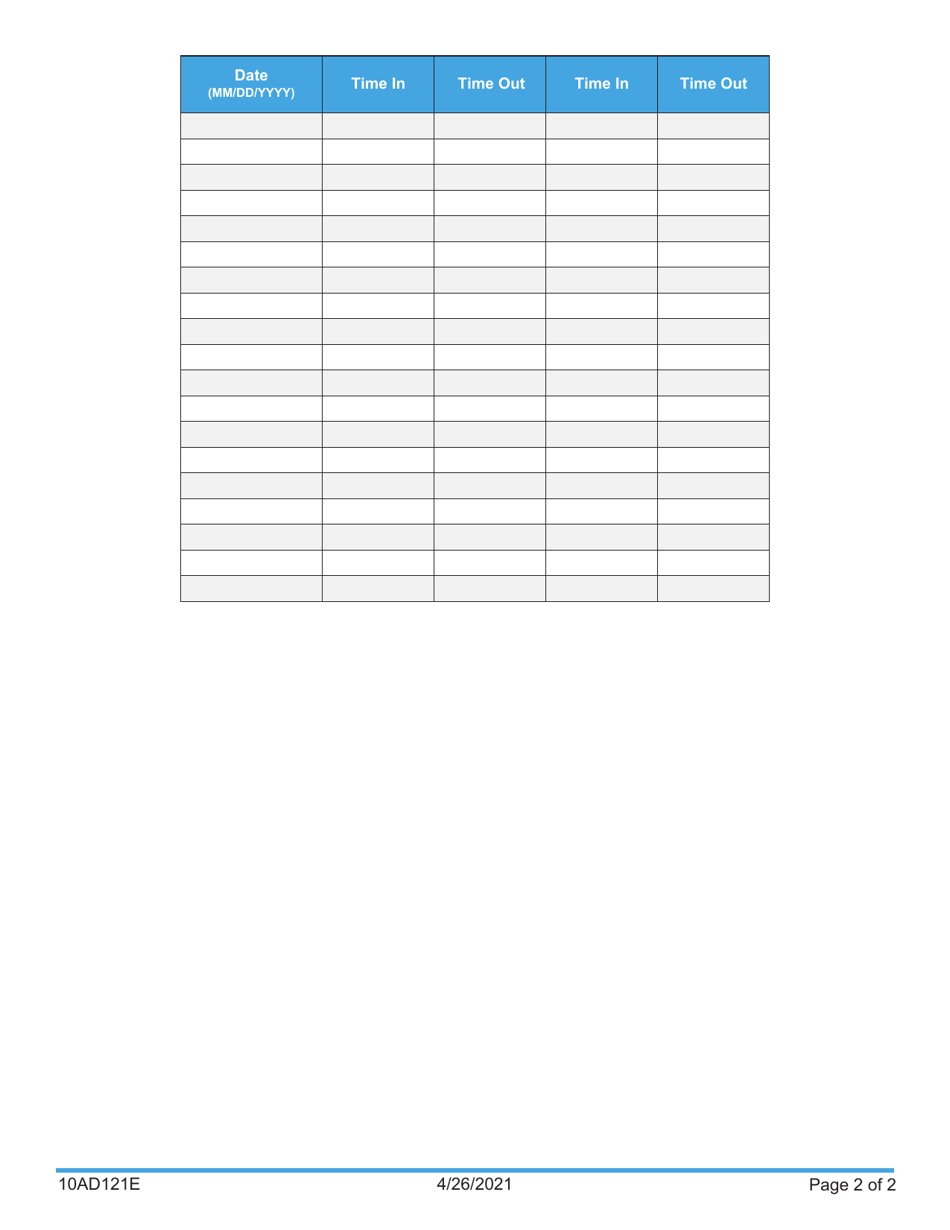

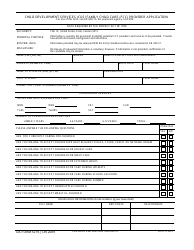

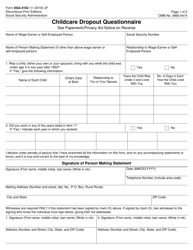

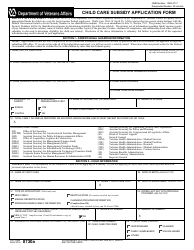

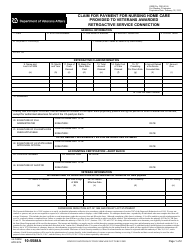

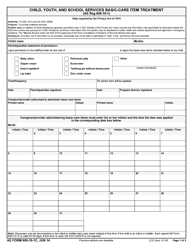

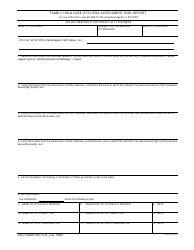

Form 10AD121E (ADM-12-S) Child Care Claim - Oklahoma

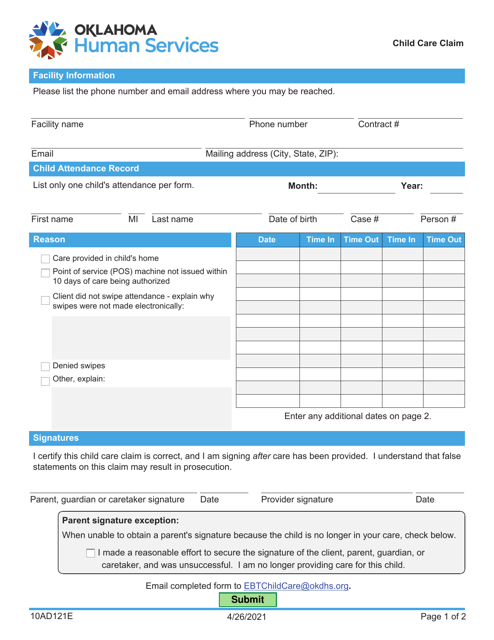

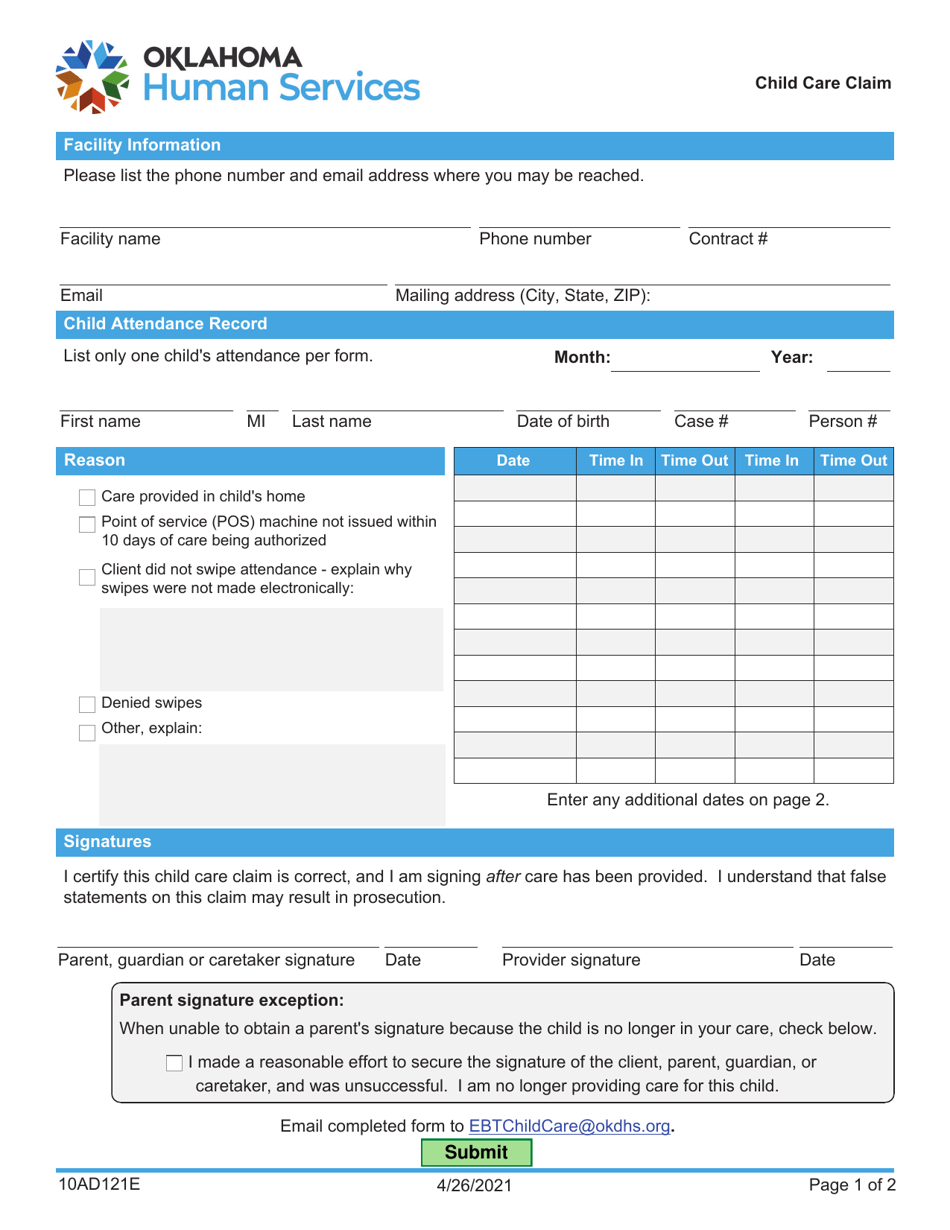

What Is Form 10AD121E (ADM-12-S)?

This is a legal form that was released by the Oklahoma Department of Human Services - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 10AD121E (ADM-12-S)?

A: Form 10AD121E (ADM-12-S) is a form used in Oklahoma to claim child care expenses.

Q: What can I use this form for?

A: This form is used to claim child care expenses in Oklahoma.

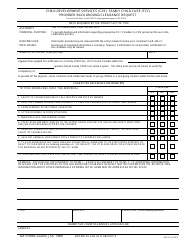

Q: What information do I need to complete this form?

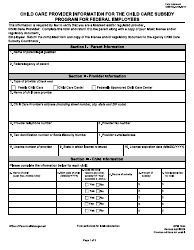

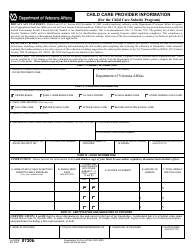

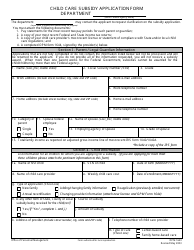

A: To complete Form 10AD121E (ADM-12-S), you will need to provide information about your child care provider and the amount of child care expenses paid.

Q: Do I need to attach any supporting documents?

A: Yes, you will need to attach proof of payment for the child care expenses, such as receipts or invoices.

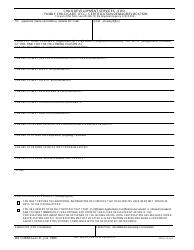

Q: Is there a deadline for submitting this form?

A: The deadline for submitting Form 10AD121E (ADM-12-S) may vary. Please check the instructions on the form or contact the Oklahoma Department of Human Services for more information.

Q: Can I claim child care expenses for multiple children on this form?

A: Yes, you can claim child care expenses for multiple children on Form 10AD121E (ADM-12-S).

Q: Is there an income limit to be eligible for this claim?

A: There may be income limits to be eligible for this claim. Please review the instructions on the form or contact the Oklahoma Department of Human Services for more information.

Q: Are there any other forms or requirements to claim child care expenses in Oklahoma?

A: There may be other forms or requirements to claim child care expenses in Oklahoma. Please consult the Oklahoma Department of Human Services or a tax professional for more information.

Form Details:

- Released on April 26, 2021;

- The latest edition provided by the Oklahoma Department of Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

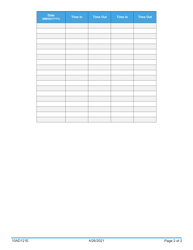

Download a fillable version of Form 10AD121E (ADM-12-S) by clicking the link below or browse more documents and templates provided by the Oklahoma Department of Human Services.