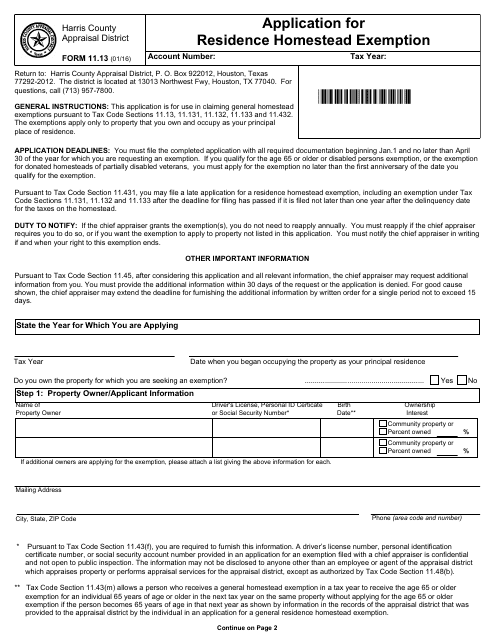

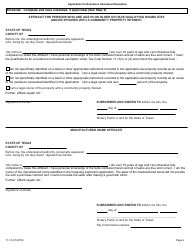

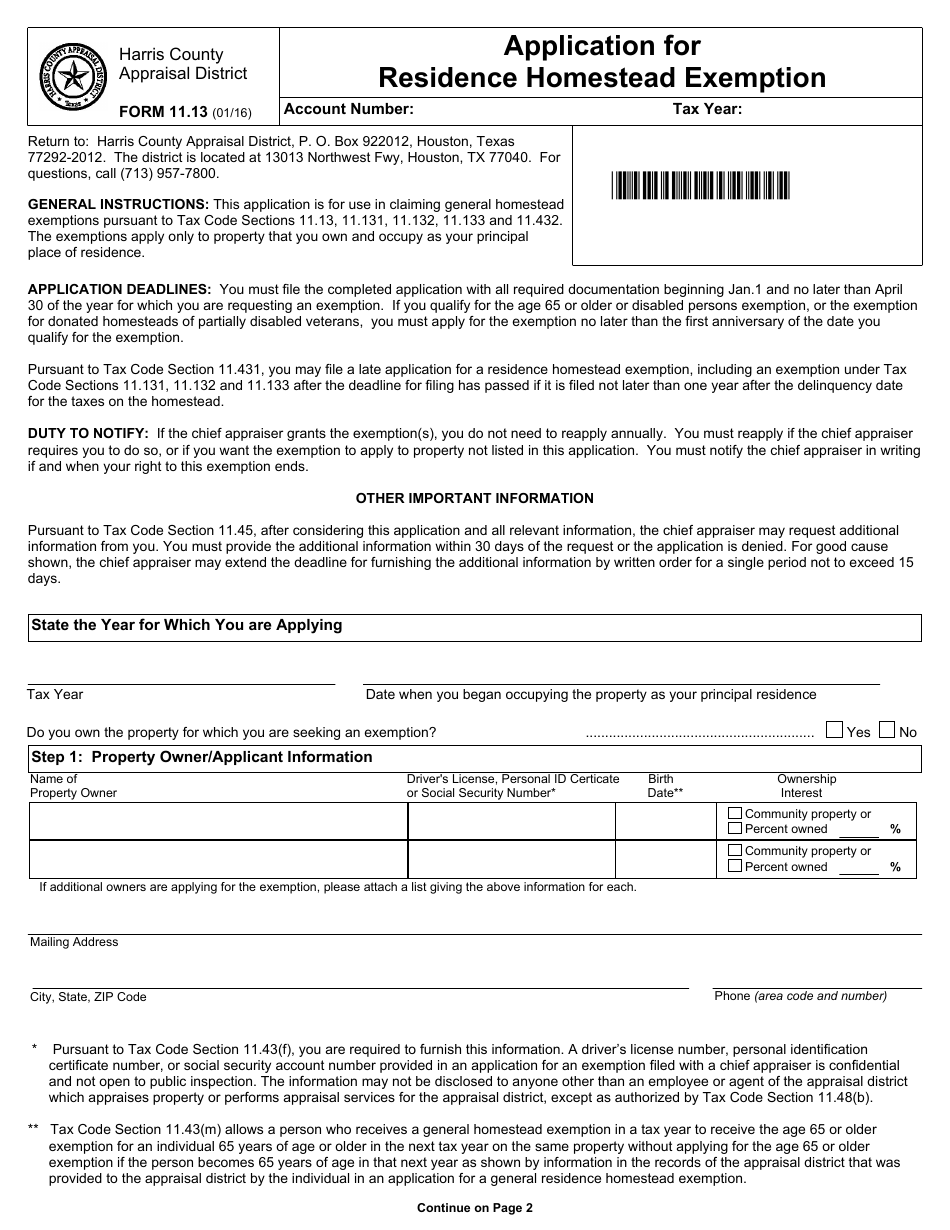

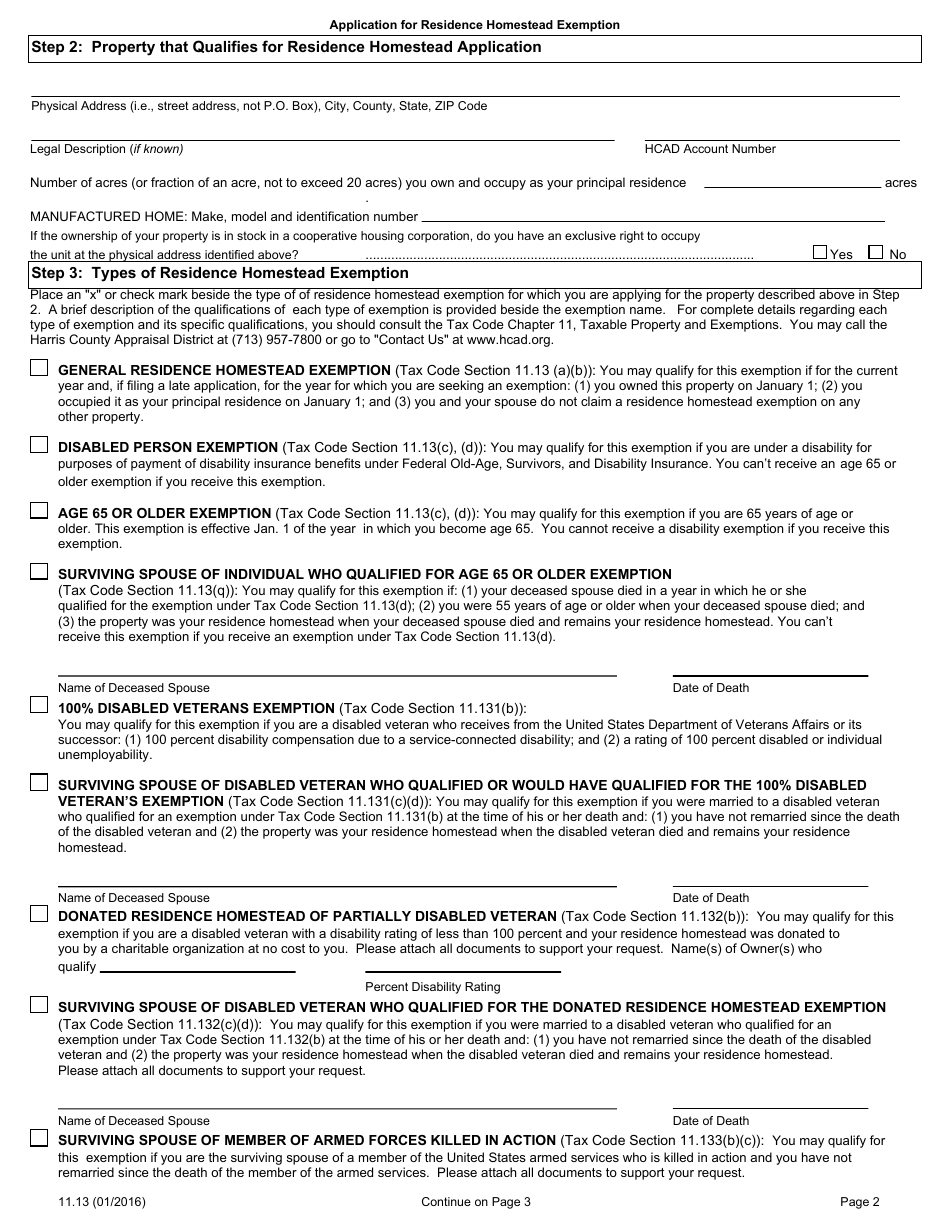

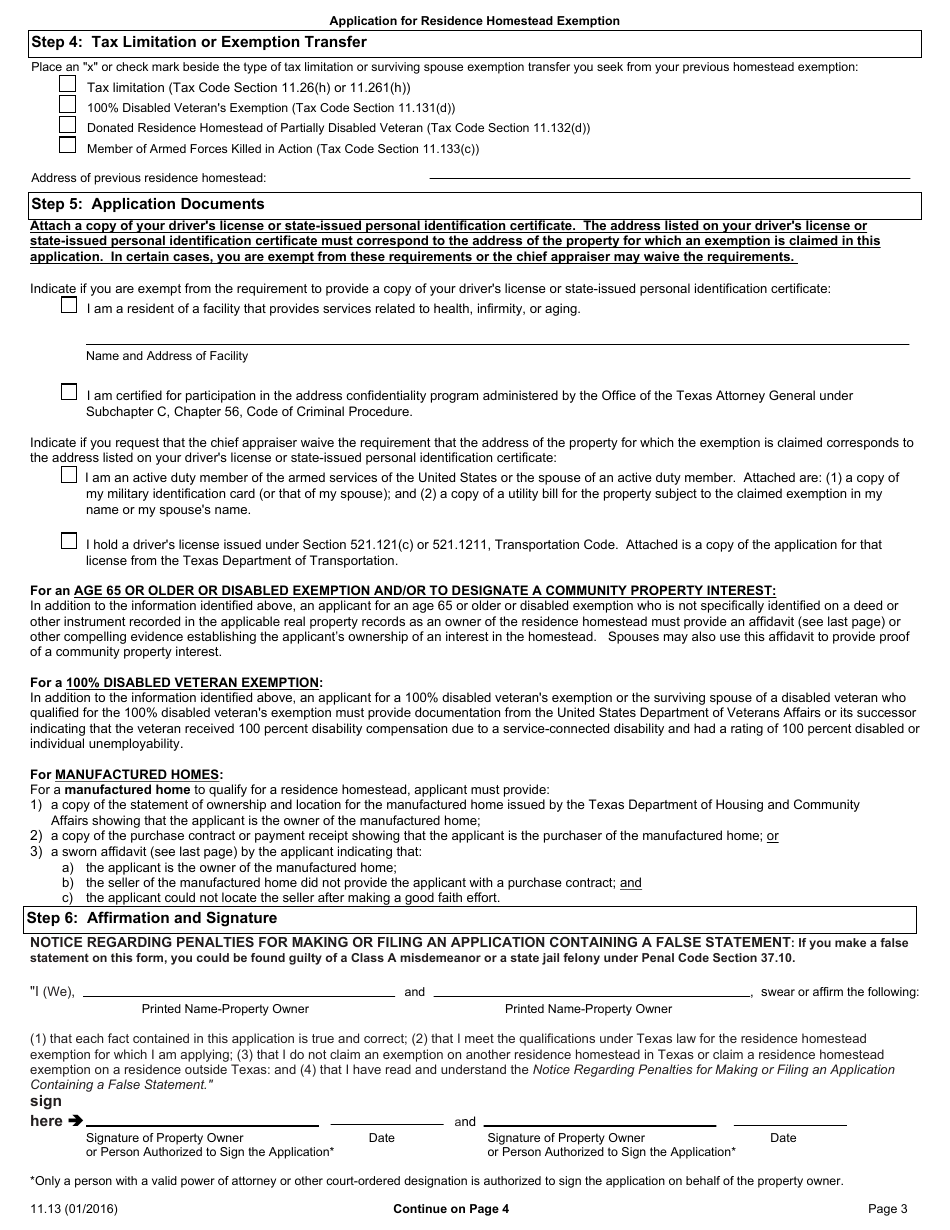

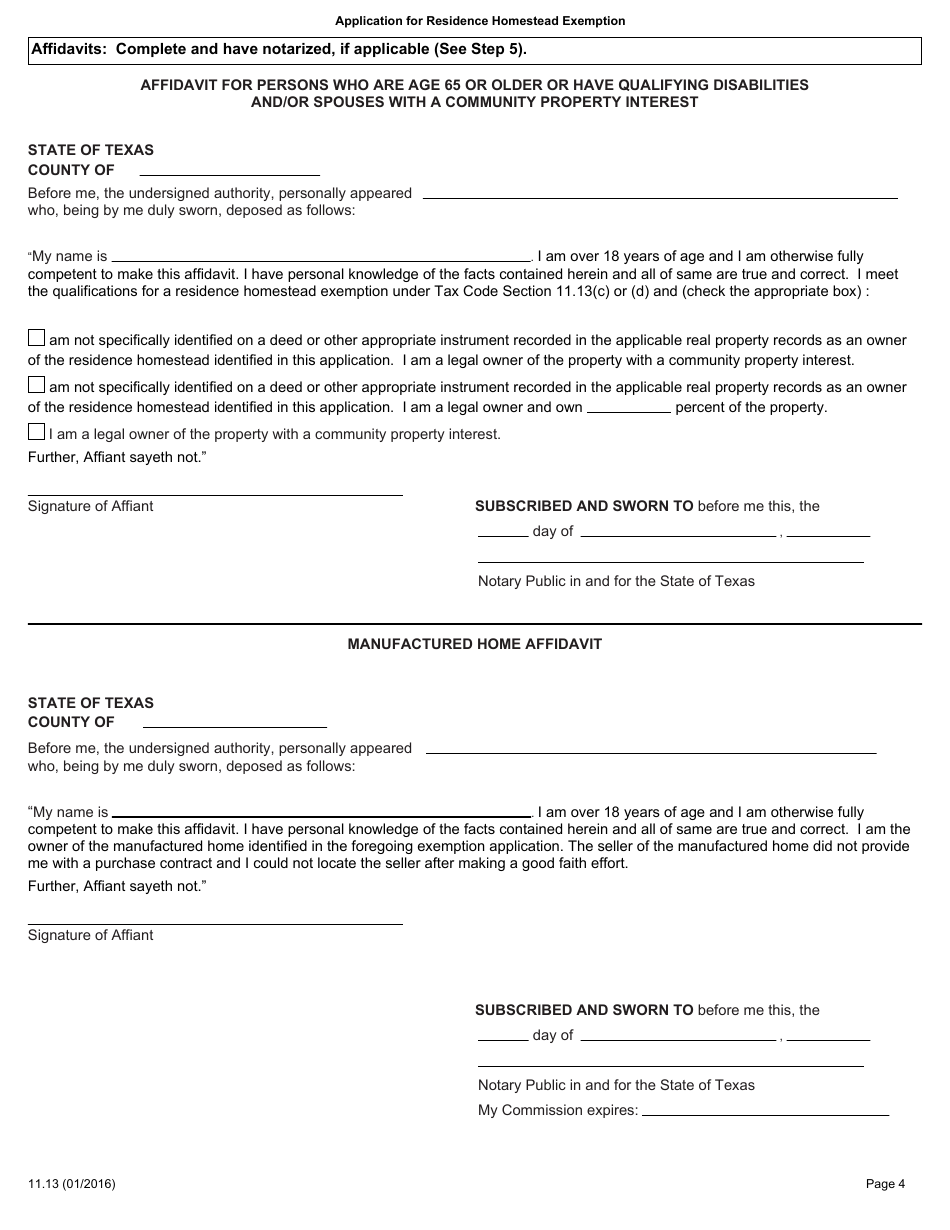

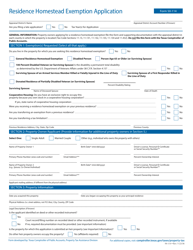

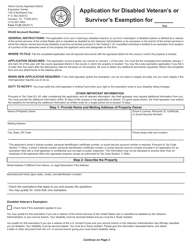

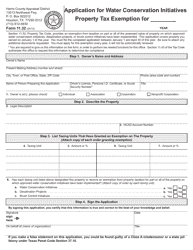

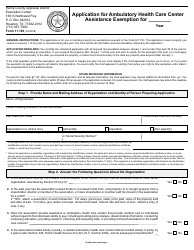

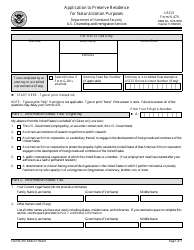

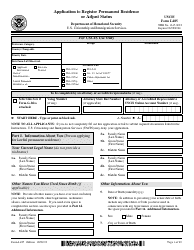

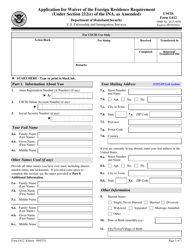

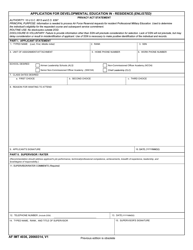

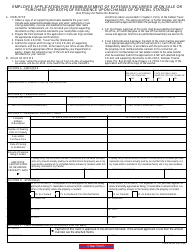

Form 11.13 Application for Residence Homestead Exemption - Harris County Appraisal District, Texas

What Is Form 11.13?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. The form may be used strictly within Harris County Appraisal District. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

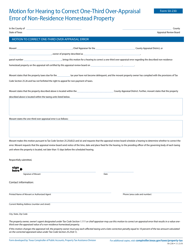

Q: What is Form 11.13?

A: Form 11.13 is an application for Residence Homestead Exemption.

Q: Which county is the Form 11.13 used in?

A: Form 11.13 is used in Harris County, Texas.

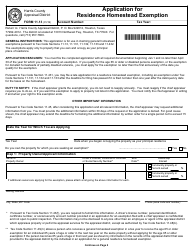

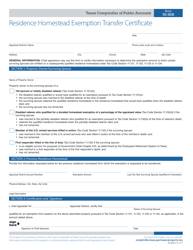

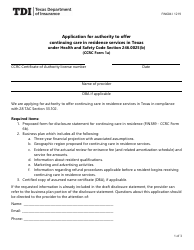

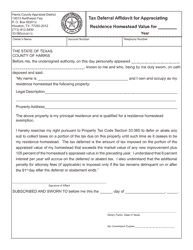

Q: What is a Residence Homestead Exemption?

A: A Residence Homestead Exemption is a tax break for homeowners that lowers the taxable value of their property.

Q: Who can apply for a Residence Homestead Exemption?

A: Homeowners who use their property as their primary residence can apply for a Residence Homestead Exemption.

Q: Why should I apply for a Residence Homestead Exemption?

A: Applying for a Residence Homestead Exemption can help reduce your property taxes.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Texas Comptroller of Public Accounts;

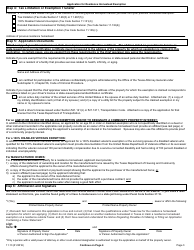

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 11.13 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.