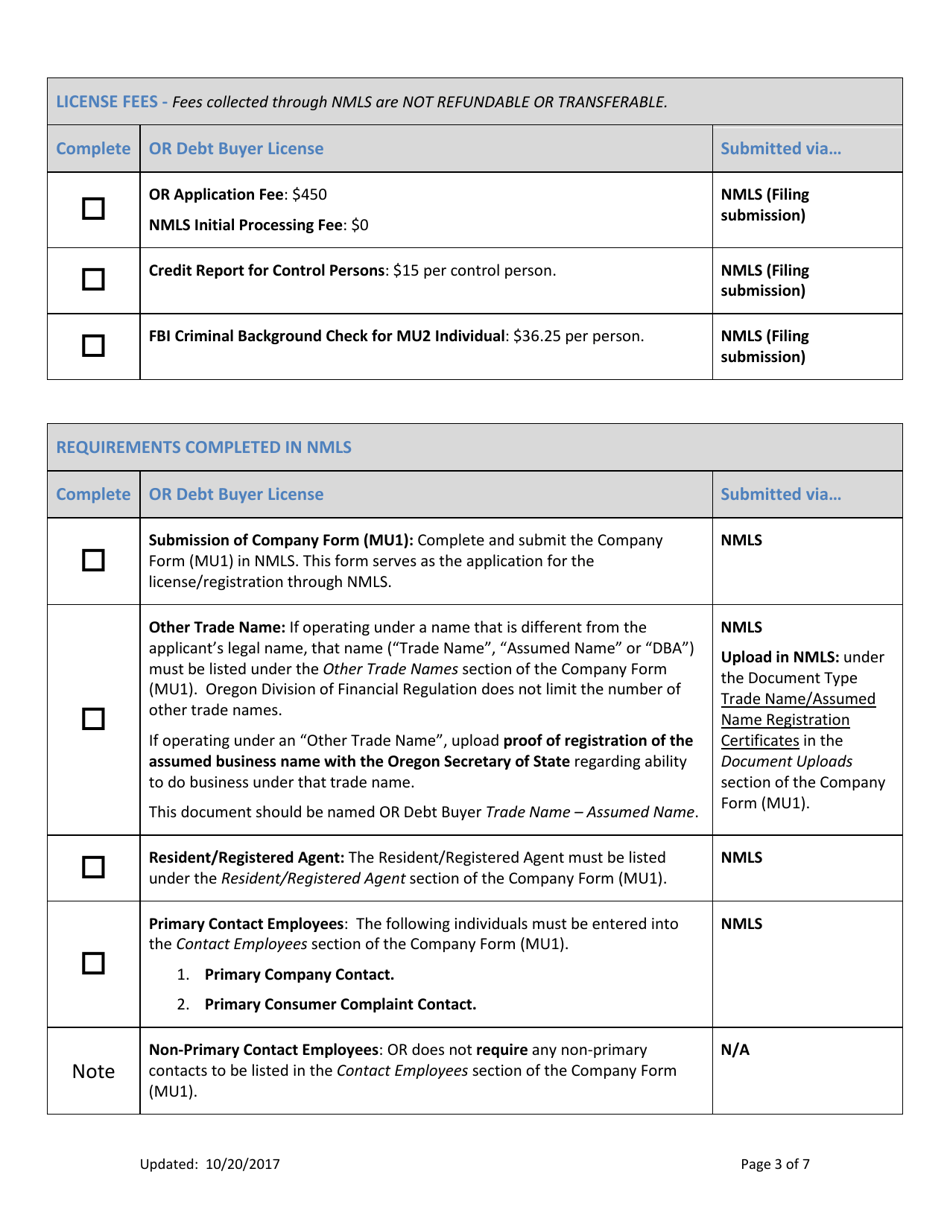

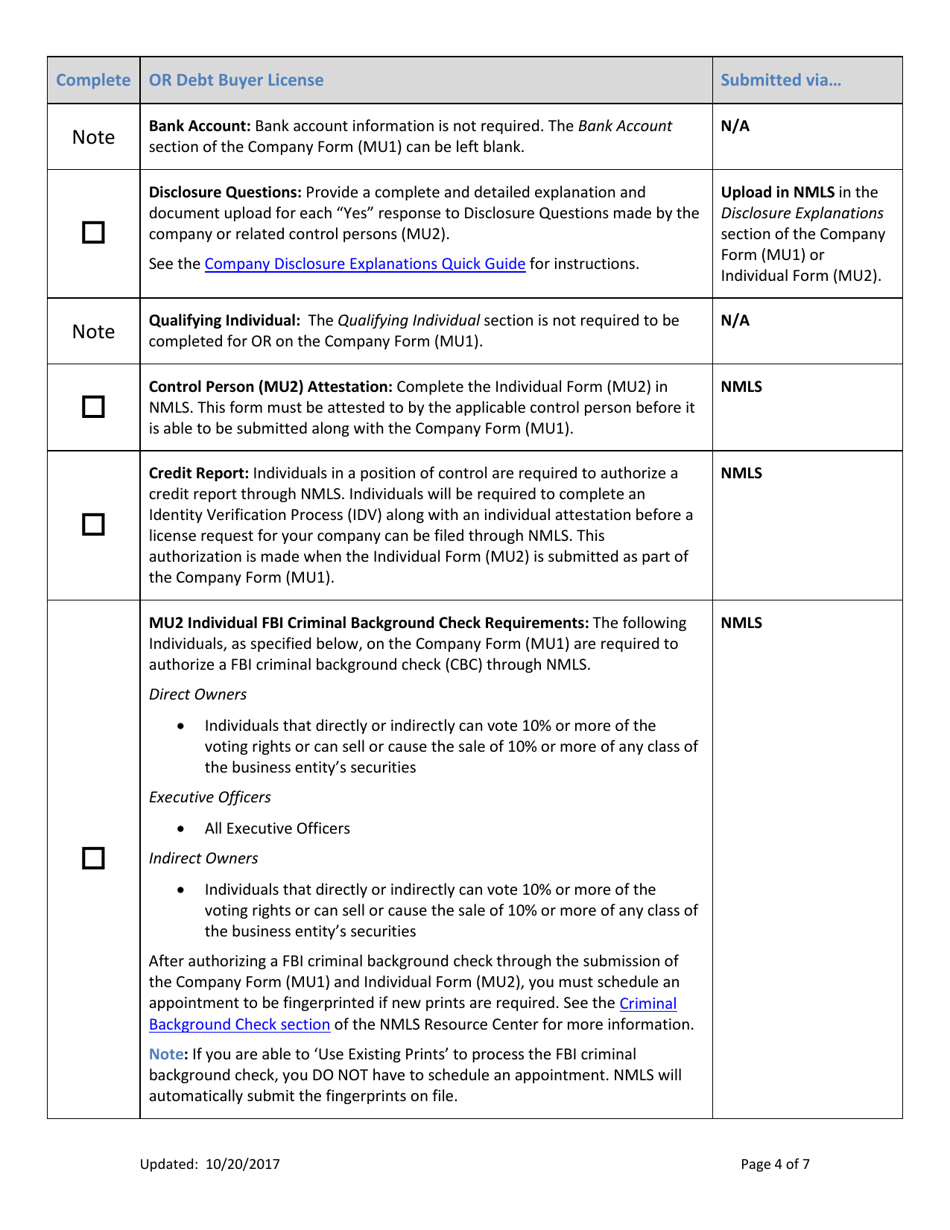

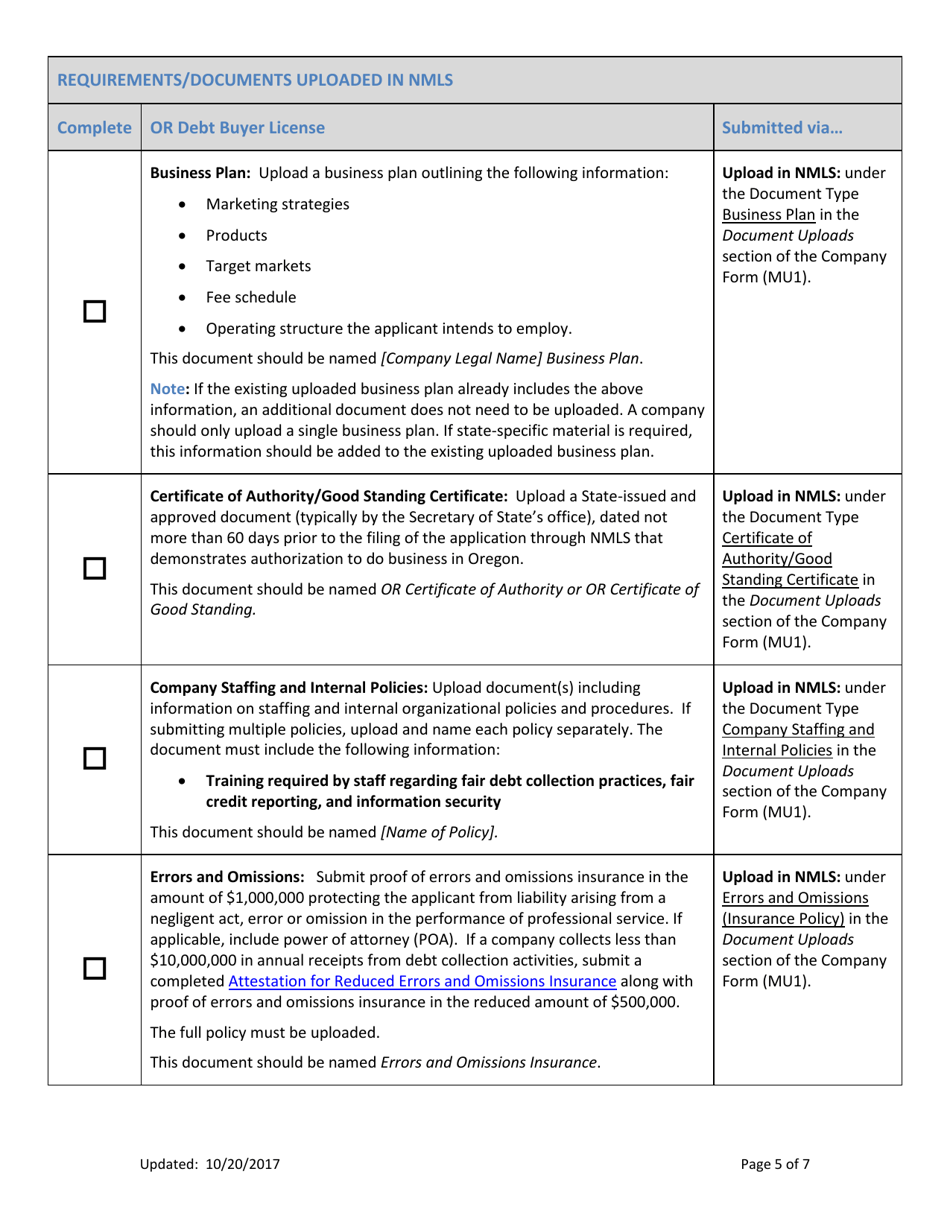

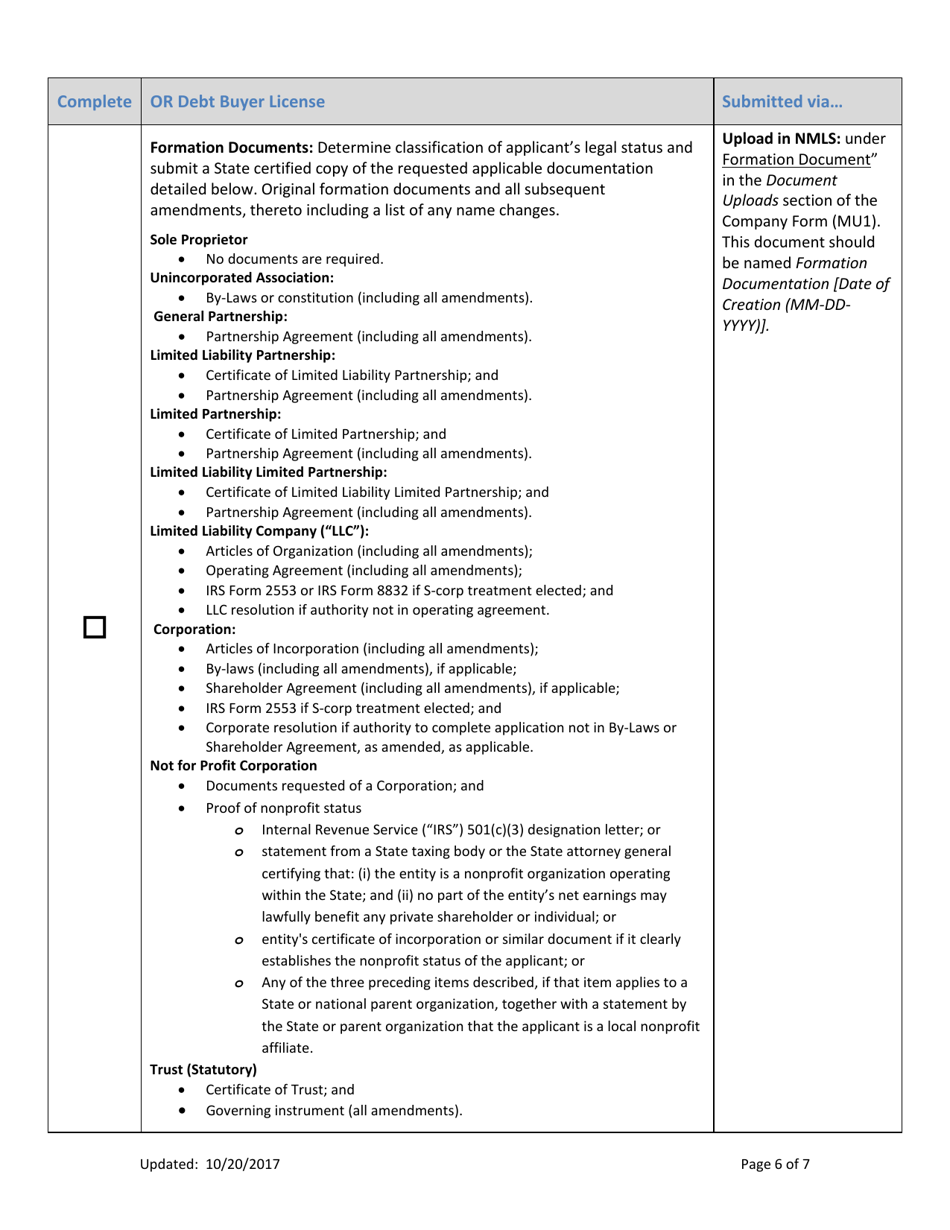

A: The debt buyer license application checklist serves as a guide for applicants to ensure they submit all the necessary documents and meet the requirements.

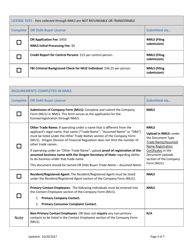

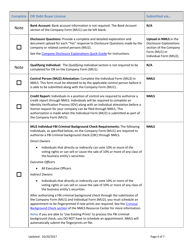

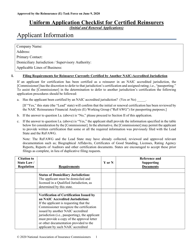

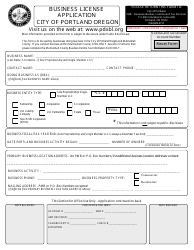

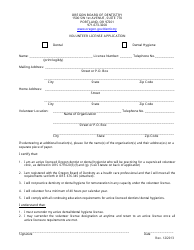

Q: What documents are typically required for a debt buyer license application in Oregon?

A: The specific documents required may vary, but typically you will need to submit an application form, financial statements, a surety bond, and information about your business.

Q: How long does it usually take to process a debt buyer license application in Oregon?

A: The processing time for a debt buyer license application in Oregon can vary, but it usually takes several weeks to a few months.

Form Details:

- Released on October 20, 2017;

- The latest edition currently provided by the Oregon Department of Consumer and Business Services - Division of Financial Regulations;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Oregon Department of Consumer and Business Services - Division of Financial Regulations.