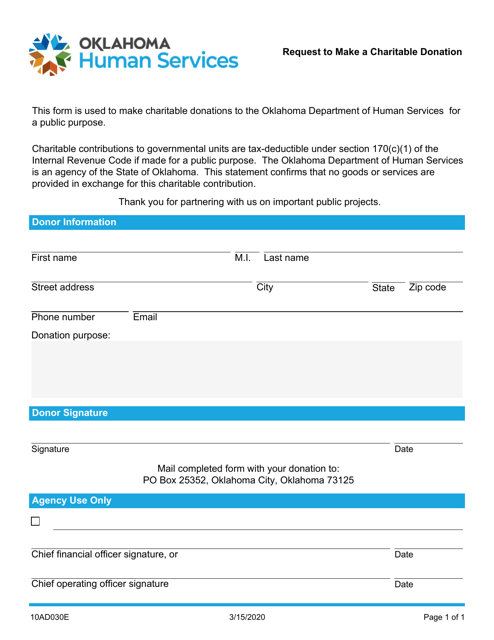

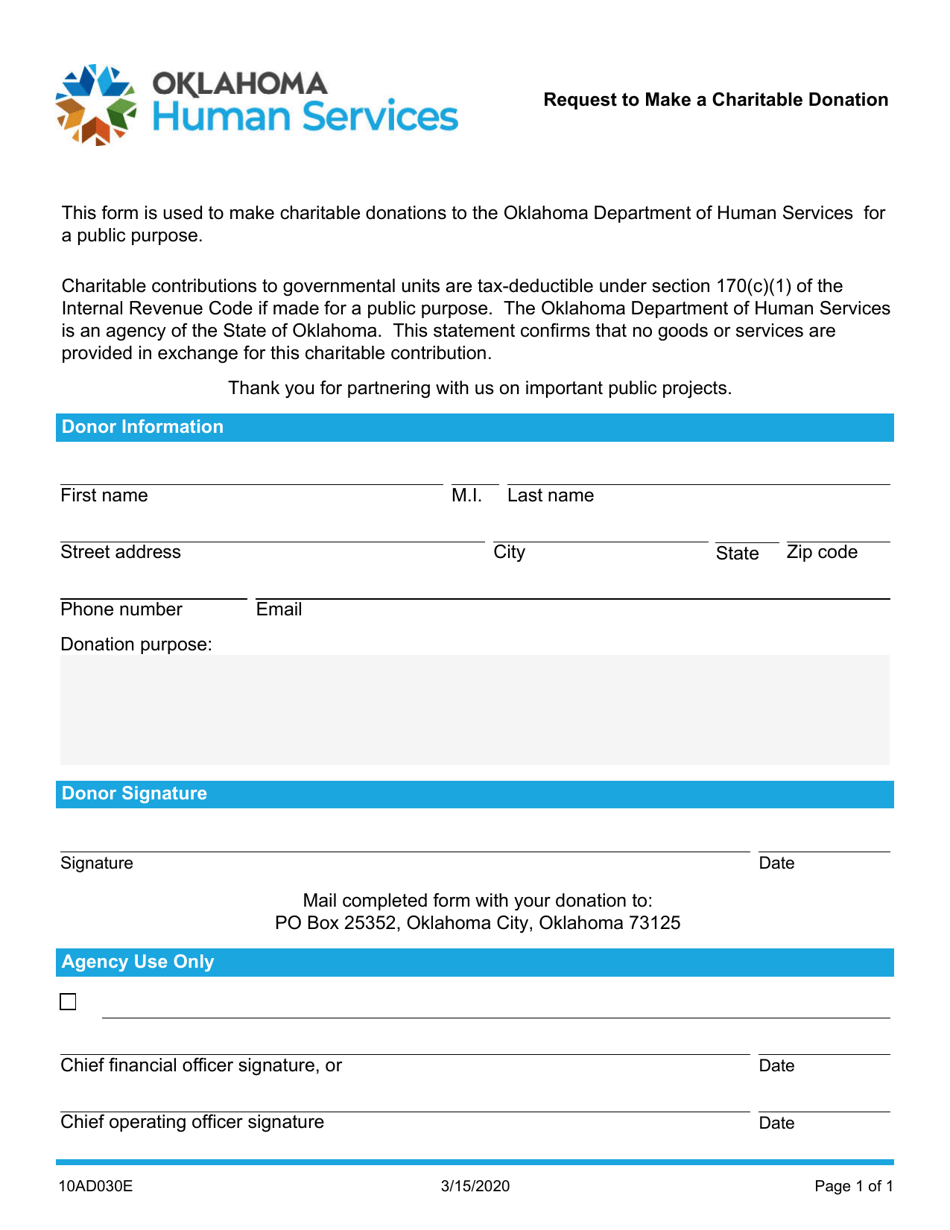

Form 10AD030E Request to Make a Charitable Donation - Oklahoma

What Is Form 10AD030E?

This is a legal form that was released by the Oklahoma Department of Human Services - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 10AD030E?

A: Form 10AD030E is a request form to make a charitable donation in Oklahoma.

Q: Who can use Form 10AD030E?

A: Any individual or organization wishing to make a charitable donation in Oklahoma can use Form 10AD030E.

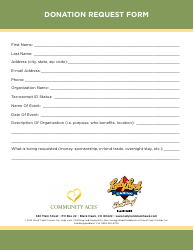

Q: What information is required on Form 10AD030E?

A: Form 10AD030E requires information such as the donor's name, contact information, donation amount, and the recipient of the donation.

Q: Can I claim a tax deduction for my donation using Form 10AD030E?

A: Yes, if your donation qualifies for a tax deduction, you can claim it using Form 10AD030E.

Q: Are there any fees associated with Form 10AD030E?

A: No, there are no fees associated with submitting Form 10AD030E.

Q: What should I do with Form 10AD030E after I fill it out?

A: After filling out Form 10AD030E, you should submit it to the Oklahoma Tax Commission along with any required supporting documents.

Q: How long does it take to process Form 10AD030E?

A: The processing time for Form 10AD030E may vary, so it is recommended to submit it well in advance of any deadlines or events requiring the donation.

Q: Can I make a recurring donation using Form 10AD030E?

A: Form 10AD030E is primarily for one-time charitable donations. For recurring donations, you may need to explore other options or contact the recipient directly.

Q: Is there a limit to the amount I can donate using Form 10AD030E?

A: There is no specific limit to the amount you can donate using Form 10AD030E, but you should consult with the recipient organization or a tax professional for any potential limitations or guidelines.

Form Details:

- Released on March 15, 2020;

- The latest edition provided by the Oklahoma Department of Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 10AD030E by clicking the link below or browse more documents and templates provided by the Oklahoma Department of Human Services.