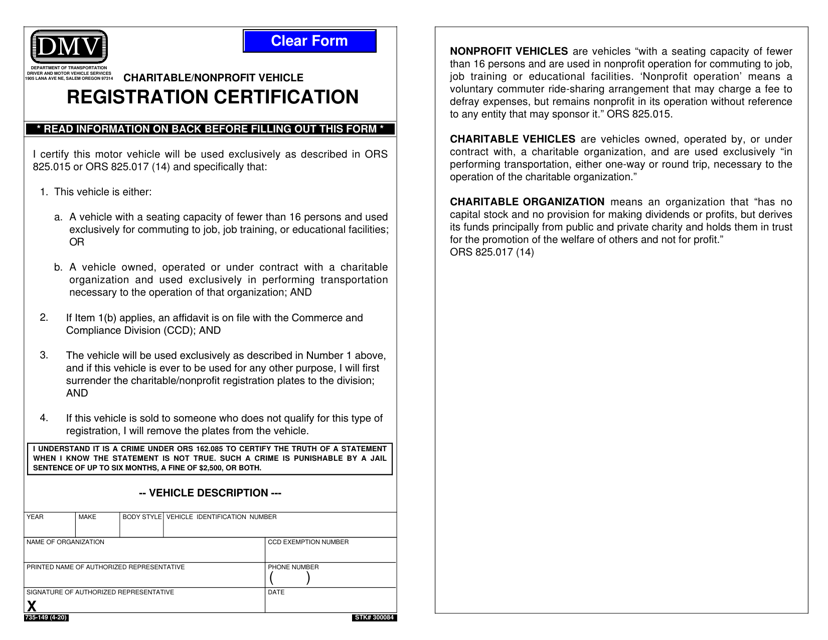

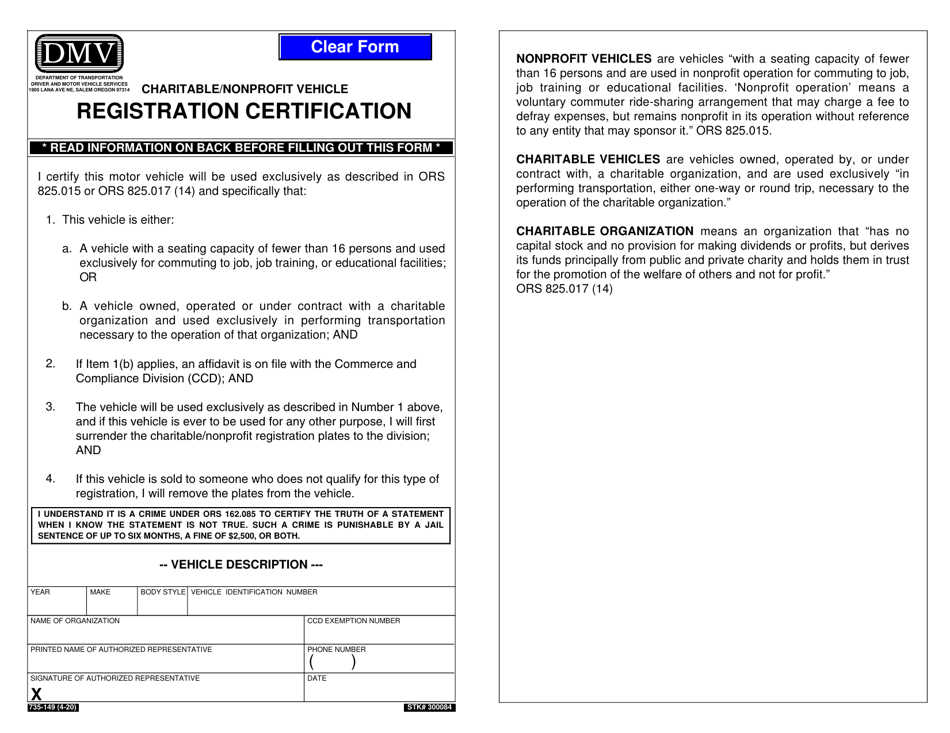

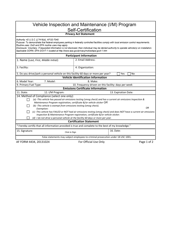

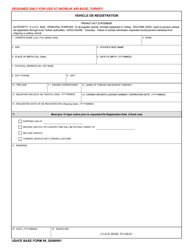

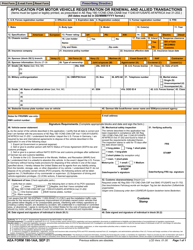

Form 735-149 Charitable / Nonprofit Vehicle Registration Certification - Oregon

What Is Form 735-149?

This is a legal form that was released by the Oregon Department of Transportation - Driver and Motor Vehicle Services - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 735-149?

A: Form 735-149 is the Charitable/Nonprofit Vehicle Registration Certification in Oregon.

Q: Who needs to use form 735-149?

A: Charitable or nonprofit organizations in Oregon need to use form 735-149 for vehicle registration certification.

Q: What is the purpose of form 735-149?

A: The purpose of form 735-149 is to certify that a vehicle is owned by a charitable or nonprofit organization.

Q: Is there a fee for submitting form 735-149?

A: No, there is no fee for submitting form 735-149.

Q: What documents do I need to submit with form 735-149?

A: You need to submit proof of tax-exempt status from the IRS or Oregon Department of Revenue with form 735-149.

Q: Can I use form 735-149 for personal vehicle registration?

A: No, form 735-149 is specifically for charitable/nonprofit vehicle registration certification and cannot be used for personal vehicles.

Q: How long is form 735-149 valid?

A: Form 735-149 is valid for one year and needs to be renewed annually.

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the Oregon Department of Transportation - Driver and Motor Vehicle Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 735-149 by clicking the link below or browse more documents and templates provided by the Oregon Department of Transportation - Driver and Motor Vehicle Services.