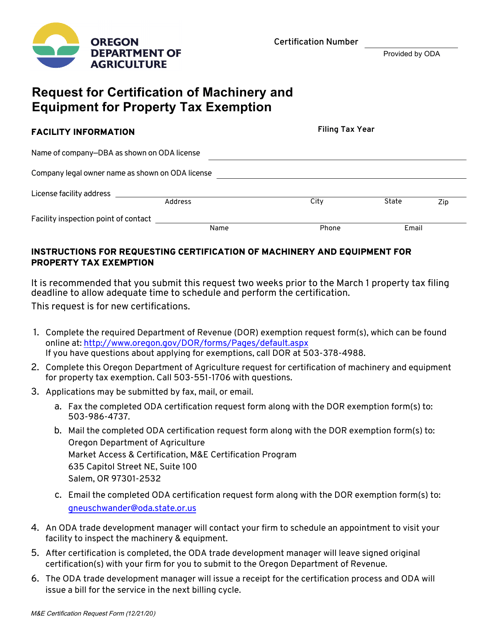

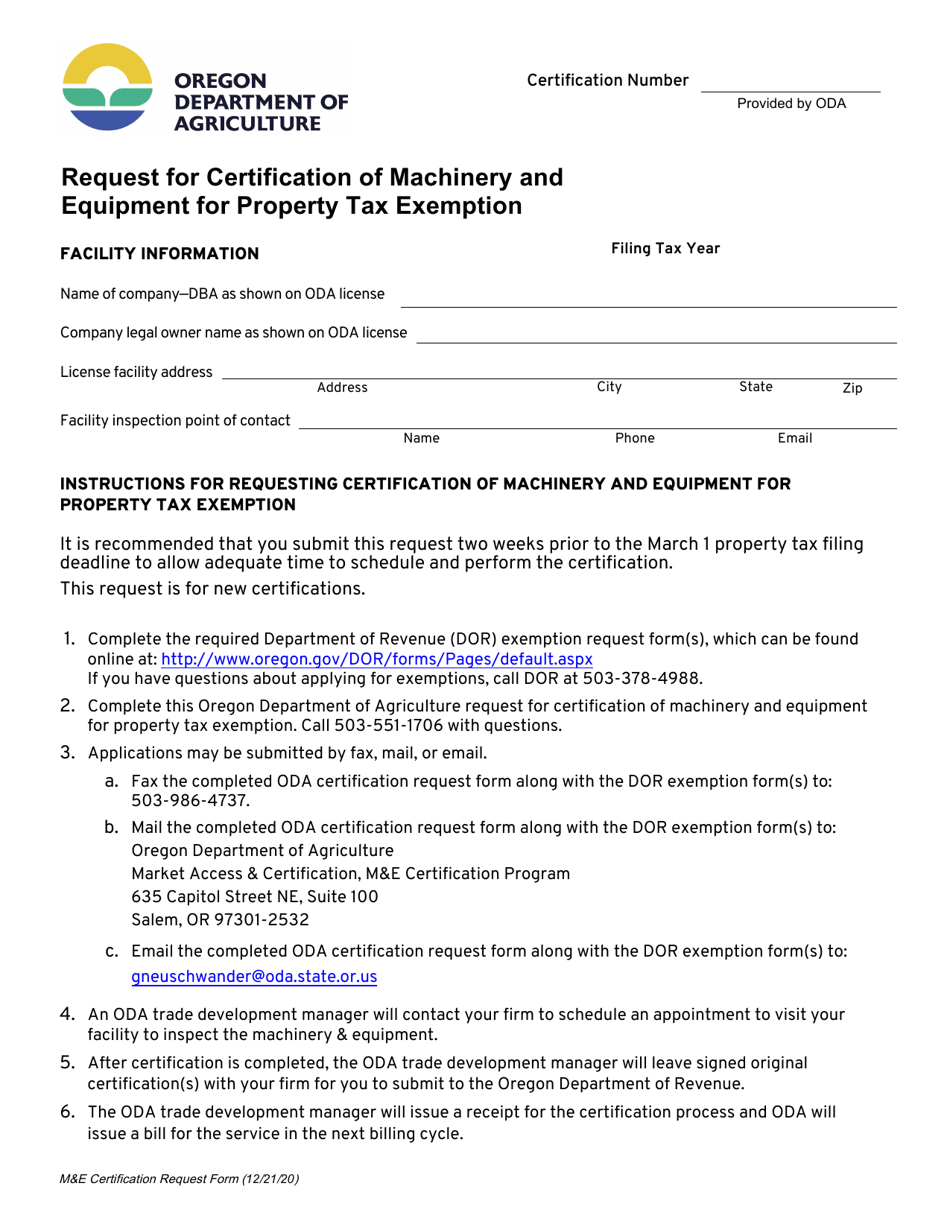

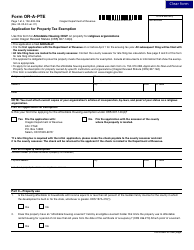

Request for Certification of Machinery and Equipment for Property Tax Exemption - Oregon

Request for Certification of Machinery and Equipment for Property Tax Exemption is a legal document that was released by the Oregon Department of Agriculture - a government authority operating within Oregon.

FAQ

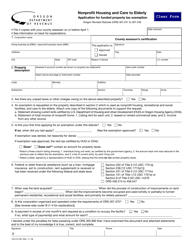

Q: What is the certification of machinery and equipment for property tax exemption in Oregon?

A: The certification of machinery and equipment for property tax exemption in Oregon is a process that allows certain qualifying machinery and equipment to be exempt from property taxes.

Q: What is the purpose of the certification?

A: The purpose of the certification is to provide tax incentives for businesses to invest in machinery and equipment, promoting economic growth and development.

Q: Who is eligible for the property tax exemption?

A: Businesses that meet certain criteria and have qualifying machinery and equipment may be eligible for the property tax exemption.

Q: What types of machinery and equipment are eligible for the exemption?

A: Generally, manufacturing, processing, and certain research and development machinery and equipment are eligible for the exemption.

Q: How do I apply for the certification?

A: You can apply for the certification by submitting an application to the appropriate local tax assessor's office.

Q: What documents are required for the application?

A: The required documents may vary, but typically you will need to provide information about the machinery and equipment, proof of ownership, and supporting documentation.

Q: Is there a deadline to apply for the certification?

A: Yes, there is a deadline to apply for the certification. The application must be submitted by April 1st of each year to be considered for the following tax year.

Q: How long does the certification last?

A: The certification is valid for up to five years, after which it must be renewed.

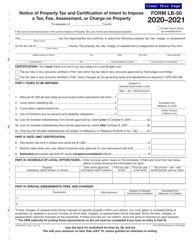

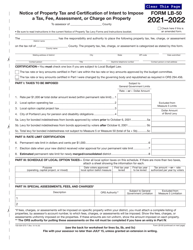

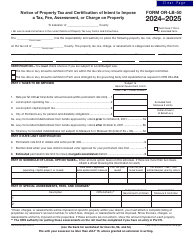

Form Details:

- Released on December 21, 2020;

- The latest edition currently provided by the Oregon Department of Agriculture;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oregon Department of Agriculture.